The WisdomTree Q2 Model Portfolio Positioning

This article is relevant to financial professionals who are considering offering Model Portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional. Not all financial professionals have access to these Model Portfolios.

It is time for our quarterly update on the positioning of WisdomTree Model Portfolios. While we tend to be strategic investors who build portfolios to perform as expected (based on their various mandates) over full market cycles, we do not ignore changing economic and market conditions, and we will reposition and reallocate our Model Portfolios from time to time to hopefully optimize performance under shifting market regimes. We think it is safe to say that Q1 2022 represented a “shifting market regime.”

In our March Model Portfolio Investment Committee (MPIC) meeting, we voted to implement a small handful of such changes as we head into the second quarter of 2022.

The WisdomTree Economic and Market Outlook for Q2 2022

We recently published our Economic and Market Outlook for Q2 2022. Before diving into the reallocations approved by the MPIC, let’s summarize that outlook, to provide a frame of reference for the changes we opted for.

When focusing on what we believe are the primary market signals of economic growth, earnings, interest rates, inflation and Central Bank policy, we view the current economic and market conditions as somewhat of a mixed bag, with some large outstanding uncertainties.

Economic growth and earnings are expected to be positive, and COVID-19 and its variants should move into the rearview mirror despite recent increases in new cases.

But inflation, rising interest rates and the Russia/Ukraine conflict are significant uncertainties that could dramatically affect global economic and market conditions.

We believe that “fundamentals” will matter again, and we may enjoy another “economic reopening” market regime sometime in 2022, which may favor value, small-cap and dividend-focused stocks. We’ve already witnessed a significant “factor rotation” toward value and dividend stocks, both of which at least partially mitigated the broad market downturn in Q1. We think that trend will continue.

But inflation, interest rates, Fed behavior and the invasion of Ukraine all weigh on market sentiment. So, while we are modestly optimistic in our outlook for 2022, we believe we are in for increased volatility. We continue to recommend focusing on a longer-term time horizon and the construction of “all-weather” portfolios, diversified at both the asset class and risk factor levels.

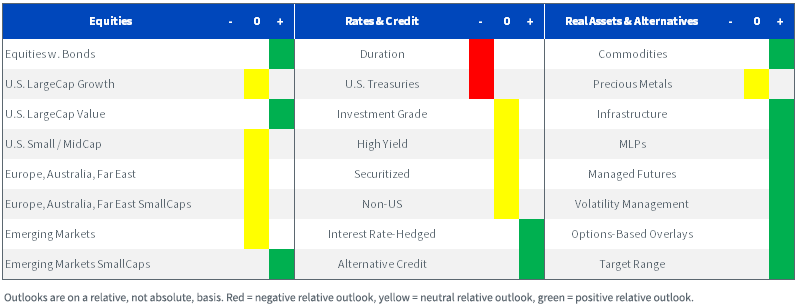

Our asset allocation guidelines remain as follows:

- Inflation remains the story of the year, as the Fed belatedly acknowledges being “behind the curve.” The biggest risks to our cautiously optimistic outlook are (a) an increasingly aggressive Fed raising rates more than the market expects and (b) an escalation of the invasion of Ukraine.

- In equities, we remain in line with the MSCI ACWI Index in terms of our regional exposures to the U.S., EAFE and emerging markets (“EM”).

- Somewhat uniquely (we think), we have explicit over-weight allocations in small-cap stocks in the U.S., EAFE and EM.

- Acknowledging the uncertainties caused by the invasion of Ukraine and the corresponding commodity shortages and human suffering, we still think we may see another “economic reopening” cycle at some point in 2022, which should bode well for our allocations to value, dividend-focused and small-cap stocks.

- Rising rates may provide a headwind to large-cap/growthier sectors and stocks, which tend to be more interest-rate sensitive.

- Within fixed income, we moved further under-weight in duration relative to the Bloomberg Aggregate Bond Index (the “Agg”), as well as over-weight in quality credit. As interest rates rise, prepayments on mortgages decline, and the duration of mortgage-backed securities (MBS) extends accordingly. In response, we are also under-weight in MBS within our fixed income models and allocations.

- The dollar continues to rise, and Fed action plus “flight to quality” trades may push this trend forward.

Reallocations within the WisdomTree Model Portfolios

With this market outlook and these asset allocation guidelines providing an appropriate framework, here is a summary of the changes we made within some of our Model Portfolios.

Endowment Model Portfolios: These are strategic multi-asset Model Portfolios that allocate to stocks, bonds, real assets and “nontraditional” or alternative assets to deliver a diversified “endowment-like” investment experience. Within these Model Portfolios, we voted to remove a hybrid infrastructure/real estate position—which proved to be more interest-rate sensitive than we anticipated—with an actively managed inflation hedge strategy that allocates between inflation-sensitive stocks, commodities and TIPS (Treasury Inflation-Protected Securities).

Volatility Management: This “outcome-focused” Model Portfolio is designed to act as a complementary sleeve to an existing multi-asset portfolio to provide additional diversification and potential drivers of lower-correlated returns. Within this Model Portfolio, because of our view on rising interest rates, we removed our “Black Swan” strategy, which invests in Treasury securities and longer-dated equity options, and reallocated to a more traditional equity long/short strategy, which we expect to be more idiosyncratic and have fewer macro headwinds driving performance.

Strategic Fixed Income Model: This “strategic building block” Model Portfolio serves as a foundation for many of our multi-asset Model Portfolios. Given our view on rates, we voted to further reduce the duration of this portfolio by reducing our exposure to our core bond and intermediate-maturity Treasuries strategies and reallocating to our own USFR, a floating rate Treasury strategy that offers rates that reset weekly based upon the three-month Treasury Bill auction.

Conclusions

As a reminder, while each of our Model Portfolios has different investment mandates and objectives, they do share certain common characteristics:

- They are global in nature (with the exception of regional-specific Model Portfolios, such as the U.S. Multifactor Model Portfolio). We are a global asset management firm, and we believe in global diversification.

- They are ETF-centric, as we believe this helps to optimize both fees and taxes—the two things any advisor has the most control over with respect to their client portfolios.

- They are “open architecture” and include both WisdomTree and third-party strategies. This is the right thing to do for the end investor, and it helps to improve the asset class and risk factor diversification of the Model Portfolios.

- The factor tilts inherent in many WisdomTree ETFs allow us to build “core/satellite” Model Portfolios that may optimize fees and taxes and still provide the potential for alpha generation versus plain vanilla cap-weighted “beta” portfolios.

- We charge no strategist fee—all revenue generated from our Model Portfolios comes only from the expense ratios associated with the WisdomTree products we choose to include in any given Model Portfolio.

Our Model Portfolios are designed to be strategic in nature and diversified at both the asset class and risk factor levels to potentially optimize risk-adjusted performance through full market cycles regardless of economic and market regimes.

As such, we remain largely comfortable with our core allocations and strategies—they have delivered consistent performance in line with their objectives throughout the past somewhat tumultuous two-plus years.

Furthermore, the embedded value and dividend tilts of many of our Model Portfolios very much benefited us in Q1, as those two factors were better “hedges” to the broad market declines than our fixed income allocations.

We did, however, opt to make marginal changes as summarized above to position our Model Portfolios in accordance with our economic and market outlook as we entered the second quarter of 2022.

You can learn more about all our Model Portfolios, including full transparency into allocations, individual securities, fees, yield and performance, at our Model Adoption Center.

Important Risks Related to this Article

For Retail Investors: WisdomTree’s Model Portfolios are not intended to constitute investment advice or investment recommendations from WisdomTree. Your investment advisor may or may not implement WisdomTree’s Model Portfolios in your account. The performance of your account may differ from the performance shown for a variety of reasons, including but not limited to: your investment advisor, and not WisdomTree, is responsible for implementing trades in the accounts; differences in market conditions; client-imposed investment restrictions; the timing of client investments and withdrawals; fees payable; and/or other factors. WisdomTree is not responsible for determining the suitability or appropriateness of a strategy based on WisdomTree’s Model Portfolios. WisdomTree does not have investment discretion and does not place trade orders for your account. This material has been created by WisdomTree, and the information included herein has not been verified by your investment advisor and may differ from information provided by your investment advisor. WisdomTree does not undertake to provide impartial investment advice or give advice in a fiduciary capacity. Further, WisdomTree receives revenue in the form of advisory fees for our exchange-traded Funds and management fees for our collective investment trusts.

For Financial Advisors: WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy. In providing WisdomTree Model Portfolio information, WisdomTree is not acting and has not agreed to act in an investment advisory, fiduciary or quasi-fiduciary capacity to any advisor or end client, and has no responsibility in connection therewith, and is not providing individualized investment advice to any advisor or end client, including based on or tailored to the circumstance of any advisor or end client. The Model Portfolio information is provided “as is,” without warranty of any kind, express or implied. WisdomTree is not responsible for determining the securities to be purchased, held and/or sold for any advisor or end client accounts, nor is WisdomTree responsible for determining the suitability or appropriateness of a Model Portfolio or any securities included therein for any third party, including end clients.

Advisors are solely responsible for making investment recommendations and/or decisions with respect to an end client and should consider the end client’s individual financial circumstances, investment time frame, risk tolerance level and investment goals in determining the appropriateness of a particular investment or strategy, without input from WisdomTree. WisdomTree does not have investment discretion and does not place trade orders for any end client accounts. Information and other marketing materials provided to you by WisdomTree concerning a Model Portfolio—including allocations, performance and other characteristics—may not be indicative of an end client’s actual experience from investing in one or more of the funds included in a Model Portfolio. Using an asset allocation strategy does not ensure a profit or protect against loss, and diversification does not eliminate the risk of experiencing investment losses. There is no assurance that investing in accordance with a Model Portfolio’s allocations will provide positive performance over any period. Any content or information included in or related to a WisdomTree Model Portfolio, including descriptions, allocations, data, fund details and disclosures, are subject to change and may not be altered by an advisor or other third party in any way.

WisdomTree primarily uses WisdomTree Funds in the Model Portfolios unless there is no WisdomTree Fund that is consistent with the desired asset allocation or Model Portfolio strategy. As a result, WisdomTree Model Portfolios are expected to include a substantial portion of WisdomTree Funds notwithstanding that there may be a similar fund with a higher rating, lower fees and expenses or substantially better performance. Additionally, WisdomTree and its affiliates will indirectly benefit from investments made based on the Model Portfolios through fees paid by the WisdomTree Funds to WisdomTree and its affiliates for advisory, administrative and other services.

USFR: There are risks associated with investing, including possible loss of principal. Securities with floating rates can be less sensitive to interest rate changes than securities with fixed interest rates but may decline in value. The issuance of floating rate notes by the U.S. Treasury is new, and the amount of supply will be limited. Fixed income securities will normally decline in value as interest rates rise. The value of an investment in the Fund may change quickly and without warning in response to issuer or counterparty defaults and changes in the credit ratings of the Fund’s portfolio investments. Due to the investment strategy of this Fund, it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.