El Salvador Makes Bitcoin Legal Tender

On September 7, 2021, El Salvador became the first nation-state to make bitcoin legal tender. The experiment about to play out is interesting from a few angles. This article considers the development through the concept of the technology adoption curve. It also considers what has led El Salvador to become the first nation-state to adopt bitcoin as legal tender. Answers to these questions can serve as a basis for making predictions about which other nation-states are most likely to follow suit…

El Salvador is a country of approximately 6 million people located in Central America. Its economic and political history is unfortunately characterized by the instability that is common among other nations in the region. In 2001, El Salvador “dollarized,” thereby abandoning the colon and subsequently using the U.S. dollar as its legal tender. Now El Salvador has “bitcoinized,” whereby bitcoins must be accepted if offered for repayment of debts—a move that was championed by incumbent president Nayib Bukele.

Why has President Bukele taken such an unorthodox economic policy move?

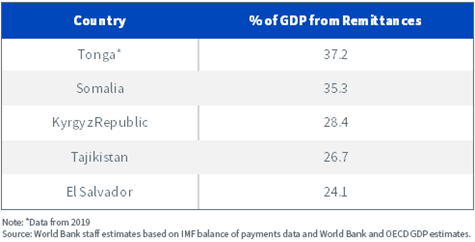

The World Bank estimates that around 20% of El Salvador’s GDP comes from the 1.5 million Salvadoreans who send remittances from the U.S. This diaspora has previously paid heavy fees to use legacy money transfer services. Now, via the Chivo Wallet powered by Bitcoin Lightning or other mobile wallets, the fees paid on bitcoin remittances are expected to be fractions of a U.S. cent. This will potentially save the people of El Salvador money, along with the time saved by receiving instant transactions directly to their phones.

Top 5 Countries with the Highest Proportion of Remittances as a % of GDP, 2020

Moreover, around 70% of Salvadorans did not have bank accounts in 2017 . Yet El Salvador is home to more cell phones than people. In fact, with 151 cell phone subscriptions per 100 people, Salvadorans have more cell phones than Japan (125), the U.S. (129) and the U.K. (118). (Side note: in many countries, people have multiple cell phone SIM cards to juggle preferential on/off rate deals.) With bitcoin, these cell phones potentially put a bank in everyone’s pocket.

Where Is El Salvador on the Technology Adoption Curve?

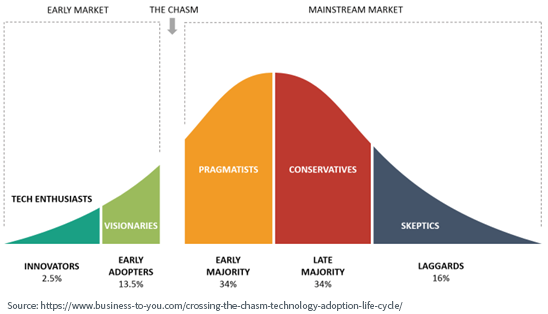

This move by El Salvador is an indication of where along the technology adoption curve bitcoin now finds itself in one country in the world. In a survey conducted just prior to Bitcoin officially becoming legal tender, it was found:

“At least 67.9% of 1,281 people surveyed said they disagree or strongly disagree with the use of bitcoin as a legal tender, said the poll by UCA, a Jesuit university based in El Salvador. Just over 32% of people said they agree on some level.”

This is normal. El Salvador is still mainly a paper economy where goods and services are paid for in cash (U.S. dollars). Bitcoin will sit alongside the USD, which is likely to continue to be the main way people make payments over the coming years. If 30% of the population of El Salvador already agrees with bitcoin being used as legal tender, assuming some margin for error due to non-random sampling, that means the urban part of the country is likely already well into the “Early Adopter” phase.

A more important dimension to consider is what happens when the 30% of fast adopters show their friends and relatives how bitcoin works and how much money they save in fees. Expect this proportion of the population to grow—the question is how steep will the adoption curve end up being?

Consider also what happens when other countries, particularly in this region but also globally, watch if the sky does not fall in El Salvador post-bitcoinization. The maximum supply of bitcoin is 21 million. Combine that with increased demand for bitcoins due to adoption in other countries with high remittances as a percentage of GDP, a recent history of macroeconomic instability and a population with widespread cell phone possession.

Important Risks Related to this Article

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

There are risks associated with investing, including the possible loss of principal. Crypto assets, such as bitcoin and ether, are complex, generally exhibit extreme price volatility and unpredictability, and should be viewed as highly speculative assets. Crypto assets are frequently referred to as crypto “currencies,” but they typically operate without central authority or banks, are not backed by any government or issuing entity (i.e., no right of recourse), have no government or insurance protections, are not legal tender and have limited or no usability as compared to fiat currencies. Federal, state or foreign governments may restrict the use, transfer, exchange and value of crypto assets, and regulation in the U.S. and worldwide is still developing.

Crypto asset exchanges and/or settlement facilities may stop operating, permanently shut down or experience issues due to security breaches, fraud, insolvency, market manipulation, market surveillance, KYC/AML (know your customer/anti-money laundering) procedures, noncompliance with applicable rules and regulations, technical glitches, hackers, malware or other reasons, which could negatively impact the price of any cryptocurrency traded on such exchanges or reliant on a settlement facility or otherwise may prevent access or use of the crypto asset. Crypto assets can experience unique events, such as forks or airdrops, which can impact the value and functionality of the crypto asset.

Crypto asset transactions are generally irreversible, which means that a crypto asset may be unrecoverable in instances where: (i) it is sent to an incorrect address, (ii) the incorrect amount is sent or (iii) transactions are made fraudulently from an account. A crypto asset may decline in popularity, acceptance or use, thereby impairing its price, and the price of a crypto asset may also be impacted by the transactions of a small number of holders of such crypto asset. Crypto assets may be difficult to value, and valuations, even for the same crypto asset, may differ significantly by pricing source or otherwise be suspect due to market fragmentation, illiquidity, volatility and the potential for manipulation. Crypto assets generally rely on blockchain technology, and blockchain technology is a relatively new and untested technology which operates as a distributed ledger. Blockchain systems could be subject to Internet connectivity disruptions, consensus failures or cybersecurity attacks, and the date or time that you initiate a transaction may be different than when it is recorded on the blockchain. Access to a given blockchain requires an individualized key, which, if compromised, could result in loss due to theft, destruction or inaccessibility.

In addition, different crypto assets exhibit different characteristics, use cases and risk profiles. Information provided by WisdomTree regarding digital assets, crypto assets or blockchain networks should not be considered or relied upon as investment or other advice or as a recommendation from WisdomTree, including regarding the use or suitability of any particular digital asset, crypto asset, blockchain network or any particular strategy. WisdomTree is not acting and has not agreed to act in an investment advisory, fiduciary or quasi-fiduciary capacity to any advisor, end client or investor, and has no responsibility in connection therewith, with respect to any digital assets, crypto assets or blockchain networks.