A Fresh Idea for Bond Investors

In this historically low interest rate environment, I often get asked the question: do you have any “fresh” ideas I could use to bolster my bond portfolio? My answer to this lies in the securitized product space. Most investors are quite comfortable with Treasuries, corporate bonds and/or municipals in their fixed income allocation, but the securitized space is often overlooked. That’s why I want to focus this blog post on a solution that does not always come first to mind.

Securitized debt is the second-largest U.S. fixed income market behind only Treasuries, totaling about $13 trillion outstanding. Perhaps the most well-known component within this universe is agency mortgage-backed securities (MBS)—more specifically, agency residential mortgage-backed securities (RMBS)—which are issued by such familiar names as Ginnie Mae and government-sponsored enterprises (GSE) Fannie Mae or Freddie Mac. These securities are supported by mortgage loans on single-family homes and, in the case of Ginnie Mae, are backed by the “full faith and credit” of the U.S. government. “Fannie and Freddie” are GSE-guaranteed and remain under the conservatorship of the Federal Housing Finance Agency following the financial crisis.

Other sectors of the securitized market include bonds backed by single-family mortgages but not guaranteed by the GSEs (non-agency RMBS), commercial mortgage loans (CMBS), consumer loans or asset-backed securities (ABS) and corporate loans or collateralized loan obligations (CLO).

For MBS, one of the risks to be aware of is “prepayment risk,” or receiving your principal back sooner if interest rates fall and mortgages are refinanced. The opposite side of this trade occurs when rates rise and is known as “extension risk.” As a result, investors typically expect some incremental yield relative to a similar duration Treasury.

Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost.

For the most recent month-end and standardized performance click here.

The WisdomTree Mortgage Plus Bond Fund (MTGP) offers investors a way to tap into the securitized space that follows an active strategy within the securitized space. MTGP provides exposure to the aforementioned agency RMBS and agency commercial MBS sectors, representing at least 80% of the core portfolio. As a result, the Fund has the ability to diversify toward other yield-enhancing sectors in the securitized debt market, up to 20% in total. The Fund is also designed to be at least 80% investment-grade.

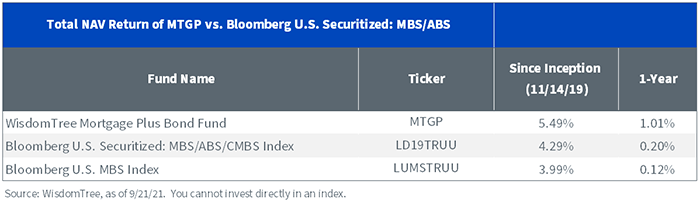

As the enclosed table highlights, MTGP has seen outperformance as compared to the market-cap-based (passive) options in the securitized space. Indeed, since inception in November 2019, MTGP has produced an excess return of 120 basis points (bps) versus the Bloomberg U.S. Securitized Index and 150 bps versus the Bloomberg U.S. MBS Index. Over the last year, the trend was in the plus column by 81 bps and 89 bps, respectively.

Another noteworthy aspect of MTGP is its makeup as compared to U.S. investment-grade corporate bonds. As of this writing, MTGP’s average yield to maturity is only 24 bps below the Bloomberg U.S. Corporate Index, but perhaps more importantly, effective duration stands at 3.49 years, or less than half of the corporate figure of 8.75 years.

Conclusion

The securitized debt universe tends to be more closely tied to the well-being of the consumer and housing markets and often follows a different path than corporate bonds or even equities. We believe MTGP offer investors a unique solution that focuses on income while maintaining a diversified risk approach to an investor’s portfolio.

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Fixed income investments are subject to interest rate risk; their value will normally decline as interest rates rise. In addition, when interest rates fall, income may decline. Fixed income investments are also subject to credit risk, the risk that the issuer of an investment will fail to pay interest and principal in a timely manner, or that negative perceptions of the issuer’s ability to make such payments will cause the price of that investment to decline. Investing in mortgage- and asset-backed securities involves interest rate, credit, valuation, extension and liquidity risks and the risk that payments on the underlying assets are delayed, prepaid, subordinated or defaulted on. Liquidity risk may result from the lack of an active market, reduced number and capacity of traditional market participants to make a market in fixed income securities and may be magnified in a rising interest rate environment and/or with respect to particular types of securities, such as securitized credit securities.

Non-agency and other securitized debt are subject to heightened risks as compared to agency-backed securities. High yield or “junk” bonds have lower credit ratings and involve a greater risk to principal. Derivative investments can be volatile, and these investments may be less liquid than other securities, and more sensitive to the effects of varied economic conditions. Unlike typical exchange-traded funds, the Fund is actively managed using proprietary investment strategies and processes, and there can be no guarantee that these strategies and processes will be successful or that the Fund will achieve its investment objective. Due to the investment strategy of the Fund, it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.