Billion Dollar Mindset: Unlocking Time to Create a Flywheel for your RIA

Reaching $1 billion in assets under management (AUM) is an amazing accomplishment for a registered investment advisor (RIA).

But it also creates a flywheel effect.

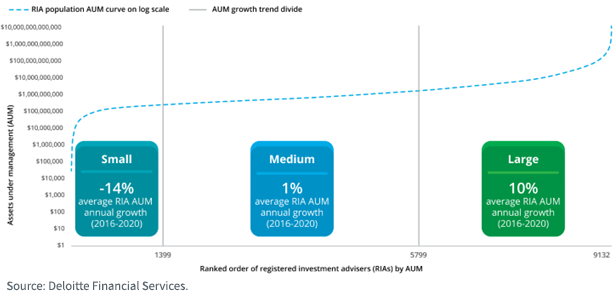

A recent study analyzed over 9,000 RIA firms that were active between 2016 and 2020. Using a log scale to identify the distribution of AUM within the population, three distinct groups were formed: “small” firms that are defined as having less than $100 million in AUM, “medium” firms, defined as having between $100 million and $1 billion, and “large” firms, defined as having more than $1 billion in AUM.

Two fascinating insights were uncovered about medium firms relative to large firms:

- The average RIA in the medium group experienced a 1% compound annual growth rate (CAGR) in AUM from 2016 to 2020, versus an astonishing 10% CAGR for the large group.

- AUM per employee (other than those performing only clerical, administrative or support functions) increased three times from small to medium groups, while the jump from medium to large was greater than 10 times.

The average AUM annual growth rate of the three segments of RIAs from 2016–2020 (Bullet Point #1)1

If there’s one conclusion that should be made from this image, it is that scale matters.

Scale creates a flywheel effect for RIAs that makes large firms grow faster, more efficient and potentially more profitable.

This leaves us with one important question: how can financial advisors grow their AUM to unlock scale and efficiency?

By wearing 20 different hats to keep their firm afloat? No!

By focusing on manual processes on an antiquated tech stack? Definitely not!

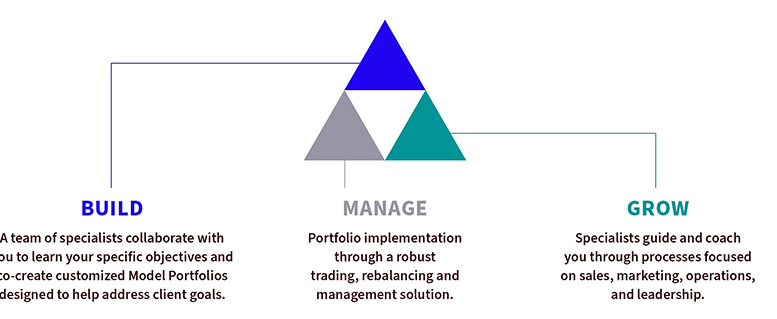

The answer lies in three words: build, manage and grow.

WisdomTree’s Portfolio and Growth Solutions are designed to unlock time, which can aide in creating a flywheel for an advisor’s practice. This program was built to help advisors deliver customized portfolios to their clients and be more efficient.

Our Portfolio and Growth Solutions program is made up of three primary pillars:

- Build through Portfolio Solutions: A team of specialists collaborate with each advisor to learn their specific objectives and create model portfolios designed to achieve the advisor’s goals, which can, in turn, help advisors address their clients’ goals.

- Manage through Trading Solutions: WisdomTree, through an agreement with Adhesion Wealth, offers advisors rebalancing and trading services for their clients’ model portfolios.

- Grow through Advisor Solutions: We offer advisors access to a suite of growth solutions, including workshops, presentations and practice management, that can help you grow your practice.

Through this Build – Manage – Grow framework, independent advisors working at small- to medium-size RIAs can potentially unlock several benefits, including:

- Increased client satisfaction from the ability to offer customized, institutionally managed model portfolios. Most investors believe an advisor using a third-party model portfolio is “applying a more sophisticated approach to their asset allocation that is backed by extensive research and technology.”2

- Increased advisor satisfaction from removing some of their operational burdens and manual processes—such as trading and rebalancing. The same study found that 92% of advisors believe third-party model portfolios “improve the efficiency of my practice” and 89% said models “enable me to easily scale my business.”3

- More time spent focusing on strengthening existing client relations and prospecting. Advisory practices that dedicate 70%+ of their time to client service and asset gathering report 3.5 times the number of new clients and twice the asset growth relative to firms that do not.4

These benefits make progress towards levelling the playing field for small- to medium-sized RIAs when it comes to resources and support typically associated with large-sized RIAs.

And more importantly, WisdomTree’s Portfolio and Growth Solutions program sets the foundation for those same firms to achieve the scale needed to reach that flywheel effect that large firms possess.

Are you a financial advisor interested in learning more?

Contact Us

Ryan Krystopowicz joined WisdomTree in March 2016 and serves as a Product Specialist, ETF Model Portfolios. He is a leading voice in the content and commercialization of WisdomTree’s Model Portfolio Research Study & Model Adoption Center. Ryan also contributes to the commercial success of WisdomTree’s Model Portfolio offerings by supporting Distribution and the management of host platforms. His passion for third-party model portfolios and investment outsourcing was cultivated during his tenure at a Registered Investment Advisor where he took on a variety of roles within research and operations. Ryan received a degree from Loyola University of Maryland and is a CFA charterholder.