Protecting the "Core"terback

The 2021 football season is upon us with the first pro and college games now under our belt. One of the keys to success on the gridiron is to protect the quarterback. And when it comes to investing in fixed income, one of the keys for performance is to safeguard your bond portfolio from rising rates.

So, how is football related to fixed income, you might ask? At the center of the football universe lies the aforementioned quarterback, while typically at the center of a bond portfolio, it is a core aggregate holding...aka the “core”terback (too corny?). The lion’s share of any fixed income asset allocation begins with this “core” building block. Indeed, this is the starting point with which to invest in the bond market, and one can build the other pieces of the portfolio around this core to act as a complement.

In the current historically low interest rate environment, one complement investors should be considering is a rate-hedged vehicle. As we have seen over the last year or so, rate movements can shift quickly, and in our opinion, yield levels are poised to resume another upward trend into the final stretch of this year and into 2022, if not beyond.

I believe the WisdomTree Interest Rate Hedged U.S. Aggregate Bond Fund (AGZD) offers investors a rate-hedged strategy that serves as a targeted counterpart to an investor’s core fixed income holding, especially the widely used Bloomberg U.S. Aggregate Bond Index, more commonly referred to as the Agg. AGZD utilizes an approach of taking the Agg and then overlaying a short position in Treasury futures to target a duration of zero years. Thus, the investor is provided with a “long” portfolio that is representative of the Agg but without the duration of 6.6 years.

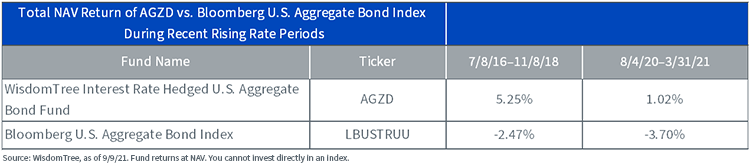

The above table offers a snapshot of how AGZD has fared versus the benchmark during the two most recent noteworthy rising rate periods for the UST 10-Year yield. In each case, the UST 10-Year yield rose in excess of 100 basis points (bps). As you can see, AGZD registered positive readings while the Agg was producing rather visible negative performances.

Conclusion

The divergent results in the highlighted rising rate periods underscores how AGZD could potentially serve as an effective pairing with one’s core bond holding, acting as a counterweight to duration while also maintaining an investment-grade profile.

Important Risks Related to this Article

Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Standardized performance for AGZD is available here.

WisdomTree shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Total returns are calculated using the daily 4:00 p.m. net asset value (NAV). Market price returns reflect the midpoint of the bid/ask spread as of the close of trading on the exchange where Fund shares are listed. Market price returns do not represent the returns you would receive if you traded shares at other times.

There are risks associated with investing, including possible loss of principal. Fixed income investments are subject to interest rate risk; their value will normally decline as interest rates rise. The Fund seeks to mitigate interest rate risk by taking short positions in U.S. Treasuries (or futures providing exposure to U.S. Treasuries), but there is no guarantee this will be achieved. Derivative investments can be volatile, and these investments may be less liquid than other securities, and more sensitive to the effects of varied economic conditions.

Fixed income investments are also subject to credit risk, the risk that the issuer of a bond will fail to pay interest and principal in a timely manner, or that negative perceptions of the issuer’s ability to make such payments will cause the price of that bond to decline. The Fund may engage in “short sale” transactions of U.S. Treasuries where losses may be exaggerated, potentially losing more money than the actual cost of the investment, and the third party to the short sale may fail to honor its contract terms, causing a loss to the Fund. While the Fund attempts to limit credit and counterparty exposure, the value of an investment in the Fund may change quickly and without warning in response to issuer or counterparty defaults and changes in the credit ratings of the Fund’s portfolio investments. Investing in mortgage- and asset-backed securities involves interest rate, credit, valuation, extension and liquidity risks and the risk that payments on the underlying assets are delayed, prepaid, subordinated or defaulted on. Due to the investment strategy of certain Funds, they may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.