Mid-Cap and Small-Cap Dividends Shine amid Volatility

In our third of three posts on small-cap valuations, let’s examine how focusing on dividend payers amid a volatile market backdrop has provided excess returns, with even lower valuations.

While this blog series has focused our attention on the valuations and the earnings trends of small caps, a similar picture can be extended to mid-caps.

Many investors rarely think of dividends when it comes to mid- and small caps. This can be a costly oversight.

Consider this:

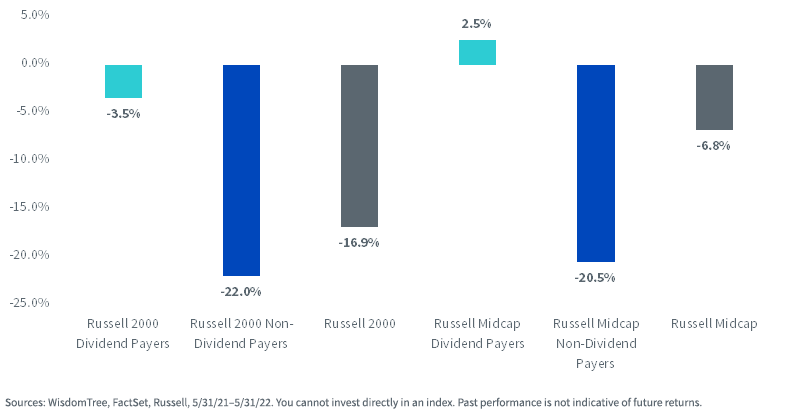

- A simple market cap-weighted strategy that bought all Russell 2000 Index dividend payers would have outperformed the Russell 2000 by 13.5% over the 12 months ended in May

- A simple market cap-weighted strategy that bought all Russell Midcap Index dividend payers would have outperformed the Russell Midcap by 9.3% over the 12 months ended in May

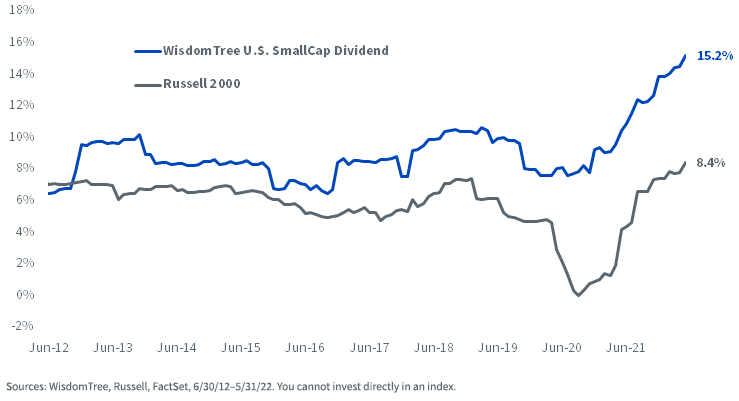

Trailing 12-Month Returns, as of 5/31/22

The WisdomTree U.S. MidCap Dividend Index and the WisdomTree U.S. SmallCap Dividend Index have each benefited from investors’ return to focusing on dividend cash flows over the last 12 months.

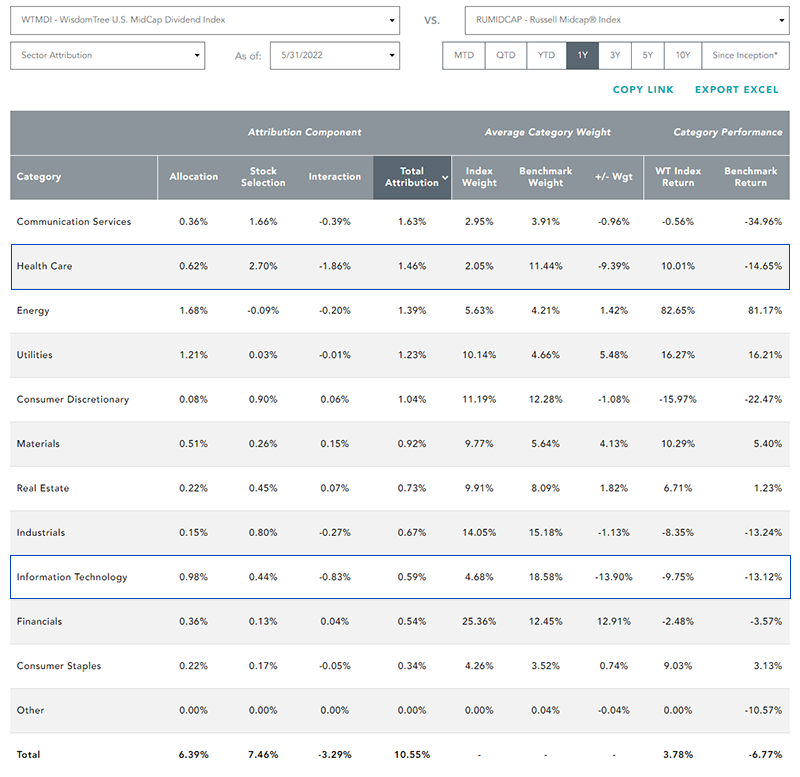

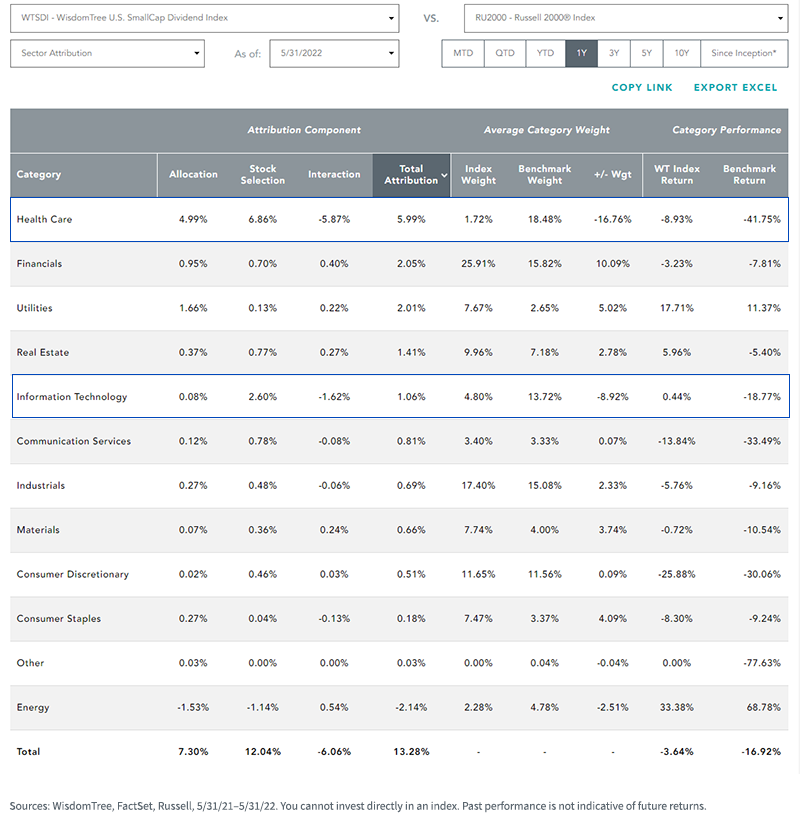

Relative to the Russell Midcap Index and the Russell 2000 Index, each WisdomTree Dividend Index has significant under-weight allocations to Information Technology and Health Care—two growth-heavy sectors with very little in terms of dividend payments aside from the large caps.

The WisdomTree Indexes had over-weight allocations to the higher-dividend-paying sectors like Financials, Real Estate, Materials and Utilities.

Over the 12 months ended in May 2022:

- The WisdomTree U.S. MidCap Dividend Index outperformed the Russell Midcap Index by 10.55%

- The WisdomTree U.S. SmallCap Dividend Index outperformed the Russell 2000 Index by 13.28%

Mid-Cap Index One-Year Sector Attribution

Small-Cap Index One-Year Sector Attribution

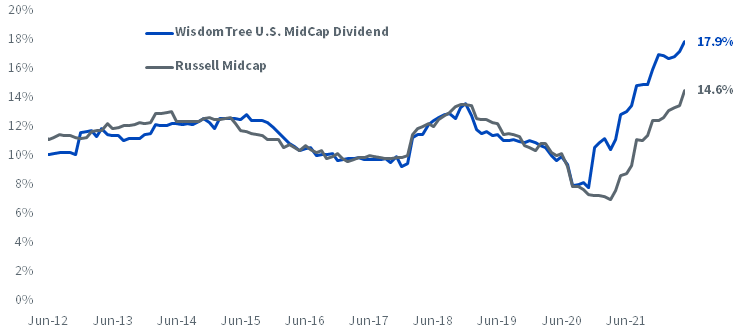

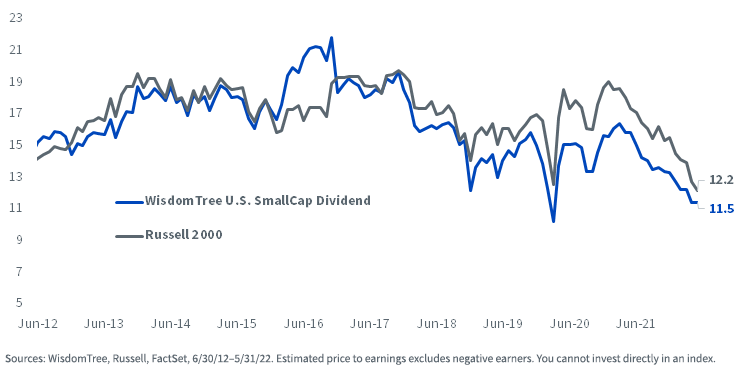

Like the strong growth in earnings we saw from the S&P 600, we also see robust earnings growth trends—and premium earnings ratios—from the WisdomTree U.S. MidCap and SmallCap Dividend Indexes.

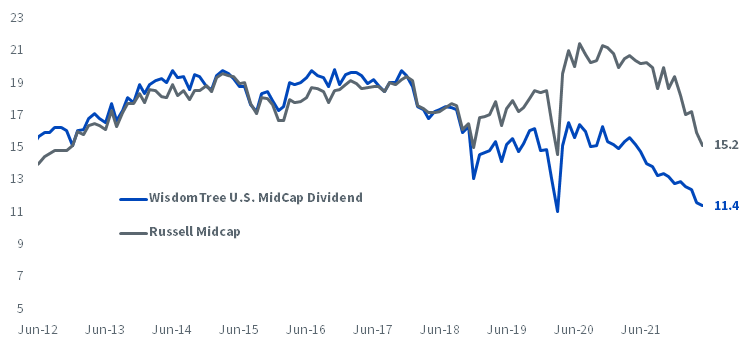

A widening profitability gap has developed between WisdomTree’s Dividend Indexes and the market cap-weighted Russell Indexes.

As of May 31, 2022, 9.4% of the weight of the Russell Midcap Index was in companies with negative earnings, as was 22.9% of the Russell 2000 Index. This compares to a less-than-3.5% weight in negative earnings for the WisdomTree Dividend Indexes.

Mid-Caps Return on Equity

Small Caps Return on Equity

As we’ve mentioned, market prices suggest the pace of earnings growth will slow (or turn negative). WisdomTree’s Dividend Indexes—despite their recent outperformance—have even greater discounts in their price-to-earnings ratios than the market cap-weighted Russell indexes.

Mid-Cap Estimated Price-to-Earnings Ratios

Small-Cap Estimated Price-to-Earnings Ratios

Conclusion

Dividends have provided safety amid the volatility in U.S. equities this year. While many investors may ignore dividends outside of large caps, the relative performance of mid- and small-cap dividend payers and non-payers over the past 12 months suggests this can be a mistake.

We anticipate the leadership of companies with strong cash flows and dividend payouts will be sustained during a rising interest rate environment that punishes non-dividend-paying story stocks. The opportunity cost of not having current cash flows is a headwind to non-payers.

For investors interested in allocating to a diversified basket of dividend-paying mid- and small-caps, consider the WisdomTree U.S. MidCap Dividend Fund (DON) and the WisdomTree U.S. SmallCap Dividend Fund (DES).

Please read our latest Market Insight, “Where Is a Recession Being Priced In? U.S. Small Caps” for more on the small- and mid-cap dividend story.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Funds focusing their investments on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.