The Evolution of Value Investing: From Buffett to Intelligent Machines

Warren Buffett epitomizes the notion of value investing. With a net worth of approximately $100 billion, he attributes much of his success to the foundational investment methods learned while studying under Benjamin Graham, the “father of value investing.” With methodologies proven to stand the test of time, value investing has sheltered the storm of the 1970s inflation, the burst of the tech bubble of the early 2000s, the great financial crises a couple of years later and most recently, the coronavirus pandemic.

With so much historical success, why has value investing lagged growth over the last decade? Why has Buffett been so successful, yet the greater population of value investors struggled to outperform? The next evolution of value investing may hold the answer. By augmenting human intelligence with machine intelligence, a level of expertise like that of Buffett and Graham may be repeated or exceeded through the revolutionary technology of artificial intelligence (AI). AI toppled the chess grandmaster Garry Kasparov in 1997 and has come to surpass human capabilities in a plethora of tasks in the 20 years since. Time has come for AI to compete with the great financiers of our time.

Introducing the WisdomTree AI Enhanced Value Family

Through collaboration between Voya and WisdomTree, the next evolution of the value fund is now made accessible to the public markets.

The WisdomTree U.S. AI Enhanced Value Fund (ticker AIVL) and the WisdomTree International AI Enhanced Value Fund (ticker AIVI)1 seek to offer uncorrelated returns streams from the value universe by leveraging the expertise of the Voya Equity Machine Intelligence (EMI) team and their fundamentally driven machine learning approach.

The EMI model approaches value investing dynamically to avoid narrow style biases that may be out of favor, while still providing value exposure across equities. The strategy seeks to capitalizes on short- and long-term investment opportunities—in an effort to deliver the virtue of patience and agility, acting quickly and decisively when opportunities arise.

Collaborating across WisdomTree, Voya’s EMI team and the greater Voya Quantitative Equities group, the WisdomTree Enhanced Value Family has the support of a diverse team of individuals with the financial and technical expertise to offer a world class investment product.

The Strategy

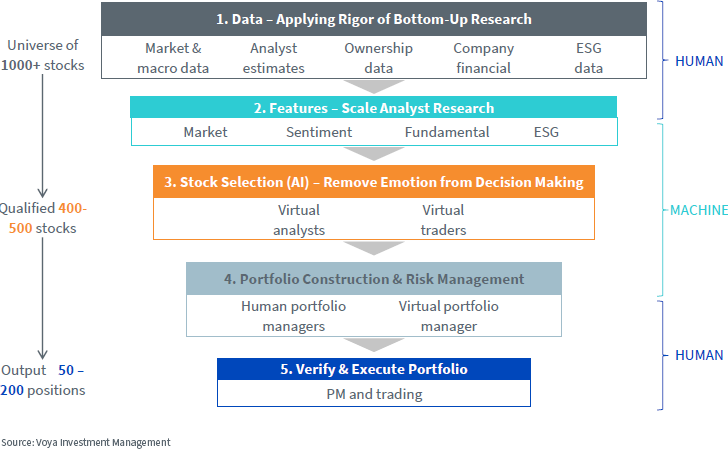

Each Fund’s strategy consists of five stages with varying degrees of involvement between human and machine—something the EMI team calls ‘human in the loop’.

This concept emphasizes that the strategy not only is driven by AI, but also has the proper human intervention and oversight to seek to ensure robust security selection and risk management.

The Investment Process

The first step in the process consists of aggregating 10,000+ data points for each company over a 20-year history. Then, these data points are ‘feature engineered’ by human experts to provide a more insightful view of the company versus its peers, the entire stock universe or its own historical characteristics.

The result of this step is approximately 250 features spanning company financials, macro indicators and company sentiment. Trained on 20 years of these historical features, the virtual analysts (the true AI) identify companies for inclusion in the portfolio based on learned patterns.

But not all are automatically bought—these initial selections are passed on to virtual traders that focus on shorter-term indicators, identifying proper entry and exit timing, as well as any risk events that may necessitate a reduced weight. An example of this might be negative news sentiment prior to earnings, where virtual traders may de-risk prior to earnings announcements, then add back to the position after, if the virtual analyst still ‘likes’ the company medium to long term.

After being deemed a good and timely investment by both the virtual analyst and virtual traders, these proposed trades are passed on to the virtual and human portfolio managers for review before being executed by the human portfolio management and trading team at Voya.

The Strategy in Action

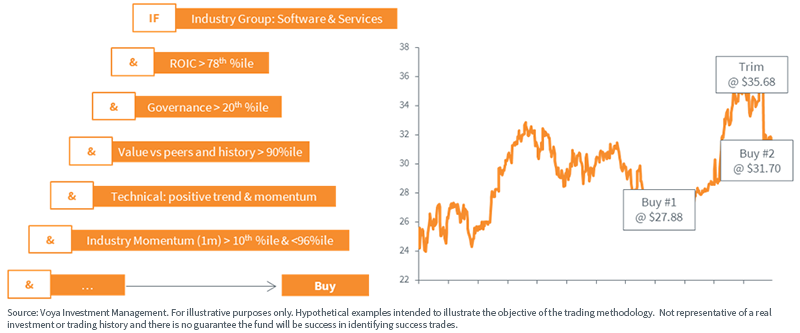

The virtual traders use machine learning to identify dynamic ‘rules’ and patterns for defining value at the company level, and use this information for security selection.

The hypothetical example below demonstrates the logic derived from the continuous learning of the model. The actual entry and exit points are determined by the virtual traders (with human oversight), but one can begin to understand how security selection is made based upon the subset of features listed below – industry group, return on invested capital, governance percentile, and value vs. peers, among others.

Stylized Security Selection Example

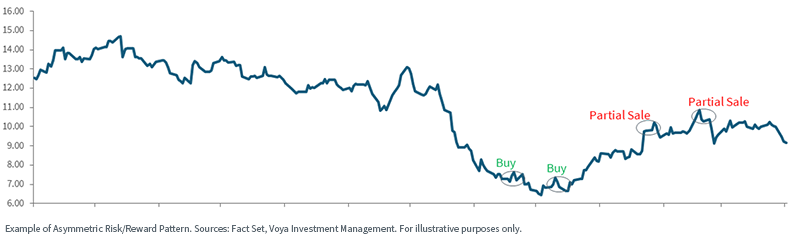

When the model identifies positive characteristics indicating a buying opportunity: such as cheap financial valuation metrics relative to peers and history, market sentiment indicating rebound, and positive technical indicators, the model enters a position in the particular company. As the model continually ingests new information and tracks the features representing the changing market conditions and dynamics of the company, it determines the best time to begin taking profits. In doing so, the model seeks to capitalize on these asymmetric risk/reward patterns.

Asymmetric Risk/Reward Pattern

Fitting AI Enhanced Value in a Portfolio

The WisdomTree AI Enhanced Value Family seeks to provide an actively managed value strategy with varying value characteristics designed to avoid drawdowns in single metrics. Its fundamentally driven machine learning approach allows for the EMI model to lean into more performant value metrics, dynamically adjusting as the model continues to learn from new data. We believe the strategy is a good fit for investors’ allocations to mid- and large-capitalization value stocks. With the strategy focusing on companies in the tails of the distribution, it aims to deliver strong idiosyncratic alpha and may perform best in a market driven by fundamentals.

The WisdomTree AI Enhanced Value Family

To offer investors access to a more dynamic definition of value, WisdomTree and Voya created the WisdomTree AI Enhanced Value Family. With diversified exposure to what we believe to be the most value-centric equity investment opportunities, AIVL and AIVI can be an option within a portfolio’s large and mid- cap value allocation.

1 WisdomTree U.S. AI Enhanced Value Fund (AIVL) was formerly the WisdomTree U.S. Dividend ex-Financials Fund (DTN). WisdomTree International AI Enhanced Value Fund (AIVI) was formerly the WisdomTree International Dividend ex-Financials Fund (DOO).

Important Risks Related to this Article

AIVL: There are risks associated with investing, including possible loss of principal. Funds focusing their investments on certain sectors increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. While the Fund is actively managed, the Fund’s investment process is expected to be heavily dependent on a quantitative model and the model may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

AIVI: There are risks associated with investing, including possible loss of principal. Investments in non-U.S. securities involve political, regulatory, and economic risks that may not be present in U.S. securities. For example, foreign securities may be subject to risk of loss due to foreign currency fluctuations, political or economic instability, or geographic events that adversely impact issuers of foreign securities. Funds focusing their investments on certain sectors increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. While the Fund is actively managed, the Fund’s investment process is expected to be heavily dependent on a quantitative model and the model may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.

When Models and Data prove to be incorrect or incomplete, any decisions made in reliance thereon may lead to the inclusion or exclusion of securities that would have been excluded or included had the Models and Data been correct and complete. Errors in the Models and Data, calculations and/or the construction of the AI model may occur from time to time and may not be identified and/or corrected by the Sub-Adviser or other applicable party for a period of time or at all, which may have an adverse impact on the Fund and its shareholders.

Blake Heimann is a Senior Associate on the Quantitative Research & Multi Asset Solutions team at WisdomTree, based in Europe. He initially joined WisdomTree in 2020 as an Analyst on the Research team in the U.S. In his current role, he is responsible for supporting the creation, maintenance, and reconstitution of equity and digital asset indices.

Blake's finance career began in 2017 at TD Ameritrade, where he started as an Analyst before transitioning to a role as a Quantitative Analyst. During this time, he focused on research and development of machine learning applications in finance. Blake holds bachelor's degrees in Mathematics and Economics from Iowa State University, and he has completed his Master's in Computer Science with a specialization in Machine Learning at Georgia Tech.