High Dividends for Stagflation

The topic of stagflation and comparisons to the 1970s has reached a fever pitch recently.

For the first time in decades, concerns over out-of-control inflation, a behind-the-curve Federal Reserve and a slowing economy are sending both equities and bonds tumbling.

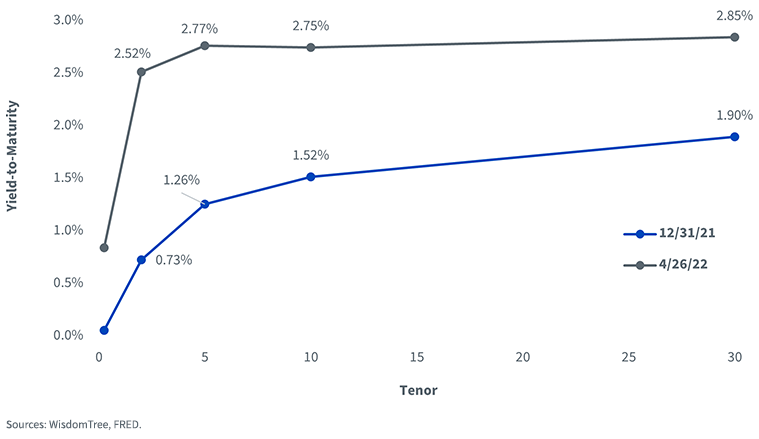

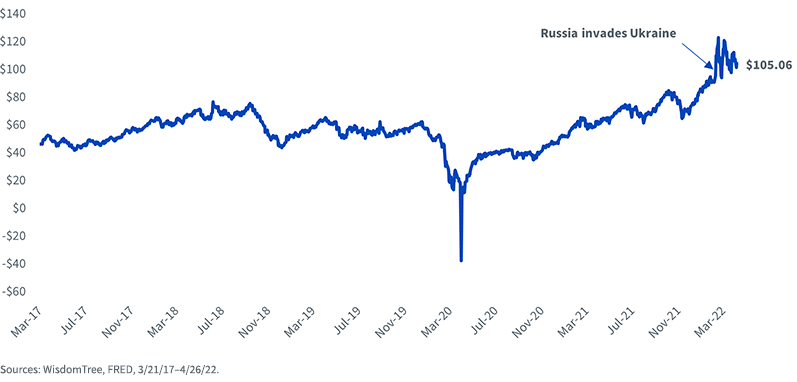

The main arguments underpinning the case for stagflation are a flat—and briefly inverted—yield curve that indicates expectations for an impending economic slowdown coupled with surging energy prices.

Treasury Yield Curve

WTI Spot Oil Prices per Barrel

While stagflation may not be the base-case scenario for many investors, how to allocate in this scenario now requires at least some consideration.

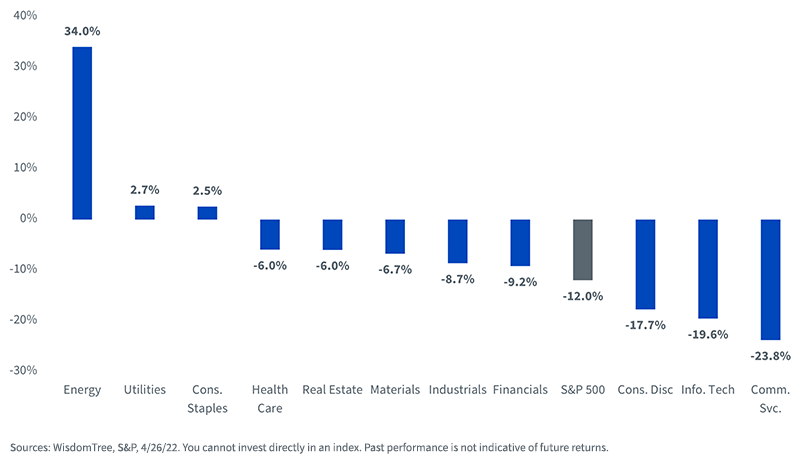

According to Bank of America research, the best-performing sectors during stagflation have historically been Utilities, Energy and Staples. The worst have been Consumer Discretionary, Information Technology and Communication Services.

Year-to-date performance has thus far favored the stagflation havens. Energy (+34%), Utilities (+3%) and Staples (+3%) have been the best performing sectors, while Consumer Discretionary (-18%), Information Technology (-20%) and Communication Services (-24%) have been the worst.

Year-to-Date Sector Returns

Sector performance can arguably be explained as much by stagflation concerns as by a rotation from growth to value after growth index multiples became wildly stretched and the forward price-to-earnings ratio of the Russell 1000 Growth Index (32.0x) peaked at over two times the multiple on the Russell 1000 Value Index (15.8x) last November.

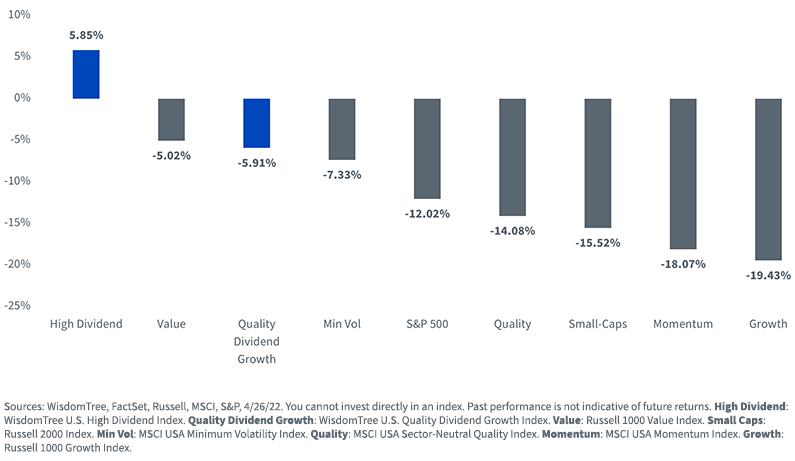

Amid this rotation, high dividends—which tend to skew toward value—have been one of the best-performing pockets of global equity markets.

YTD Factor Index Performance

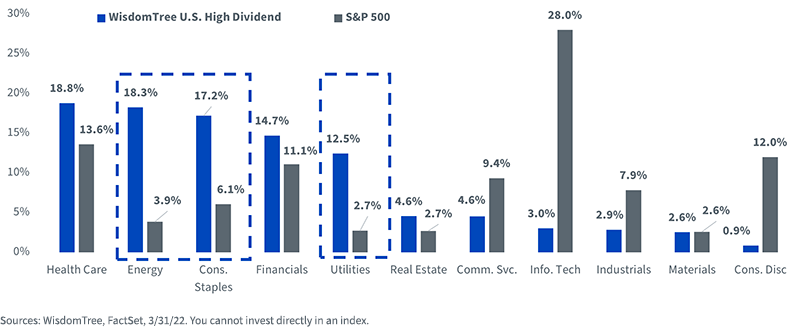

Sector allocations of the WisdomTree U.S. High Dividend Index are well aligned with the sectors that, according to BofA’s research, tend to benefit the most from a stagflation environment. The Index has a combined over-weight of 35% in Energy (+14%), Staples (+11%) and Utilities (+10%).

For clients considering how to allocate in a world of slow economic growth and persistently high inflation, an allocation to high-dividend payers may be just the solution.

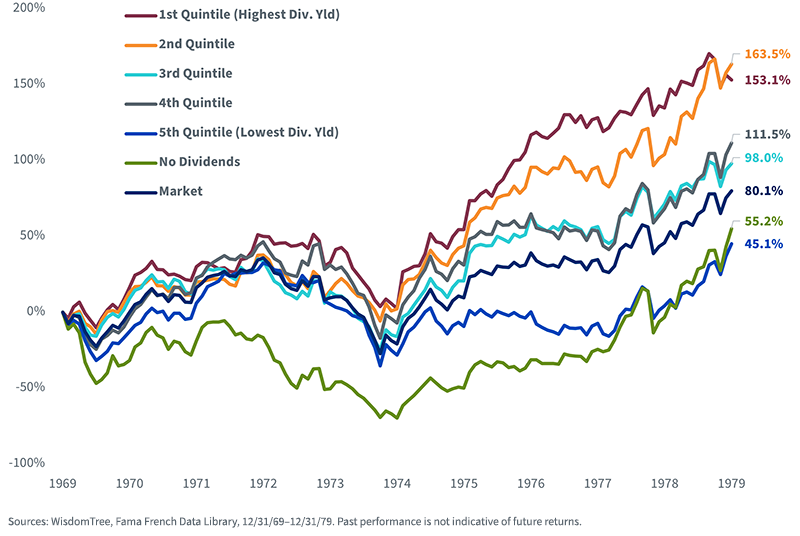

To compare to the 1970s experience, the two highest-dividend-yield quintiles handily outperformed the market, and the lowest-dividend-yield companies were laggards.

Cumulative Total Returns

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Funds focusing their investments on certain sectors increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.