Take Note: Indian Equities Are Roaring

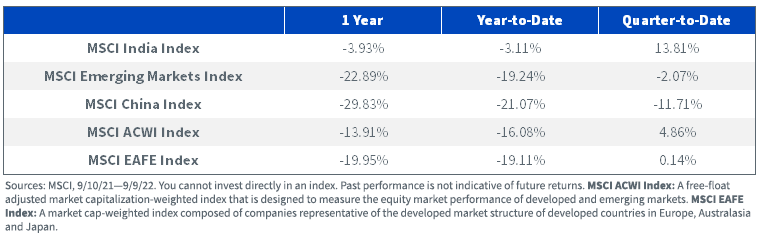

The past year has been anything but easy for emerging markets, where equities are facing challenges on multiple fronts.

Spiking fuel and energy costs are raising inflation expectations and interest rates, and a surging U.S. dollar is hurting local currencies.

Year-to-date, the MSCI Emerging Markets Index (MXEF) is down by 16.84%, of which no small portion has been due to floundering Chinese equities.

Chinese COVID and Regulatory Clampdown

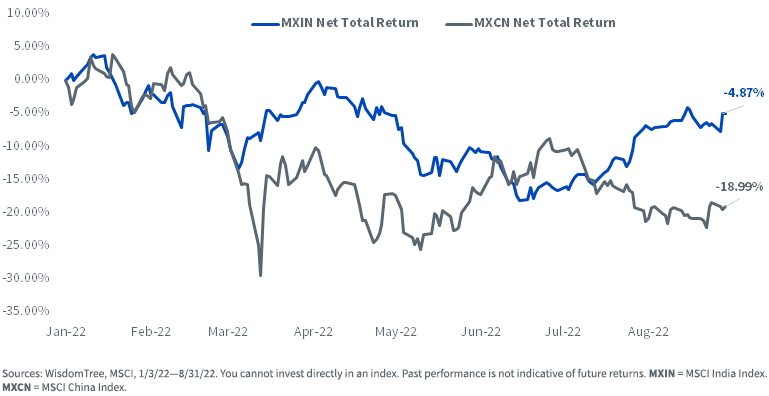

Chinese residents and businesses alike are struggling under uncompromising “zero-COVID” policies, and the MSCI China Index is down 18.99% this year. All sectors except Energy are down between 9.97% and 30.67%.

The Information Technology and Communication Services sectors are key contributors to the negative performance of the index, due to increasing regulatory measures and probes.

Though months-long total lockdowns placed on major cities like Shanghai have ended, the Chinese government is still enforcing strict COVID controls, such as immediate lockdowns of retail store (along with shoppers) upon discovery of positive cases. Some manufacturers are required to operate under a closed-loop system, where employees live on-site. These ongoing measures have contributed to supply-chain woes, exacerbated by unpredictable demand patterns.

Supply and demand uncertainty in the Chinese economy and strict regulations, coupled with rising geopolitical tensions with the U.S. and Taiwan, are expected to deter hesitant foreign and domestic investors.

Indian Equities Rallying

By comparison, the MSCI India Index is only down by 4.87% this year and is continuing to outperform most other emerging markets countries, driven by the resilience of its Utilities sector.

The Indian economy has shown a remarkable post-COVID recovery, facilitated by government efforts to ease compliance burdens on businesses and remove redundant policies and laws.

On August 20, the Ministry of Commerce and Industry announced that it simplified almost 20,000 compliances and decriminalized thousands of laws. The significant reduction in red tape is expected to bolster further outperformance and attract investors.

Since the start of Q3 2022, the gap between India’s performance and that of other emerging markets has been widening. The differences are even more glaring when comparing India and China (proxied by the MSCI India and MSCI China indexes, respectively).

India, a major oil importer, has benefited as oil prices have slid over 20% since the middle of June. Lower prices will help tamper inflation and mitigate the need for the Reserve Bank of India to aggressively tighten interest rates—a boon to equities.

WisdomTree India Earnings Index Rebalance

The WisdomTree India Earnings Index (WTIND) targets profitable companies from the fast-growing Indian equity market.

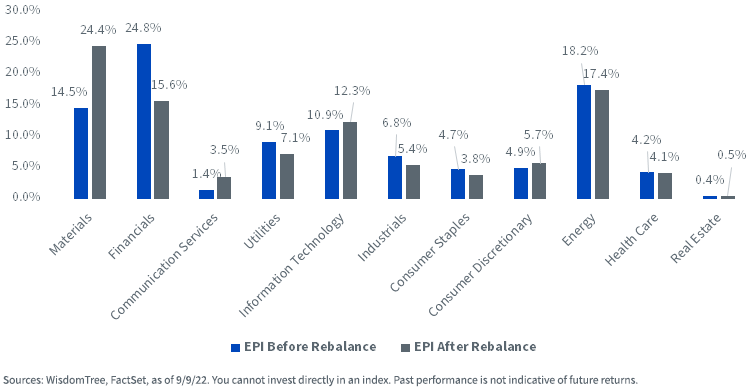

The annual rebalance of this Index—which screens at the end of August—tilted the Index away from the Financials sector, due to the Index’s rule to exclude companies recently reclassified as passive foreign investment companies (or PFICs). The Index also added to the Materials sector which has seen profits increase with soaring commodity prices.

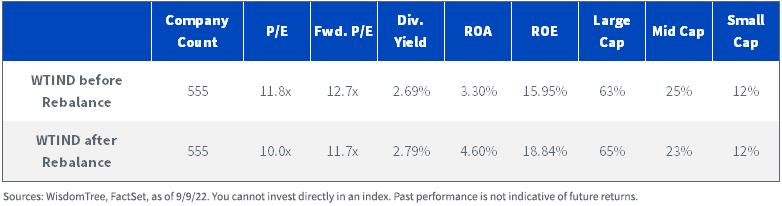

From a fundamental perspective, quality metrics improved, with ROA increasing from 3.3% to 4.6%, and ROE from 16.0% to 18.8%. The Index’s price-to-earnings (P/E) decreased to 10times—less than half of that of the MSCI India Index. Adds and drops to WTIND netted out, leaving the total number of companies at 555.

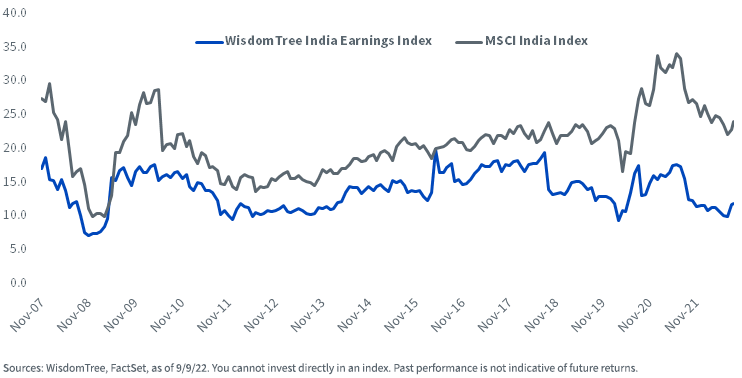

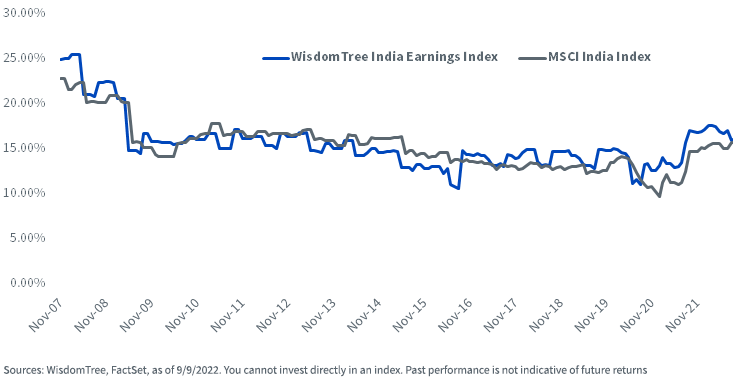

For the past six years, WTIND’s ROE has been increasing relative to the MSCI India Index’s with each rebalance.

WTIND has historically traded at a significant discount to the MSCI India Index, and the spread between their P/E ratios has generally widened over time.