Implementing "Efficient Core" Portfolios

This article is relevant to financial professionals who are considering offering Model Portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional. Not all financial professionals have access to these Model Portfolios.

WisdomTree introduced the idea of “efficient core” portfolios last fall. Given today’s rapidly changing market regime, it is time for an update.

First, a quick reminder of the structure behind our capital efficient suite of individual products (using NTSX as the example). Put simply, if you have $100 to invest, you can invest $67 of it into NTSX and have the equivalent exposure to $100 worth of an S&P 500/Treasury portfolio, leaving you with $33 left to explore more alpha-seeking, yield-seeking or diversifying exposures within your overall portfolio.

How the Capital Efficient Strategies Are Constructed

- Equity component: For every $100 invested in the ETF, $90 is invested in equity exposure via the WisdomTree U.S. Efficient Core Fund (NTSX). The equity component is a portfolio of 500 large-cap U.S. stocks, weighted by market capitalization to provide broad exposure to U.S. equities.

- Cash component: For every $100 invested in the ETF, $10 is held in short-term collateral that earns returns comparable to U.S. Treasury bills.

- Bond futures ladder: To help magnify the potential benefits of the asset allocation, $60 of bond futures are overlaid on top of the $90 of equity exposure and $10 of cash collateral.

- Treasury futures are laddered (equal-weighted) across the 2-, 5-, 10- and 30-year segments of the yield curve to diversify interest rate risk.

- The average effective duration for the fixed income portion of NTSX is typically 7–7.5 years and is meant to offer the duration profile of traditional aggregate bond indexes.

In addition to NTSX, the other strategies currently available in our Efficient Core suite include NTSI (the EAFE version of NTSX), NTSE (the EM version), GDE (a gold plus equity version) and GDMN (a gold plus gold miners version).

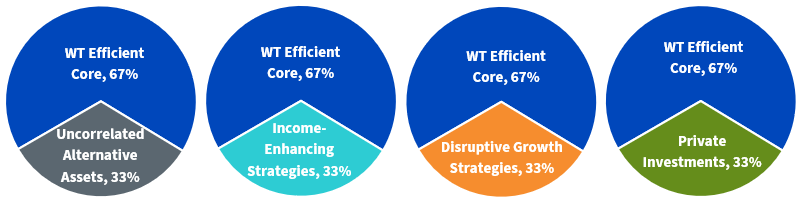

In that introductory blog post from last fall, we provided some hypothetical examples of how advisors might allocate the freed-up capital.

- Uncorrelated alternative assets to reduce volatility and/or add in additional potential sources of return.

- Income-enhancing strategies to boost incremental yield on top of a 100% portfolio.

- Maximum growth satellites to allocate to longer-term thematic and high-growth industries, sectors and firms.

- Private investments for longer-term growth allocations.

Why Now for Efficient Core Portfolios?

We seem to be at the beginning of a market regime that is different than most advisors have experienced in a long time—where it is not enough to simply allocate to long stocks and bonds to deliver the appropriate investment experience. U.S. and global stocks, as well as bonds, are down sharply year-to-date, so using just bonds to hedge equity risk is not working.

Given our view on rates (they will continue to rise), inflation (higher for longer than the consensus view) and what we believe will be consistently higher volatility in equity markets, we think this regime may be with us for quite some time.

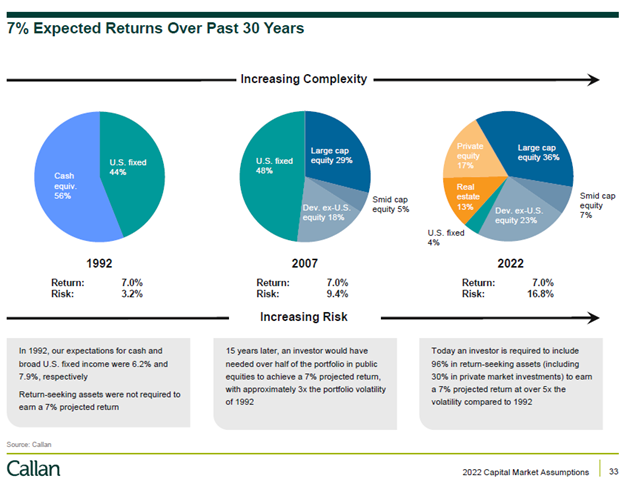

From a longer-term perspective, meeting defined investor objectives with specific asset allocations has changed dramatically. Consider this chart, which is updated annually by investment consultant Callan Associates, based on their own capital market assumptions.

Assume the investment objective was an annualized 7% return. According to Callan’s analysis, that objective could have been met in 1992 with a simple allocation to cash and bonds, resulting in an annualized standard deviation of 3.2%.

In 2007, 15 years later, the same return target would have required an allocation to global equities and bonds, resulting in a standard deviation of 9.4% (three times that in 1992).

Roll forward to 2022 and that same 7% return target requires an allocation to global equities, private investments and real estate, resulting in a standard deviation of 16.8% (roughly five times that in 1992).

In other words, it might benefit advisors to consider additional portfolio allocations to meet long-term client objectives. We certainly are receiving more inbound enquiries asking some variation of the question, “What else might I put into client portfolios, beside stocks and bonds?”

But how to fund them? Let’s consider one simple hypothetical example, where the investment objectives are to hedge inflation and increase diversification within the portfolio.

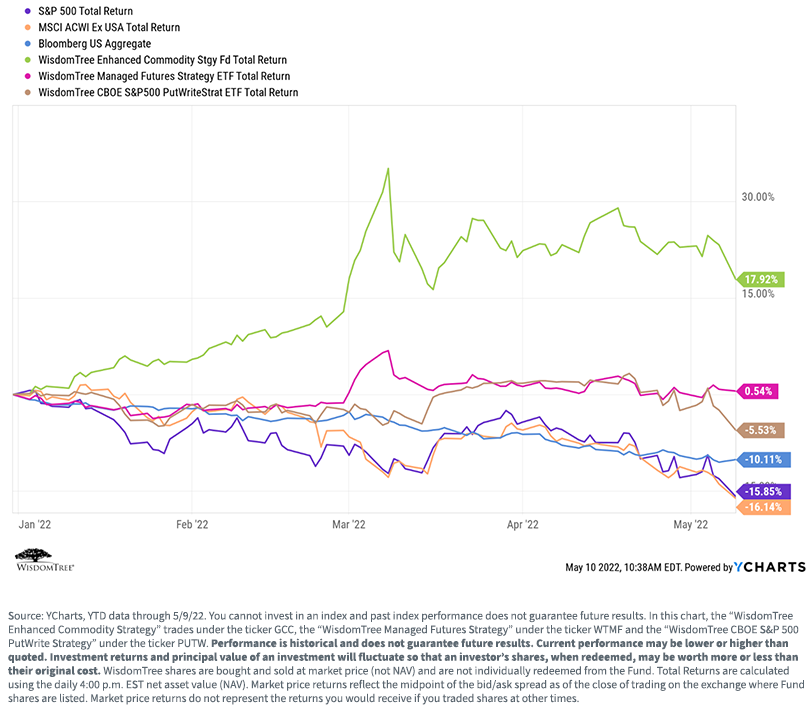

Take a look at the YTD performances of (a) U.S. large-cap equities (as measured by the S&P 500), (b) large-cap non-U.S. equities (as measured by the MSCI ACWI ex-U.S.), (c) U.S. bonds (as measured by the Bloomberg Aggregate), (d) a global commodities strategy (using our own GCC at NAV), (d) a managed futures strategy (using our own WTMF at NAV) and (e) a variation of a hedged equity strategy that capitalizes on higher volatility (our own PUTW at NAV).1

For the most recent standardized performance, click the respective ticker: GCC, WTMF, PUTW.

The YTD performance differential between the core equity and bond exposures and the diversifying strategies is stark. Using the capital efficient strategies (NTSX and/or NTSI and NTSE) and using the freed-up capital to allocate to these diversifying strategies may have dramatically improved both overall performance and the inflation-hedging profile of the portfolio.2

This is just a simple hypothetical example. The opportunities to “explore” appropriate allocations for the freed-up capital are almost limitless and completely dependent on the investment objectives for the overall portfolio.

A final thought is this—many advisors have been hesitant to make reallocations within their clients’ portfolios because of unrealized capital gains, the result of a remarkable multi-year bull rally in both stocks and bonds.

As bad as this year has been for most allocations, the result is the ability to make portfolio reallocations while minimizing realized gains, or perhaps even capturing tax losses that can offset gains elsewhere in the portfolio (i.e., “tax alpha,” which is real money back into the end clients’ pockets).

Conclusions

We think the time has come to explore the possibilities of building efficient core portfolios. The market regime has changed and both advisors and clients are investigating innovative ideas.

One of the age-old questions we have always received as advisors is, “I like the idea of including non-core stocks and bonds into my portfolio, but how do I fund them?” We believe the efficient core portfolios can—well—efficiently address that question. You can still implement the core portfolio without having to pick and choose how to fund the portfolio satellite positions.

The primary point is the use of the WisdomTree Efficient Core suite of portfolios opens possibilities for advisors and investors to build truly customized portfolios in a highly capital-efficient manner, without sacrificing an underlying allocation to a traditional stock/bond portfolio.

1 We use all WisdomTree strategies in this example for simplicity purposes. In actuality, all actual WisdomTree Model Portfolios are “open architecture” and contain both WisdomTree and third-party strategies.

2 This is a hypothetical example for illustration purposes only and does not represent actual investment advice. Past performance does not guarantee future results.

Important Risks Related to this Article

For retail investors: WisdomTree’s Model Portfolios are not intended to constitute investment advice or investment recommendations from WisdomTree. Your investment advisor may or may not implement WisdomTree’s Model Portfolios in your account. The performance of your account may differ from the performance shown for a variety of reasons, including but not limited to: Your investment advisor, and not WisdomTree, is responsible for implementing trades in the accounts; differences in market conditions; client-imposed investment restrictions; the timing of client investments and withdrawals; fees payable; and/or other factors. WisdomTree is not responsible for determining the suitability or appropriateness of a strategy based on WisdomTree’s Model Portfolios. WisdomTree does not have investment discretion and does not place trade orders for your account. This material has been created by WisdomTree and the information included herein has not been verified by your investment advisor and may differ from information provided by your investment advisor. WisdomTree does not undertake to provide impartial investment advice or give advice in a fiduciary capacity. Further, WisdomTree receives revenue in the form of advisory fees for our exchange-traded funds and management fees for our collective investment trusts.

For financial professionals: WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy. In providing WisdomTree Model Portfolio information, WisdomTree is not acting and has not agreed to act in an investment advisory, fiduciary or quasi-fiduciary capacity to any advisor or end client, and has no responsibility in connection therewith, and is not providing individualized investment advice to any advisor or end client, including based on or tailored to the circumstance of any advisor or end client. The Model Portfolio information is provided “as is,” without warranty of any kind, express or implied. WisdomTree is not responsible for determining the securities to be purchased, held and/or sold for any advisor or end client accounts, nor is WisdomTree responsible for determining the suitability or appropriateness of a Model Portfolio or any securities included therein for any third party, including end clients.

Advisors are solely responsible for making investment recommendations and/or decisions with respect to an end client and should consider the end client’s individual financial circumstances, investment time frame, risk tolerance level and investment goals in determining the appropriateness of a particular investment or strategy, without input from WisdomTree. WisdomTree does not have investment discretion and does not place trade orders for any end client accounts. Information and other marketing materials provided to you by WisdomTree concerning a Model Portfolio—including allocations, performance and other characteristics—may not be indicative of an end client’s actual experience from investing in one or more of the funds included in a Model Portfolio. Using an asset allocation strategy does not ensure a profit or protect against loss, and diversification does not eliminate the risk of experiencing investment losses. There is no assurance that investing in accordance with a Model Portfolio’s allocations will provide positive performance over any period. Any content or information included in or related to a WisdomTree Model Portfolio, including descriptions, allocations, data, fund details and disclosures, are subject to change and may not be altered by an advisor or other third party in any way.

WisdomTree primarily uses WisdomTree Funds in the Model Portfolios unless there is no WisdomTree Fund that is consistent with the desired asset allocation or Model Portfolio strategy. As a result, WisdomTree Model Portfolios are expected to include a substantial portion of WisdomTree Funds notwithstanding that there may be a similar fund with a higher rating, lower fees and expenses or substantially better performance. Additionally, WisdomTree and its affiliates will indirectly benefit from investments made based on the Model Portfolios through fees paid by the WisdomTree Funds to WisdomTree and its affiliates for advisory, administrative and other services.

Neither diversification nor asset allocation strategies assure a profit or protect against loss.

Neither WisdomTree Investments, Inc., nor its affiliates, nor Foreside Fund Services, LLC, or its affiliates provide tax advice. All references to tax matters or information provided in this blog are for illustrative purposes only and should not be considered tax advice and cannot be used for the purpose of avoiding tax penalties. Investors seeking tax advice should consult an independent tax advisor.