Be Greedy when Others Are Fearful

This article is relevant to financial professionals who are considering offering Model Portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional. Not all financial professionals have access to these Model Portfolios.

Let’s talk about something few people have any interest in talking about this year.

I swear, this is not because I want a large portion of you to close this browser window. But in investing, the best times to talk about something is often when people have the least interest in talking about it.

Let’s talk about emerging markets (EM).

An Afterthought, and Not Hard to See Why

Frankly, it isn’t difficult to see why investors have had little interest in EM lately. It is currently in one of the longest bear market drawdowns in the history of the asset class, having peaked nearly a full year before the S&P 500 did earlier this year.

The relentless strength of the dollar—arguably the biggest macro driver of EM returns—has tightened liquidity globally and squeezed EM investor returns.

And the Chinese government has been on a regulatory rampage, issuing one body blow after another to many of its largest tech companies.

It isn’t purely anecdotal that investors have little interest in EM right now—the data backs it up, too.

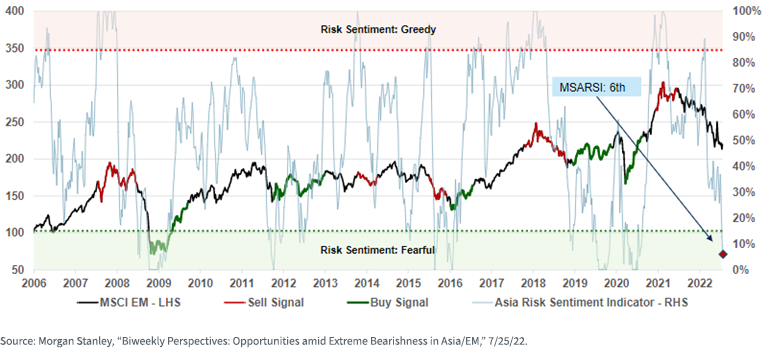

Global fund managers have close to the biggest underweight allocations to EM they have had in the last five years.1 According to Morgan Stanley, investor sentiment toward EM is what they would classify as “extremely bearish,” with their sentiment indicator currently in the bottom decile of its history.2

Light at the End of the Tunnel?

But it is possible that right now we’re seeing signs of a turnaround.

For one, sentiment is a remarkably effective contrarian indicator. The historical periods when the Morgan Stanley sentiment indicator was this deeply negative wound up being excellent times to buy EM: Q2 2020, Q3 2019, Q1 2016, Q4 2011 and Q1 2009.

In China, the July Politburo meeting statement called for a normalizing of regulation of platform businesses and gave the green light to several pending technology investment deals. This regulatory “normalization” could perhaps signify the end to the punitive measures taken by Beijing against tech companies.

Additionally, recent weeks have seen global central banks, aside from the Fed, taking aggressive steps to get a handle on their countries’ persistently high inflation. With the Fed no longer the only aggressively hawkish major central bank in town, this development could potentially lessen the upward pressure on the dollar.

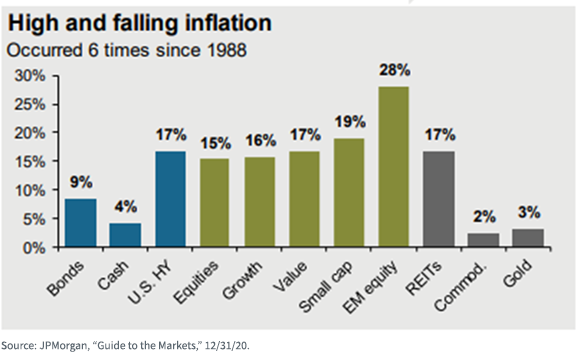

Lastly, it is possible that inflation in the U.S. has peaked (although it is important to note that we expect it to remain sticky). According to JPMorgan, high but falling inflationary periods have been extremely positive for EM equities.

Our Current Approach to EM Allocations

Most of the WisdomTree Model Portfolios will take a multi-pronged approach to EM.

Our flagship Core Equity Model barbells the WisdomTree Emerging Markets ex-State-Owned Enterprises Fund (XSOE) with the WisdomTree Emerging Markets SmallCap Dividend Fund (DGS).

Having experienced the brunt of the unwinding in China tech, XSOE is currently trading at just a 14.5 times P/E ratio—the third percentile of cheapness for its entire history.3

XSOE’s attractive valuations are reflective of the current valuations for names like Alibaba and Tencent, with both trading at an unthinkable 12 times earnings.4

Occasionally we’ll be met with a few raised eyebrow when discussing EM small caps, typically accompanied by the natural follow-up question, “Aren’t those too risky?”

Year-to-date 2022 may epitomize a down year for risk assets. During this time, DGS was down less than the MSCI EM Index, less than the MSCI EM Small Cap Index, and even nearly in-line with the blue-chip S&P 500.5

Lastly, many of the WisdomTree Model Portfolios that include an income mandate will often utilize the WisdomTree Emerging Markets High Dividend Fund (DEM).

Like DGS, DEM has outperformed the broad MSCI EM Index by 4.8% thus far in 2022.6 But its true value comes in the form of its incredibly attractive 8.3% dividend yield.7

For anyone that hasn’t closed their browser window just yet, we’d love to talk about what EM and the WisdomTree lineup have to offer.

1 Morgan Stanley, “Asia EM Equity Strategy – Weekly Fund Flows,” 7/29/22.

2 Morgan Stanley, “Biweekly Perspectives: Opportunities amid Extreme Bearishness in Asia/EM,” 7/25/22.

3 WisdomTree, as of 6/30/22

4 Bloomberg, as of 7/31/22

5 Performance at NAV as of 7/31/22

6 Performance at NAV as of 7/31/22

7 Fund distribution yield as of 7/31/22. Click here for the most recent standardized returns.

Important Risks Related to this Article

This material must be preceded or accompanied by a prospectus. Please read the prospectus carefully before investing. Click here.

DGS, DEM: There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Funds focusing on a single sector and/or smaller companies generally experience greater price volatility. Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation, intervention and political developments. Due to the investment strategy of these Funds, they may make higher capital gain distributions than other ETFs. Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time. Please read the Funds’ prospectuses for specific details regarding the Funds’ risk profiles.

XSOE: There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in emerging or offshore markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. Funds focusing their investments on certain sectors and/or regions increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

You cannot invest directly in an index.

References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.