Emerging Markets: Too Big to Ignore in 2022

Emerging markets (EM) are entering 2022 from a low base after their economic recovery was hindered by the resurgence of COVID-19 variants, China’s regulatory crackdown and concerns of a more hawkish Federal Reserve (Fed). We expect 2022 to be another reversal of fortunes, quite like how 2021 was a reversal of 2020. What makes us confident of the turnaround is renewed policy easing efforts in China, an improvement of fiscal and current accounts in EM, continuation of global growth and rising trade volumes alongside an uptick in the pace of digitalization and decarbonization.

Strong Global Growth Backdrop, Range-Bound Dollar to Benefit EM

Growth in EM remains more sensitive to the state of the world than in developed markets (DM). EM are highly dependent on global factors to drive local growth. 2021 has shown us that while we are far from resolving COVID-19, corporations and governments worldwide have learned to cope with the peaks and troughs of the pandemic. For this reason, we remain optimistic that global growth is set to remain on track in 2022. This should not only reduce demand for safe-haven U.S. dollars but also bolster structural forces to foster EM growth in 2022.

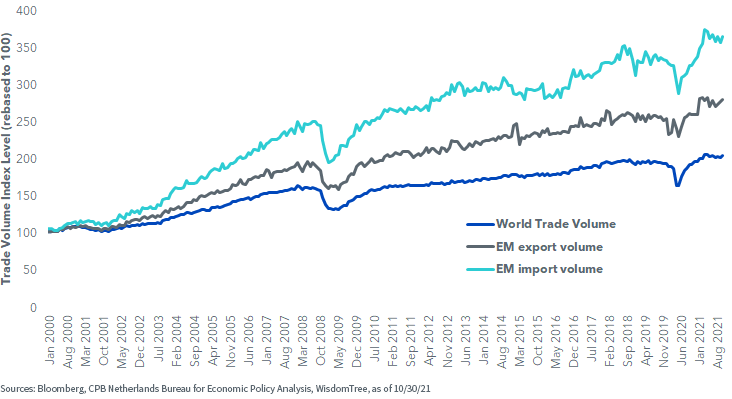

Figure 1: Global Trade Volumes Continue to Rise Globally

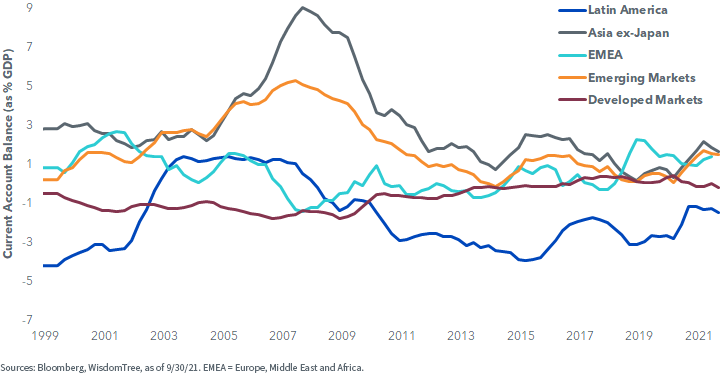

A key hurdle facing EM investors is the Fed’s more hawkish stance. The minutes of the December 15 Fed meeting clarified that the more aggressive orientation toward policy extends to the reduction of the balance sheet starting in 2022. This implies a first rate hike by June 2022. The markets are pricing in more than a 90% probability of a Fed rate hike by March 2022 following St. Louis Fed President James Bullard’s comments. While a more aggressive rate tightening would be a headwind for EM, we believe EM economies are in a much better position to withstand the rising rate environment owing to their stronger fiscal and current accounts balances.

Higher commodity prices have also been a windfall for the exporter. Central banks in EM have remained vigilant and some have already raised rates to tackle inflationary pressures, including Russia, Brazil, Chile and Peru.

Figure 2: EM Current Account and Regional Components

It’s Different in China this Time

The experience of 2021 shows us that Chinese policy makers appeared intent on reducing the economy’s dependence on investment in the real estate sector and geared the economy toward consumption of more domestic goods and services. This clearly did not pan out as planned. By the end of 2021, Chinese policy makers finally threw in the towel and mobilized forces to re-stimulate the economy. We believe the economic restructuring of resources away from real estate toward agriculture, energy and technology will be a more long-term project by China, Inc., than originally planned. It is evident that Chinese authorities have a pro-growth agenda, have given way to renewed policy easing and are willing to utilize the tools when needed. Easy financial conditions in China have been an important tailwind for economic growth and provide an important positive ripple effect for broader EM. The regulatory crackdown in China last year has been an important headwind for EM investors. However, it is expected to ease with the culmination of the Chinese Communist Party’s 20th National Congress, as it has in past political cycles.

A Differentiated Approach to Investing in EM via Non-State-Owned Enterprises (SOE)

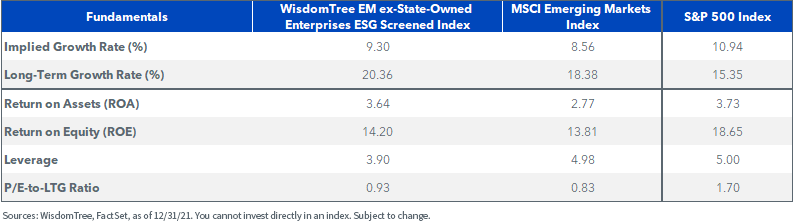

One of the big differences between DM and EM stocks lies in their ownership structures. The largest share of EM companies are SOEs, in which a government entity has significant (more than 20%) ownership control. China has one of the highest proportions of state ownership within EMs. Notably, the rise in default rates of SOEs within China has certainly played a role in turning investors’ attention to non-SOEs. We have held the view for a while that non-SOEs display a structural advantage versus SOEs in terms of higher performance, higher quality (ROE and ROA) and lower leverage1. Owing to the lower degree of state ownership, non-SOEs also have an inherent tilt toward ESG via better corporate governance and environmental considerations. The WisdomTree Emerging Markets ex-State-Owned Enterprises Fund (XSOE) enables investors to capitalize on the long-term growth opportunity of EMs while limiting exposure to SOEs. It aims to deliver two important factors—long-term growth and quality—as it screens for companies with significant government ownership. This is evident in the table below from the relatively higher long-term growth rate and quality metrics compared to its peers.

Figure 3: Fundamentals Comparison

For definitions of terms in the chart above, please visit the glossary.

1 From 12/30/07 to 6/30/21, SOEs represented a broad-based market capitalization-weighted portfolio of companies that have more than 20% ownership by a government entity.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in emerging or offshore markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. Funds focusing their investments on certain sectors and/or regions increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Aneeka Gupta is Director of Research at WisdomTree. Prior to the acquisition of ETF Securities in April 2018, Aneeka worked as an Equity & Commodities Strategist at the company. Aneeka has 17 years of experience working as a Research Analyst across a wide range of asset classes. In her current role she is responsible for conducting analysis for all in-house equity, commodity and macro publications and assisting the sales team with client queries around products and markets.

Prior to WisdomTree, Aneeka began her career as an equity analyst at Bear Stearns International Ltd in London. She also worked as an Equity Sales Trader at Sunrise Brokers across US and Pan European Exchanges. Before that she worked as an Equity Derivatives Sales Manager at Mashreq Bank in Dubai.

Aneeka holds a Masters in Mathematics from Oxford University and a BSc in Mathematics from the University of Delhi, India. She is also a CFA Charterholder.

Christopher Gannatti began at WisdomTree as a Research Analyst in December 2010, working directly with Jeremy Schwartz, CFA®, Director of Research. In January of 2014, he was promoted to Associate Director of Research where he was responsible to lead different groups of analysts and strategists within the broader Research team at WisdomTree. In February of 2018, Christopher was promoted to Head of Research, Europe, where he was based out of WisdomTree’s London office and was responsible for the full WisdomTree research effort within the European market, as well as supporting the UCITs platform globally. In November 2021, Christopher was promoted to Global Head of Research, now responsible for numerous communications on investment strategy globally, particularly in the thematic equity space. Christopher came to WisdomTree from Lord Abbett, where he worked for four and a half years as a Regional Consultant. He received his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern School of Business in 2010, and he received his bachelor’s degree from Colgate University in Economics in 2006. Christopher is a holder of the Chartered Financial Analyst Designation.