Can a Time Machine Exist in Investing?

While there aren’t ‘do-overs’ in investing—you cannot go back to a particular time, take a different action and then play events as they transpired forward to the present—we can still learn a lot from history.

Think of a few examples of big downdrafts:

- In March 2020, much of the world did not know what was going to happen next. There wasn’t a clear playbook for how to deal with a global pandemic. Developed markets were locking down and it just wasn’t clear what the effect would be.

- In 2008, it wasn’t impossible to think that the U.S. government would take a significant ownership stake in many of the largest banks due to the global financial crisis.

Many who experienced the March 2009 lows did not allocate to equities during the worst of that period. But they did live through the results that followed and wished they had. It’s possible they even anticipated they would act differently the next time a similar drop occurred.

But did they, come March 2020?

These drops are informative in that they are so distinct from each other, and yet they are also similar in their degree of fear and uncertainty. Allocating to risky assets in a period of fear and uncertainty, when it does not seem possible to know what will happen next, will never be easy. If the picture was clearer, the downdraft would not be as severe.

If We Cannot Be Greedy When Others Are Fearful, What Can We Do?

Even if we cannot force ourselves to allocate during peak uncertainty, there are still opportunities.

Sometimes, there can be big downdrafts within a particular market segment. It may be easier to add risk in these areas because other parts of your overall asset allocation may be doing well and taking some of the pressure off making a decision.

Software-focused cloud computing companies in March 2022 could be one such market segment.

We look here at the BVP Nasdaq Emerging Cloud Index constituents to make certain inferences about this market.

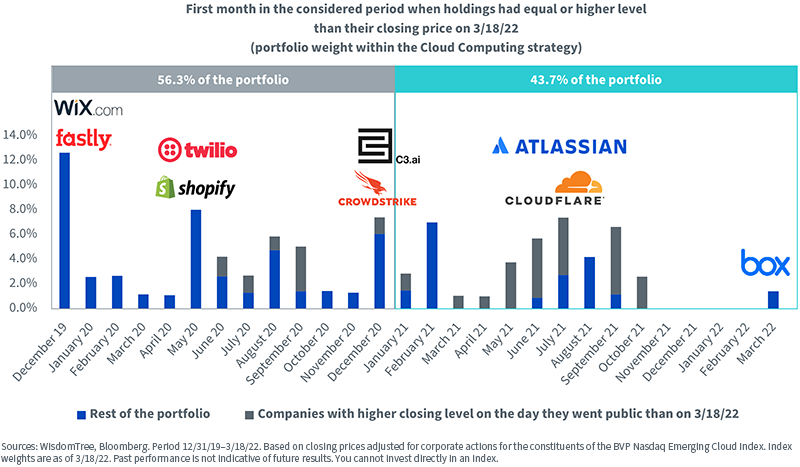

Figure 1 can be viewed as a veritable time machine, in that investors can think of cloud companies exhibiting share prices at levels similar to where they were at a certain period in the past.

In effect, the recent correction has reset the share prices to levels lower than before the start of the global pandemic, in some cases.

As we look at the period that starts December 31, 2019, there are certain companies trading higher on that day than in March 2022.

In figure 1, their weight is 12.7% of the BVP Nasdaq Emerging Cloud Index, as of March 18, 2022. Overall, 56.3% of the index is now allocated to companies that even back in 2019–2020 had share prices at higher levels than on March 18, 2022. More than a quarter of the portfolio weight is in companies that only went public in 2021, meaning they did not have any price history in 2020. All of those companies but one, that is, 24.7% of the portfolio weight, had their closing level on the first day of trading above their closing level on March 18, 2022.1

- Wix.com and Fastly are examples of companies trading at levels lower than before the global lockdowns and before there was a such thing as a ‘stay-at-home’ stock. Wix.com had revenues of $761 million in 2019 and $1.27 billion in 2021. Revenue growth may be decelerating, but it is still around 30%. Fastly has experienced bigger challenges. Its 2019 revenue was $200 million, and $354 million last year. Revenue growth guidance has been crushed—but it’s still performing at around a 20% year-over-year figure. Fastly is involved in content delivery networks, and while it wouldn’t be immune from idiosyncratic risks to its own execution, there is little question that consumers and businesses want more content at a higher quality and speed over the internet—not less.

- Twilio and Shopify have been two of the strongest and most well-run businesses within the cloud computing market, and share prices are now back to May 2020 levels. In 2020, Shopify had revenue of $2.929 billion, whereas in 2021 revenue had grown to $4.612 billion. Shopify’s unique privilege for doing so well in helping small business owners run online storefronts is ending up on the radar screen of Amazon.com—certainly a challenge. Twilio earned $1.762 billion in revenue during 2020, growing to $2.842 billion in 2021. It is among the best-in-class companies that help software developers add communications capabilities to their applications, and it’s important to ask ourselves—are we predicting a world where we use FEWER applications?

Figure 1: A Time Machine for Cloud Computing Companies

Investors Wanted Better Valuations (a Correction) and it Has Arrived

WisdomTree has focused on cloud computing as an important megatrend since September 2019. Few realized the tailwind to many of these stocks that societal behavior during the pandemic would offer, but history shows the returns of 2020 were, in a word, incredible.

Firms were trading at triple-digit ratios of enterprise value to sales—meaning greater than 100 times. Many discussions recognized the value of what the businesses were providing, but investors were skeptical that the growth rates could be maintained. If valuations could get more reasonable, there would be greater interest.

As we look at the space in March 2022, this correction has come.

1 Source for revenue data in bullets: www.wsj.com, specifically the financial statement data reported for the individual companies

Important Risks Related to this Article

Christopher Gannatti is an employee of WisdomTree UK Limited, a European subsidiary of WisdomTree Asset Management Inc.’s parent company, WisdomTree Investments, Inc.

Christopher Gannatti began at WisdomTree as a Research Analyst in December 2010, working directly with Jeremy Schwartz, CFA®, Director of Research. In January of 2014, he was promoted to Associate Director of Research where he was responsible to lead different groups of analysts and strategists within the broader Research team at WisdomTree. In February of 2018, Christopher was promoted to Head of Research, Europe, where he was based out of WisdomTree’s London office and was responsible for the full WisdomTree research effort within the European market, as well as supporting the UCITs platform globally. In November 2021, Christopher was promoted to Global Head of Research, now responsible for numerous communications on investment strategy globally, particularly in the thematic equity space. Christopher came to WisdomTree from Lord Abbett, where he worked for four and a half years as a Regional Consultant. He received his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern School of Business in 2010, and he received his bachelor’s degree from Colgate University in Economics in 2006. Christopher is a holder of the Chartered Financial Analyst Designation.