Integrating WisdomTree Models into a “Core/Satellite” Framework

This article is relevant to financial professionals who are considering offering Model Portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional. Not all financial professionals have access to these Model Portfolios.

Satellite in my eyes

Like a diamond in the sky

How I wonder

Satellite strung from the moon

And the world your balloon…

(“Satellite” by the Dave Matthews Band, 1994)

Defining Core/Satellite

Most advisors are familiar with the concept of “core/satellite” portfolio construction (sometimes referred to as “core and explore”), but let’s define terms, so we are working from a similar framework.

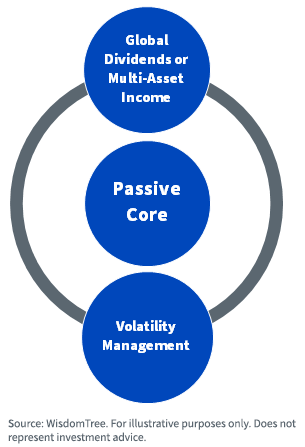

The idea is to build a relatively inexpensive and passive “core” portfolio, typically using ETFs, in an attempt to build a desired market exposure (or “beta”) portfolio in a cost- and tax-efficient manner. Then surround that core portfolio with actively managed “satellite” managers in an attempt to add net-of-fee outperformance (or “alpha”) to the overall portfolio. Historically, those active managers have come by way of mutual funds or, for larger clients, separately managed accounts (SMAs).

To understand the notion of adding “alpha,” we also need to remind ourselves of the concept of “active risk.” Simplistically, active risk can be thought of as “bets” (over-weights, under-weights, factor tilts, etc.) an active manager takes away from the underlying benchmark in an attempt to generate outperformance versus that benchmark.1

So, the goal of a core/satellite portfolio is to deliver cost- and tax-efficient outperformance relative to a defined benchmark (e.g., the S&P 500 Index or the MSCI ACWI Index for an equity portfolio).

Building a Better Mousetrap

The satellite component of the portfolio was constructed using actively managed mutual funds and/or SMAs. But the structural shortcomings of mutual funds are well-known—they are typically more expensive than comparable ETFs, have certain potential tax disadvantages, cannot be traded intra-day and so forth.

But what if you could build the satellite portfolio with structurally advantaged ETFs? Enter the WisdomTree Outcome-Focused Model Portfolios.

We built these models with “satellite” very firmly in mind. While they can be—and are—used as stand-alone models, they were built specifically to complement already existing portfolios to help achieve specific investment mandates.

Our Outcome-Focused models include:

- Global Dividend, an all-equity portfolio seeking capital appreciation and high current income.

- Global Multi-Asset Income, exactly as it sounds, this portfolio includes stocks, bonds and other assets in an attempt to maximize current income while managing risk.

- Multifactor, an all-equity portfolio that seeks to improve the risk factor diversification of an overall portfolio while pursuing the generation of a positive total return. This model is available in U.S., EAFE and EM versions.

- Volatility Management, a portfolio allocated to nontraditional or “alternative investment” strategies, including equity long/short, managed futures, diversified arbitrage, short-biased and options-based. The investment objective of including this portfolio is to help improve the overall diversification of the portfolio by including lower-correlated strategies and thereby seeking to deliver more consistent performance over full market cycles.

- Disruptive Growth, precisely as it sounds, this portfolio’s objective is maximum long-term capital appreciation, and it seeks to take advantage of evolving or disruptive trends in the workplace, platforms, cloud computing, financial technology, cybersecurity, biotech and genomics, video games and esports, and sustainable investing.

All these portfolios are ETF-only, except for the Volatility Management portfolio, which contains one mutual fund (diversified arbitrage). They are all “open architecture” and contain both WisdomTree and third-party strategies. We charge no strategist fee on the models—our revenue capture is only the expense ratios of any WisdomTree strategy we include in each model.

If you know WisdomTree, you know we are not a passive beta shop, even though we are an ETF shop. ALL our products have one or more “factor tilts” embedded in them—dividends, value, size, quality, earnings and so forth.

In other words, all our strategies take “active risk” relative to an underlying passive beta index—risks that we believe, both academically and empirically, have the potential to deliver “alpha” over full market cycles in comparison to passive beta.

Think about an actively managed mutual fund (the typical component of a “satellite” portfolio). What is it? It is a portfolio manager (or team) taking on active risk in an attempt to deliver net-of-fee alpha, right?

Well, that is exactly what WisdomTree does. The difference is that our active risk “bets” are rules-based and quantitative in nature. We are one of the few asset managers that “self- indexes”—we define a quantitative and rules-based filter or screen for a given product, develop an index around those defined screens and then wrap an ETF around that index.

So, in many respects, despite being an ETF shop, most of our products are more accurately compared to actively managed mutual funds than passive beta products. We typically will be more expensive than the passive beta product but much less expensive than the more comparable mutual funds while taking on similar active risk.

So, let’s visualize some potential “core/satellite” portfolios using WisdomTree Outcome-Focused models versus actively managed mutual funds.

1. Goal of the satellite is to optimize risk-adjusted income:

2. Goal of the satellite is to increase the overall diversification of the portfolio:

3. Goal of the satellite has potential for high growth and its objective is maximum long-term:

4. Goal of the satellite is maximize long-term capital appreciation and overall portfolio diversification:

Conclusion

The beauty of “core/satellite” portfolio construction is that the possibilities are almost endless—you can construct the satellite portfolio with myriad investment objectives and populate it accordingly.

We built our suite of Outcome-Focused model portfolios with this flexibility in mind. They are designed and managed to address a number of potential investment objectives and can be mixed and matched to meet multiple objectives. A primary purpose in doing so is to make “core/satellite” portfolio construction easy using what we believe is a more cost- and tax-effective approach—a “better mousetrap.”

You can learn more about our Outcome-Focused models (allocations, line-item tickers, performance, yields, fees, etc.) on our Model Adoption Center.

1 The seminal paper on active risk is “How Active is Your Fund Manager” by Martijn Cremers and Antii Petajisto, first published as a working paper in 2006. It can easily be found by searching on the title and authors.

Important Risks Related to this Article

For financial advisors: WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy.

For retail investors: WisdomTree’s Model Portfolios are not intended to constitute investment advice or investment recommendations from WisdomTree. Your investment advisor may or may not implement WisdomTree’s Model Portfolios in your account. The performance of your account may differ from the performance shown for a variety of reasons, including but not limited to: your investment advisor, and not WisdomTree, is responsible for implementing trades in the accounts; differences in market conditions; client-imposed investment restrictions; the timing of client investments and withdrawals; fees payable; and/or other factors. WisdomTree is not responsible for determining the suitability or appropriateness of a strategy based on WisdomTree’s Model Portfolios. WisdomTree does not have investment discretion and does not place trade orders for your account. This material has been created by WisdomTree, and the information included herein has not been verified by your investment advisor and may differ from information provided by your investment advisor. WisdomTree does not undertake to provide impartial investment advice or give advice in a fiduciary capacity. Further, WisdomTree receives revenue in the form of advisory fees for our exchange-traded funds and management fees for our collective investment trusts.

Fixed income investments are subject to interest rate risk; their value will normally decline as interest rates rise. In addition, when interest rates fall, income may decline. Fixed income investments are also subject to credit risk, the risk that the issuer of a bond will fail to pay interest and principal in a timely manner or that negative perceptions of the issuer’s ability to make such payments will cause the price of that bond to decline.

Derivative investments can be volatile; these investments may be less liquid than other securities, and more sensitive to the effects of varied economic conditions

Due to the investment strategy of certain funds included in a model portfolio, such funds may make higher capital gain distributions than other funds. Actively managed ETFs, unlike typical ETFs, do not attempt to track or replicate an index. Thus, the ability of these ETFs to achieve their objectives will depend on the effectiveness of the portfolio manager.

Please see the prospectus of each fund included in a model portfolio for discussion of risks of investing in the fund.

Diversification does not eliminate the risk of experiencing investment losses.