U.S. Mid-Caps Remain Attractive After July’s Rally

July offered investors a slight reprieve from the market volatility that has characterized the first half of 2022. Although most major equity indexes remain down more than 10% since January, investors got a brief taste of a midsummer “buy the dip” rally to kick off the third quarter. U.S. economic data remains surprisingly robust, encouraging investors that a soft landing from late-cycle recession fears may be possible. However, the highest inflation rates in decades remain an albatross for the Federal Reserve.

Though the risk-on rally did little to quell losses from earlier this year, if July’s bull market is any indication of forthcoming tranquility, it will be important to analyze potential opportunities before they may disappear.

U.S. mid-cap and mid-cap value are two areas that should not be overlooked.

Valuations May Regain Upside

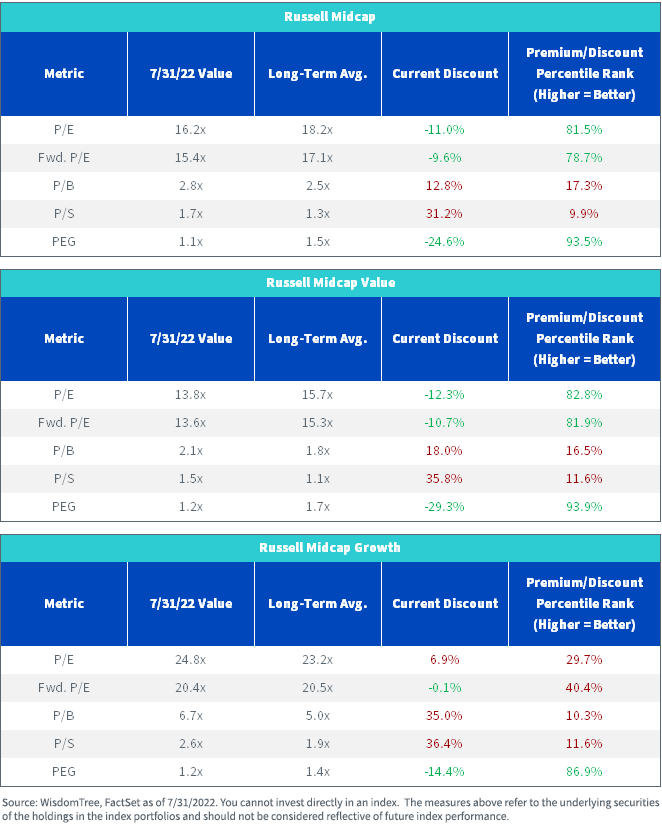

This year’s volatility has compressed the peak valuations from late 2021, making most asset classes relatively more affordable across various metrics. Mid-caps are no exception.

The Russell Midcap and Russell Midcap Value indexes have seen their price-to-earnings (P/E) and forward P/E values (both excluding negative earners) retrace substantially by mid-summertime, both recently hovering around a 10% to 12% discount to their long-term averages. Despite July’s rally, these are still among the steepest discounts observed for these asset classes dating back to 2002.

Even the Russell Midcap Growth Index has returned to more modest valuations, trading right around its long-term average for both measures.

For definitions of the terms in the chart above, please visit the glossary

Investing Opportunities

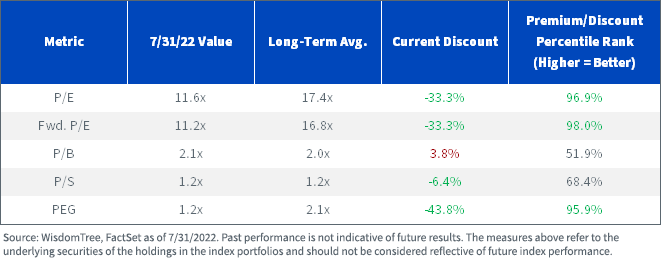

Although July’s rally helped mid-cap value regain its footing, both valuation measures are still about a full standard deviation below their long-term averages. The forward P/E and trailing P/E, both excluding negative earners, of the Russell Midcap Value finished July at a modest 13.6x and 13.8x, respectively.

Historical Forward P/E (ex. Negative Earners) of Russel Midcap Value

-of-russell-mid-cap-value.png)

Historical P/E (ex. Negative Earners) of Russell Mid Cap Value)

-of-russell-mid-cap-value.png)

Compared to U.S. large-cap value, it almost appears as if the July rally didn’t happen. Historically, mid-cap value commanded about a 5% to 7% premium to large-cap value on a price-to-earnings basis, yet it remains deeply discounted compared with its larger brethren through July.

Current valuations remain about two standard deviations below their longer-term average. This implies that last month’s rally may have disproportionately benefitted large-cap value more than mid-cap value. The latter may be poised to catch an overdue tailwind if historical patterns after such bargains are upheld.

Russell Midcap Value Fwd. P/E (ex. Negative Earners) vs. Russell 1000 Value

-vs,-d-,-russell-1000-value.png)

Russell Midcap Value P/E (ex. Negative Earners) vs. Large Cap Value

-vs,-d-,-large-cap-value.png)

Actionable Ideas for Mid-Cap Value

WisdomTree has preached the merits of mid-cap investing since launching the WisdomTree U.S. MidCap Dividend Fund (DON) in 2006. Its emphasis on dividends has also given it an explicit value tilt.

We believe that it looks attractive in today’s market, with valuations comfortably below long-term averages and discounts among the lowest observed since inception. It also may offer an attractive entry point for investors looking to establish or maintain mid-cap value exposure amid a tenuous period for the U.S. economy.

WisdomTree U.S. MidCap Dividend Fund (DON)

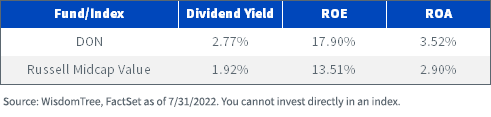

But the valuations look even more compelling when you consider the underlying fundamentals that accentuate them. DON offers an advantage in value metrics, such as dividend yield, and quality measures, such as return on equity (ROE) and return on assets (ROA), at a discount to broader mid-cap value markets.

Fundamental Comparison

Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. For the most recent standardized performance, 30-day SEC yield and month-end performance, click here.

Though it will require audacity to combat the narrative that a U.S. recession is imminent, mid-cap equities may be a worthwhile asset class to weather whatever the near-term economic future holds.

Important Risks Related to this Article

This material must be preceded or accompanied by a prospectus. We advise you to consider the fund’s objectives, risks, charges and expenses carefully before investing. The prospectus contains this and other important information. Please read the prospectus carefully before investing.

There are risks associated with investing, including possible loss of principal. Funds focusing their investments on certain sectors and/or smaller companies may be more vulnerable to any single economic or regulatory development. This may result in greater share price volatility. Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Brian Manby joined WisdomTree in October 2018 as an Investment Strategy Analyst. He is responsible for assisting in the creation and analysis of WisdomTree’s model portfolios, as well as helping support the firm’s research efforts. Prior to joining WisdomTree, he worked for FactSet Research Systems, Inc. as a Senior Consultant, where he assisted clients in the creation, maintenance and support of FactSet products in the investment management workflow. Brian received a B.A. as a dual major in Economics and Political Science from the University of Connecticut in 2016. He is holder of the Chartered Financial Analyst designation.