Too Much of a Good Thing

We’ve previously touched on the trajectory of earnings growth and valuations for the S&P 500 and the S&P 600.

While we suggest you go back and read that post, we will sum it up here—small-cap earnings growth has been remarkable, but valuations imply that it has been low-quality earnings growth.

In other words, small-cap earnings are likely to mean-revert to some lower, more sustainable level.

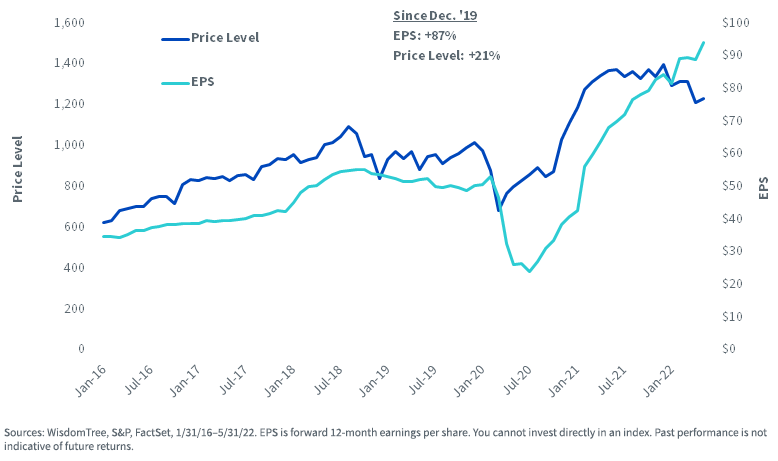

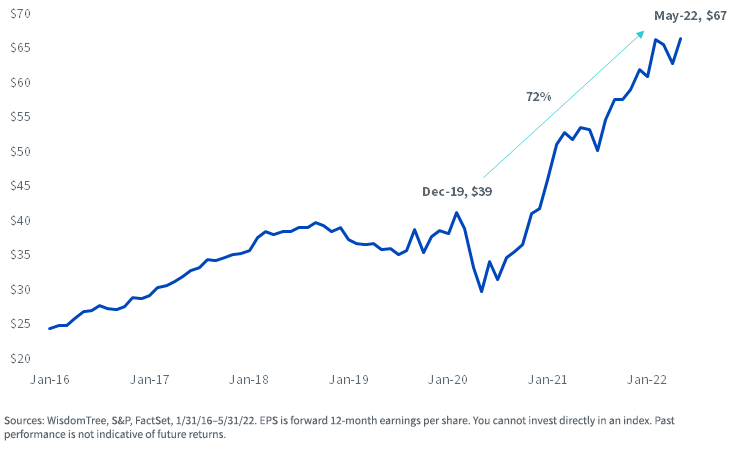

The below chart of S&P 600 earnings per share (EPS) and price levels gives an illustration of this narrative.

Since the end of 2019, S&P 600 price returns have been a respectable 21%—or 8.2% annualized. This return hasn’t come close to matching 87% EPS growth, which has meant the P/E ratio of the index has contracted from 20.2 times to 13.1 times.

From the below chart, we continue to see robust analyst estimates for future earnings growth. A bearish assessment would be that analysts are too optimistic in the face of macroeconomic headwinds that should stymie earnings growth.

Let’s review where small-cap earnings growth has been coming from and the latest trends in those earnings.

S&P 600

Sector Earnings Growth

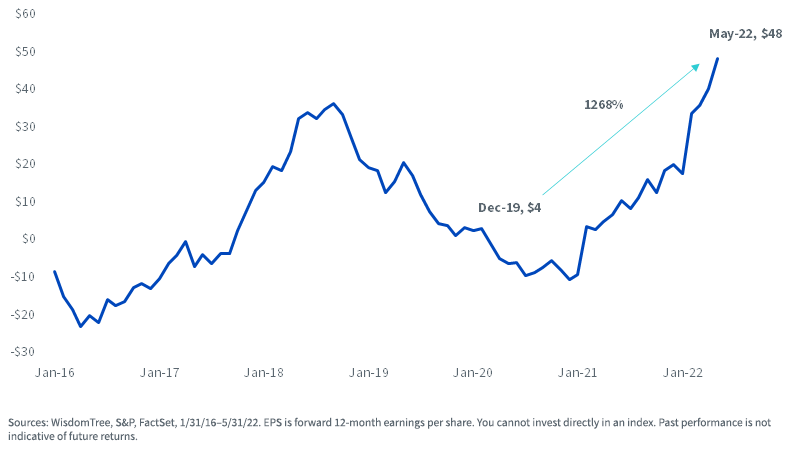

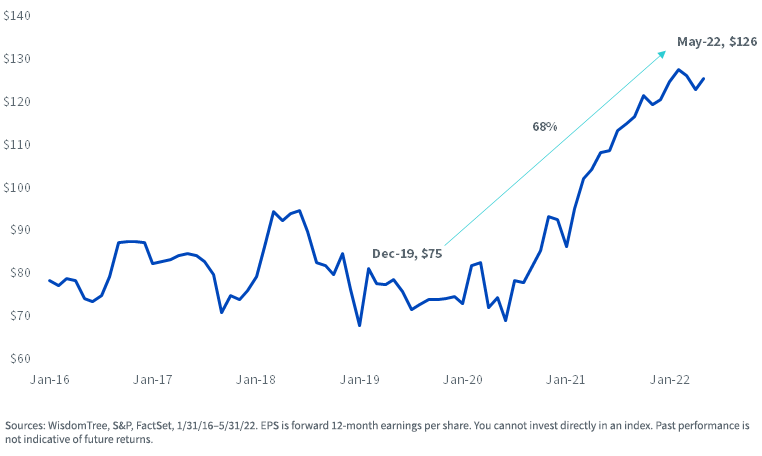

The traditional “Old Economy” sectors of Energy, Industrials and Materials have experienced a torrid pace of earnings growth with little sign of slowing. These sectors’ earnings are highly volatile and sensitive to economic fluctuations—no better exemplified than by the fact that the Energy sector has experienced aggregate negative earnings twice over the past six years, and over 1,000% earnings growth since the end of 2019.

“Old Economy” Sectors Earnings per Share (EPS)

S&P 600 Industrials

S&P 600 Materials

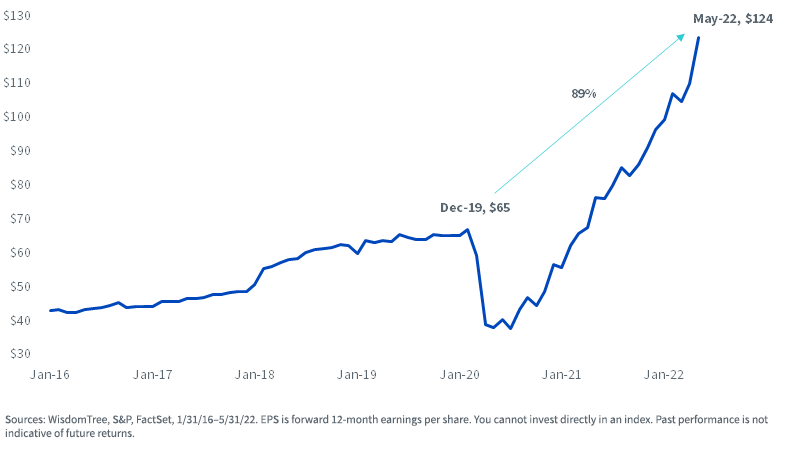

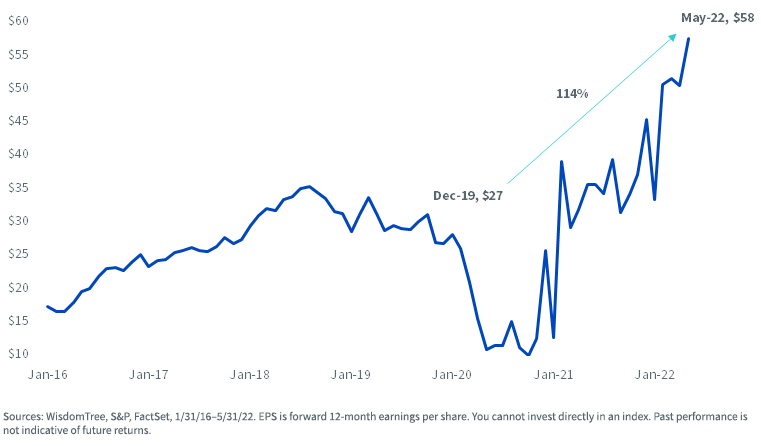

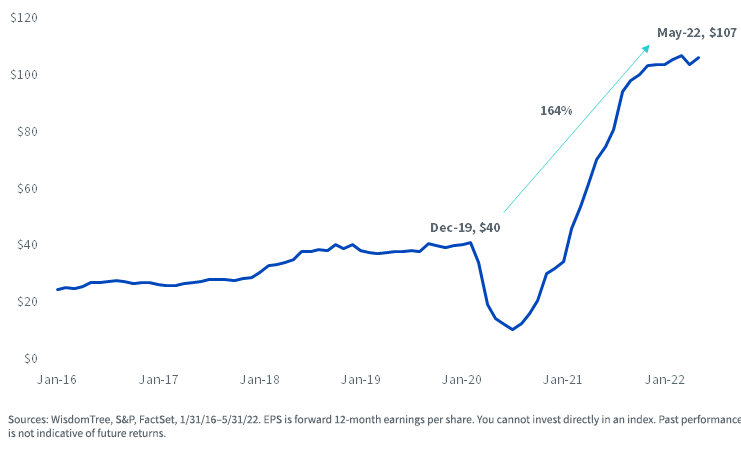

The Consumer sectors—Discretionary in particular—have been major beneficiaries of a healthy American consumer. Earnings growth in these sectors has continued nearly unabated for much of the past two years, even in the face of headwinds like rising gas prices and Covid variants.

However, some downward revisions to forward earnings estimates can be seen from the last several months, providing early evidence to those who believe we may have reached “peak earnings” for this cycle.

In recent weeks, earnings reports from large-cap retailers Target and Wal-Mart have sent consumer stocks plummeting across the board as their announcements’ indicated consumers are beginning to pull back in response to higher prices.

Consumer Sectors EPS

S&P 600 Consumer Staples

S&P 600 Consumer Discretionary

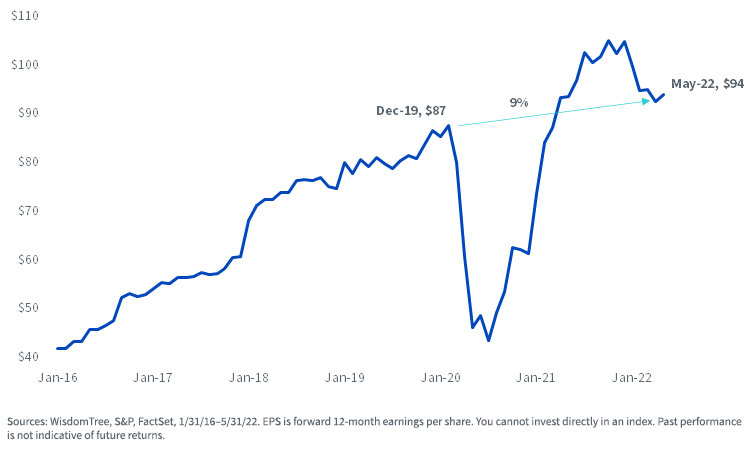

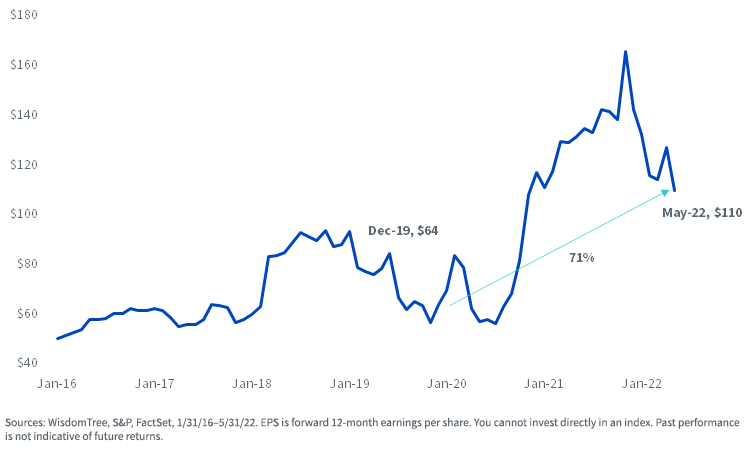

The earnings outlook for Financials has arguably been the direst of late. After a roaring recovery in earnings expectations throughout much of the past few years, earnings growth estimates seem to have rolled over.

Financials and Real Estate EPS

S&P 600 Financials

S&P 600 Real Estate

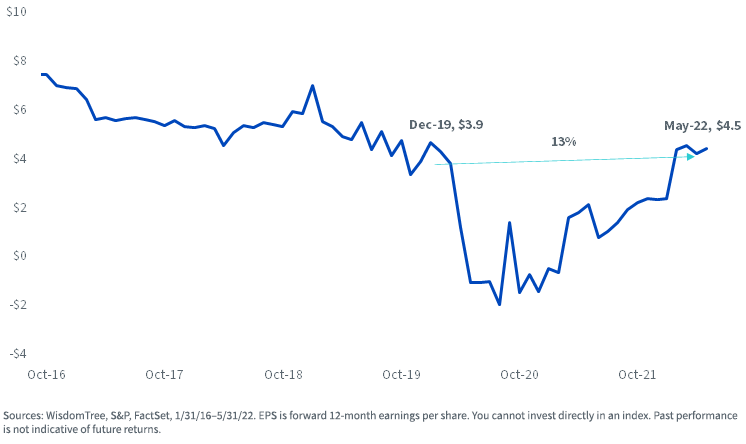

Technology and Health Care—specifically biotechnology—have had tremendous earnings growth over the past few years.

These sectors—big allocations in small-cap growth indexes—also have significant earnings growth expectations they must meet, lest they be punished by investors.

Those earnings growth expectations have been reduced in recent months, particularly for Health Care. The latest forward earnings per share number is a 34% decline from peak forward earnings estimates in November of last year as the market has readjusted expectations of many high-growth stories.

Technology and Health Care

S&P 600 Information Technology

S&P 600 Health Care

The Bottom Line

Certain sectors—Energy and Industrials in particular—show no signs of slowing earnings growth. Others, such as Financials and the Consumer sectors, are showing moderating growth expectations.

Nonetheless, small caps appear to be priced for a recession, at least far more so than large caps. While this may or may not be a base-case scenario for many investors, it is important to see what appears to be baked into market prices.

For long-term investors, with the time horizon to withstand the normal fluctuations of the business cycle, the current 30% discount of small caps’ price-to-earnings ratio relative to the historical median may provoke consideration for a small-cap allocation.

Even if recession seems to be a foregone conclusion, consider these two points:

- The Russell 2000 is currently 24% off its November 2021 peak. Small caps have historically dropped 36% on average in a recession, meaning the market has already priced in two-thirds of a typical recession1

- What has worked within small caps over the past year—dividends—may be the place to allocate during this volatile market2

In the last of three posts on small-cap valuations, we will examine how focusing on dividend-payers in small caps—as well as mid-caps—has contributed to outperformance in this turbulent market environment.

Please read our latest Market Insight “Where is a Recession Being Priced In? U.S. Small Caps” for more on the small- and mid-cap dividend story.

1 Bank of America Research, “Small/Mid-Cap Valuations: For small caps, recession risks now largely discounted,” 5/10/22.

2 Dividends are not guaranteed and may fluctuate.