How Do You ‘Price’ Innovation?

Equity investment strategies focused on specific themes or megatrends have been largely out of favor in 2022, at least in the early weeks. The commonly held belief at the macroeconomic level is that the relatively high inflation readings seen in many markets is leading central banks to shift course and consider varying ways to take liquidity out of the global system. Since that liquidity was a driver of strong equity market performance in recent years, many companies are seeing their valuations drop, leading to significantly negative performance in short periods.

During the 2020 portion of the pandemic, many companies with innovative ideas were given funding in the private markets and high valuations in the public markets. Equity investors appeared focused on the stories and possible transformative potential, more than they focused on current cash flows, earnings or dividends. In early 2022, there has been a shift, and equity investors are now more interested in cash flows, earnings and dividends and less geared toward exciting stories of massive future potential.

What is the ‘right’ approach?

Innovation—If it Was Certain or Predictable, it Wouldn’t Be Exciting

Venture capital investors reference the ‘power law,’ an approach to concentrated investing in private companies with big potential. It is understood that of a subset of investments, many will fail completely, seeing their values stagnate and possibly go to zero. A small number will have remarkable, world-changing results. The success of the ‘world-changers’ makes up for the fact that the others failed, giving venture capital investing the possibility of being highly lucrative.

Vibrant capital markets give entrepreneurs a seemingly ever-increasing set of options to achieve their financing. Venture capital is fine in the private markets, but now companies have differentiated options—the special purpose acquisition vehicle (SPAC), direct-listing, initial public offering (IPO)—to get into the public markets. If entrepreneurs are able to go public sooner in their life cycles, then investors might get a risk profile that is more similar, at the company level, to what is seen on the venture capital side.

There are now public companies in the human health space, for instance, where if they can develop and scale certain therapies or techniques in their respective markets, they could change many aspects of how health care is done. However, the risk is high—if they are unable to develop and scale these ideas, the businesses would cease to exist. Share prices can move massively on certain announcements, like clinical trials, lending a degree of idiosyncratic risk investors wouldn’t typically see in broader equity strategies or more established companies.

BioRevolution: The Market in Early 2022 Has Been ‘Repricing’ Innovation

For those who have been following the biotechnology space in recent years, the ride in terms of share price returns has been, well, WILD. The period from 2019 to 2020 saw unbelievable returns in many cases, with little attention paid to such concerns as revenues or positive earnings. There was a bit more volatility in 2021, and the start of 2022 has been very challenging. True, those investors who might have initiated their positions prior to 2019 may still be above water, but others who were swept up in the excitement and returns of 2019–2020 might be significantly negative.

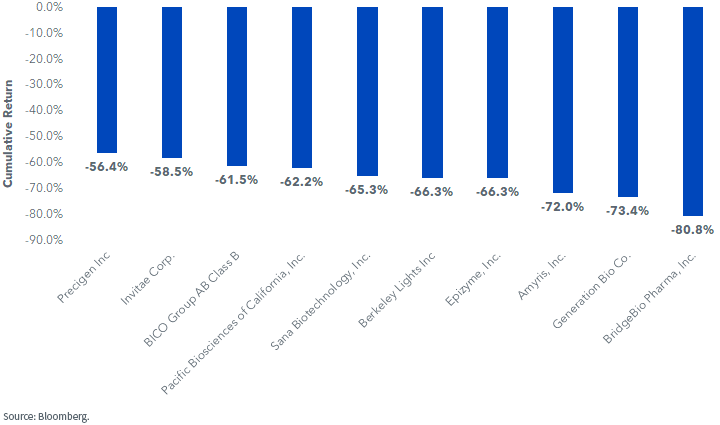

The BioRevolution is one of WisdomTree’s megatrend investment strategies, and its most recent semiannual rebalancing occurred in early November 2021. Unfortunately, this also coincided with the near-term equity market peak and the start of a more generalized equity market sell-off, particularly in the more growth-oriented market segments. Figure 1 indicates the 10 worst performers on a share price basis from within the WisdomTree BioRevolution Index.

Figure 1: Cumulative Returns (11/7/21–2/7/22)

Goldilocks: Likely an Impossibility in the BioRevolution

The Goldilocks fable is well-known for the principle of getting something ‘just right’ rather than too much or too little. Scientific innovation takes a certain amount of time, and it is difficult for non-experts to interpret the mile markers along the way. Therefore, the stocks are susceptible to overreactions. The 2019–20 period was likely an overreaction to the positive side, in that many of the companies had great ideas and excitement, but had not scaled their products fully into their markets. Similarly, the early 2022 period is likely an overreaction in the other direction, since the actual prospects for scientific innovation to dramatically change in short periods, based on things like U.S. Federal Reserve communications, are also not highly likely.

We therefore find it important to indicate what the companies in figure 1, which have faced these particularly difficult returns, are doing1:

- Precigen, Inc: Precigen has, as of this writing, seven innovative therapies at various phases of the clinical trial process.

- Invitae Corp: Presently, the company’s mission is to share genetics on a global scale to diagnose more patients correctly and earlier, and bring therapies to market faster. The future could see the provision of information services that inform genetic health care throughout life.

- BICO Group: BICO has industry-leading expertise in ‘Bio Convergence’ by combining the power of biology, engineering and computer science. Robotics, artificial intelligence, advanced genomics and bioprinting intersect to create these potential outcomes.

- Pacific Biosciences of California, Inc: Pacific Biosciences is creating some of the world’s most advanced sequencing technologies. The company has leading long-read and highly accurate short-read technology for sequencing the genome.

- Sana Biotechnology: Sana Biotechnology utilizes engineered cells as medicines. If we assume that many diseases are caused by damage to or dysfunction of cells, Sana’s ambition is to repair or replace any cell in the body.

- Berkeley Lights: Berkeley describes their function as ‘bringing DNA sequences’ to life. The company is active across such verticals as cell therapy, synthetic biology, gene therapy and agriculture biology.

- Epizyme: Epizyme focuses on the global oncology opportunity.

- Amyris: Amyris uses biology, the most precise and efficient chemistry on earth, to manufacture the molecules needed in the everyday lives of humans.

- Generation Bio: Generation Bio operates across multiple modalities, including closed-ended DNA, internal large-scale manufacturing capacity and cell-targeted LNP delivery.

- BridgeBio Pharma: BridgeBio is seeking to discover, create, test and deliver transformative medicines to treat patients who suffer from genetic diseases and cancers with clear genetic drivers. In 2020 and 2021, the company has actually achieved 25 Food & Drug Association (FDA) approvals for drugs targeting rare genetic diseases or genetically defined cancers.

Conclusion: What Is the ‘Right Price’?

The volatility in the market is telling us that this is not an easy question for companies identified in WisdomTree’s BioRevolution megatrend strategy. It is difficult to justify a high valuation on a firm that may not yet have proved its capability to scale its business model, but that also doesn’t preclude investors from getting carried away with excitement at different points. We believe in the potential benefit of a long time horizon to at least give companies a chance to execute, recognizing that some will likely not make it and others may be massively successful. Trying to figure out which ones end up in each category is part of the fun of assembling the puzzle that leads to the potential for strong returns.

1 Sources: The bullet points specifying details behind each company are sourced from the respective company investor presentations and websites, using what was current as of 2/7/22.

Important Risks Related to this Article

Christopher Gannatti is an employee of WisdomTree UK Limited, a European subsidiary of WisdomTree Asset Management Inc.’s parent company, WisdomTree Investments, Inc.

Christopher Gannatti began at WisdomTree as a Research Analyst in December 2010, working directly with Jeremy Schwartz, CFA®, Director of Research. In January of 2014, he was promoted to Associate Director of Research where he was responsible to lead different groups of analysts and strategists within the broader Research team at WisdomTree. In February of 2018, Christopher was promoted to Head of Research, Europe, where he was based out of WisdomTree’s London office and was responsible for the full WisdomTree research effort within the European market, as well as supporting the UCITs platform globally. In November 2021, Christopher was promoted to Global Head of Research, now responsible for numerous communications on investment strategy globally, particularly in the thematic equity space. Christopher came to WisdomTree from Lord Abbett, where he worked for four and a half years as a Regional Consultant. He received his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern School of Business in 2010, and he received his bachelor’s degree from Colgate University in Economics in 2006. Christopher is a holder of the Chartered Financial Analyst Designation.