A New Regime for Commodities: An Update

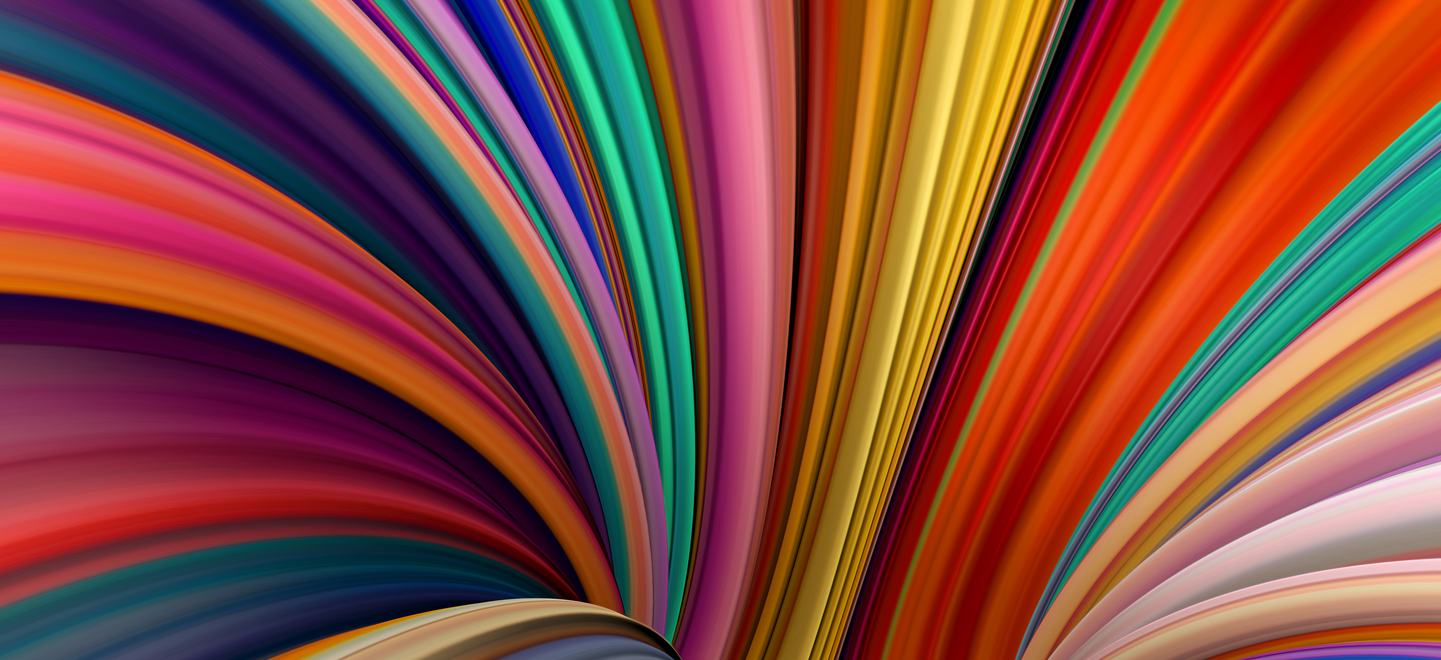

Bonds are not providing the diversification benefits they did historically, as both equities and bonds have declined materially in 2022, and the correlation between equities and bonds has risen to levels rarely seen over the last two decades.

With inflation being a key risk to both stocks and bonds, now is a useful time to consider strategies that can hedge inflation risks.

Commodities are one such asset. The correlation between equities and commodities has been declining, while commodity correlation with bonds remains in negative territory. (What is good for commodities—rising prices that fuel inflation—has been bad for bonds.)

252-Day Rolling Correlation Between Equities, Bonds and Commodities

We previously wrote about the past environments when bonds failed to provide a downside cushion to stocks and how commodities were often better hedges to stocks than bonds during those periods.

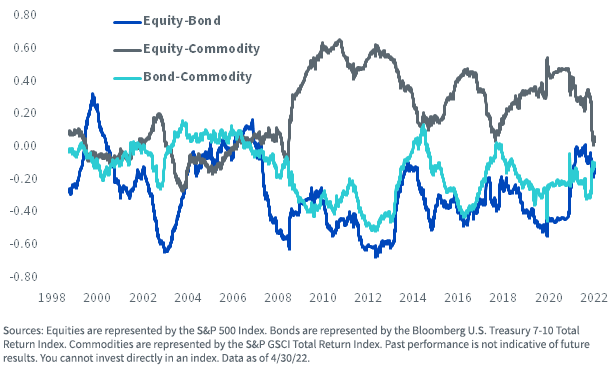

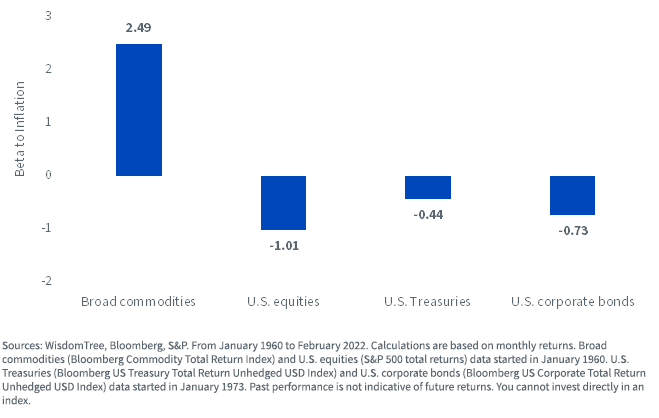

Below are two charts that illustrate commodity sensitivity to inflationary dynamics.

The first chart represents the sensitivity of stocks, commodities, Treasuries and corporate bonds to inflation using a beta measurement. Commodities were the only one of the four assets with a positive beta to inflation, as the other assets responded negatively to inflation.

Commodities Have a High Beta to Inflation

This second chart illustrates the time series of commodity prices with inflation, and the directional impulse from commodities feeds into other inflation measures.

Commodity Prices Closely Aligned with Inflation

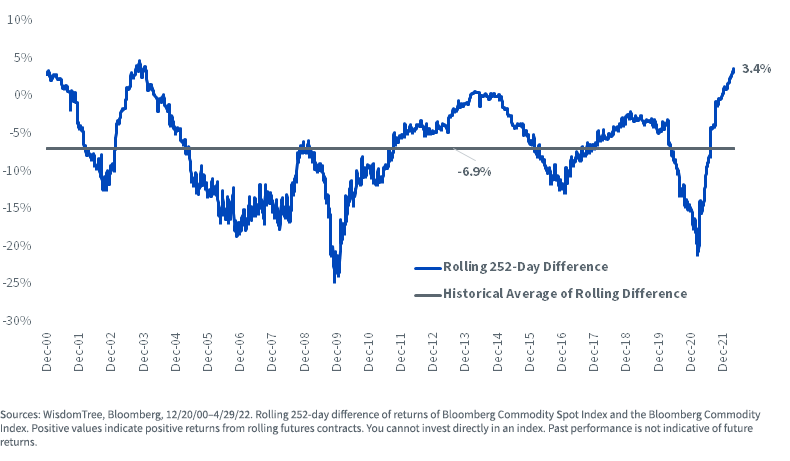

If we go back to 1999, the average cost to roll futures (measured as the difference between the Bloomberg Commodity Spot Index and the Excess Return Index of the futures) was nearly 7% a year.

But the latest differentials show the costs have been declining, and they even turned into a positive contribution to returns.

Cost to Roll Broad Commodities Futures Contracts

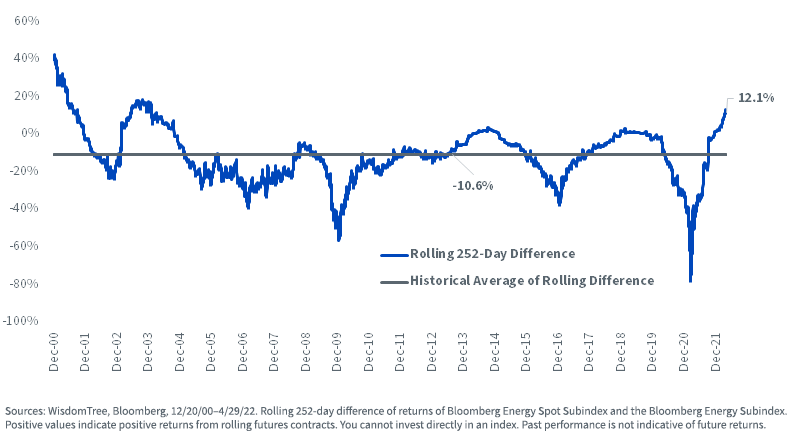

In no sector is this more apparent than Energy, where very high levels of demand have pushed up spot prices while farther out prices remain relatively subdued.

While the average cost to roll Energy futures was 10.6% over the last 20 years, over the trailing 12 months, the net benefit has been 12%. The stories on how Energy futures funds are outperforming spot oil have been few and far between, though.

While the Energy story is certainly positive, it is more than in Energy that the costs to roll the futures have declined dramatically.

Difference: Excess Return Minus Spot Return Index

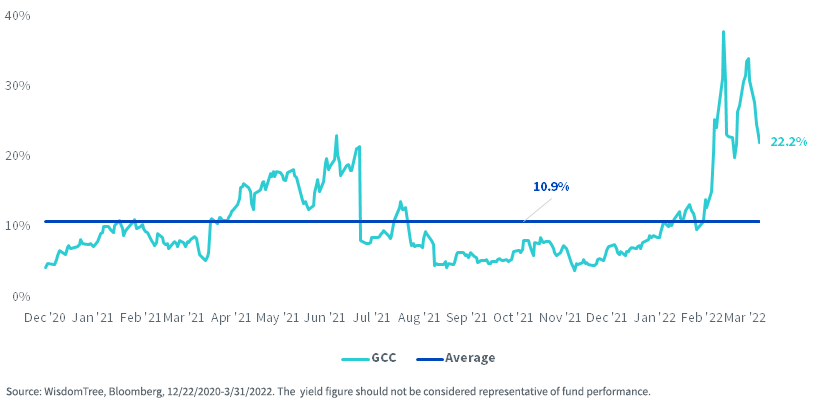

For the WisdomTree Enhanced Commodity Strategy ETF (GCC), this can translate to meaningful contributors to returns. GCC had an average implied roll yield of 10.9% over the last year, and it is currently significantly higher still.

The Energy complex has some of the highest roll yields but so, too, do aluminum, nickel, cotton and sugar.

Annualized Weighted Implied Roll Yield

For definitions of terms in the chart, please visit our glossary.

During a time when few assets have hedged inflation, commodities certainly look timely for this new regime.

Please visit our Fund compare tool for GCC’s latest performance.

Important Risks Related to this Article

Commodities and futures are generally volatile and are not suitable for all investors.

There are risks associated with investing, including the possible loss of principal. An investment in this Fund is speculative, involves a substantial degree of risk and should not constitute an investor’s entire portfolio. One of the risks associated with the Fund is the complexity of the different factors that contribute to the Fund’s performance. These factors include the use of commodity futures contracts. In addition, bitcoin and bitcoin futures are a relatively new asset class. They are subject to unique and substantial risks and, historically, have been subject to significant price volatility. While the bitcoin futures market has grown substantially since bitcoin futures commenced trading, there can be no assurance that this growth will continue. In addition, derivatives can be volatile and may be less liquid than other securities and more sensitive to the effects of varied economic conditions. The value of the shares of the Fund relates directly to the value of the futures contracts and other assets held by the Fund, and any fluctuation in the value of these assets could adversely affect an investment in the Fund’s shares. Because of the frequency with which the Fund expects to roll futures contracts, the price of futures contracts further from expiration may be higher (a condition known as “contango”) or lower (a condition known as “backwardation”). The impact of such contango or backwardation may be greater than the impact would be if the Fund experienced less portfolio turnover. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.