January Dividend Update: #GotDividends?

Got dividends?

That’s the pervasive sentiment in equity markets at the moment.

As the work-from-home trade unwinds, one thing is certain—investors are becoming more discerning about investing in companies that pay dividends.

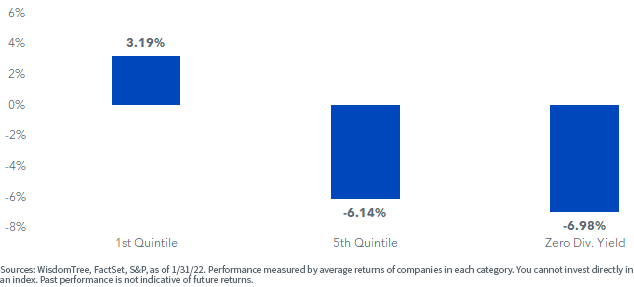

Within the S&P 500, the highest dividend yield companies have outperformed the lowest yield companies by a whopping 933 basis points (bps) this year. That margin is even greater—1,017 bps—when compared to the roughly 100 S&P 500 companies that don’t pay a dividend.

According to Howard Silverblatt of S&P Dow Jones Indices, S&P 500 dividend-payers outperformed non-payers in January by the greatest monthly performance spread (6.58%) since July 2004.

As we discussed in a recent post, high dividend yield companies have a shorter duration, so the group’s outperformance given the sharp move higher in rates does not come as a surprise.

S&P 500 Index Dividend Yield Quintiles, Year-to-Date

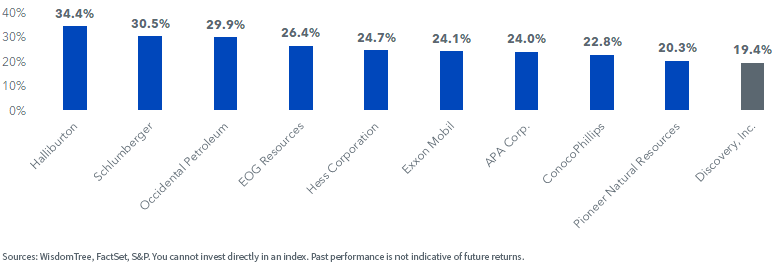

This trend is even starker when looking at the top and bottom performers in the S&P 500. Among the 10 best performers, nine do pay dividends (with the exception of Discovery).

One could argue this is largely a sector/inflation story as this list is entirely comprised of Energy companies, aside from Discovery.

S&P 500 Top 10, Year-to-Date (as of 1/31/22)

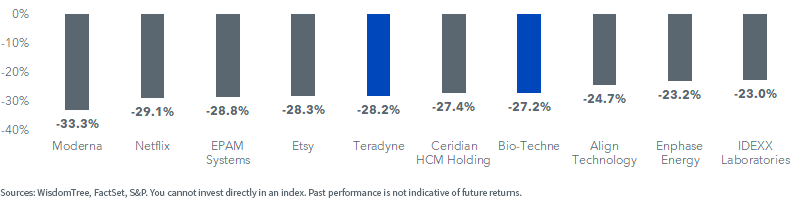

The below chart of bottom performers is more diverse across sectors. What these companies have in common is that eight of the 10 (with the exception of Bio-Techne Corp. and Teradyne) do not pay a dividend.

S&P 500 Bottom 10, Year-to-Date (as of 1/31/22)

FANAMA Revisited

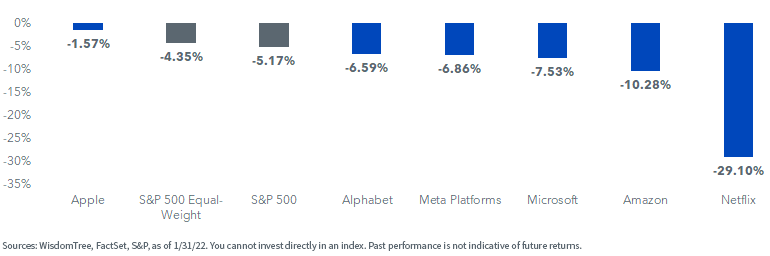

Last fall, we wrote about the outperformance of Facebook, Amazon, Netflix, Alphabet, Microsoft and Apple over the last several years. We dubbed the group FANAMA (this was before the Facebook rebrand to Meta Platforms).

As a group, FANAMA outperformed the S&P 500 by over 20% annualized between 2015 and 2020.

Of this group, only Apple and Microsoft pay a dividend. As a result, dividend-focused investments have struggled to keep pace with the broader market given such an unprecedented rally in non-dividend-paying shares.

Naturally, after years of steady outperformance, investments into FANAMA and similar tech-enabled companies had become a crowded trade.

A month into the new year, only Apple is outperforming the S&P 500. Relative to the S&P 500 Equal-Weight Index—a benchmark that mitigates the disproportionate influence these companies have on the performance of the cap-weighted index—the underperformance is even greater.

FANAMA Stocks, Year-to-Date Returns

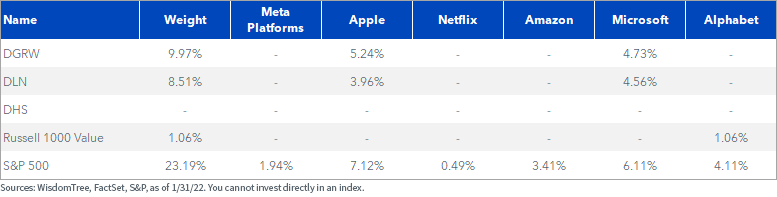

Of WisdomTree’s large-cap dividend ETFs, the WisdomTree U.S. Quality Dividend Growth Fund (DGRW) and the WisdomTree U.S. LargeCap Dividend Fund (DLN), both have sizeable weights to Apple and Microsoft. However, each Fund has an under-weight allocation to Apple and Microsoft, by over 100 bps relative to the S&P 500.

The WisdomTree U.S. High Dividend Fund (DHS) does not hold Apple and Microsoft as they each have relatively low dividend yields of less than 1%.

FANAMA Weights

For holdings of the Funds mentioned in the table above, please click the respective ticker: DGRW, DLN, DHS.

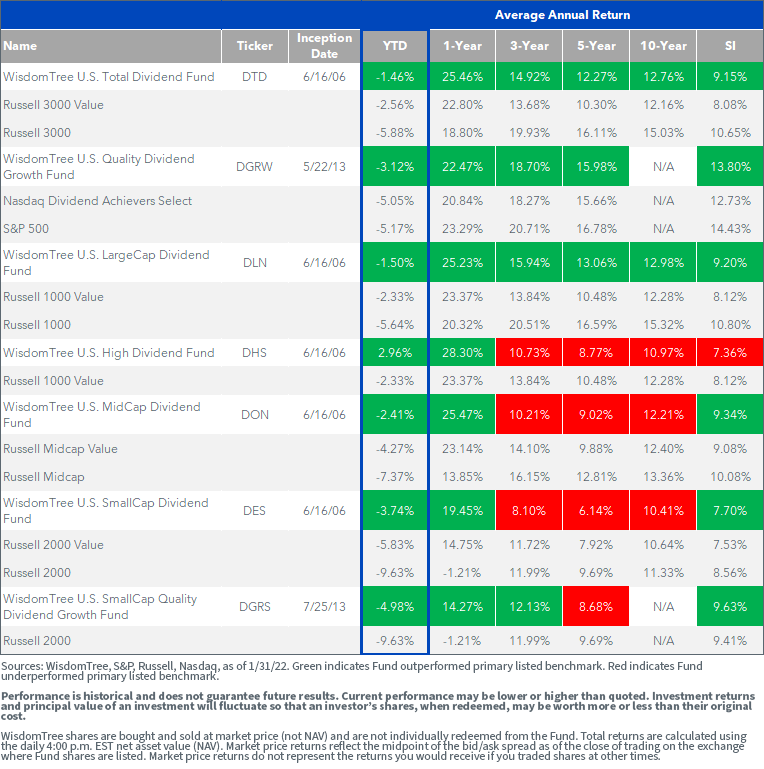

The start to 2022 has been a favorable backdrop for WisdomTree’s family of U.S. dividend ETFs.

A few highlights in January:

- DHS bested the Russell 1000 Value Index by over 500 bps and is the only Fund that has held onto a positive return (2.96%)

- DGRW has shown resilience during a turbulent market environment, outperforming the NASDAQ Dividend Achievers Select Index by 193 bps and the S&P 500 by 205 bps

- Behind DHS, the WisdomTree U.S. SmallCap Quality Dividend Growth Fund (DGRS) had the second-best performance relative to its benchmark, outperforming the Russell 2000 by 465 bps as unprofitable, speculative small caps struggled amid rising rates and inflation fears

Standardized performance and performance data for the most recent month end is available by clicking here.

For definitions of terms in the chart above, please visit the glossary.

Conclusion

As we have written recently, we believe investors should continue favoring dividend-paying equities in this environment of high inflation and negative real yields from fixed income.

Value generally, and the dividend-yield factor specifically, have been challenged for most of the past 15 years relative to growth. We believe the rotation that has occurred over the past several months is just the beginning of a longer-run mean reversion in favor of value/dividends.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Funds focusing their investments on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time. Please read each Fund’s prospectus for specific details regarding that Fund’s risk profile.

References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.