Unstacking Currency Risks amid Rising Volatility

Most investors allocate to international stocks by adding, or stacking, currencies on top of their equity exposures. Yet one can ‘unstack’ these currency returns and focus on the local markets to reduce volatility when going abroad by investing in currency hedged strategies.

Many have viewed currency hedged strategies as making a tactical call on the U.S. dollar.

From that perspective, we will show the U.S. dollar has some interesting diversifying properties.

While many international asset allocators argue foreign stocks provide diversification properties for a declining U.S. dollar regime, we will show the U.S. markets already have embedded exposure to a down dollar regime—and what is more interesting is the U.S. dollar’s diversifying properties. And you can get that dollar hedge in a capital efficient manner.

Moreover, when contextualized, we ask, “Do you want to bet on the euro or yen appreciating forever, or do you think that bet just stacks uncompensated risk to your equity investment?” You might be better served by unstacking your currency risk and using a strategic allocation that is neutral to currency directions with a currency hedged approach.

Currency volatility

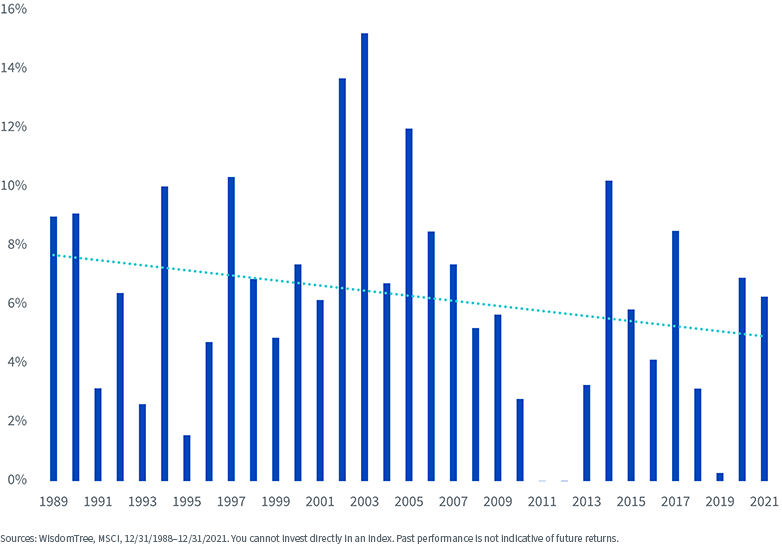

The long-term volatility of MSCI EAFE currencies was around 8% a year since 1989. Investors often have a hard time thinking about standard deviations—this 8% a year is roughly half the risk of a typical U.S. equity market.

More simply, if you take the absolute value of the differences in calendar year returns to show what is the typical move of a currency in any given year, you find the typical currency move for MSCI EAFE was plus or minus 6% a year. This typical move has been lower than usual of late due to the macro environment given global policy rates that were well anchored and predictable.

But things are changing in macro and currency land much more quickly now with more volatility in bond rates and terms of trade.

It was understandable for currency volatility to be trending lower when all central banks pegged their interest rates at the zero lower bound (or negative territory). But now that policy divergences are appearing, perhaps volatility in the FX world is also re-appearing.

Absolute Value of MSCI EAFE Yearly Currency Moves

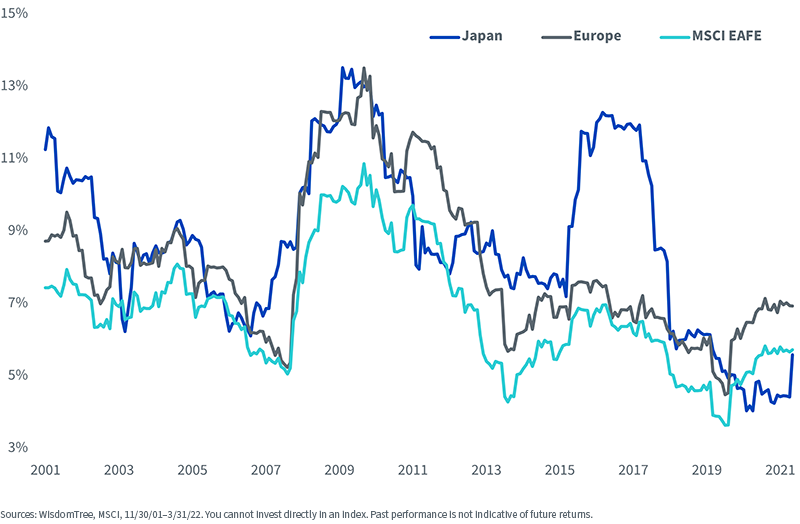

Just looking at the rolling 24-month standard deviations of major regional currencies, we can see that Japanese currency volatility spiked in March. But even with that spike, the trailing 24-month volatility remains at one of the lowest levels in the past 20 years.

It should not surprise anyone to see volatility levels returning to higher levels more consistent with past experience.

Currency Volatility Rolling 24-Month Standard Deviation

What diversification?

We argue that a strategic case for hedging currency risk is easily described by just wanting local market returns and not wanting to bet on a currency direction. If you are benchmarking to a worldview that starts with international investments from a foreign stock + foreign currency stack, hedging currency risk adds a U.S. dollar return stream to help neutralize that embedded foreign currency exposure.

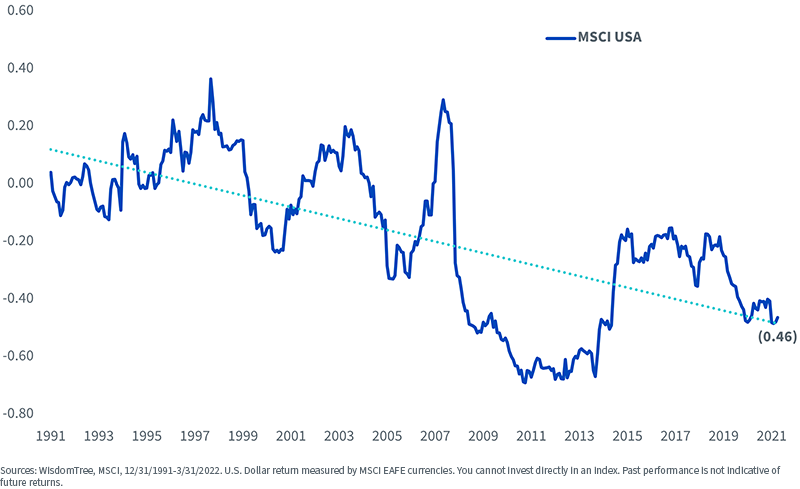

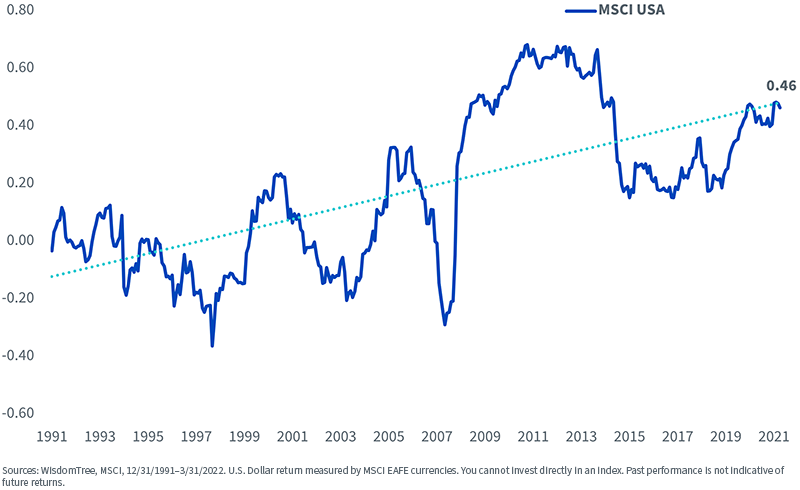

Here we chart the U.S. dollar correlation to the S&P 500. What you find is a downward sloping trendline and the latest correlation is −0.46. That means the U.S. dollar was anti-correlated to the S&P 500. Isn’t that the definition of “diversification” and the holy grail asset you are looking for?

Rolling 36-Month Correlation: U.S. Dollar & MSCI USA Index

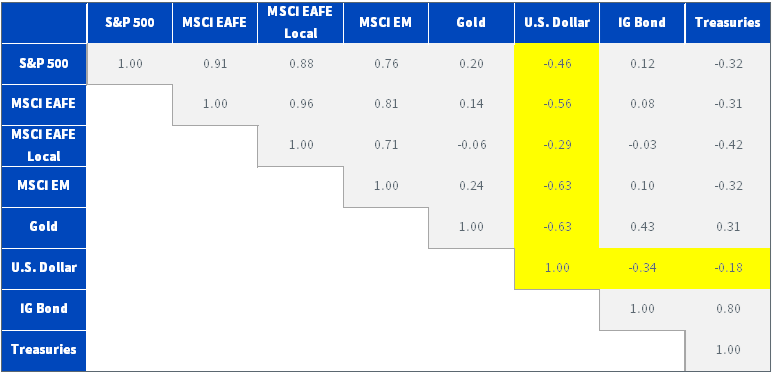

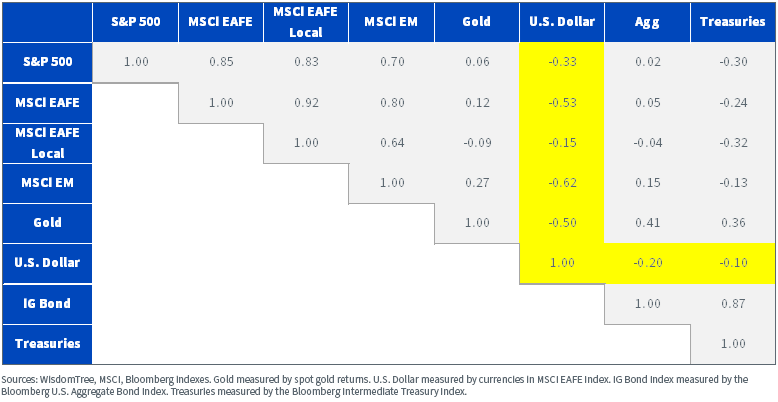

In fact, the dollar has been among the best portfolio diversifiers in recent years. The dollar’s −0.46 correlation to the S&P 500 over the most recent trailing three-year period is better than common hedge assets like gold (0.20), investment-grade fixed income (0.12) and even Treasuries (−0.32).

3-Year Index Correlation Matrix

A similar pattern of strong negative correlation for the dollar and the S&P 500 exists when extending to the past decade.

10-Year Index Correlation Matrix

It is puzzling to me why most asset allocators get this completely backwards.

A well-regarded analyst at a major research firm just published the following on the case for international equities1:

...there’s no guarantee that international stocks will always move in lockstep with the U.S. market. And even with higher correlation levels, international stocks still provide some diversification benefits, particularly as it relates to currency exposure. In a period of U.S. dollar weakness, international diversification could become increasingly important.

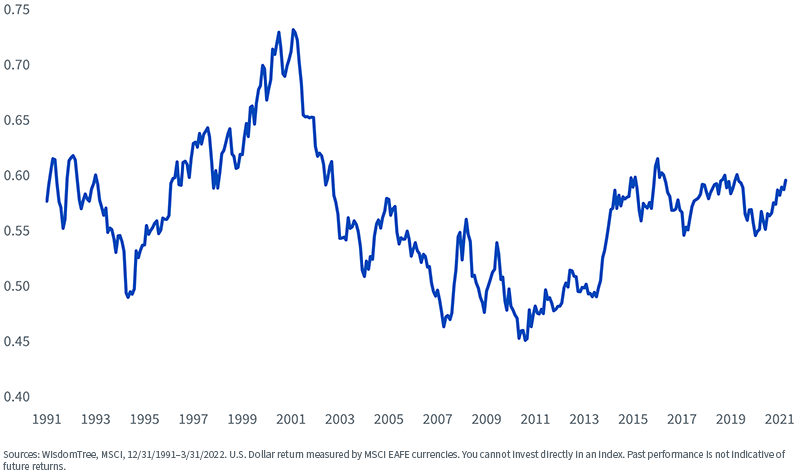

The negative correlation of the U.S. dollar says it all, but just to put it simply, we graph the opposite—the correlation of foreign currency risk to the S&P 500.

Rather than showing a negative (diversifying) correlation that is getting increasingly more diversifying, this shows the mirror image—a rising correlation of foreign currencies with the S&P 500—showing even lower diversification properties than has historically been the case.

Rolling 36-Month Correlation: Foreign Currency/MSCI USA Index

We graph a 30-year view of the U.S. dollar. It shows some great bull and bear market trends that continue for long periods of time. Do you have a clear view on which direction the dollar is going from here?

Should the dollar be in permanent decline versus the euro, yen, Swiss franc and British pound? Those are the major currencies in international developed markets and what you are betting on if you take currency risk unhedged.

The dollar has appreciated the most against the yen, as there is the starkest difference in the two countries’ central bank policies. But what if the Fed tightens policy more than people expect today? That has been our call for some time. Short-term rates (also known as carry) are one of the strongest factors impacting the directions of currencies.

While I am arguing you should bet less on currencies by adopting a strategic currency hedged framework, I also believe currency hedged strategies offer the more interesting diversifying property for the current Fed cycle and the negative correlation the dollar brings.

U.S. Dollar Index

1 See Amy Arnott, “Is International Diversification Necessary?” Morningstar Research note, 3/28/22.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.