Forgotten Mid- and Small-Cap Dividends

Many investors think of investing down the size spectrum of mid- and small caps for premium earnings growth potential—searching for the next Amazon or Alphabet.

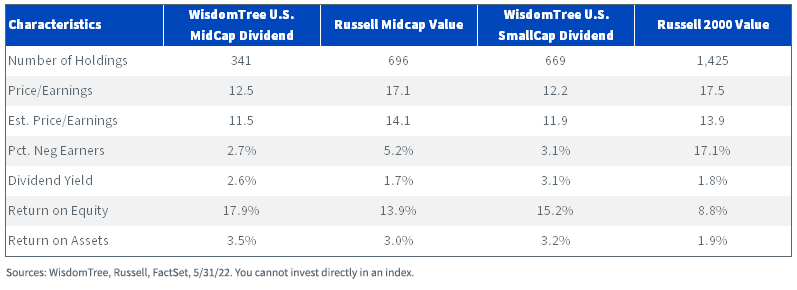

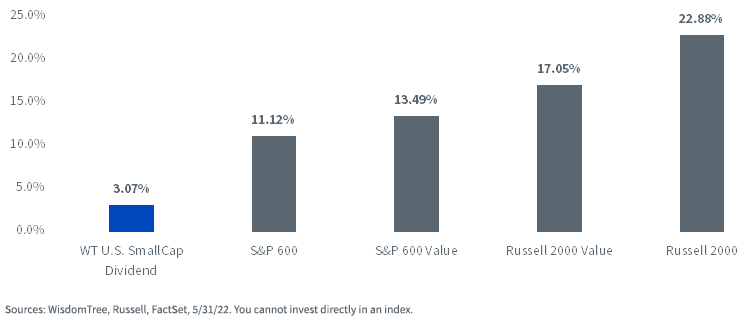

Academic research into long-run historical returns suggests investors are better off bargain hunting. The live track record of the Russell Value and Growth Indexes similarly shows that high-growth companies have heavily lagged slower-growth value stocks, particularly in small caps.

Annualized Index Total Returns

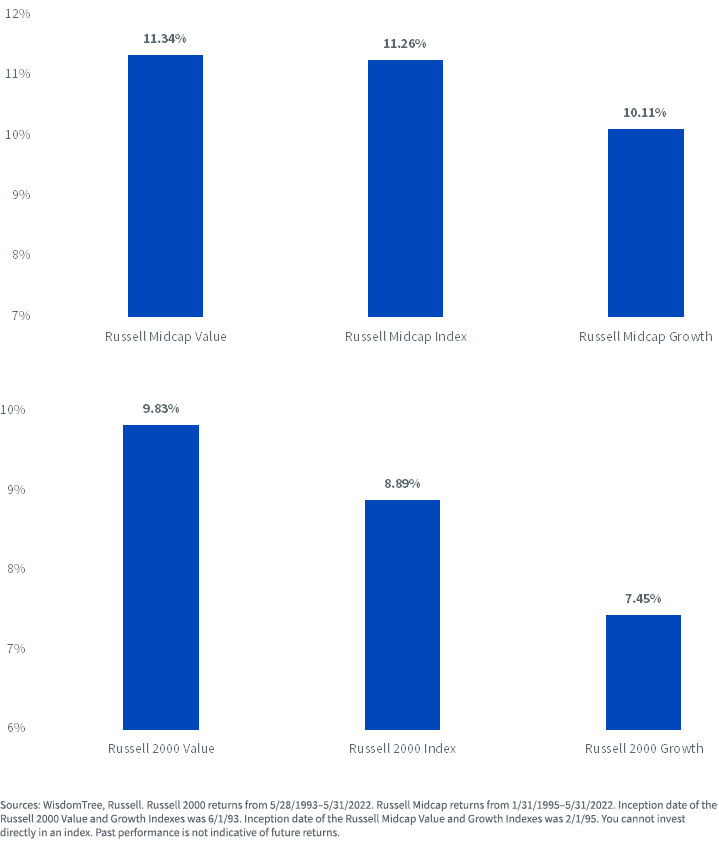

There are any number of approaches to isolating value stocks—price-to-earnings, price-to-cash flow, price-to-book, dividend yield, etc. One straightforward approach—investing in dividend payers and avoiding the non-payers—has proven to be an effective strategy within mid- and small caps to manage valuation risks and improve profitability ratios.

Many investors overlook allocating toward dividends outside of large caps. For investors looking to harvest the size and value factor premiums, as well as increase income potential in a challenging inflationary environment for bonds, mid- and small-cap dividends may prove an attractive solution.

Annualized Total Returns

Characteristics of Mid- and Small-Cap Dividends

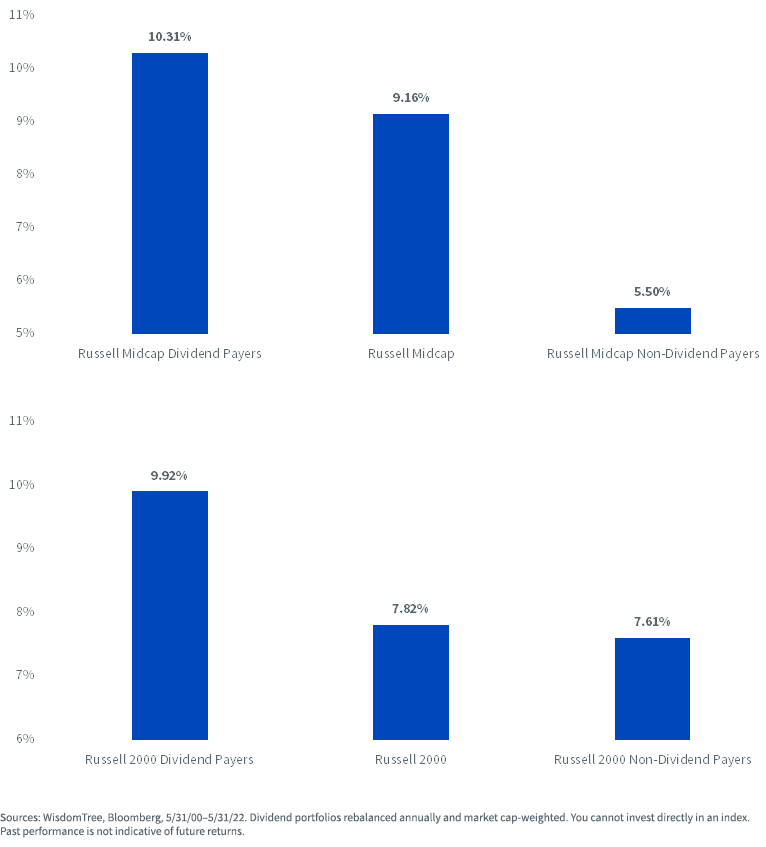

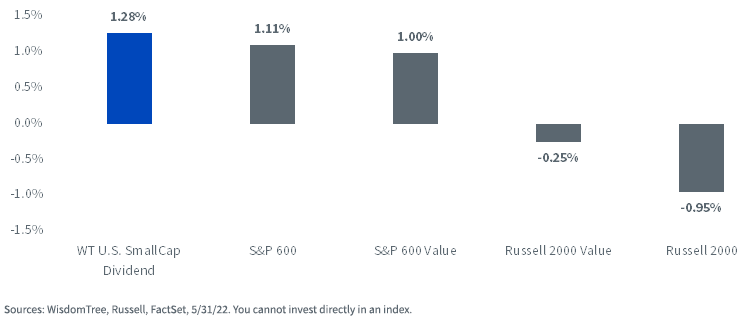

The outperformance of value stocks in 2022 has coincided with the outperformance of dividend payers.

WisdomTree’s mid- and small-cap dividend Indexes have handily outpaced their respective value and broad-market Russell Midcap and Russell 2000 Indexes through the first five months of the year.

YTD Performance

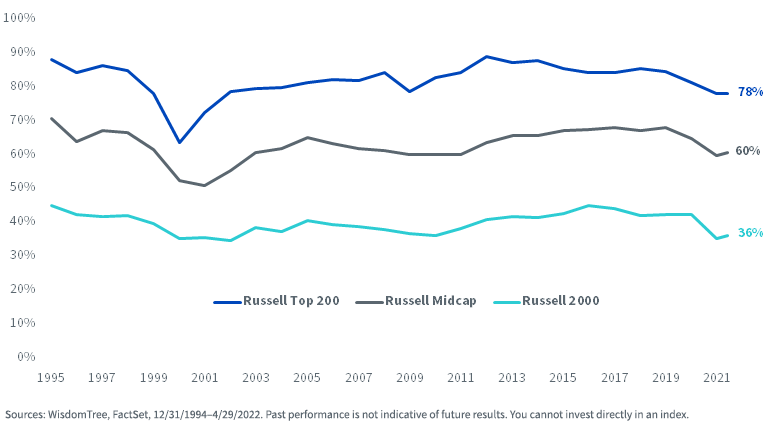

While a greater percentage of large-cap companies pay dividends, there is still a significant percentage of mid- and small-cap companies that pay dividends. About 60% of companies in the Russell Midcap Index (500 out of 822) and about 35% of companies in the Russell 2000 Index (725 out of 2,002) pay dividends.

Percentage Index Constituents Dividend Payers

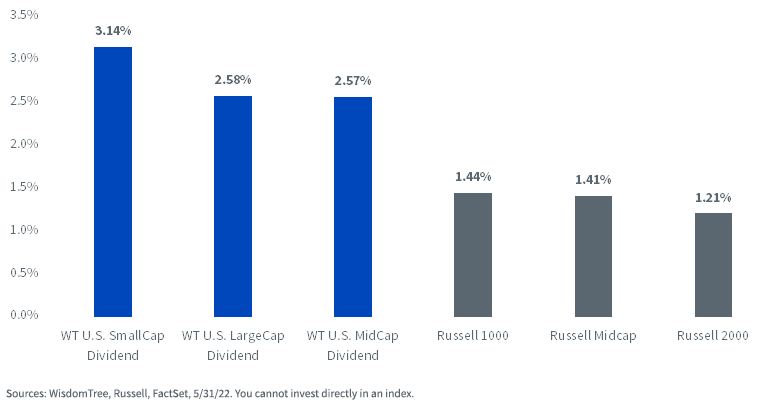

What may be surprising is that investors do not have to sacrifice yield when going down the size spectrum. WisdomTree’s dividend-weighted U.S. MidCap Dividend Index has a dividend yield roughly equal to the U.S. LargeCap Dividend Index. The WisdomTree U.S. SmallCap Dividend Index has a yield premium of more than 50 basis points relative to the large-cap Index.

Trailing 12-Month Dividend Yield

And isolating dividend payers not only results in higher dividend yields, but it reduces exposure to the share diluters that are so prominent in market cap-weighted small-cap indexes. Both the Russell 2000 Value and Russell 2000 have negative net buyback yields because their constituents issue more shares than they buy back.

Trailing 12-Month Net Buyback Yield

Removing exposure to non-payers also cuts down on the non-profitable segments of the Russell 2000. About 23% of the weight of the Russell 2000 is in negative earning companies, largely in the biotech industry.

Even looking at the Russell 2000 Value Index, which would theoretically exclude cash-burning growth names, 17% of the weight of that Index is in negative earners.

Conclusion: Don’t Forget the Dividend Payers

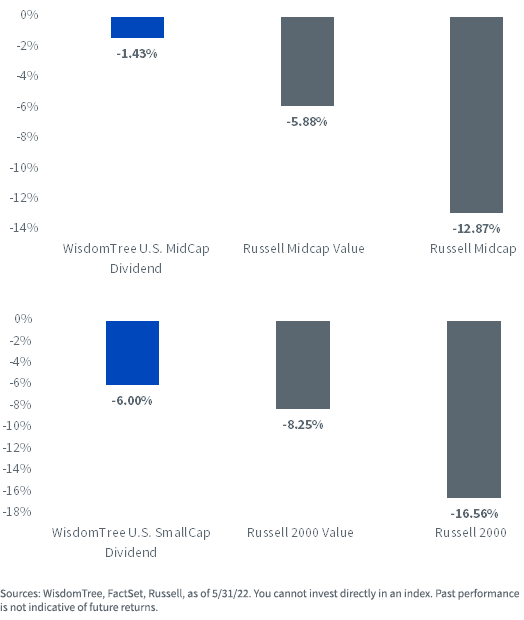

As we can see in the below characteristics, both the mid- and small-cap dividend Indexes offer broad exposures of 341 and 669 holdings, respectively. From a valuation perspective, each Index has discounted price-to-earnings multiples as well as higher dividend yields than the Russell Value Indexes.

With lower exposure to unprofitable companies in the small-cap universe, both dividend Indexes have a premium return on equity and return on assets.

Index Characteristics