Indian Economy and Market at a Glance

On a recent China of Tomorrow podcast, Liqian and Aneeka chatted with senior portfolio manager Wei Huang of The Stanley-Laman Group, who manages active China and India portfolios. We’ve written before on how India and China are similar due to their heavy reliance on imported oil and domestic coal.

In this episode, Wei and Aneeka see three tailwinds for the Indian economy in 2022: (1) continued dovish monetary policy, (2) the government’s plan to sell off state assets to finance infrastructure investment, similar to China 20 years ago, and (3) sectors like software and real estate that can reap the benefits of domestic and global growth.

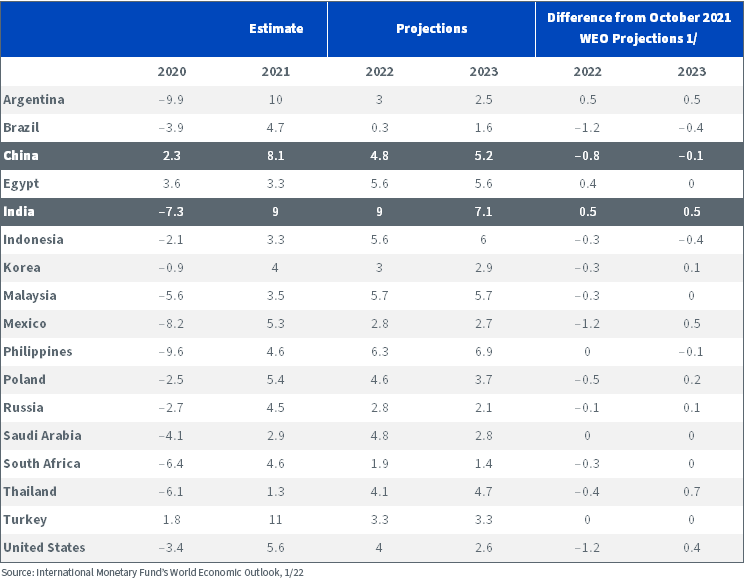

The International Monetary Fund (IMF) projected India’s 2022 growth at 9%, the highest among developing economies.

World Economic Outlook, January 2022 Update: Selected Economies Read GDP Growth (percent change)

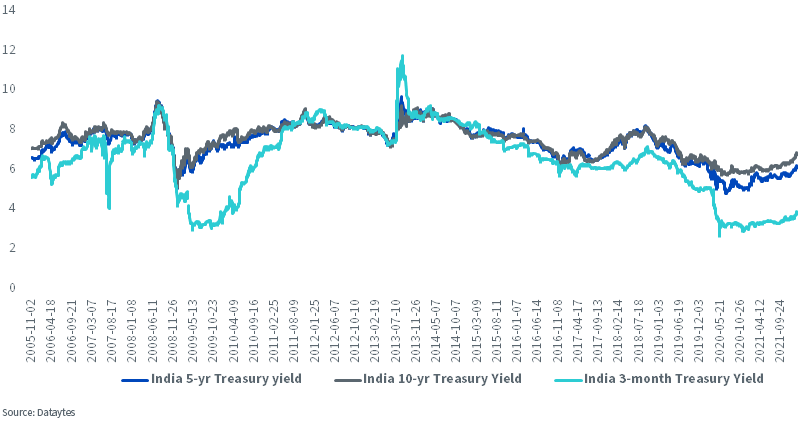

India’s wholesale price inflation has been running high, sometimes above 5%, the threshold the Reserve Bank of India watches for heightened inflation risk. But the expectation is that its monetary stance is still on the looser side, and it won’t flirt with rate increases until 2023, setting itself apart from other emerging markets (EM) countries like Brazil, Russia and Korea that have aggressive rate tightening.

India Treasury Curves with Different Maturities

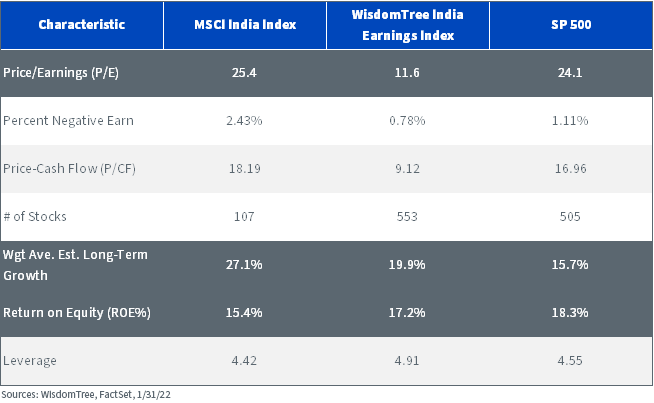

Historically, Indian equities have traded at rich valuations. As of January 31, 2022, the MSCI India Index had a slightly higher price-to-earnings ratio (P/E) than the S&P 500. Earnings weighting instead of market-cap weighting made the portfolio substantially more value-oriented and less growth-oriented, as the WisdomTree India Earnings Index shows. Plus, an earnings-weighted index has higher quality measures, such as return on equity (ROE).

Wei mentioned that as the developed world becomes more accustomed to working from home, India’s software services industry will continue benefiting from both domestic and global outsourcing businesses. He’s positive on India’s pharmaceutical industry for its high pricing power and India’s real estate sector.

For those interested, please listen to the full conversation below.

Liqian Ren, Ph.D., joined WisdomTree as Director of Modern Alpha in 2018. She leads WisdomTree’s quantitative investment capabilities and serves as a thought leader for WisdomTree’s Modern Alpha® approach. Liqian was previously at Vanguard, where she worked for 12 years, most recently as a portfolio manager in the Quantitative Equity Group managing Vanguard’s active funds and conducting research on factor strategies. Prior to joining Vanguard, she was an associate economist at the Federal Reserve Bank of Chicago. Liqian received her bachelor’s degree in Computer Science from Peking University in Beijing, her master’s in Economics from Indiana University—Purdue University Indianapolis, and her MBA and Ph.D. in Economics from the University of Chicago Booth School of Business. Liqian co-hosts a podcast on China and Asian markets with Jeremy Schwartz, WisdomTree’s Global Head of Research, and she is a co-host on the Wharton Business Radio program Behind the Markets on SiriusXM 132.

Aneeka Gupta is Director of Research at WisdomTree. Prior to the acquisition of ETF Securities in April 2018, Aneeka worked as an Equity & Commodities Strategist at the company. Aneeka has 17 years of experience working as a Research Analyst across a wide range of asset classes. In her current role she is responsible for conducting analysis for all in-house equity, commodity and macro publications and assisting the sales team with client queries around products and markets.

Prior to WisdomTree, Aneeka began her career as an equity analyst at Bear Stearns International Ltd in London. She also worked as an Equity Sales Trader at Sunrise Brokers across US and Pan European Exchanges. Before that she worked as an Equity Derivatives Sales Manager at Mashreq Bank in Dubai.

Aneeka holds a Masters in Mathematics from Oxford University and a BSc in Mathematics from the University of Delhi, India. She is also a CFA Charterholder.