Digital Asset Market Note: A “De-pegging” Soros Would Be Proud Of

This week has seen a series of rapid contractions across the digital asset ecosystem. In a space that is well-known for volatility, even this week has stood out to observers. To navigate effectively, investors must understand the broader investment context in which these events have transpired, the trigger for the sharp sell-off and how this is part of the evolutionary process that could propel the digital asset ecosystem forward—though also backward at times.

Since January 2022, the broader market sentiment has been “risk-off.” After an unprecedented run-up to all-time highs for the digital asset ecosystem, which reached more than US$3 trillion in market capitalization in November 20211, a series of external factors took hold. The first was the flagging of tighter monetary policy in major economies, particularly the United States, over the course of 2022. The second was the outbreak of conflict between Ukraine and the Russian Federation, which has caused volatility in commodity markets and further stoked already-elevated inflation. Finally, portfolio managers face a 60/40 equity and bond portfolio that has found its limits, as broader equity markets have contracted at the same time that bond market yields have been falling. The NASDAQ, broadly, and non-profit-making technology stocks, in particular, have seen steep sell-offs during 2022. This is the backdrop against which a series of events transpired over the past week.

The impetus for the most recent sell-off in the digital asset space was the “de-pegging” of the ironically termed “stablecoin” associated with the Terra blockchain, called UST, and the related LUNA cryptocurrency.

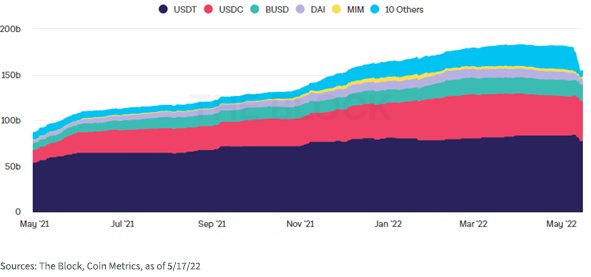

Not All Stablecoins Are Created the Same – or Equally Stable

Not all stablecoins are the same—the term is commonly applied in too broad a fashion. Some stablecoins are collateralized and managed by a regulated, centralized corporation (e.g., Circle’s USDC). Some are over-collateralized but managed algorithmically (e.g., Maker’s DAI). Then there is Tether, which is centrally managed and mostly backed by not-yet-fully-disclosed commercial paper.

Figure 1: Market Share of Stablecoins May 2021 to May 2022 in USD

(see https://www.theblockcrypto.com/data/decentralized-finance/stablecoins)

The UST stablecoin is designed to maintain a peg of US$1. It does this using an algorithm linked to Terra’s native cryptocurrency, called LUNA, which fluctuates depending on the value of UST. Put succinctly:

If the market value of Luna is US$100, you can redeem 100 UST for 1 LUNA. This is the stability mechanism. If UST has lost its peg and is trading at US$0.95, you can still redeem 100 UST for 1 LUNA and sell the LUNA for US$100, a profit of US$5. In this way, the market liquidity of Luna is used to underpin the value of UST, and as long as there is demand for Luna, arbitrageurs should keep the system in line.2

Over the last few weeks, the entity that manages LUNA, the so-called Luna Foundation Guard (LFG), began acquiring bitcoin to form a reserve with which to defend the UST peg if required. As of May 5, 2022, the LFG had acquired US$1.5 billion in bitcoin.3

There are a number of well-known ways in which an undefended, algorithmic stablecoin design can fail. One of these is the “coupon curse,”4 which is a situation where there is not sufficient demand to soak up demand for the LUNA cryptocurrency in the face of UST liquidations, which sets in motion a chain reaction wherein more UST holders seek to liquidate their holdings, which aggravates the already de-pegged UST to fall even further. This cascading chain of events has been seen before.5

On May 8, 2022, large liquidations of UST occurred on the Curve decentralized exchange. These large liquidations put pressure on the UST peg. As part of defending the peg, the LFG began exchanging bitcoin for other U.S. dollar tokens—to allow them to intervene in the market and support the ecosystem. This put downward pressure on the spot price for bitcoin—and engendered a further “rush for the theater exits” for UST holders.6

What’s unique about this incident is the sheer size and scale of the Terra/LUNA ecosystem. At its peak at the start of April 2022, the LUNA cryptocurrency was valued at the equivalent of around US$41 billion. On Friday, May 6, it was worth US$27 billion. Today7 it is worth less than US$300 million8. The peak amount of outstanding UST was more than US$18 billion on May 7, 2022.9 The Terra network was taken offline on May 12, 2022.10

The rapid liquidation of LUNA and de-pegged UST sent shockwaves throughout the digital asset ecosystem. Aside from the effects on the bitcoin spot price, due to the rapid selling of bitcoin to defend the peg, the price collapse of LUNA meant margin calls and liquidation for leveraged LUNA holders. The knock-on effects could also be seen in disruptions to other pegged stablecoins, with slight declines in the collateralized USDT “Tether” token11 and premiums in the collateralized USDC “Circle” token12.

An Ecosystem Characterized by a Lot of Trial and Error Will Sometimes Have . . . Errors

Stepping back from the events of this week, to put them in perspective, consider that there was an investment rush into new protocols and decentralized applications during 2020–2021. More venture capital was invested in the space during 2021 than in the six prior years combined.13 These newly developed technologies and companies have not been fully battle-tested in an extremely adversarial software environment—their potential returns, uncertainty and investment cases are very different from more established networks like Bitcoin and Ethereum.

There have been countless technical and economic failures throughout the now 13-year history of the digital asset ecosystem. Prior to the Terra/LUNA event, perhaps the highest-profile ones were the DAO hack14 for US$150 million at the time, which led to the hard-forking of Ethereum, and the collapse of the US$2.4 billion Bitconnect15. Both cases were nowhere near the scale of the collapse of Terra/LUNA this week. This is partly because the digital asset ecosystem has never been bigger. In terms of scale, incidents like this can have the impact they do because the ecosystem is very different from that which prevailed even three years ago.

Going forward, expect two broad trends to emerge. One trend will see the failure of a variety of experiments due to technical, economic, organizational, regulatory or other reasons. This is how the venture capital business model works: a small proportion of portfolio companies make the lion’s share of outsized returns while the bulk either break even or fail. The other trend will see a clutch of survivors who find scalable and sustainable business models and a new crop of experiments against which they will compete. This is where the opportunities lie over the next two or so years.

1 https://www.coingecko.com/en/global_charts

2 Inspired by: https://0xfoobar.substack.com/p/partially-collateralized-algostables?s=w

3 https://www.cnbc.com/2022/05/05/luna-foundation-guard-bolsters-stablecoin-reserve-by-raising-1point5-billion-in-bitcoin.html

4 https://mirror.xyz/damsondao.eth/OVeBrmrfcWm7uKLlA2Q4W1XTVkFU3cMKfNWhgf7mQuM

5 https://0xfoobar.substack.com/p/partially-collateralized-algostables?s=w

6 https://twitter.com/onchainwizard/status/1524123935570382851?s=21&t=roAPYhzJEb3SI2gisN0gKQ

7 At the time of writing on 5/12/22.

8 https://www.coingecko.com/en/coins/terra-luna

9 https://www.coingecko.com/en/coins/terra-usd

10 https://twitter.com/terra_money/status/1524785058296778752?cxt=HHwWgMDS6dH7j6kqAAAA

11 https://www.ft.com/content/5887ef43-d43a-4608-a1ac-aacc99f076b9

12 As of 6:49 p.m. GMT on 5/12/22: https://www.coingecko.com/en/coins/usd-coin

13 https://www.wisdomtree.eu/-/media/eu-media-files/other-documents/research/market-insights/WisdomTree-Market-Outlook-Model-Portfolios.pdf#page=26

14 https://www.gemini.com/cryptopedia/the-dao-hack-makerdao

15 https://www.coindesk.com/markets/2021/05/28/sec-sues-5-over-2b-bitconnect-ponzi/

Important Risks Related to this Article

Benjamin Dean is an employee of WisdomTree UK Limited, a European subsidiary of WisdomTree Asset Management Inc.’s parent company, WisdomTree Investments, Inc.