Navigating the Odds of a Recession

The re-opening trade in 2021 has evolved into the recession trade in 2022, owing to the late start to beginning the hiking cycle by central banks in developed markets. Their misreading of inflation as transitory has left them way behind the curve. To save face, they are moving expeditiously in tightening monetary policy at a time when breakeven inflation expectations are receding. Sure, core inflation is showing signs of cresting but it is unlikely to decelerate, paving the way for further hikes.

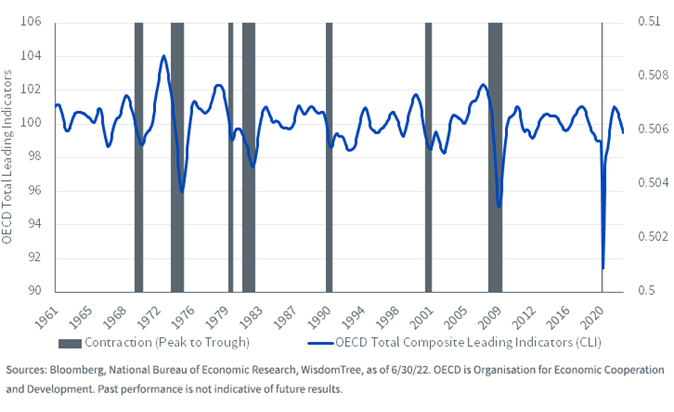

This aggressive tightening plan is slowing the global economy and raising the probability of a global recession. As central banks in the US, Europe, the UK and China have been on different paths in their efforts to quell inflation, the probability, timing and intensity of a recession will differ in each of these regions. Leading economic data (LEI) shows economic momentum is fading quickly. Historically, four consecutive monthly declines in LEI have foretold a recession.

Recession Risks Appear Higher in Europe than in U.S. and China

The Russia/Ukraine war has exacerbated the energy crisis, fuelling higher global inflation. The uncertainty of the war and falling real income growth is evidently taking a toll on consumers across the globe. Owing to its proximity to the war, as well as its high dependence on Russia for energy supplies, Europe is facing higher recession risks. With no abatement of the war in sight, we expect higher energy prices to erode the European consumer’s purchasing power, and further rationing of energy intensive production sites.

The likelihood of recession in Europe has risen to 50% in the next six months. We expect to see two consecutive quarters of negative growth starting in the second half of 2022. The European Central Bank (ECB) is likely to step up the pace of tightening rates, bringing the refi rate to 1% before year-end. The looming recession in the eurozone alongside doubts about debt sustainability should restrain the ECB from going beyond the initial normalization, keeping rates on hold in 2023.

In the U.S., the current economic dynamics appear consistent with a recession. While June payrolls came in at +372,000, exceeding expectations, U.S. inflation rose 9.1% in a broad-based advance. The inflation data will keep Fed officials on an aggressive policy course to rein in demand despite unemployment remaining low at 3.6%.

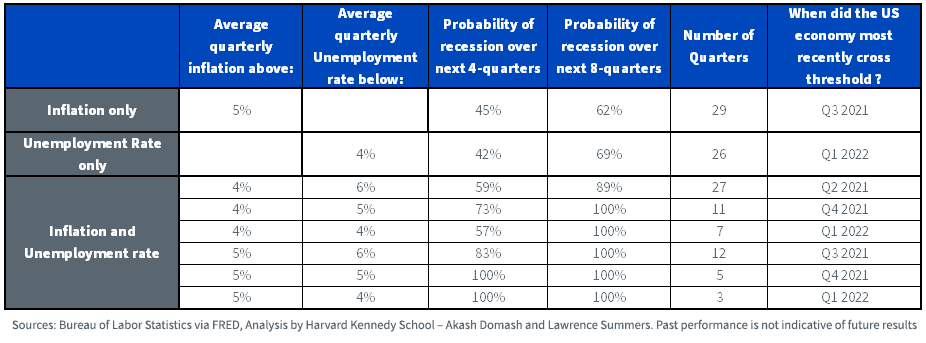

Historically, when average quarterly inflation has risen above 5%, the probability of a recession over the next two years has been above 60%. When the unemployment rate drops below 4%, the probability of a recession over the next two years approaches 70%. Since 1955, there has never been a quarter with average inflation above 4% and unemployment below 5% that was not followed by a recession within the next two years. In Q1 2022, the U.S. economy shrank by an annualised rate of 1.6%, signalling that we might well be on our way to a recession according to the technical definition.

With recession risks rising across economies but with timing and intensity still uncertain, investors need to be careful within their equity allocation. In uncertain markets, when contradictory scenarios are possible, portfolio construction is paramount. The objective should be to build versatile portfolios that can adapt to quickly changing market conditions and remain resilient in the face of unexpected events. In other words, portfolios can participate in market rallies while having a defensive tilt.

All-Weather or Asymmetric Asset?

Most (all?) equity drawdowns are violent and triggered by unpredictable events. Investors do not have a crystal ball to tell them when to switch into defensive assets just before the drawdown. Therefore, they need to consider staying invested in defensive assets for long periods of time in preparation for possible shocks. The opportunity cost of doing so could be significant and varies from one asset to another. This is why we introduce a detailed framework to define “useful” defensive assets. Useful defensive assets should tick four boxes:

- Risk reduction—reduction of drawdowns and volatility

- Asymmetry of returns—versatility, capacity of the asset to capture more of the performance of an asset when it goes up than when it goes down, and to reduce opportunity cost (i.e., the performance an investor did not benefit from because they were invested in another asset)

- Diversification—uncorrelated behavior to the rest of the portfolio and in particular to equities

- Valuation—a cheaper asset usually exhibits less room for negative performance and less crowding as well

In order to improve the versatility of a portfolio, it is important to consider all four aspects for potential investments.

The Right Choice for an Equity Portfolio

Traditionally defensive equities like minimum volatility (min vol) or utilities, typically exhibit strong defensiveness in the form of low volatility and lower drawdowns . However, they also exhibit limited upside potential in upward trending markets. This means that properly timing the point of entry and exit for this strategy is key to its success. Of course, this is very difficult. On the contrary, factors such as quality and high dividend provide a more balanced risk/return profile, allowing for more versatility. They remain somewhat defensive, but they can also capture market upside very efficiently.

At WisdomTree, we believe that the right quality strategy is the cornerstone of an equity portfolio. High-quality companies exhibit an ‘all-weather’ behaviour that promises a balance between building wealth over the long term and protecting the portfolio during economic downturns. A quality focused investment can deliver resilient portfolios, helping investors build wealth over the long term and weather the inevitable storms along the way. This makes quality an ideal candidate for a strategic, long-term, core investment in equities.

Aneeka Gupta is Director of Research at WisdomTree. Prior to the acquisition of ETF Securities in April 2018, Aneeka worked as an Equity & Commodities Strategist at the company. Aneeka has 17 years of experience working as a Research Analyst across a wide range of asset classes. In her current role she is responsible for conducting analysis for all in-house equity, commodity and macro publications and assisting the sales team with client queries around products and markets.

Prior to WisdomTree, Aneeka began her career as an equity analyst at Bear Stearns International Ltd in London. She also worked as an Equity Sales Trader at Sunrise Brokers across US and Pan European Exchanges. Before that she worked as an Equity Derivatives Sales Manager at Mashreq Bank in Dubai.

Aneeka holds a Masters in Mathematics from Oxford University and a BSc in Mathematics from the University of Delhi, India. She is also a CFA Charterholder.