Growth Solutions for Advisors during Market Volatility

Never let a good crisis go to waste.

Whether or not you consider the global markets to be in a crisis is subjective.

What I believe to be a fact is that market volatility creates an opportunity for financial advisors to refine and grow their business.

Here are five actions to consider taking to capitalize on this opportunity:

1. Establish a client niche

2. Align your digital presence with that niche

3. Outsource tasks

4. Leverage third-party investment expertise

5) Market your network of experts

Establish a Client Niche

Use this time of market volatility to establish a niche, or if you already have one, refine it to be more specific.

Having trouble getting started?

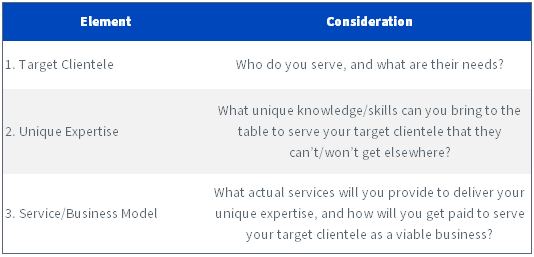

Michael Kitces lays out three key elements to defining and serving a niche successfully: “You need a target clientele to serve, expertise to serve them, and a business model that’s viable to work with them.”1

Why is this important?

Defining and serving a niche successfully enables advisors to be intentional with their prospecting and solidify an ideal client persona and client value proposition. Research has shown that firms with documented ideal client personas and client value propositions attracted 28% more new clients and 45% more new client assets than those that did not.2

Align Your Digital Presence with That Niche

Let’s say you’ve identified your target clientele as millennials working in startups in Austin, Texas. How will these specific individuals arrive at the conclusion that you might be a good fit for their needs before meeting you?

Your digital presence—specifically what they see on Google, LinkedIn and your website.

Your online presence matters more than you know. It’s often the first thing prospects see, and nearly 50% of them have eliminated advisors from contention simply because of what they found, or didn’t find, online!3

The key is to properly advertise your unique expertise (Kitces’ second element) on the routes most individuals take when searching for a financial advisor. The risk of not doing this is losing out on opportunities you never even knew existed.

Outsource Tasks

It seems straightforward, but how do you choose what aspects of your business to outsource without impacting the quality and value that you are providing to clients?

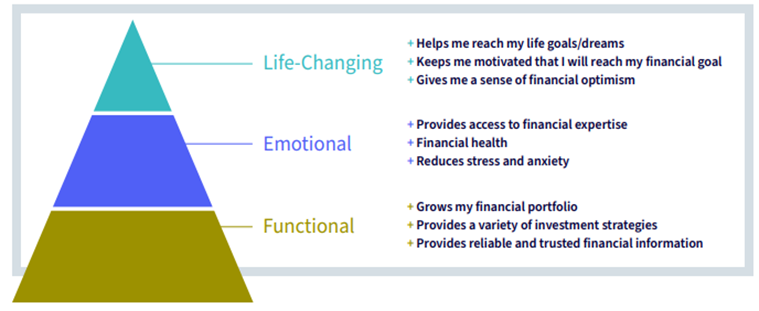

Enter the Advisor Value Pyramid.

This Pyramid is based on Maslow’s hierarchy of needs and illustrates the value clients put on the products and services that advisors offer.

See below for an illustration of the Advisor Value Pyramid. For more background, refer to this blog post.

We believe advisors should leverage software and third-party expertise to meet the functional needs of their clients. By doing so, they more efficiently address their client’s basic needs, which gives them more time to focus on their client’s higher needs—the needs most cherished during market volatility and uncertainty.

Leverage Third-Party Investment Expertise

Examples of commoditized aspects of your business that should be considered for outsourcing include asset allocation, security selection and rebalancing.

How can you tackle all three with one solution?

Leverage third-party investment expertise through the utilization of model portfolios.

I’ve written extensively about the benefits of third-party ETF model portfolios. However, it has become increasingly apparent that these benefits have increased during market volatility and uncertainty.

Consider the following statistics produced by BlackRock in a piece titled “Which advisors had a smoother ride during Covid-19?”4:

• 92% of model and SMA users said that outsourcing improved their practice during the COVID-19 volatility

• 85% of wealth outsourcers won new business during volatility versus 69% who do not use models or SMAs

• 66% of wealth outsourcers were able to spend most or all of their time with clients during the COVID-19 volatility (more time with clients)

• Wealth outsourcers were 17% more likely to help their clients stay the course

Advisors who use models were able to experience a smoother ride for their practice and their clients during COVID-19. If you were one of these advisors, broadcast it! Clients are more likely to choose an advisor who uses models.

Market Your Network of Experts

Our research discovered that clients find comfort in knowing that third-party models provide the benefit of the collective expertise of an asset management firm’s analysts, strategists and PhDs. From their perspective, advisors using third-party model portfolios are combining valuable research and data with their intimate knowledge of the client’s needs—a welcome approach that will help their portfolios.

In fact, the research identified that 58% of investors would consider switching advisors if the new advisor properly promoted a models-based practice. Perhaps even more eye-opening—this number increased to 84% when only considering the millennial age group.5

Given that our research found that investors were far more likely to switch advisors if they were aware that another advisor was using third-party models in their portfolios—it’s vital for you to promote that in your marketing efforts.

How to Get Started on These Five Actions:

It can sound daunting to rethink the clients you serve, the marketing approaches you take and the functions of your practice that are candidates for outsourcing.

But WisdomTree is here to help.

We recently introduced an exciting program for RIAs and Independent Advisory Firms, WisdomTree Portfolio and Growth Solutions. This program was built to assist advisors in delivering customized portfolios and provide rebalancing and trading services and access to practice management expertise focused on business growth—such as digital presence and client segmentation.

No matter what the markets bring us for the remainder of 2022 and onward—WisdomTree is well-positioned to serve growth-oriented advisors through our resources and expertise. We welcome you to try it out!

Contact Us

1 Michael Kitces, “How To Find Your Niche As A Financial Advisor,” Nerd’s Eye View, 5/5/14. https://www.kitces.com/blog/how-to-find-your-niche-as-a-financial-advisor/

2 Source: Charles Schwab. 2020 RIA Benchmarking Study. (Median results for all firms with $250 million or more in AUM.)

3 Source: Kredible, Wealth Management Research, 11/15.

4 Source: BlackRock. In response to the COVID-19-induced volatility, during the week of May 4, 2020, BlackRock collected responses to a 15-question survey about wealth outsourcing (SMA & Models usage) experience and intentions from approximately 305 financial advisors across more than 10 independent and wire channel firms. The results above are a snapshot of the data collected as of May 11, 2020.

5 WisdomTree Model Portfolio Research Study 2020. WisdomTree’s Models Research Initiative maintained a +/-2.3% margin of error among consumer investors across generations and a +/-6.2% error rate among financial advisors.

Important Risks Related to this Article

For financial advisors: WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy.

Ryan Krystopowicz joined WisdomTree in March 2016 and serves as a Product Specialist, ETF Model Portfolios. He is a leading voice in the content and commercialization of WisdomTree’s Model Portfolio Research Study & Model Adoption Center. Ryan also contributes to the commercial success of WisdomTree’s Model Portfolio offerings by supporting Distribution and the management of host platforms. His passion for third-party model portfolios and investment outsourcing was cultivated during his tenure at a Registered Investment Advisor where he took on a variety of roles within research and operations. Ryan received a degree from Loyola University of Maryland and is a CFA charterholder.