WisdomTree Megatrends: A Pulse Check on Valuations as Interest Rates Rise

In late November, Federal Reserve chair Jerome Powell hinted at an accelerated wind-down of the Fed’s easy-money policy.

Since that announcement, Treasury yields have pushed higher, reflecting expectations that in early 2022, the Fed will begin raising its policy rate for the first time since 2018.

As my colleague recently wrote, a rising rate environment is often viewed more constructively for cyclical value stocks like financials than for the growth stocks captured in our megatrend suite of ETFs.

But this new rate cycle has created opportunity on both sides of the growth-value coin.

Our megatrend ETFs are trading at much more attractive valuations—let’s do a pulse check on the three that have been most impacted since late November.

WCLD – Down 14.7%1

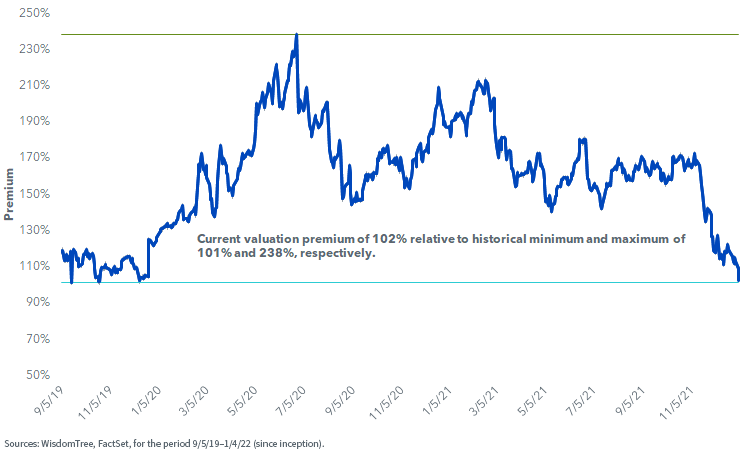

The WisdomTree Cloud Computing Fund (WCLD) is currently valued at 11.5x price-to-sales, its lowest level since the first few months of the COVID-19 pandemic. Its premium relative to the Russell 1000 Growth Index is 102.0%, within 2% of its historical minimum of 100.8%.2

While WCLD’s valuation premium has meaningfully contracted, its expected revenue growth over the benchmark Index has not. Over the last year, WCLD’s revenue growth has consistently been forecasted at an average of 1.7x that of the Russell 1000 Growth. Looking over the next 12 months, WCLD’s median revenue growth is 23%, or 1.8x the 13% median revenue growth rate expected for the Russell 1000 Growth Index.3

These levels could be attractive entry points into the higher-growth cloud names, which Bessemer Venture Partner’s Byron Deeter recently spoke about on CNBC.4

WCLD – Price-to-Sales

WCLD Premium to Russell 1000 Growth – Price-to-Sales

WCBR – Down 10.3%5

Like WCLD, The WisdomTree Cybersecurity Fund (WCBR) has been hit hard by the shift in the market and is trading at a similar level of 11.2x price-to-sales, roughly double the valuation of the Russell 1000 Growth Index.

With just under a year of performance, WCBR has traded within a tighter price-to-sales range than WCLD but has generated similar revenue growth metrics. Over the next 12 months, the median expected revenue growth rate for WCBR is 20%, 1.6x the expected median revenue growth of 13% for the Russell 1000 Growth Index.6 Notably, WCBR’s expected growth rate differential relative to the Russell benchmarks is wider than its historical average of 1.3x. The key takeaway is that WCBR’s relative valuation has compressed while its relative growth rate has expanded.

WCBR – Price-to-Sales

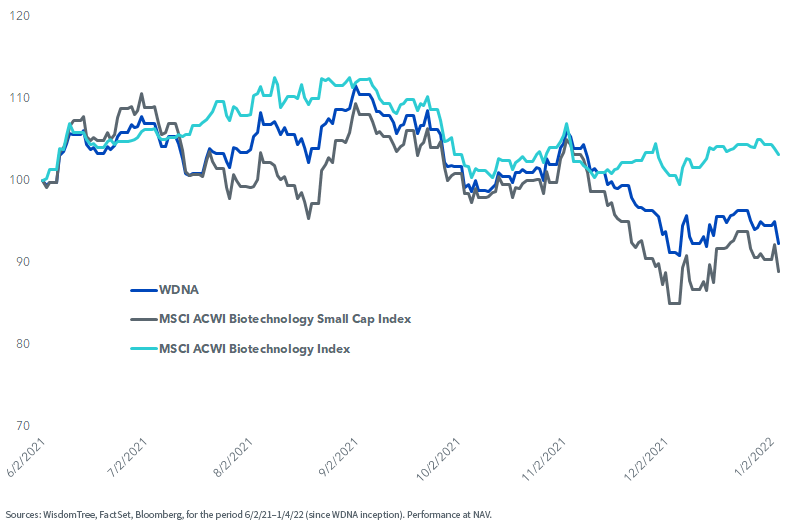

WDNA – Down 4%7

The WisdomTree BioRevolution Fund (WDNA) has not been immune to the sell-off in growth names either, but its drawdown has been more modest than those of WCLD and WCBR.

Biotechnology is an inherently volatile market, and performance can be vastly different within the industry depending on the size exposure. 2021 was a very different year for small-cap relative to all-cap biotechnology indexes. The MSCI ACWI Biotechnology Index returned 8%, while the small-cap cut of that Index returned -22.3%, equating to a 30 percentage point differential within the same industry.8 That level of all-cap outperformance has not occurred in at least the last decade and marks a sharp reversal from small-cap outperformance of 32 percentage points in 2020.

In our view, this environment creates opportunity for WDNA, with balanced size exposure across small-, mid- and large-cap companies, to benefit from a potential small- to mid-cap biotech rebound in 2022.

Growth of $100 – Since WDNA Inception

The Takeaway

For investors who were concerned about frothy valuations of high-growth stocks, today’s multiples offer a meaningfully cheaper entry point for long-term exposure to specific secular and economic megatrends.

1 Sources: WisdomTree, FactSet, for the period 11/29/21–1/4/22. Period chosen since the Federal Reserve indicated a potential end to easing monetary policy. Performance at NAV.

2 Sources: WisdomTree, FactSet, as of 1/4/22.

3 Sources: WisdomTree, FactSet, as of 1/4/22; There is no guarantee that any projection, forecast or opinion will be realized. Actual results may vary.

4 “Cloud basket feels like a buying opportunity: Bessemer Venture Partners' Byron Deeter,” YouTube video, 2:47, posted by "CNBC Television," January 4, 2022.

5 Sources: WisdomTree, FactSet, for the period 11/29/21–1/4/22. Period chosen since the Federal Reserve indicated a potential end to easing monetary policy. Performance at NAV.

6 Source: WisdomTree, FactSet as of 1/4/2022. There is no guarantee that any projection, forecast or opinion will be realized. Actual results may vary.

7 Sources: WisdomTree, FactSet, for the period 11/29/21–1/4/22. Period chosen since the Federal Reserve indicated a potential end to easing monetary policy. Performance at NAV.

8 WisdomTree, Bloomberg, for the period 12/31/20–12/31/21.

Important Risks Related to this Article

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Returns less than one year are not annualized. For current standard performance, holdings and expenses, visit the respective fund page: WCLD, WCBR, WDNA.

WCLD: There are risks associated with investing, including possible loss of principal. The Fund invests in cloud computing companies, which are heavily dependent on the internet and utilizing a distributed network of servers over the internet. Cloud computing companies may have limited product lines, markets, financial resources or personnel and are subject to the risks of changes in business cycles, world economic growth, technological progress and government regulation. These companies typically face intense competition and potentially rapid product obsolescence. Additionally, many cloud computing companies store sensitive consumer information and could be the target of cybersecurity attacks and other types of theft, which could have a negative impact on these companies and the Fund. Securities of cloud computing companies tend to be more volatile than securities of companies that rely less heavily on technology and, specifically, on the internet. Cloud computing companies can typically engage in significant amounts of spending on research and development, and rapid changes to the field could have a material adverse effect on a company’s operating results. The composition of the Index is heavily dependent on quantitative and qualitative information and data from one or more third parties, and the Index may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

WCBR: There are risks associated with investing, including possible loss of principal. The Fund invests in cybersecurity companies, which generate a meaningful part of their revenue from security protocols that prevent intrusion and attacks to systems, networks, applications, computers and mobile devices. Cybersecurity companies are particularly vulnerable to rapid changes in technology, rapid obsolescence of products and services, the loss of patent, copyright and trademark protections, government regulation and competition, both domestically and internationally. Cybersecurity company stocks, especially those which are internet related, have experienced extreme price and volume fluctuations in the past that have often been unrelated to their operating performance. These companies may also be smaller and less experienced companies, with limited product or service lines and markets or financial resources and fewer experienced management or marketing personnel. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit, and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. The composition of the Index is heavily dependent on quantitative and qualitative information and data from one or more third parties, and the Index may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

WDNA: There are risks associated with investing, including possible loss of principal. The Fund invests in BioRevolution companies, which are companies significantly transformed by advancements in genetics and biotechnology. BioRevolution companies face intense competition and potentially rapid product obsolescence. These companies may be adversely affected by the loss or impairment of intellectual property rights and other proprietary information or changes in government regulations or policies. Additionally, BioRevolution companies may be subject to risks associated with genetic analysis. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit, and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. The composition of the Index is governed by an Index Committee, and the Index may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.