Data Centers Are the Physical Backbone of Digital Life

People, businesses and even governments have been shifting the relationship that they have with data.

Now, with a mere internet connection, services like Spotify allow you to access almost entire discographies. The idea of trying to carry around all of one’s data no longer makes sense.

Data centers and smooth, efficient internet connectivity are responsible for this change.

Cloud Providers vs. Data Centers

Cloud computing has received enormous attention as a megatrend in its own right. In 2022, global sales are forecast to surpass $495 billion, and it could get to more than $1 trillion by 2030. Roughly 30% of enterprise workloads have been shifted to the cloud.1

When we think of “the cloud,” some of the biggest companies in the world leap to mind. Amazon’s Amazon Web Services (AWS) is the leader; combined with Microsoft and Google, the three companies comprise 65% of the total share of global cloud-service spending.2

But when we say “the cloud,” what does this look like in the physical world? We may take for granted that the software is always there on our smartphones, tablets and computers, but this is all dependent on specific, purpose-built infrastructure.

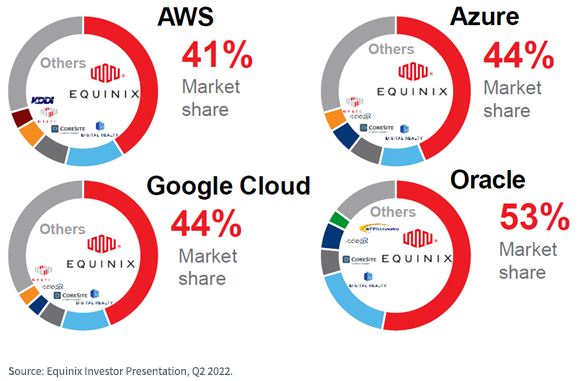

Figure 1 comes from the Equinix Second Quarter 2022 Investor Presentation. Equinix is a leading provider of data center infrastructure, operating on six continents in 31 countries with 248 data centers.3 Here, they take four of the large “hyperscalers”—the companies running the cloud platforms that allow for much of the world’s digital needs to be met.

While we may know the names of the hyperscalers—these do tend to be some of the largest market capitalization companies in the world—we might not immediately know the name “Equinix.” Yet, it’s very clear that Equinix is central to the functioning of today’s digital world.

Figure 1: Equinix Provides a Physical Foundation for the Cloud Hyperscalers

Slicing the Pie of Economic Profits

Now, Equinix gets about 35% of its overall rent from the biggest cloud providers. Would you want to sit on the other side of the negotiating table from the biggest companies on earth? If one controls for the impact of energy costs, major tech companies pay roughly half the rental rate that a small business or government tenant does.5

Asking whether data center providers will ever supersede the largest companies in the world in terms of their ability to extract economic value from the cloud ecosystem is probably the wrong question. Instead, it may make sense to think of the relationship between the current price and predicted future supply/demand balances. Data center infrastructure, in a broad sense, is a commodity, assuming that the providers can bring the cloud computing companies basically the same suite of capabilities.

The world’s increased focus on climate and the environment is making it trickier to build more data centers, which use a lot of water (cooling) and a lot of electricity. In the first six months of 2022, asking rents for data centers in major U.S. locations increased 5.9% compared with the same period in 2021. If this trend continues, it’s possible that 2022 will be the first year of positive rent growth for data centers since 2017.6

Will the Hyperscalers “Go Their Own Way?”

The world’s largest companies, due to their vast resources, are able to think strategically over long periods. People external to Apple, for instance, might have realized only too late that the perceived tie to Intel’s chips was not permanently binding, and that Apple—with the appropriate commitment and investment—could design its own chips to make the experience of its customers better. When companies generate tens of billions in cash flows on an annual basis, those resources combined with long-term thinking could make perceived limitations melt away.

Hedge fund manager Jim Chanos is actually betting against data center infrastructure providers, like Equinix and Digital Realty Trust. These hyperscalers can and do build some of their own facilities—a Microsoft data center in Chicago spans 700,000 square feet, the size of about 52 Olympic swimming pools.7 Why wouldn’t they start transitioning to build all of their own facilities, thereby taking away the cost of the data center infrastructure providers?

While nothing is ever “impossible,” when one is thinking of real estate that has strategic value like this, location is important. If Equinix or Digital Realty Trust has its infrastructure in the more ideal locations, connected to the most important networks with the right infrastructure, it is not possible to come in and build something new in that same location. If the hyperscalers were starting from scratch today, they would probably build a lot themselves. Given that these companies are seeking to use existing infrastructure where they can to serve their customers—assuming that companies like Equinix and Digital Realty Trust hold this real estate—they will likely continue to have their place in the ecosystem. The convenience of plugging into existing setups may supersede the cost savings of doing it themselves.

It is also the case that the customer base will likely evolve. Just as the hyperscalers might be thinking of ways to extract more economic value and take away the expense line item being paid to technological infrastructure providers, other companies are seeing big expenses being paid to the likes of Microsoft, Amazon, Google Cloud, etc. It is possible that the diverse array of businesses undergoing their specific “cloud migrations” will explore direct relationships with the infrastructure providers in the future.

People have debated this idea for almost as long as the hyperscalers have been in the cloud computing business, and so far, the data center infrastructure providers, like Equinix and Digital Realty Trust, are still there.

Conclusion: Digital Transformations Need Physical Infrastructure

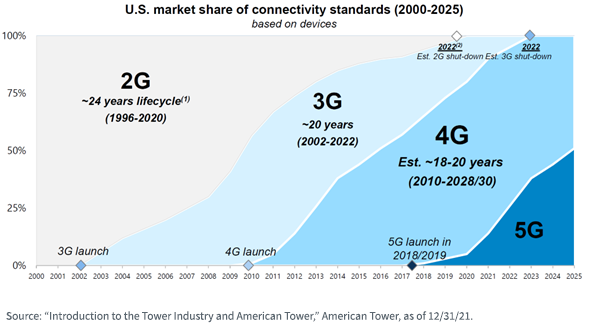

We spend a lot of time considering different megatrends, like cloud computing, artificial intelligence, 5G, the internet of things…the list goes on.

Figure 2 shows that data transmission standards—things we know of as 2G, 3G, 4G, 5G—tend to have lifespans of roughly 20 years.8 The shift toward 5G tells us that more and more data is going to be generated and processed, and we will need data center infrastructure to support it.

Figure 2: Evolutions of Connectivity Standards in the United States

If investors are thinking of a different way to gain exposure to megatrends—their underlying infrastructure rather than the more direct players—the concept of “new economy” real estate may offer something unique that could have a risk and return profile different than the more growth-oriented tech equities. Learn more about our specific strategy: the WisdomTree New Economy Real Estate Fund (WTRE).

1 Source: “The cloud computing giants are vying to protect fat profits,” Economist, 8/29/22.

2 Source: Aaron Tilley, “Cloud Companies’ Outlook Cools as Customers Tighten Spending,” Wall Street Journal, 8/25/22.

3 Source: Equinix Investor Presentation, Q2 2022.

4 Source: Carol Ryan, “Data Centers Are Unpopular. All the Better for Their Stocks,” Wall Street Journal, 8/30/22.

5 Source: Ryan, 8/30/22.

6 Source: Ryan, 8/30/22.

7 Source: Anna Gross, “Will the cloud kill the data center? Jim Chanos thinks so,” Financial Times, 8/29/22.

8 Source: “Introduction to the Tower Industry and American Tower,” American Tower, as of 12/31/21.

Christopher Gannatti is an employee of WisdomTree UK Limited, a European subsidiary of WisdomTree Asset Management, Inc.’s parent company, WisdomTree Investments, Inc.

As of September 9, 2022, WTRE held 4.70% and 5.03% of its weight in Equinix and Digital Realty Trust, respectively. Click here for a full list of fund holdings.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as the risk of loss from currency fluctuation or political or economic uncertainty. Investments in real estate involve additional special risks, such as credit risk, interest rate fluctuations and the effect of varied economic conditions. A Fund focusing on a single country and/or sector and/or emphasizing investments in smaller companies may experience greater price volatility. The Fund invests in the securities included in, or representative of, its Index, regardless of their investment merit, and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Christopher Gannatti began at WisdomTree as a Research Analyst in December 2010, working directly with Jeremy Schwartz, CFA®, Director of Research. In January of 2014, he was promoted to Associate Director of Research where he was responsible to lead different groups of analysts and strategists within the broader Research team at WisdomTree. In February of 2018, Christopher was promoted to Head of Research, Europe, where he was based out of WisdomTree’s London office and was responsible for the full WisdomTree research effort within the European market, as well as supporting the UCITs platform globally. In November 2021, Christopher was promoted to Global Head of Research, now responsible for numerous communications on investment strategy globally, particularly in the thematic equity space. Christopher came to WisdomTree from Lord Abbett, where he worked for four and a half years as a Regional Consultant. He received his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern School of Business in 2010, and he received his bachelor’s degree from Colgate University in Economics in 2006. Christopher is a holder of the Chartered Financial Analyst Designation.