October Dividend Update

For many, the fall season brings cherished traditions: tailgating, apple picking, hiking.

WisdomTree has a tradition of our own: the annual Global Dividend Index reconstitution.

The aim of the reconstitution is to refresh exposure to regular cash-dividend payers, with an eye toward giving greater weight to companies paying greater cash dividends.

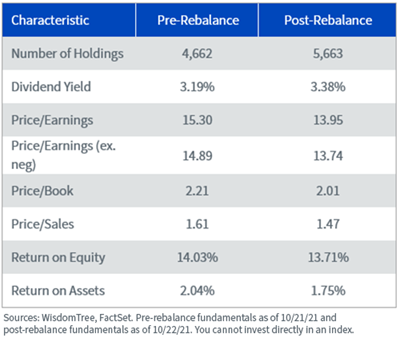

Given the broad-based rebound in dividends this year, we saw an increase of about 1,000 constituents, from 4,662 to 5,663. As a by-product of its modified dividend weighting, the dividend yield of the Index increased modestly from 3.19% to 3.38%.

WisdomTree Global Dividend Index: Fundamentals

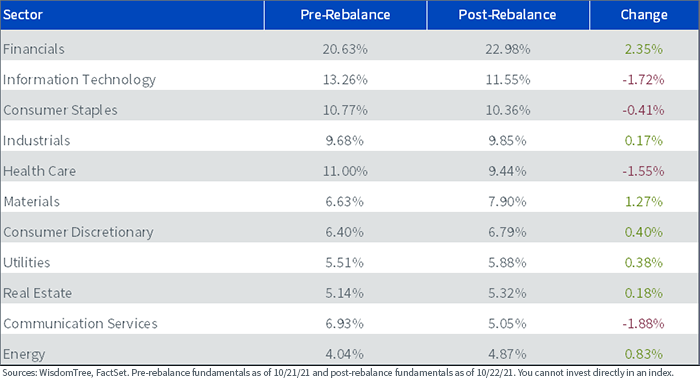

Sector Changes

From a sector perspective, Financials had the biggest increase in weight, followed by Materials and Energy.

- Financials: Many banks—particularly in Europe and Australia—were required to cease or reduce dividend payouts at the height of the pandemic in 2020. Over the past 12 months, these dividends have been largely reinstated.

- Materials: Big Materials companies—like Vale, BHP, Rio Tinto and Fortescue—have made year-over-year increases of more than 100% in their dividend payouts on the back of soaring commodities prices.

- Energy: Brent crude has skyrocketed from below $20 a barrel in April 2020 to more than $80 a barrel currently, helping Energy sector profits, and dividend payouts, rebound.

WisdomTree Global Dividend Index: Sector Weights

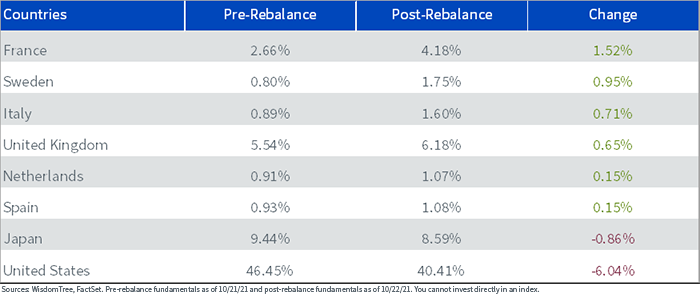

Country Changes

Markets that had the most stable payouts in 2020—like the U.S. and Japan—saw their weight reduced at rebalance relative to countries—like those in Europe—that swiftly slashed payouts and resumed them in 2021.

WisdomTree Global Dividend Index: Country Weights

Largest Payers

The list of the largest global dividend payers is diverse across countries and sectors. Among the 20 largest, there are nine countries and seven sectors represented.

- The three largest are Info. Tech. giants Microsoft, Samsung Electronics and Apple

- As mentioned previously, the large Materials companies can be seen on this top 20 list after a boom in payouts reflecting rising commodities prices

- There are four sectors tied for the greatest representation (four companies) on the top 20 list: Info. Tech., Consumer Staples, Health Care and Materials

Top 20 Global Dividend Payers

Dividend Growth Can Offset Inflation

Equities are an inflation hedge to a certain extent. As input prices go up, companies can pass on higher costs to consumers and distribute those earnings in the form of dividends.

As we’ve seen from this global dividend rebalance, certain sectors of the market—notably Materials and Energy—are more direct inflation hedges than sectors like Consumer Staples. As commodity prices have increased, dividend growth has gone hand in hand.

Focusing on quality companies with the pricing power and profitability to continue increasing dividends may be important in this above-average inflation environment.