2021: A Year for Cash Flows

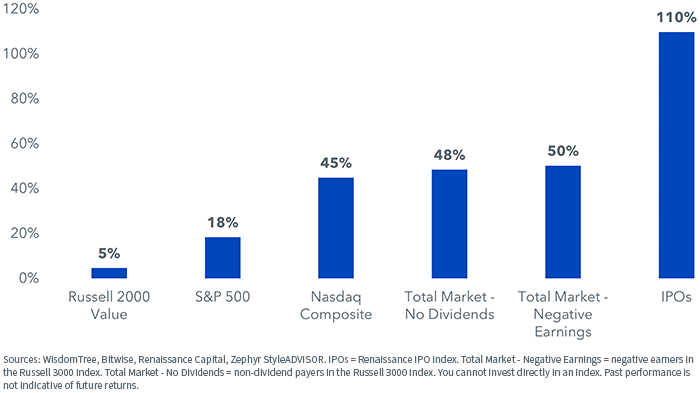

2020 was the year of story stocks.

Recently issued IPOs and companies with negative earnings heavily outpaced the broader market.

2020 Index Performance

For definitions of indexes in the chart above, please visit the glossary.

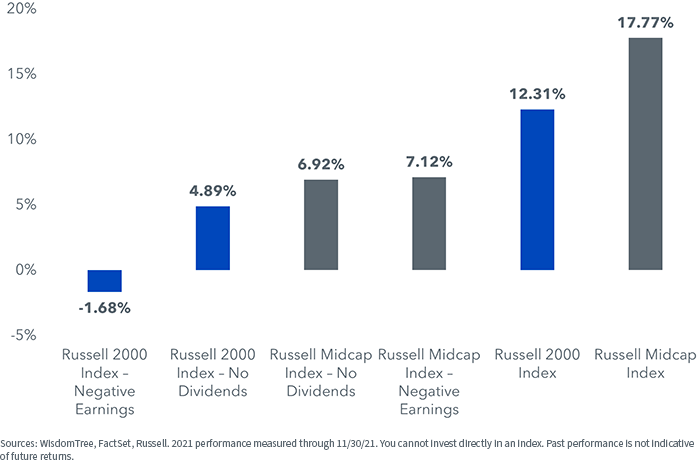

As interest rates rose and the economy accelerated its recovery this year, investors became more focused on near-term cash flows in the form of current profits and dividends. The reversal from market leadership to laggards for non-earners and non-dividend payers was most pronounced in more speculative mid- and small caps.

2021 Index Performance

For definitions of indexes in the chart above, please visit the glossary.

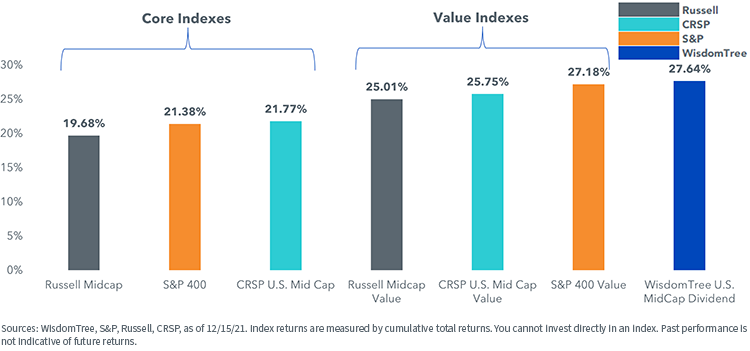

The WisdomTree U.S. MidCap Dividend Index was a prime beneficiary of this flight to cash flows. Through December 15, the Index has outperformed the most widely tracked mid-cap core and value Indexes this year.

Year-to-Date Index Performance

For definitions of indexes in the chart above, please visit the glossary.

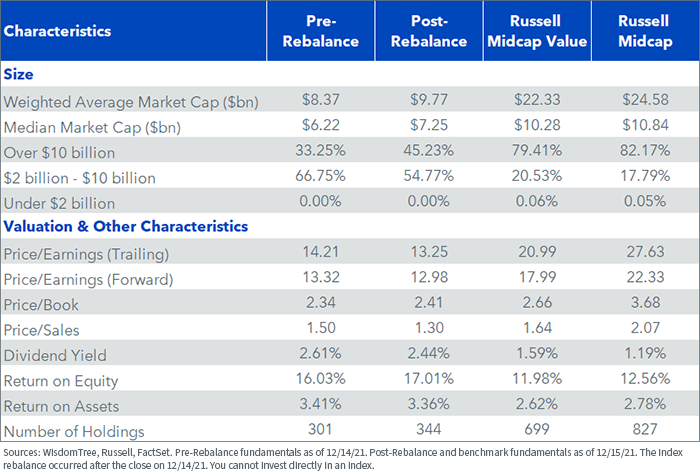

The WisdomTree U.S. MidCap Dividend Index targets a high-quality basket of dividend paying mid-caps, giving greater weight to companies paying higher cash dividends. This investment process typically produces lower valuation multiples and higher quality characteristics than market cap-weighted indexes.

The Index is rebalanced on an annual basis each December, with the most recent rebalance taking place after the market close on December 14.

WisdomTree U.S. MidCap Dividend Index—Characteristics

For definitions of terms in the chart above, please visit the glossary.

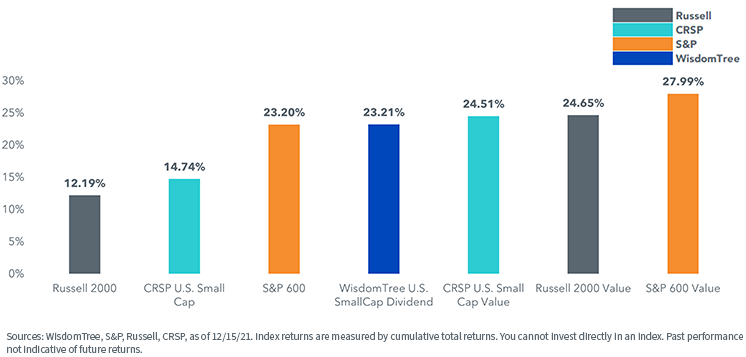

The WisdomTree U.S. SmallCap Dividend Index has a comparable investment process for the small-cap universe.

Through December 15, the Index has heavily outperformed the Russell 2000 and CRSP U.S. Small Cap indexes—both indexes that skew toward larger market-cap companies—but has lagged value indexes tilted toward higher beta companies.

Headed into 2022, investors are looking to solve for the key risk of elevated valuations in both equities and fixed income.

Looking at the valuations of the WisdomTree U.S. SmallCap Dividend Index, this area of the market may help investors lower overall portfolio valuations while also offering premium dividend income potential.

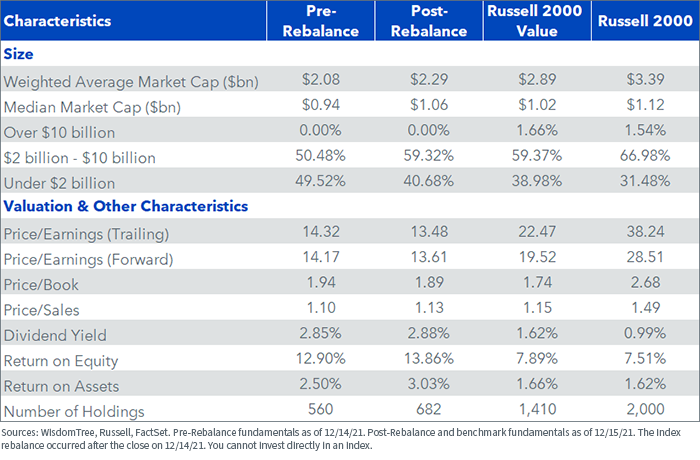

WisdomTree U.S. SmallCap Dividend Index—Characteristics

Sector Allocations

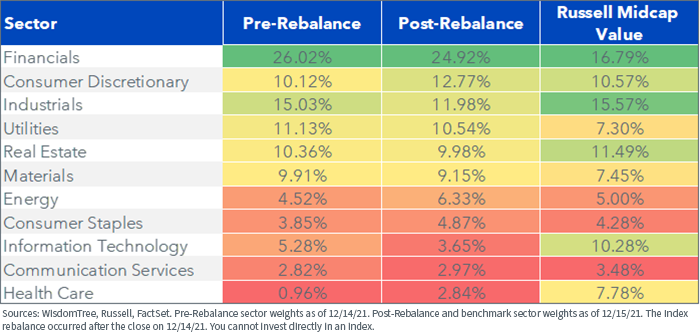

The sector allocations changes for the WisdomTree U.S. MidCap Dividend Index at this year’s rebalance were modest. The Index added over 2% to the Consumer Discretionary allocation and reduced weight to the Industrials allocation by a similar amount.

WisdomTree U.S. MidCap Dividend Index—Sectors

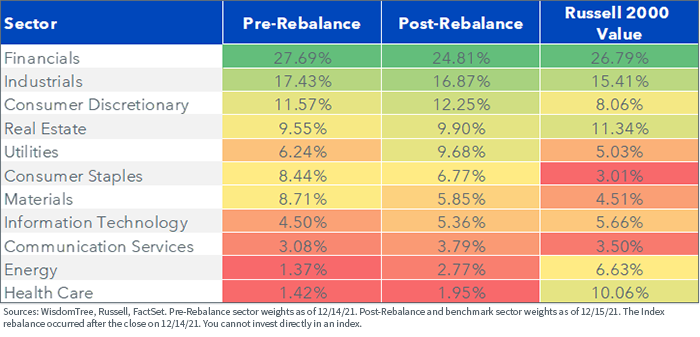

The WisdomTree U.S. SmallCap Dividend Index added over 3% to the Utilities sector as several companies moved down from the mid-cap Index. Financials, which gets capped at 25% in both Indexes, had its weight reduced by over 2%.

WisdomTree U.S. SmallCap Dividend Index—Sectors

Conclusion

With elevated valuations in large-cap U.S. equities, mid- and small-caps look more attractively valued for long-term focused investors. And as the Fed is expected to raise interest rates multiple times in 2022, we may see more of the same in terms of outperformance of mid- and small-value stocks relative to the unprofitable story stocks that outperformed in 2020.

In this market environment, dividend payers may be poised to solve for income as well as generate long-term outperformance.

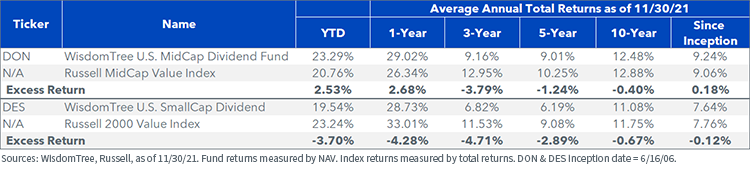

For investors looking to tap into this thesis, we highlight the WisdomTree U.S. MidCap Dividend Fund (DON) and the WisdomTree U.S. SmallCap Dividend Fund (DES).

Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Standardized performance for DON is available here. Standardized performance for DES is available here. Performance of less than one year is cumulative. You cannot invest directly in an index.

WisdomTree shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Total returns are calculated using the daily 4:00 p.m. net asset value (NAV). Market price returns reflect the midpoint of the bid/ask spread as of the close of trading on the exchange where Fund shares are listed. Market price returns do not represent the returns you would receive if you traded shares at other times.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Funds focusing their investments on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time. Please read each Fund’s prospectus for specific details regarding the Fund’s risk profile.