Not All Advisors Wear Capes…but Many Wear Too Many Hats

Helping a family achieve their financial plan is heroic. Financial advisors are superheroes.

We know, “Not all superheroes wear capes,” but in the case of advisors, many are wearing “multiple hats.”

These hats include the responsibilities of:

- Trading and rebalancing

- Managing a digital presence and content marketing

- Keeping abreast of technology

- Portfolio management

- Hiring staff

- Staying current on financial markets

Advisors know these hats are critical to running their business. But the burden of these extra hats can make the advisor feel like the business is running them.

This begs the question: Which hats are most important?

A framework based on Maslow’s hierarchy of needs can help answer this.1

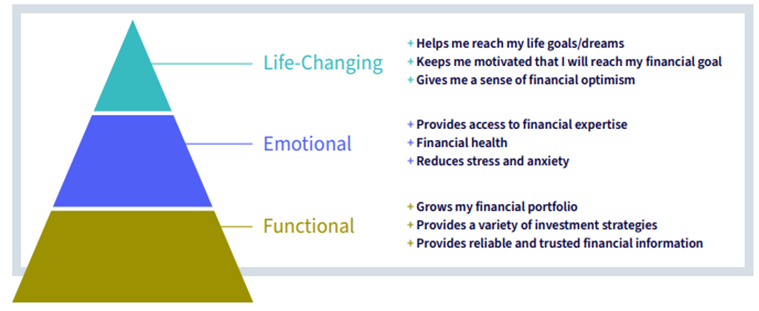

Maslow’s hierarchy of needs helps understand human motivations. WisdomTree’s proprietary research study2 discovered that it can also be adapted and applied to an investor’s needs, as seen below in the Advisor Value Pyramid. This illustrates the value clients put on the products and services advisors offer.

With Maslow, the functional needs at the bottom of the pyramid are food and shelter. With investors, the functional needs are related specifically to their portfolios. Once these needs are met, they look to advisors to help meet their “emotional” and “life-changing” needs.

The research revealed that, with an advisor’s in-depth knowledge of their clients, they are the only ones who can deliver these emotional and life-changing values. This is in stark contrast to functional needs, where leveraging software and third-party expertise is more practical.

Using Maslow’s hierarchy of needs as a framework, advisors should assess where their time is best spent within the Advisor Value Pyramid. The goal is to offload as many hats as possible related to the functional level and spend more time delivering the emotional and life-changing services clients value most.

For example, many advisors use model portfolios to satisfy functional needs. Leveraging the expertise of third-party managers achieves the clients’ functional needs of “grows my financial portfolio” and “provides a variety of investment strategies” as referenced in the Pyramid.

WisdomTree recently introduced an exciting program for RIAs and Independent Advisory Firms, WisdomTree Portfolio & Growth Solutions. This program was built to help assist advisors in delivering customized portfolios, provide rebalancing and trading services, and access to practice management expertise focused on business growth.

Our goal is to help advisors with the burden of wearing multiple hats. This program can assist advisors with portfolio management, trading and rebalancing accounts, managing their digital presence, and staying current on financial markets—just to mention a few.

If you’re a financial advisor reading this, ask yourself, Why did I choose my profession?

Many mention their passion in helping friends, families and strangers feel better about achieving their financial goals and worry less about their finances.

If you’re spending Saturday mornings buried in Excel spreadsheets to keep the business running, you’re not spending your time making that difference.

Instead, you should reference the Advisor Value Pyramid and think about how much time you are manually spending on functional tasks verses satisfying the emotional and life-changing needs of your clients. Let WisdomTree help you run your business by assisting with the functional tasks, so your business isn’t running you.

What are the benefits in doing so?

Advisors can potentially regain time, save money and achieve higher client satisfaction.

Regain time: Advisors outsourcing at least 90% of their assets save an average of 8.4 hours per week on investment management. Imagine what you could do with another 450 hours per year?3

Save money: A recent study found more than 50% of advisors currently outsourcing their investment management have reported a decrease in operating costs since they began outsourcing, with 40% seeing declines in costs of 5% or more.4

Achieve higher client satisfaction: The same study surveyed advisors who outsource investment management and found that 83% of advisors reported stronger client relationships; 82% said they increased client retention; 74% mentioned the acquisition of new/higher-quality clients; and 67% increased the number of client referrals as a direct result of outsourcing.5

When you add up the three benefits of regaining time, saving money and achieving higher client satisfaction—WisdomTree is empowering superheroes to keep being superheroes…

…all at the expense of removing some of the hats advisors don’t need to wear.

Capes are optional.

1 Maslow’s hierarchy of needs is a motivational theory in psychology consisting of a five-tier model of human needs, often depicted as hierarchical levels in a pyramid.

2 2020 WisdomTree Model Portfolio Study

3 “Impact of Outsourcing” Whitepaper by AssetMark and © 2020 BlackRock, Inc. All rights reserved. Quoting: Cerulli Associates, “U.S. Advisor Metrics 2018: Combatting Fee and Margin Pressure.” Time savings estimation assumes 20% time savings x a 45-hour work week x 50 weeks per year = 450 hours saved.

4 “Impact of Outsourcing Study” by AssetMark

5 The Impact of Outsourcing study was conducted in partnership with 8 Acre Perspective, an independent research firm, and represents the second installment of original research conducted by AssetMark in 2019. 757 financial advisors participated in the study, completing an online survey between September and October 2021.

Contact Us

Important Risks Related to this Article

For financial advisors: WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy.

For retail investors: WisdomTree’s Model Portfolios are not intended to constitute investment advice or investment recommendations from WisdomTree. Your investment advisor may or may not implement WisdomTree’s Model Portfolios in your account. The performance of your account may differ from the performance shown for a variety of reasons, including but not limited to: your investment advisor, and not WisdomTree, is responsible for implementing trades in the accounts; differences in market conditions; client-imposed investment restrictions; the timing of client investments and withdrawals; fees payable; and/or other factors. WisdomTree is not responsible for determining the suitability or appropriateness of a strategy based on WisdomTree’s Model Portfolios. WisdomTree does not have investment discretion and does not place trade orders for your account. This material has been created by WisdomTree and the information included herein has not been verified by your investment advisor and may differ from information provided by your investment advisor. WisdomTree does not undertake to provide impartial investment advice or give advice in a fiduciary capacity. Further, WisdomTree receives revenue in the form of advisory fees for our exchange-traded funds and management fees for our collective investment trusts.

Ryan Krystopowicz joined WisdomTree in March 2016 and serves as a Product Specialist, ETF Model Portfolios. He is a leading voice in the content and commercialization of WisdomTree’s Model Portfolio Research Study & Model Adoption Center. Ryan also contributes to the commercial success of WisdomTree’s Model Portfolio offerings by supporting Distribution and the management of host platforms. His passion for third-party model portfolios and investment outsourcing was cultivated during his tenure at a Registered Investment Advisor where he took on a variety of roles within research and operations. Ryan received a degree from Loyola University of Maryland and is a CFA charterholder.