A BioRevolution Update

The headline: The top-performing stock in the S&P 500 this year—by a wide 49% margin—is biotechnology company Moderna (+219%).1

The fine print: The Pharmaceuticals, Biotechnology & Life Sciences industry group is one of the S&P 500’s biggest laggards. The group’s year-to-date return currently ranks the sixth lowest of the 24 groups represented in the benchmark Index.

There is some nuance to reconciling these two statistics.

There are only 27 pharmaceuticals, biotechnology and life sciences stocks held within the S&P 500, which is likely driven by the Index’s profitability requirement. On average, these 27 securities have only constituted 7% of the Index’s weight year-to-date. Also, Moderna was only added to the S&P 500 in July 2021. So, the Index’s performance hasn’t quite fully benefited from the stock’s stellar year-to-date performance.

The range of performance within Pharmaceuticals, Biotechnology & Life Sciences is by far the widest of any other industry group. Even excluding Moderna’s outlying +200% return, the Pharmaceuticals, Biotechnology & Life Sciences return disparity still ranks near the top of the list.2

In the context of a global pandemic, it’s no surprise that the firms working on the world’s antidote were some of the biggest movers. Novel virus aside, we still view Pharmaceuticals, Biotechnology & Life Sciences companies as one of the most idiosyncratic subsets of the market. The performance of many of these companies is driven by developments that are unique to their product pipelines, like clinical trial results or patent authorizations, which contributes to a wider variation of returns within the industry group.

Given uncertainty around outcomes and timing, we believe the portfolio diversification that the ETF structure provides is the best way for investors to gain exposure to the Pharmaceuticals, Biotechnology & Life Sciences industry group and related companies that may be classified outside of this industry group.*

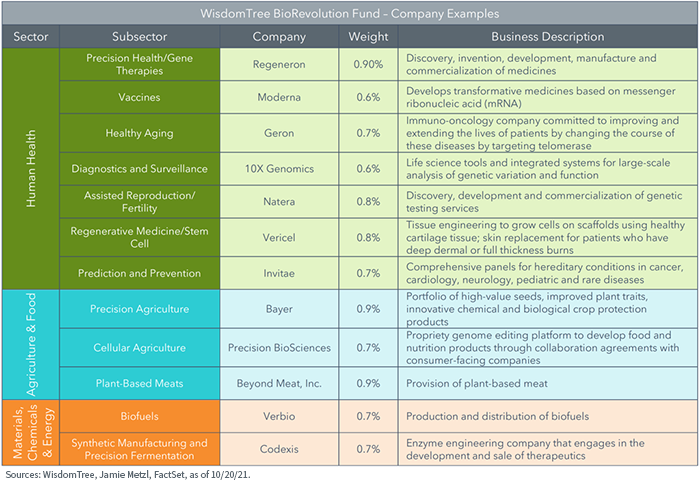

In June 2021, we launched the WisdomTree BioRevolution Fund (WDNA), a basket of companies with the potential to be significantly transformed by advancements in genetics and biotechnology.

WDNA is uniquely positioned to provide exposure to companies that are reading, understanding, writing and editing DNA for applications within the health care vertical and across interdisciplinary fields like agriculture, food, materials, chemicals and energy production. WDNA currently allocates 15% of its weight to companies outside of the Health Care sector.3

To help investors stay up to date with this fast-moving basket, we highlight some of the key new stories and biggest movers in our portfolio since launching.4

Moderna (+74%)

- In June 2021, Moderna announced its COVID-19 vaccine protected against the Delta variant strain.

- In July 2021, Moderna was added to the S&P 500 Index.

- In August, the company reported earnings and revenue above Street expectations and also disclosed that its COVID-19 vaccine is still 93% effective six months after the second dose.

- Most recently, the U.S. Food and Drug Administration (FDA) approved a third Moderna booster shot for at-risk populations and “vaccine mixing,” meaning that the administered booster vaccine would not need to be the same brand received in the initial two dosages.

Intellia (+77%)5

- We wrote about Intellia’s positive clinical study data in June 2021. In short, the company presented positive results from the first human clinical trial using genome editing to treat a fatal disorder causing nerve and heart disease.

Vitrolife AB (+53%)

- In vitro fertilization company Vitrolife announced the acquisition of its reproductive health peer Igenomix from private equity sellers. The addition of Igenomix adds a wide-range genetic testing service to Vitrolife’s portfolio.

Repligen (+50%)

- Bioprocessor Repligen raised its revenue, margin and profit guidance for full-year 2021, driven by strong performance in both its COVID-19- and non-COVID-19-related businesses.

CureVac N.V. (-65%)

- In June, RNA technology companies CureVac reported disappointing results from its first generation COVID-19 vaccine, showing that it was only 47% effective.

- In October, the company withdrew the first-generation COVID-19 vaccine application. Importantly, the company is still working with GlaxoSmithKline on a second-generation version of the vaccine.

Translate Bio

- mRNA therapeutics company Translate Bio was acquired by Sanofi in September at a 56% acquisition premium.6 The companies had already been collaborating, including two ongoing mRNA vaccine clinical trials.

Merck (+14%)

- In early October, Merck announced that its oral antiviral medicine for COVID-19 reduced the risk of hospitalization by 50%. The company submitted an Emergency Use Authorization to the U.S. FDA. While this was a major positive catalyst for Merck, it had a negative impact on competing COVID-19 vaccine makers, including Moderna, BioNTech, Pfizer and Novavax.

- The company also announced the acquisition of biopharmaceutical company Acceleron Pharma, Inc., in September.

October 2021 – WDNA Rebalance

There is no shortage of news flow for the companies held within WDNA. Our semiannual rebalance process allows WDNA to reflect the latest developments in the biology revolution.

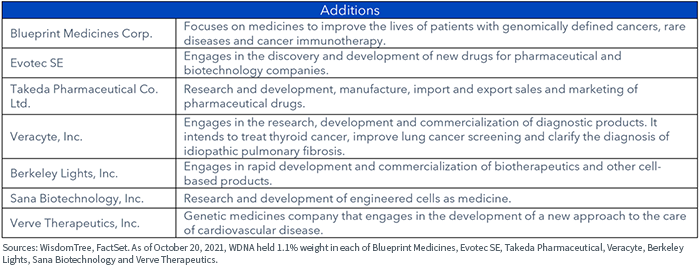

This October, we added 7 companies and removed 10 companies from WDNA, resulting in a 11% weight turnover across the entire portfolio. Notably, these 17 impacted companies were all within the the human health area of the Health Care sector.

Given the low turnover at rebalance, the sector composition of the portfolio did not change. WDNA remained uniquely exposed to the Health Care (85%), Materials (7%), Consumer Staples (4%) and Energy (4%) sectors.

Our differentiated approach to providing exposure to the BioRevolution, which encompasses more than just the Pharmaceuticals, Biotechnology & Life Sciences industry group, reflects our view that the applications of genetics and biotechnology will extend far beyond health care.

We believe there is a historic investment opportunity in the BioRevolution, which WDNA provides access to with very little concentration risk in any single name—the top 10 holdings of WDNA are currently only 15% of the Fund’s total weight7.

1 Sources: WisdomTree, Bloomberg, for the period 12/31/20–10/20/21. As of October 20, 2021, WDNA held Moderna at 1.4% weight.

2 Sources: WisdomTree, Bloomberg, for the period 12/31/20–10/20/21.

3 Sources: WisdomTree, FactSet, as of 10/20/21.

4 As of October 20, 2021, WDNA held Moderna, Intellia, Vitrolife AB, Repligen, CureVac N.V. and Merck at 1.4%, 0.5%, 1.3%, 1.6%, 0.4% and 1.2% weights, respectively. WDNA did not hold Translate Bio.

5 Performance Sources: WisdomTree, Bloomberg, for the period 6/2/21–10/20/21.

6 Source: https://translatebio.gcs-web.com/news-releases/news-release-details/sanofi-acquire-translate-bio-advances-deployment-mrna-technology

7 Sources: WisdomTree, FactSet, as of 10/20/21.

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. The Fund invests in BioRevolution companies, which are companies significantly transformed by advancements in genetics and biotechnology. BioRevolution companies face intense competition and potentially rapid product obsolescence. These companies may be adversely affected by the loss or impairment of intellectual property rights and other proprietary information or changes in government regulations or policies. Additionally, BioRevolution companies may be subject to risks associated with genetic analysis. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit, and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. The composition of the Index is governed by an Index Committee, and the Index may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

*While the fund intends to be diversified across multiple names in the BioTech and Pharmaceuticals sector the fund is a non-diversified fund and thus may be able to invest more of its assets in fewer issuers than a diversified fund. Investing a higher percentage of its assets in any one or a few issuers and sectors could increase the fund’s risk of loss and price fluctuations.

Diversification does not assure a profit, nor does it protect against a loss in a declining market.