Managing Currency Risk in a Systematic Fashion

Despite fears of a collapsing U.S. dollar fueled by high inflation levels, the dominating driver for currencies has been an aggressive Federal Reserve hiking rates, while central banks from Europe and Japan have been slow to remove their accommodation. The Bank of Japan (BoJ) has rather aggressively defended capping its long-term bond yields, which has sent the yen downward as a growing gap exists between U.S. Treasuries and Japanese government bonds (JGBs).

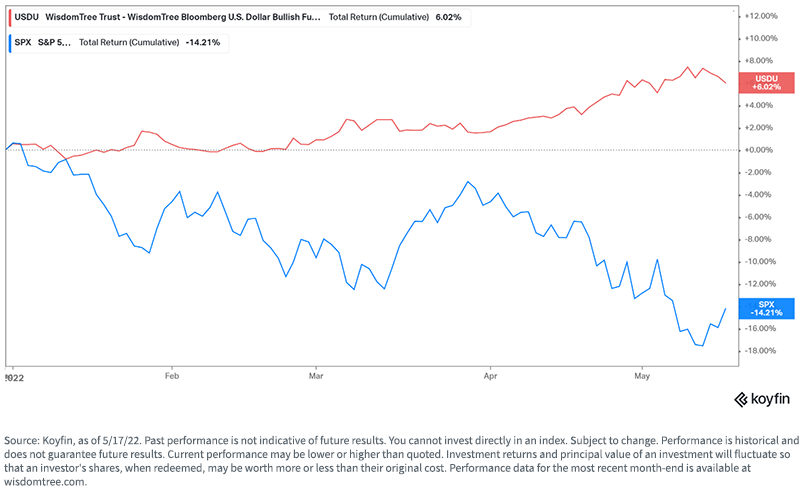

The Dollar: A Hedge on Risk

The dollar has been one of the most negatively correlated assets to the S&P 500 over the last 12 months—and also the last decade—and the evidence questions the merit of assuming foreign currency risk when investing overseas. I recently wrote a note on the benefits of being neutral on foreign currency risk due to the declining diversification properties of weak dollar bets.

For the most recent standardized performance click here.

There is also a middle ground between a completely hedged and unhedged approach.

Six years ago, WisdomTree launched a suite of dynamically hedged currency ETFs, and the track records of these systematic hedging strategies have been quite impressive, in my view. This family incorporates currency signals across momentum, interest rates and currency valuations to determine a hedge ratio on every currency.

The current aggregate hedge ratios are approximately 63% for the basket and range from a low hedge ratio of 50% for the Australian dollar to 100% hedged for the Swiss franc. The euro and yen are both two-thirds hedged—based on the combination of interest rate and momentum signals, while the valuations of those currencies are “cheap” on a purchasing power parity basis, that segment of the signals is unhedged, for one-third of the total hedge ratio.

We have a broad international value strategy and international small-cap strategy with this dynamic hedge feature. Both strategies on an unhedged basis have 16-year histories that were part of the original 20 dividend ETFs WisdomTree launched in 2006.

The WisdomTree Dynamic Currency Hedged International Equity Fund (DDWM) has received a five-star rating from Morningstar (overall rating as of 7/31/22 based on risk adjusted return out of 315 funds in the Foreign Large Value category), while the small-cap version, the WisdomTree Dynamic Currency Hedged International SmallCap Equity Fund (DDLS), has a four-star rating (overall rating as of 7/31/22 based on risk adjusted return out of 57 funds in the Foreign Small/Mid Value category). See our Morningstar ratings page for more info.

The stars are a quick way of summarizing these strategies as having delivered strong risk-adjusted returns, and there is a good emphasis on the risk-reduction properties that come with the dynamic currency hedge.

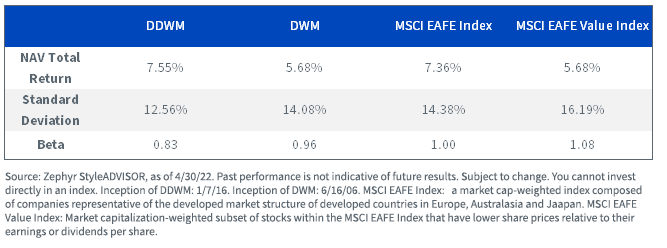

Since we launched DDWM in 2016, the MSCI EAFE Value Index has been riskier than the MSCI EAFE Index.

By contrast, our dynamic currency-hedged DDWM has displayed lower risk than the MSCI EAFE Index. We can illustrate this risk reduction in two ways:1

1. Beta: Since Fund inception, the MSCI EAFE Value Index has had a higher beta relative to MSCI EAFE, while DDWM has a beta of 0.83.

2. Standard Deviation: The MSCI EAFE Value Index had a two-point higher standard deviation relative to MSCI EAFE, while DDWM was nearly two points lower, again since Fund inception.

The dynamic currency hedge contained in DDWM—when compared to the same basket of equities without the currency hedge (available via the WisdomTree International Equity Fund (DWM))—added almost 200 basis points per year over the last six years.

The currency hedge value-add to returns was high over this period, but the risk reduction is what we would expect on a longer-run basis.

For the Fund’s full standardized performance and other important information, click the respective ticker: DDWM, DWM.

Over the last decade, the U.S. markets have strongly outperformed international stocks—some of it was tied to the Technology sector dominating U.S. markets—while global markets have more value-tilted exposures and sector biases. Another factor is currency fluctuations and a stronger dollar hurting unhedged strategies that relied on weak dollar bets.

WisdomTree’s dynamically hedged currency family can help access the low valuations of foreign markets but with a strategic approach to managing currency risk.

1 Source: Zephyr StyleADVISOR, as of April 30, 2022. Past performance is not indicative of future results. Subject to change. You cannot invest directly in an index.

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as the risk of loss from currency fluctuation or political or economic uncertainty. The Fund invests in derivatives in seeking to obtain a dynamic currency hedge exposure. Derivative investments can be volatile, and these investments may be less liquid than other securities and more sensitive to the effects of varied economic conditions. Derivatives used by the Fund may not perform as intended. A Fund that has exposure to one or more sectors may be more vulnerable to any single economic or regulatory development. This may result in greater share price volatility. The composition of the Index underlying the Fund is heavily dependent on quantitative models and data from one or more third parties, and the Index may not perform as intended. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit, and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

The Morningstar Rating™ for funds, or "star rating", is calculated for managed products (including mutual funds, variable annuity and variable life subaccounts, exchange-traded funds, closed-end funds, and separate accounts) with at least a three-year history. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a managed product's monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance. The top 10% of products in each product category receive 5 stars, the next 22.5%receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar Rating for a managed product is derived from a weighted average of the performance figures associated with its three-, five-, and 10-year (if applicable) Morningstar Rating metrics. The weights are: 100% three-year rating for 36-59 months of total returns, 60% five-year rating/40% three-year rating for 60-119 months of total returns, and 50% 10-year rating/30% five-year rating/20% three-year rating for 120 or more months of total returns. While the 10-year overall star rating formula seems to give the most weight to the 10-year period, the most recent three-year period has the greatest impact because it is included in all three rating periods.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.