Introducing the WisdomTree Short Duration Fixed Income Model

This article is relevant to financial professionals who are considering offering model portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional. Not all financial professionals have access to these Model Portfolios.

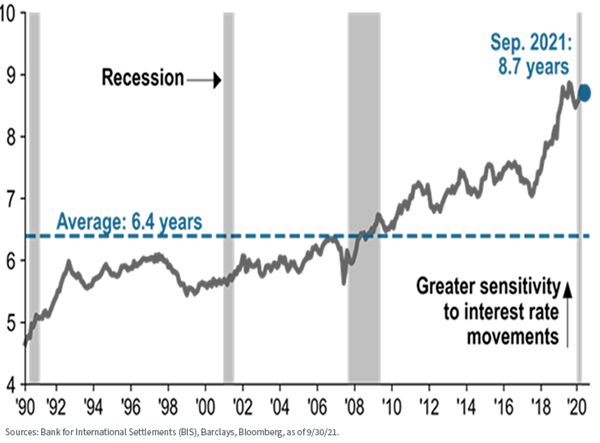

Take a look at the following three charts. The first shows the increasing duration of gross debt in the United States. Gross debt includes government, household and non-financial corporate debt. As a reminder, duration is a measure of the sensitivity of bond prices to changes in interest rates, and it is an inverted relationship—when rates go up, bond prices typically go down. The longer the duration, the more sensitive bond prices typically are to changes in rates.

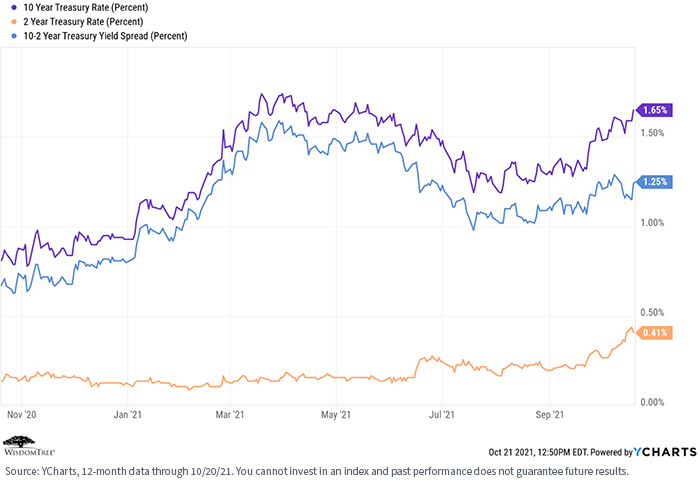

The second chart is the course of interest rates over the past 12 months, especially in the last three—a steady increase, and one that we believe will continue (with the 10-Year Treasury rate perhaps hitting 1.75%–2.00% by year-end).

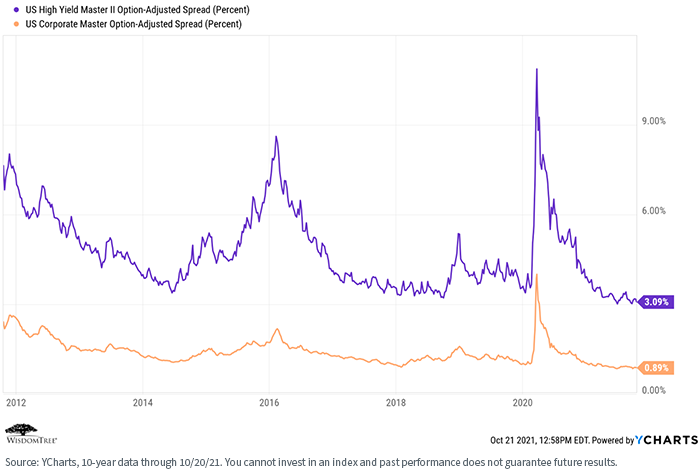

The third chart is the current level of investment-grade and high-yield credit spreads—currently trading at multi-year lows.

For definitions of terms in the charts, please visit the glossary.

So, rising rates and tight spreads. What is a poor bond investor supposed to do?

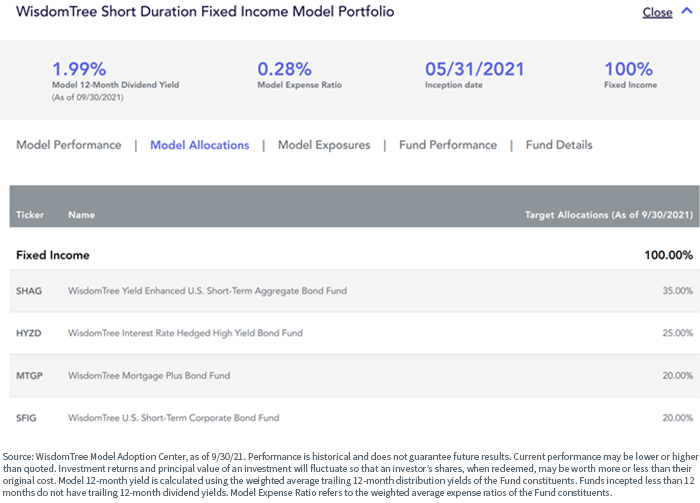

Introducing the WisdomTree Short Duration Fixed Income Model

WisdomTree recently launched a Short Duration Fixed Income Model, designed specifically to reduce interest rate risk while not sacrificing too much in terms of yield, relative to the Bloomberg Barclays U.S. Aggregate Bond Index. It can be used as a stand-alone fixed income model or as a complementary sleeve to an existing fixed income allocation as a means of reducing duration risk without disrupting existing allocations.

We kept it simple and inexpensive—four tickers that provide diversification across sectors while maintaining a low duration profile. While a simple construct, the four underlying Funds incorporate some of our most sophisticated thoughts in balancing income opportunities and the risks they entail—from the fundamental screens within our corporate strategies to the prudent approach for enhancing yield embedded in our short core Fund to our leveraging the deep expertise of the Voya Securitized Debt team in navigating opportunities in the securitized debt markets.

For standardized and month-end performance of the funds mentioned above click here.

For a prospectus for the funds referenced above click here.

As of September 30, 2021, this Model Portfolio, using the weighted average yield of the four underlying securities (since the Model itself was launched only a short while ago), posted a trailing 12-month yield of 1.99% (with a current yield-to-worst of 1.71%)1, while maintaining an average duration of 3.1 years.

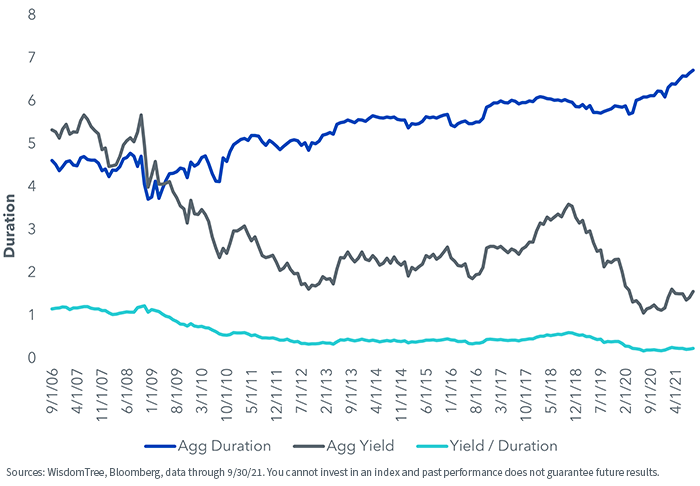

In comparison, the Bloomberg Barclays U.S. Aggregate Bond Index currently has an average duration of 6.71 years and is offering a current yield of 1.56%. The pick-up in yield in the short duration Model reflects that it is taking on more credit risk than the index.

Take a look at the following chart. It shows the marginal increase in realized yield as duration increases. Historically, this relationship was roughly 1:1—a 1% pick up in yield for every additional year of duration. That relationship is now at an historical low. Investors simply are not being rewarded at an appropriate level for taking on additional interest rate risk—especially in an environment where we believe rates will continue to grind higher.

The Trade-Off between Duration and Yield

Conclusions

With interest rates likely to move higher and credit spreads historically tight, investors should not be looking to take excessive interest rate risk within their fixed income allocations.

Our new Short Duration Fixed Income Model may be part of the solution. It can potentially help reduce interest rate (duration) risk while generating close-to-index levels of yield.

You can learn more at our Model Adoption Center. We hope you will take a look.

1 “Yield-to-worst” is a measure of the lowest possible yield that can be received on a bond that fully meets its contractual obligations without defaulting. It takes into account bond provisions that allow the issuer to close out the debt before it matures (two examples are callability and the prepayment option on mortgages).

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Fixed income investments are subject to interest rate risk; their value will normally decline as interest rates rise. Fixed income investments are also subject to credit risk, the risk that the issuer of a bond will fail to pay interest and principal in a timely manner, or that negative perceptions of the issuer’s ability to make such payments will cause the price of that bond to decline. Investing in mortgage- and asset-backed securities involves interest rate, credit, valuation, extension and liquidity risks and the risk that payments on the underlying assets are delayed, prepaid, subordinated or defaulted on. High-yield or “junk” bonds have lower credit ratings and involve a greater risk to principal. Please read each Fund’s prospectus for specific details regarding the Fund’s risk profile.

For retail investors: WisdomTree’s Model Portfolios are not intended to constitute investment advice or investment recommendations from WisdomTree. Your investment advisor may or may not implement WisdomTree’s Model Portfolios in your account. The performance of your account may differ from the performance shown for a variety of reasons, including but not limited to: Your investment advisor, and not WisdomTree, is responsible for implementing trades in the accounts; differences in market conditions; client-imposed investment restrictions; the timing of client investments and withdrawals; fees payable; and/or other factors. WisdomTree is not responsible for determining the suitability or appropriateness of a strategy based on WisdomTree’s Model Portfolios. WisdomTree does not have investment discretion and does not place trade orders for your account. This material has been created by WisdomTree and the information included herein has not been verified by your investment advisor and may differ from information provided by your investment advisor. WisdomTree does not undertake to provide impartial investment advice or give advice in a fiduciary capacity. Further, WisdomTree receives revenue in the form of advisory fees for our exchange-traded funds and management fees for our collective investment trusts.

For financial advisors: WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy. In providing WisdomTree Model Portfolio information, WisdomTree is not acting and has not agreed to act in an investment advisory, fiduciary or quasi-fiduciary capacity to any advisor or end client, and has no responsibility in connection therewith, and is not providing individualized investment advice to any advisor or end client, including based on or tailored to the circumstance of any advisor or end client. The Model Portfolio information is provided “as is,” without warranty of any kind, express or implied. WisdomTree is not responsible for determining the securities to be purchased, held and/or sold for any advisor or end client accounts, nor is WisdomTree responsible for determining the suitability or appropriateness of a Model Portfolio or any securities included therein for any third party, including end clients.

Advisors are solely responsible for making investment recommendations and/or decisions with respect to an end client and should consider the end client’s individual financial circumstances, investment time frame, risk tolerance level and investment goals in determining the appropriateness of a particular investment or strategy, without input from WisdomTree. WisdomTree does not have investment discretion and does not place trade orders for any end client accounts. Information and other marketing materials provided to you by WisdomTree concerning a Model Portfolio—including allocations, performance and other characteristics—may not be indicative of an end client’s actual experience from investing in one or more of the funds included in a Model Portfolio. Using an asset allocation strategy does not ensure a profit or protect against loss, and diversification does not eliminate the risk of experiencing investment losses. There is no assurance that investing in accordance with a Model Portfolio’s allocations will provide positive performance over any period. Any content or information included in or related to a WisdomTree Model Portfolio, including descriptions, allocations, data, fund details and disclosures, are subject to change and may not be altered by an advisor or other third party in any way.

WisdomTree primarily uses WisdomTree Funds in the Model Portfolios unless there is no WisdomTree Fund that is consistent with the desired asset allocation or Model Portfolio strategy. As a result, WisdomTree Model Portfolios are expected to include a substantial portion of WisdomTree Funds notwithstanding that there may be a similar fund with a higher rating, lower fees and expenses or substantially better performance. Additionally, WisdomTree and its affiliates will indirectly benefit from investments made based on the Model Portfolios through fees paid by the WisdomTree Funds to WisdomTree and its affiliates for advisory, administrative and other services.

Rick Harper serves as the Chief Investment Officer, Fixed Income and Model Portfolios at WisdomTree Asset Management, where he oversees the firm’s suite of fixed income and currency exchange-traded funds. He is also a voting member of the WisdomTree Model Portfolio Investment Committee and takes a leading role in the management and oversight of the fixed income model allocations. He plays an active role in risk management and oversight within the firm.

Rick has over 29 years investment experience in strategy and portfolio management positions at prominent investment firms. Prior to joining WisdomTree in 2007, Rick held senior level strategist roles with RBC Dain Rauscher, Bank One Capital Markets, ETF Advisors, and Nuveen Investments. At ETF Advisors, he was the portfolio manager and developer of some of the first fixed income exchange-traded funds. His research has been featured in leading periodicals including the Journal of Portfolio Management and the Journal of Indexes. He graduated from Emory University and earned his MBA at Indiana University.