The Value Rotation Has Done Little to Dim Enthusiasm for Cybersecurity Stocks

The global equity market shifted around November 2021, and we believe we’ll look back at that turning point for some time. Before that date, going back nearly to the Great Recession of 2008–09, the cost of capital was of little concern. After that date, with central banks signaling and then executing a policy change to fight inflation, the cost of capital became almost the full story.

In effect, the market slammed on the breaks for many of the more innovative companies that represent novel ideas but possibly a multiyear journey to hit positive cash flows and ultimately profitability. The further the perceived distance to profitability, the worse the return in 2022, at least so far.

Thematic Strategies—A Rush to the Exits?

With returns so challenged, it stands to reason that investors couldn’t exit thematic equity positions fast enough. In most cases, these are the opposite of the dividend-paying, value-oriented companies that have done well in the first half of 2022.

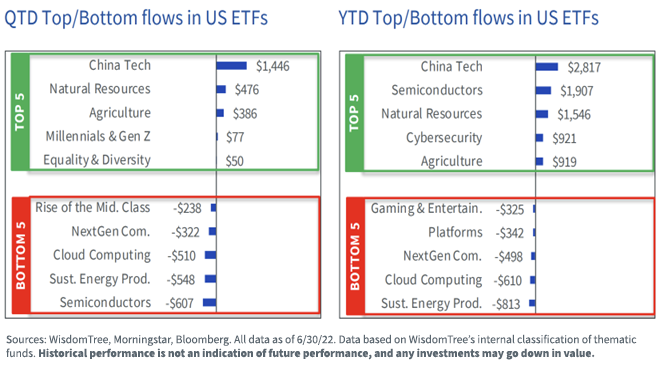

WisdomTree has classified the universe of thematic, U.S.-listed exchange-traded funds (ETFs) to track different measures. Looking at Figure 1, we can see the flows picture for the second quarter and first half of 2022.1

- With everything happening in the China/U.S. relationship, it is amazing that the top asset-gathering theme in WisdomTree’s classification was focused on Chinese companies.

- It’s interesting to see that semiconductors took in so much money during the first quarter that, even with outflows of more than $600 million during Q2 2022, they were still No. 2 in WisdomTree’s thematic classification for the six-month period.

- For the balance of this piece, we’d like to call attention to cybersecurity. Many cybersecurity companies offer their software through the cloud and could therefore also show up in cloud computing strategies, depending on the parameters of the given strategy. Cloud computing has seen a challenging performance environment, with outflows of more than $600 million during the first six months of 2022. Cybersecurity has seen a difficult performance environment, and the theme has seen inflows of more than $900 million in the same period.

Figure 1: Following the Money in U.S. Thematic ETFs

Russia/Ukraine as a Catalyst?

There is a history of cyberattacks emanating from Eastern Europe and Russia, the NotPetya attack being one of the most widely known and globally impactful.2 Russia’s action in Ukraine inspired heightened vigilance around cybersecurity. Even though offensive cyber efforts out of Russia so far in the conflict have focused mainly on Ukraine, Western nations and cybersecurity companies based in Western nations recommend respecting the possible threat and preparing accordingly.

Even in a more challenging economic environment, it is difficult to imagine companies deciding to cancel their cybersecurity subscriptions. Many also need a combination of services as employees undertake remote-first or hybrid setups, thinking about endpoint protection, cloud security, single sign-on and zero-trust network architectures, to name a few. If technology spending needs to be cut, we believe it will likely be in other areas—not cybersecurity.

An ACTIVE Acquisition Environment So Far in 2022

We saw that U.S. ETF investors put more than $900 million toward cybersecurity-specific strategies during the first six months of 2022. Large institutional investors are also putting money to work in cybersecurity companies—in certain cases buying entire firms, even as M&A and public offerings have slowed in 2022 compared with 2021.

- Ping Identity Holding will be taken private by Thoma Bravo for $2.8 billion. Compared with the closing price on the prior day, this deal represents a premium of about 63%. Ping Identity provides identity verification solutions. The deal could benefit Thoma Bravo, allowing it to tap into enterprise security solutions, and Ping Identity, allowing it to accelerate its cloud transition.3

- Tufin entered a definitive agreement to be purchased by Turn/River Capital for $570 million. This represents a 44% premium to Tufin’s closing value the day before the announcement. The deal could accelerate Tufin’s ability to help enterprise customers use policy-driven automation to improve cybersecurity solutions.4

- Datto, a market-leading global provider of security and cloud-based software solutions, has completed a sale to Kaseya in a deal valued at $6.2 billion. Vista Equity Partners, the majority holder of Datto, was involved in the deal. Vista acquired Datto in 2017. Since then, Datto has doubled its annual revenue to $620 million.5

It is not a time when investors looking at cybersecurity companies see strong share price performance, but they do see a lot of activity in the space.

Conclusion—Cybersecurity as an Investment in 2H 2022?

As we look at cybersecurity, we believe it is important to be on the cutting edge, focused on the quintessential cat-and-mouse game occurring every minute of every day across the internet. In many cases, newer companies offer disruptive solutions that could make the difference in protecting data from nefarious actors. The WisdomTree Cybersecurity Fund takes a definitive approach, focusing on innovative cybersecurity companies with strategies looking to the future.

1 Sources: WisdomTree, Morningstar, Bloomberg. All data as of 6/30/22. Data based on WisdomTree’s internal classification of thematic funds. Historical performance is not an indication of future performance, and any investments may go down in value.

2 Source: “Russian military ‘almost certainly’ responsible for destructive 2017 cyber attack,” National Cyber Security Centre, 2/14/18.

3 Source: Escobar, Sabrina, “Ping Identity Soars as Thoma Bravo Buying Software Company for $2.8 Billion,” Barron’s, 8/3/22.

4 Source: “Tufin Enters Into Definitive Agreement to be Acquired by Turn/River Capital in a $570 million Transaction,” BusinessWire, 4/6/22.

5 Source: “Datto Completes Sale to Kaseya,” BusinessWire, 6/23/22.

Important Risks Related to this Article

Christopher Gannatti is an employee of WisdomTree UK Limited, a European subsidiary of WisdomTree Asset Management, Inc.’s parent company, WisdomTree Investments, Inc.

There are risks associated with investing, including possible loss of principal. The Fund invests in cybersecurity companies, which generate a meaningful part of their revenue from security protocols that prevent intrusion and attacks to systems, networks, applications, computers, and mobile devices. Cybersecurity companies are particularly vulnerable to rapid changes in technology, rapid obsolescence of products and services, the loss of patent, copyright and trademark protections, government regulation and competition, both domestically and internationally. Cybersecurity company stocks, especially those which are internet related, have experienced extreme price and volume fluctuations in the past that have often been unrelated to their operating performance. These companies may also be smaller and less experienced companies, with limited product or service lines, markets or financial resources and fewer experienced management or marketing personnel. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. The composition of the Index is heavily dependent on quantitative and qualitative information and data from one or more third parties, and the Index may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Christopher Gannatti began at WisdomTree as a Research Analyst in December 2010, working directly with Jeremy Schwartz, CFA®, Director of Research. In January of 2014, he was promoted to Associate Director of Research where he was responsible to lead different groups of analysts and strategists within the broader Research team at WisdomTree. In February of 2018, Christopher was promoted to Head of Research, Europe, where he was based out of WisdomTree’s London office and was responsible for the full WisdomTree research effort within the European market, as well as supporting the UCITs platform globally. In November 2021, Christopher was promoted to Global Head of Research, now responsible for numerous communications on investment strategy globally, particularly in the thematic equity space. Christopher came to WisdomTree from Lord Abbett, where he worked for four and a half years as a Regional Consultant. He received his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern School of Business in 2010, and he received his bachelor’s degree from Colgate University in Economics in 2006. Christopher is a holder of the Chartered Financial Analyst Designation.