GDMN: The Efficient Alternative

With historically low global interest rates but high inflation, investors are seeking portfolio diversifiers to hedge macro risks—allocating to gold and gold miners may be well-suited as a short- and long-term solution.

Today, WisdomTree launched the WisdomTree Efficient Gold Plus Gold Miners Strategy Fund (GDMN) as a key addition to our Efficient Family of ETFs. GDMN is a unique strategy that blends gold futures and gold miners equities to seek to extract the best traits from both asset classes to help investors diversify and hedge macroeconomic risks.

The Case for Comprehensive Gold Exposure

Investors often allocate to gold during cycles of turbulence as a tactical move to hedge against financial, geopolitical or inflation risks.

During the 20 worst quarters for the S&P 500 Index, gold outperformed by an average of 18.2%.1 In Q1 2020, during the onset of the COVID-19 pandemic, gold returned +6.22% compared to -19.6% for the S&P 500 Index.2

Gold is not just a defensive asset class. It has performed well across multiple cycles, specifically during periods of strong economic activity with high inflation. During expansionary periods, gold has served as an inflation hedge, with gold price appreciation often coinciding with economic growth.

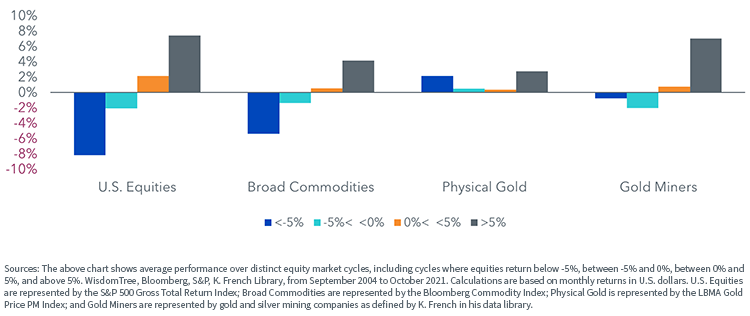

Gold miners have been a disappointing investment over the last two decades, with high volatility and subpar returns, but the rise in gold prices is improving the outlook for gold miners’ profitability. Importantly, gold miners also offer attractive dividend yields amid the backdrop of a rising rate environment. The characteristics of gold miners are between equities and gold—they have historically been more highly correlated with equities than gold, but their exposure has dampened drawdowns relative to equities and boosted positive performance relative to gold.

Asset Performance Across Equity Market Cycles (2004-2021)

Efficient Access to Comprehensive Gold Exposure – The WisdomTree Approach

Historically, there are multiple ways to access exposure to gold: physical gold or gold futures and businesses that focus on gold mining activities.

Investors bullish on gold will often allocate to both the physical precious metal and the equities of miners in separate trades to get comprehensive exposure to the metal. This approach requires two separate outlays of capital.

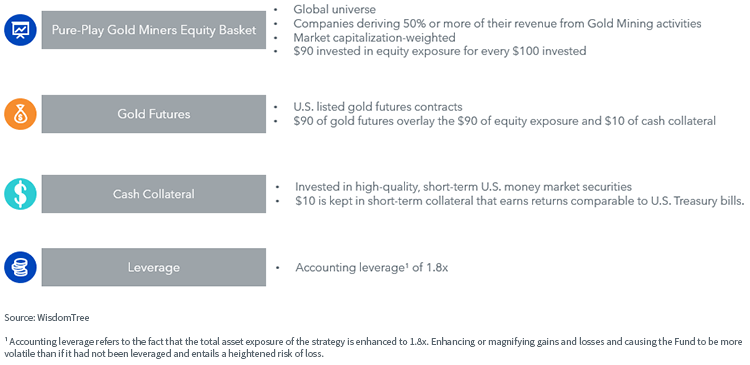

Recognizing the capital intensity of this approach, WisdomTree launched the WisdomTree Efficient Gold Plus Gold Miners Strategy Fund (GDMN). GDMN is a capital-efficient investment strategy that provides exposure to a modified market capitalization-weighted basket of global gold miners with gold futures exposure stacked on top.

This “return stacking” framework seeks to provide exposure to two separate allocations, to gold and gold miners, in a single trade with better capital efficiency.

Our strategy construction is simple. For every $100, the Fund seeks to invest approximately $90 in the gold miners’ basket and $90 in gold futures, for $180 of total gold-oriented exposure.

GDMN – The Efficient Alternative

The WisdomTree house view calls for elevated inflation levels over the coming 3–5 years, and gold is one commodity that could provide a valuable inflation hedge. GDMN offers the potential to enhance overall risk exposures in portfolios with macro and inflation hedges.

Most importantly, GDMN seeks to provide comprehensive exposure to gold in an innovative and capital-efficient manner. GDMN offers exposure to both gold and gold miners in a single strategy that requires less capital than would be needed to purchase gold, and gold equities or gold miner ETFs, in two separate transactions.

1 Sources: WisdomTree, Bloomberg. In U.S. dollars. Data for the period December 31, 1967, to October 31, 2021, using quarterly data. Gold is proxied by the LBMA Gold Price PM Index, and the S&P 500 is proxied by the S&P 500 Gross Total Return Index. Past performance is not indicative of future results. You cannot invest directly in an index.

2 Sources: WisdomTree, Bloomberg. In U.S. dollars. Data for the period December 31, 2020, to March 31, 2021, using quarterly data. Gold is proxied by the LBMA Gold Price PM Index, and the S&P 500 is proxied by the S&P 500 Gross Total Return Index. Past performance is not indicative of future results. You cannot invest directly in an index.

Important Risks Related to this Article

Diversification does not eliminate the risk of experiencing investment losses.

There are risks associated with investing, including possible loss of principal. The Fund is actively managed and invests in U.S.-listed gold futures and global equity securities issued by companies that derive at least 50% of their revenue from the gold mining business (“Gold Miners”). The Fund’s use of U.S.-listed gold futures contracts will give rise to leverage, magnifying gains and losses and causing the Fund to be more volatile than if it had not been leveraged. Moreover, the price movements in gold and gold futures contracts may fluctuate quickly and dramatically, have a historically low correlation with the returns of the stock and bond markets. By investing in the equity securities of Gold Miners, the Fund may be susceptible to financial, economic, political, or market events that impact the gold mining sub-industry, including commodity prices and the success of exploration projects. The Fund may invest a significant portion of its assets in the securities of companies of a single country or region, including emerging markets, and thus, the Fund is more likely to be impacted by events and political, economic, or regulatory conditions affecting that country or region, or emerging markets generally. The Fund’s investment strategy will also require it to redeem shares for cash or to otherwise include cash as part of its redemption proceeds, which may cause the Fund to recognize capital gains. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.