The Piping Hot Labor Market Threatens Profit Margins

I’m still thinking about the market’s shock a few weeks back when the nonfarm payrolls report showed an increase of 467,000 jobs in January, well ahead of the 150,000 that was expected by the market.

I will not be surprised if that report is a taste of what is to come in the next few months, because I contend that this may be the hottest labor market of my career.

Wage inflation and a profit margin pinch is the hypothesis.

As we get to the charts, think about what has worked in the stock market lately. Since November, the bears have been coming after stocks with distant cash flows whenever rates have headed higher, owing to the math behind discounting future values to the present. In contrast, companies that are profitable now—many of which populate value indexes—have held up.

It’s something like this:

Inflation “on” → More Fed hikes → Value stocks beating growth

Inflation “off” → Fewer Fed hikes → Growth stocks beating value

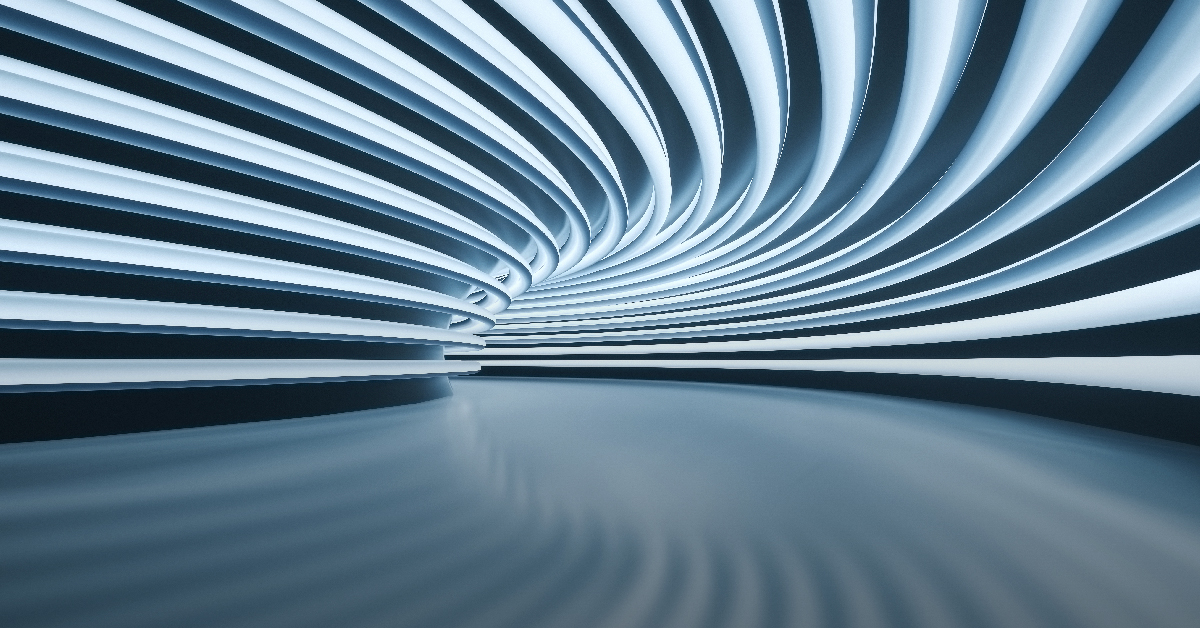

Figure 1 shows the steady climb in the U.S. quit rate over the last two years. People dump their jobs when they are confident that they can line up new ones. Critically, the biggest pay bumps often come when you go to a new company—and a lot of people are doing just that.

Figure 1: U.S. JOLTS Survey, Quit Rate

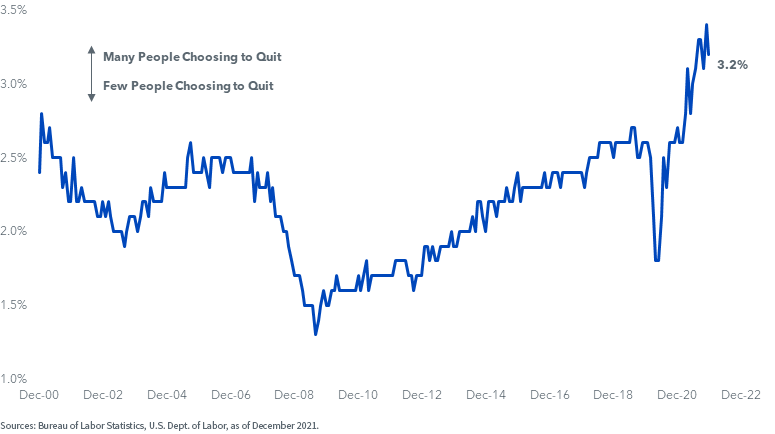

Their confidence stems from basic arithmetic. We had a few years prior to Covid when, for the first time in generations, there were more job openings than unemployed people.

Lockdowns ended that.

But 2022 is not 2020; job postings once again exceed the ranks of the unemployed, this time by a country mile (figure 2).

Figure 2: JOLTS Survey, Total Job Openings Minus Total Unemployed (Thousands)

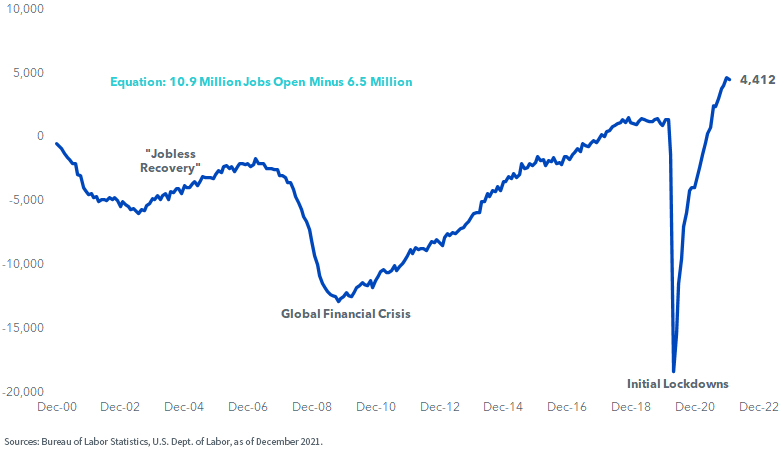

Figure 3 shows another way to look at it. As hot as the 2018–2019 job market got, this one far exceeds it.

Figure 3: U.S. Job Openings as % Unemployed

You can glean a lot of information about the labor market by checking the National Federation of Independent Businesses (NFIB) survey. In January, the most recent report, 47% of small businesses said they had one or more jobs that were hard to fill (figure 4).

You know the old saw? “The cure for high commodity prices is high commodity prices.” If copper zooms, miners mine more copper, sending the price down.

Well, if you post a job and can’t find anyone, the solution is to hike the pay. Applicants will show up…once you change the compensation.

Figure 4: NFIB Survey: “1 or More Jobs Hard to Fill”

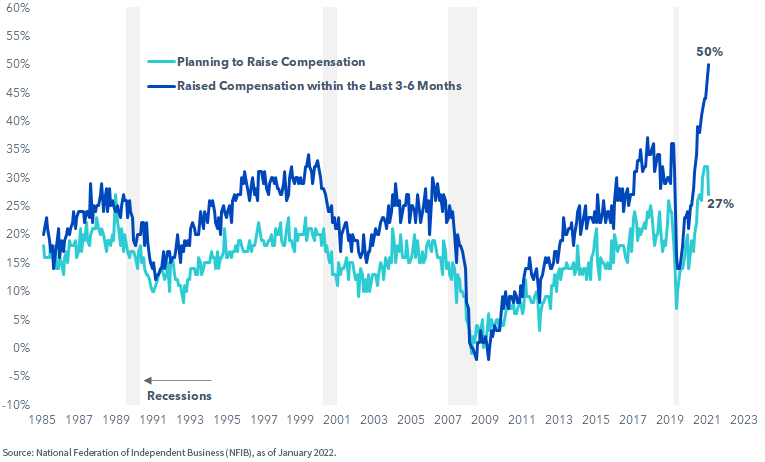

The same NFIB survey shows that 50% of employers were actively ratcheting up compensation toward the end of 2021, with 27% saying they intend to do so in the coming months (figure 5).

Figure 5: NFIB Survey, Worker Compensation

The Atlanta Fed’s wage growth tracker showed a 4% year-over-year increase in January. I suspect it’s headed higher (figure 6).

Figure 6: Atlanta Fed Wage Growth Tracker

![]()

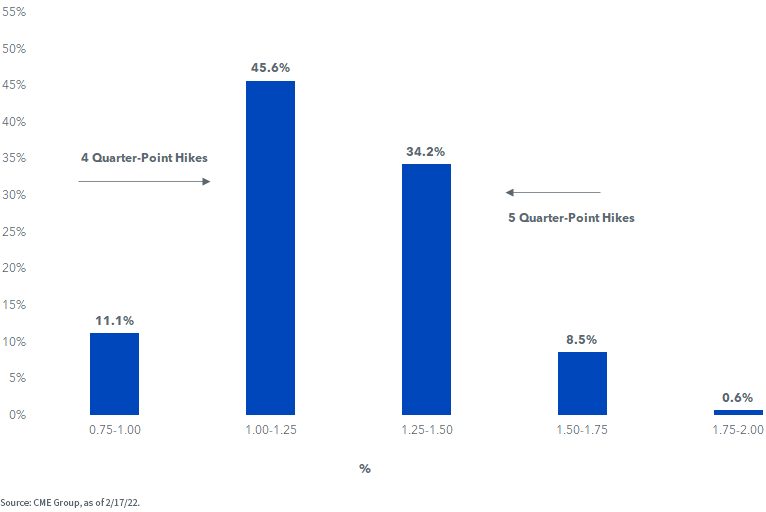

In the wake of the most recent inflation report, which recorded a 7.5% year-over-year spike in the headline Consumer Price Index (CPI), the Fed Funds Futures market now expects the policy rate to be north of 1% by summer (figure 7).

Figure 7: Fed Funds Rate Probabilities, July 2022 FOMC Meeting

The good news is that I think the labor market is going to be so hot that the Fed will not break this economy’s back just yet, at least not in 2022. The bad news is that we may be in for a shower of profit-margin warnings.

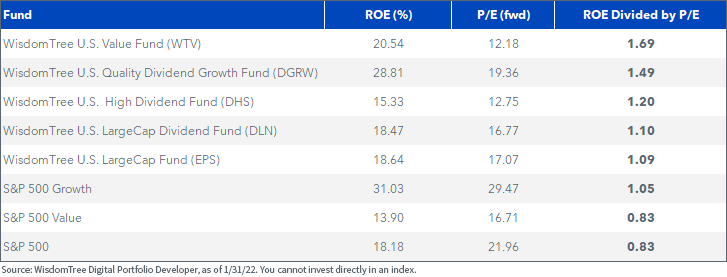

Because return on equity (ROE) math is a function of profit margins, the way to navigate this is by screening for firms that can give staff a pay bump without black ink turning red.

I did something new in figure 8. By dividing ROE by P/E, I came up with a quotient that will put in context how much high-quality equity baskets will cost you. The WisdomTree U.S. Value Fund (WTV) gets a particularly high score, 1.69. Maybe that’s the one to use if you have a theory that has inflation pinching profit margins.

Figure 8: ROE vs. P/E

For definitions of indexes and other terms in the table above, please visit the glossary.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Funds focusing their investments on certain sectors increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. While the Fund is actively managed, the Fund’s investment process is expected to be heavily dependent on quantitative models and the models may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.