A New Regime for Commodities

Commodity markets were one of the toughest places to invest for much of the last 14 years since oil peaked out around $150 in 2008.

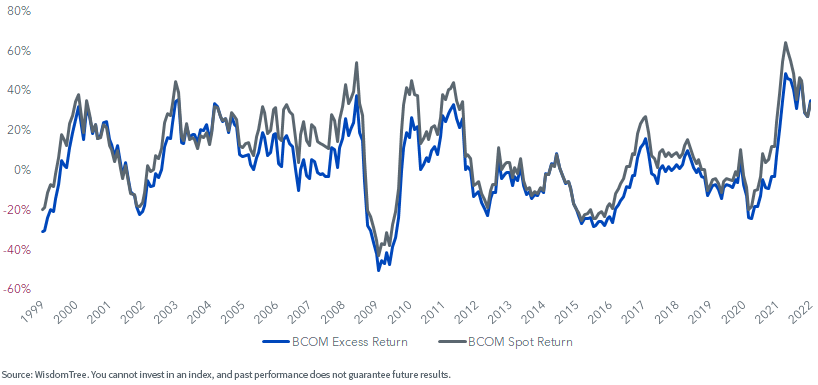

On top of disappointing spot prices, the commodities futures curve was priced in a way that the rolling of futures led to a drag in returns that caused commodity futures investors to experience something quite disappointing and below the general move in commodity prices (known as spot prices).

High Cost to Roll

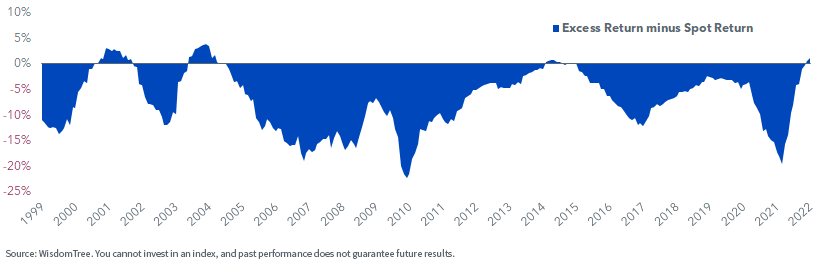

If we go back to 1999, the average cost to roll futures (measured as the difference between the Bloomberg Commodity Spot Index and the Excess Return Index of the futures) was more than 7% a year.

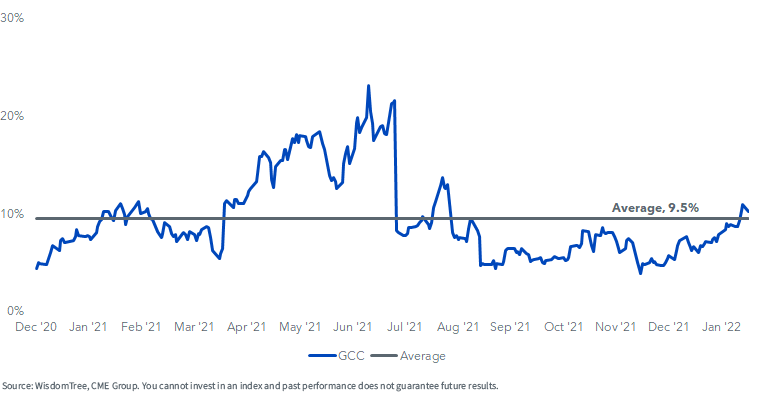

The blue line in the chart below shows that there were many years when the cost was well north of double digits, even as much as 20% in the 2008–2009 period.

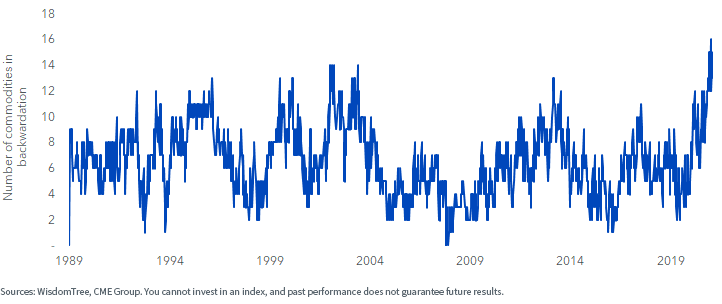

But the trend has changed. In 2021, enough commodities had moved from being in “contango” (where futures prices are higher than spot prices) to being in backwardation (where futures prices are below current prices), which means there was a net “benefit” to rolling the futures instead of being a drag/cost.

Rolling 12-Month Return on the Bloomberg Commodity Index | Excess vs. Spot Return

Rolling 12-Month Return Difference | Excess vs. Spot Return

Historically, commodity futures investors could think of return sources as coming from three components:

- Return on collateral that backs the futures

- The spot commodity return

- The futures roll component

In the past, these three components of returns were thought to be equal contributors—or at least that is what I recall from my CFA textbooks a decade ago.

Then you had a period when collateral returns went to zero, and the cost to roll futures became increasingly high.

It is understandable why many investors avoided commodities.

But those dynamics are changing.

First, we have the Fed set to embark on a rate hiking program that should help increase the returns on collateral over the coming years.

Second, a lack of capital expenditures in mining and exploration has constrained the supply of many different commodities, compounded by supply chain issues and infrastructure spending. This gave us a cocktail for strong commodity price trends over the last 12 months that has many looking for a new super cycle of commodity prices.

But now you also have segments where the futures roll can start to meaningfully contribute more positively to returns.

Out of a universe of 25 commodities in the Bloomberg Commodity Index, more than half are now priced to be in backwardation.

These are the highest levels of commodities in backwardation in the last three decades.

For the WisdomTree Enhanced Commodity Strategy ETF (GCC), this can translate to meaningful contributors to returns. GCC had an average implied roll yield of 9.5% over the last year, and it currently is around 10%.

The energy complex has some of the highest roll yields but so too do aluminum, nickel, cotton and sugar.

Annualized Weighted Implied Roll Yield

Important Risks Related to this Article

Investing in commodities and futures contracts may be speculative and involve a high degree of risk.

There are risks associated with investing, including possible loss of principal. An investment in this Fund is speculative, involves a substantial degree of risk and should not constitute an investor’s entire portfolio. One of the risks associated with the Fund is the complexity of the different factors that contribute to the Fund’s performance. These factors include the use of commodity futures contracts. In addition, bitcoin and bitcoin futures are a relatively new asset class. They are subject to unique and substantial risks, and historically, have been subject to significant price volatility. While the bitcoin futures market has grown substantially since bitcoin futures commenced trading, there can be no assurance that this growth will continue. In addition, derivatives can be volatile and may be less liquid than other securities and more sensitive to the effects of varied economic conditions. The value of the shares of the Fund relate directly to the value of the futures contracts and other assets held by the Fund, and any fluctuation in the value of these assets could adversely affect an investment in the Fund’s shares. Because of the frequency with which the Fund expects to roll futures contracts, the impact of such contango or backwardation may be greater than the impact would be if the Fund experienced less portfolio turnover.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.