WisdomTree India Earnings Fund Rebalance: Seeking to Capture a Growing Equity Market

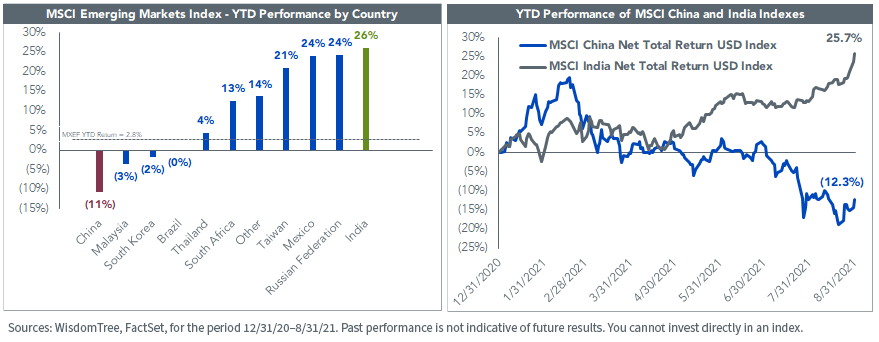

There is a sharp divergence in the performance of the two largest emerging markets economies, India and China.

Year-to-date, India is the top-performing equity market within the MCSI Emerging Markets Index (MXEF), while China is the worst-performing country exposure. So far, the MSCI India Index (MXIN) is on track to have its strongest year of performance since 2017.

India’s COVID-19 recovery has been bolstered by vaccination momentum coupled with stronger macroeconomic data. Until now, the agricultural and industrial sectors have been driving the economic recovery, but we expect faster dissemination of vaccines coupled with easing of lockdown measures to support a significant turnaround in consumption expenditure, which should continue to bolster growth in 2022.

Meanwhile, the key driver of China’s year-to-date decline can be efficiently summarized by headline risks, including the crackdown on tech and education stocks and the solvency of property developer Evergrande.

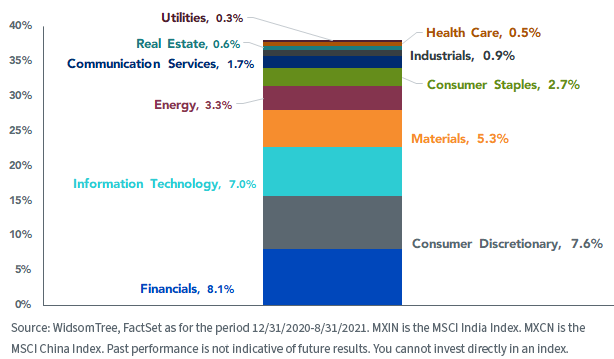

On an absolute basis, the top contributors to India’s performance are the Information Technology, Financials, Materials, Consumer Staples and Energy sectors. Apart from the Information Technology sector, these performance drivers help corroborate the cyclical economic recovery we observe from economic indicators.

Relative to China, India has outperformed in all but two sectors, but the majority of the country’s outperformance has come from Financials, Consumer Discretionary, Information Technology and Materials.

YTD Performance Attribution—MXIN vs. MXCN

India—The Leading Emerging Market

In the last year, Indian equities, as measured by stocks listed on the BSE Limited and National Stock exchanges, have gained $1.4 trillion in market capitalization. On average, companies listed on these exchanges have gained 64% and added $293 million in market capitalization in the trailing 12 months.1 The increased size exposure of the MSCI India Index confirms this finding—its weight in large-cap companies increased from 78% to 89% of the index while mid-cap exposure halved from 22% to 11%.2

The rising tide of Indian equities was reflected in the annual rebalance of the WisdomTree India Earnings Fund (EPI). We added a record 223 stocks to the Fund this year, primarily driven by a larger number of companies meeting the size and liquidity constraints necessary for inclusion.

EPI is a fundamentally focused Fund that uses a rules-based process to select and weight companies based on their profitability. To be eligible for inclusion in EPI, companies need to meet the following key criteria:

- At least $5 million in earnings

- At least $200 million in market capitalization

- At least 250,000 shares traded in each of the preceding six months

- At least $200,000 average daily dollar volume in each of the preceding six months

Nearly 250 more companies met the market cap threshold in the 2021 rebalance than in 2020. Robust initial public offering (IPO) activity also added to the growing pool of eligible companies as the number of IPOs nearly doubled year over year. Since the last screening date, 77 companies have completed IPOs, 47 of which traded above $200 million in market cap as of the August 31 screening for EPI.3

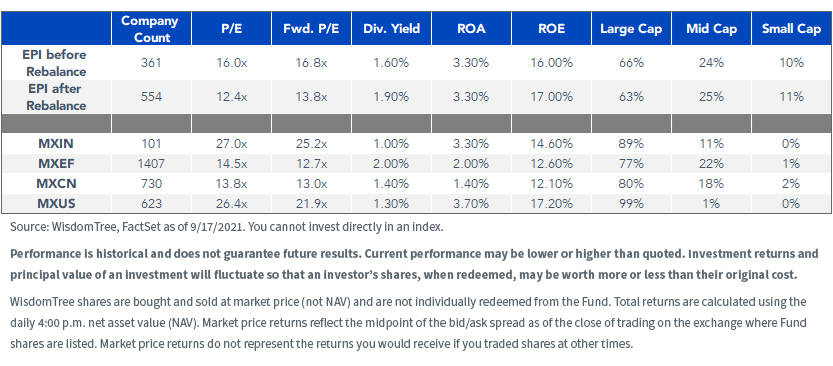

The region’s ongoing economic recovery, strong equity returns and favorable environment for raising capital have created a larger eligible universe for EPI. The constituent count increased from 361 companies to 553 companies, with 193 net additions (223 adds, 30 drops) and weight turnover of 24.8%.

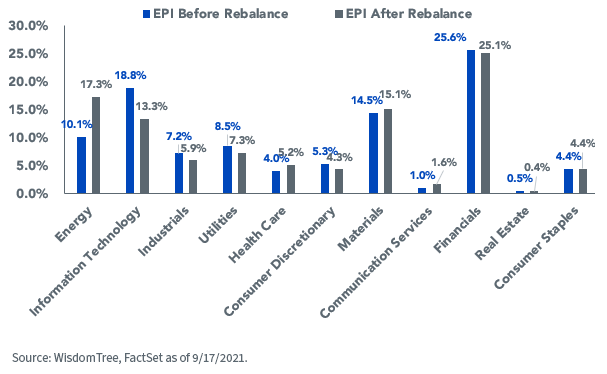

Consistent with the cyclical rebound and top-performing sectors within the MSCI India Index, the greatest number of additions in this rebalance cycle came from the Materials, Industrials and Financials sectors (139 of 223 additions).

From a fundamental perspective, EPI’s profitability screen and earnings weighting not only adjusts weight back to relative value but also eliminates negative earners—the annual rebalance lowered the P/E ratio of the basket by 3.6 turns while maintaining or improving quality metrics, like ROA and ROE.

At 12.4 times price-to-earnings, EPI’s valuation is extremely attractive—it’s currently trading at half the valuation of the broader MSCI India Index and below both the MSCI Emerging Markets Index and the MSCI China Index.

For yields and standardized performance for EPI please click here.

In terms of sector exposure, the rebalance tilted EPI toward more cyclical, value-oriented sectors. The biggest changes include a 7% increase in Energy sector exposure and a 6% decrease in Information Technology exposure.

EPI—A Regional Outperformer

EPI is one of WisdomTree’s top-performing Funds year-to-date. The Fund has returned 28.5%, slightly above its benchmark, the MSCI India Index (+27.7%) and significantly above year-to-date contractions in the MSCI Emerging Markets (-0.7%) and China (-17.2%) indexes.4

India is a core emerging markets equity exposure, and we believe EPI’s methodology is well positioned to capture the increasing breadth of the market, while remaining sensitive to profitability and valuation.

1Source: WisdomTree, Bloomberg, for the period 8/31/20–8/31/21.

2Source: WisdomTree, FactSet, as of 8/31/21 and 8/31/20.

3Source: WisdomTree, Bloomberg, as of 8/31/21.

4Source: WisdomTree, Bloomberg, for the period 12/31/20–9/21/21. Performance at NAV.

Important Risks and Disclosures Related to this Article

This information must be preceded or accompanied by a prospectus. Click here to view or download a prospectus. We advise you to consider the Fund's objectives, risks, charges and expenses carefully before investing. The prospectus contains this and other important information about the Fund. Please read the prospectus carefully before you invest.

Aneeka Gupta is an employee of WisdomTree UK Limited, a European subsidiary of WisdomTree Asset Management, Inc.’s, parent company, WisdomTree Investments, Inc.

There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. This Fund focuses its investments in India, thereby increasing the impact of events and developments associated with the region which can adversely affect performance. Investments in emerging, offshore or frontier markets such as India are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. As this Fund has a high concentration in some sectors, the Fund can be adversely affected by changes in those sectors. Due to the investment strategy of this Fund it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Aneeka Gupta is Director of Research at WisdomTree. Prior to the acquisition of ETF Securities in April 2018, Aneeka worked as an Equity & Commodities Strategist at the company. Aneeka has 17 years of experience working as a Research Analyst across a wide range of asset classes. In her current role she is responsible for conducting analysis for all in-house equity, commodity and macro publications and assisting the sales team with client queries around products and markets.

Prior to WisdomTree, Aneeka began her career as an equity analyst at Bear Stearns International Ltd in London. She also worked as an Equity Sales Trader at Sunrise Brokers across US and Pan European Exchanges. Before that she worked as an Equity Derivatives Sales Manager at Mashreq Bank in Dubai.

Aneeka holds a Masters in Mathematics from Oxford University and a BSc in Mathematics from the University of Delhi, India. She is also a CFA Charterholder.