Battery Storage: Driving the Energy Transition

A radical energy transition is underway, driven by a combination of environmental, policy and technology factors. Our energy system is being electrified and decarbonized, switching away from fossil fuels to clean, renewable sources of energy. The effect will be transformational.

Power and road transport, which together contributed around two-thirds of carbon emissions in 2020 (source: IEA), are a clear area of focus for the energy transition. A great deal has been achieved in the development of renewable power generation and electric vehicles (EVs). Breakthroughs in battery energy storage technology have been a key enabler:

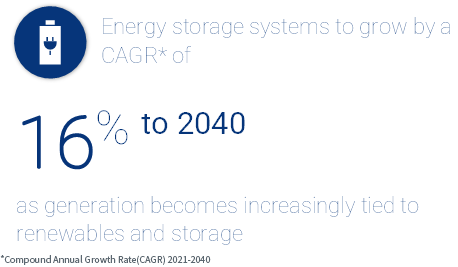

Power. The growth in intermittent renewable energy, such as wind and solar, creates a greater need for flexibility and reliability in power markets. Battery storage can help smoothen supply and improve grid stability. This type of energy storage is often called “stationary.”

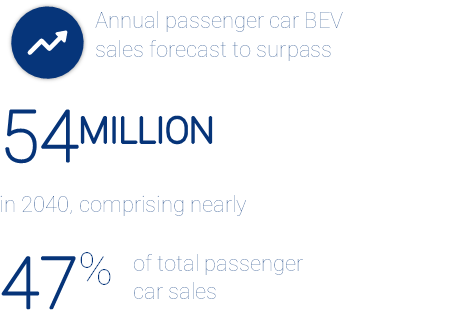

Road transport. A battery can either displace or be combined with an internal combustion engine to create hybrid or fully electric vehicles.

Lithium-Ion Technology Dominates the Market

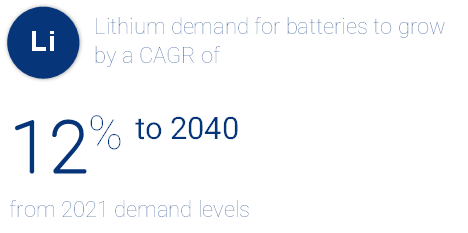

The battery storage market is currently dominated by lithium-ion battery (LiB) technology. LiBs have useful attributes. They’re lightweight, have a high energy density and offer good charging and discharging properties.

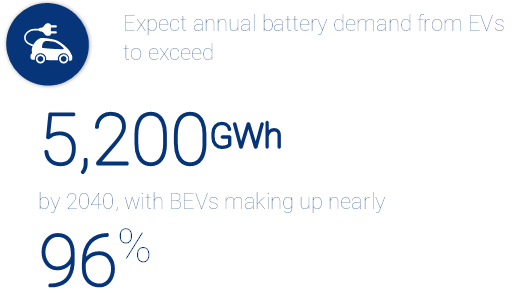

The first LiB was commercialized in 1991 by Sony after 20 years of research. Until recently, the primary use was in portable electronics, including mobile phones. As the technology has improved and scaled, it has been used in EVs and stationary storage solutions. Going forward, while stationary storage will grow significantly, the biggest driver will be EVs—which already constitute more than half of battery demand.

The rise in battery storage is fueled by falling costs. LiB costs have declined 80% this decade, primarily driven by two things.

Economies of scale. Every doubling of production capacity results in a 5%–8% reduction in cost.

Energy density improvements. Market competition accelerates improvements that lead to reductions in battery prices.

The speed of this cost decline has consistently been underestimated. Wood Mackenzie anticipates costs will continue to fall as economies of scale and energy densities further improve.

Next-Generation Technology Will Help Satisfy Growing Demand

The battery storage sector is constantly evolving. We expect next-generation lithium-ion batteries, notably solid-state batteries, will be commercialized in the coming decade.

A range of technologies will be required to fully satisfy storage demand. Flow batteries, liquid air, hydrogen and power-to-gas can all complement LiB—offering different properties to suit a range of applications.

The Battery Value Chain Is Also Evolving

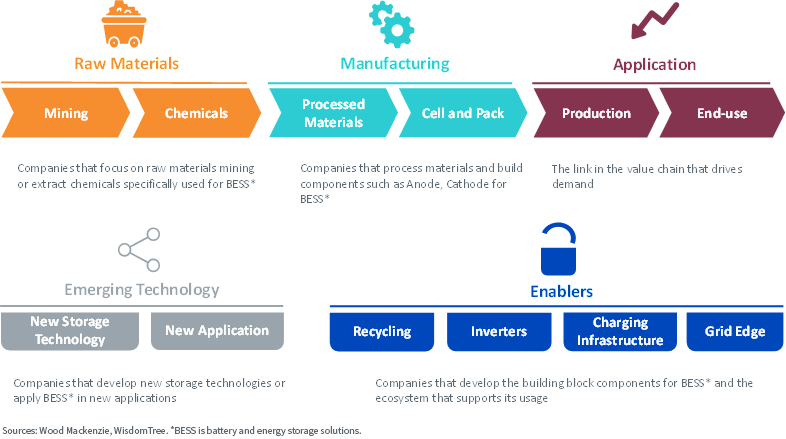

The battery value chain is made up of a myriad of industries across the globe. The mining and chemical industries each provide raw materials to manufacture battery cell components. Cells are then packed for different applications—such as the increasingly popular EVs. At the end of life, batteries are recycled or used for secondary applications, such as energy storage e-systems. Many companies stretch across different elements of the value chain, perhaps integrating the sourcing of raw materials with manufacturing.

Important Risks Related to this Article

Wood Mackenzie, a Verisk Analytics business, is a trusted source of commercial intelligence for the world’s natural resources sector. We empower clients to make better strategic decisions, providing objective analysis and advice on assets, companies and markets. For more information visit: www.woodmac.com