September U.S. Dividend Update

We suggested in last month’s dividend update that bloated cash balances and strong earnings could bolster dividend and share buyback increases and support gains for U.S. equities.

While a choppy month for price returns, September didn’t disappoint, with a flurry of dividend growth from some of the largest payers.

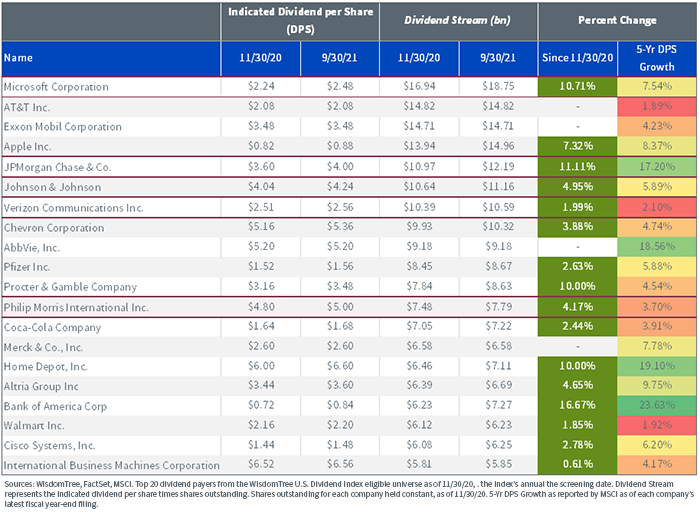

Microsoft and JPMorgan—both top five U.S. dividend payers—each increased 11%.

Microsoft also announced a whopping $60 billion stock buyback plan. That’s double the $30 billion plan that JPMorgan announced last December.

Verizon and Philip Morris increased their dividends 2% and 4%, respectively.

Of the group of the 20 largest dividend payers, there have been 16 dividend increases and four unchanged, combining for an average increase of 4.8% this year.

Top 20 U.S. Dividend Payers

Dividend Initiations/Resumptions

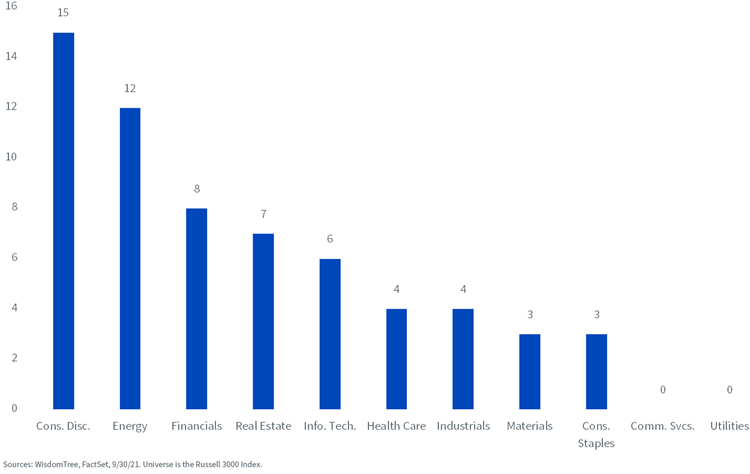

One of the main stories about dividends this year is the number of companies initiating or resuming payouts.

Since the end of the first quarter, 62 initiations/resumptions have been made by Russell 3000 Index constituents. Among these companies, many are in sectors that were most impacted by 2020 shutdowns—Consumer Discretionary, Energy, Financials and Real Estate.

At WisdomTree’s annual domestic Index rebalance in December, all active dividend payers are eligible for our starting universe. We anticipate more names from these sectors being added to our dividend Indexes.

Dividend Initiations/Resumptions since 1Q21

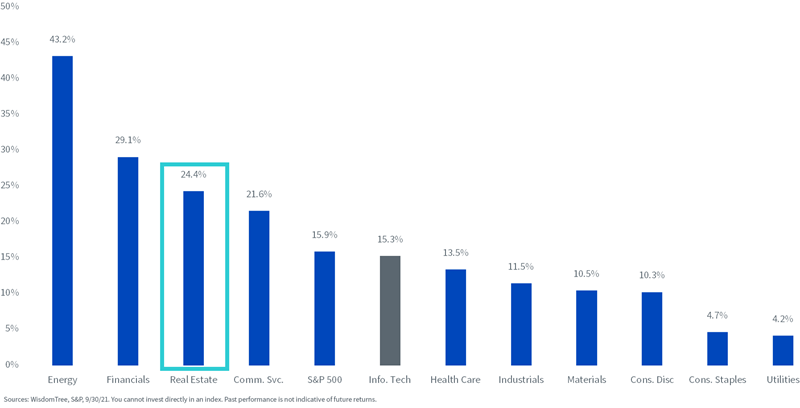

Real Estate Sector

With interest rates historically low and property markets recovering from the COVID-19 pandemic, the Real Estate sector has been one of the top performers year-to-date.

S&P 500 Sector Performance

The number of publicly traded Real Estate companies has grown dramatically over the past several years—up from 40 in May 2006, when WisdomTree launched its first dividend Indexes—to nearly 120 today.

The sector’s market cap weight in the S&P 1500 is just under 3%. Given its high payouts, the sector’s dividend weight is twice that at around 6%.

S&P 1500 Real Estate Sector

REITs—which make up much of the Real Estate sector—are a unique class of equities. They are required to pay out at least 90% of their taxable income as dividends.

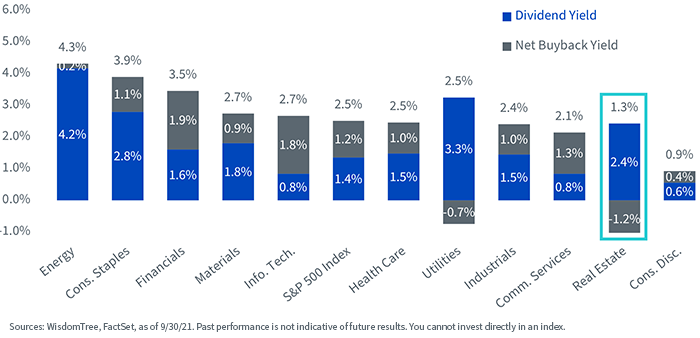

As a result of the payout requirement, the sector has the fourth-highest dividend yield. On the other hand, it is also one of only two sectors that have a negative net buyback yield—meaning companies issue more in shares than they buy back. That’s why some index providers choose to exclude the sector from dividend indexes.

Removing Real Estate means removing exposure to a sector with a premium dividend yield and one that has not only performed well in 2021 but is growing in weight (i.e., importance) in market cap-weighted benchmark indexes.

S&P 500 Index–Total Shareholder Yield by Sector

For WisdomTree’s U.S. dividend Indexes, we have chosen to include Real Estate companies with caps—either at 5% or 10%, depending on the Index.

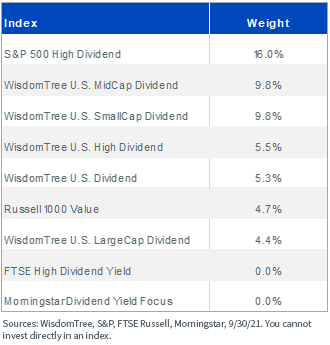

As we show below, some dividend Indexes—like the FTSE High Dividend Yield Index and the Morningstar Dividend Yield Focus Index—have no exposure.

On the other end of the spectrum, the S&P 500 High Dividend Index has a 16% weight to the sector—an over-weight of over 13% relative to the S&P 500.

We believe our approach of including Real Estate within guardrails strikes a good balance of broadness, maximizing yield and mitigating tracking risk relative to comparable value indexes.

In a low-rate environment, the premium income of the sector and its price appreciation potential makes it an attractive component of our dividend Indexes, in our view.

Percent Index Weight: Real Estate