August U.S. Dividend Update

What’s the next catalyst for equities?

That’s the age-old question for market participants, particularly when valuations are elevated.

The current S&P 500 forward P/E ratio is 21 times, which is 20% above the median of 17.5 times of the last five years.

Here are some potential catalysts today:

- Fiscal stimulus by way of a likely infrastructure package and potential green energy bill

- Retail spending on goods driven by a healthy U.S. consumer, thanks to generous stimulus checks and the positive wealth effect from higher stock prices and home values

- Waning COVID-19 concerns (eventually) that will accelerate spending on services (dining out, going to the theater) and on travel, particularly business-related

What seems increasingly likely—perhaps regardless of these catalysts—is an acceleration in payouts to shareholders in the form of dividends and share buybacks.

Earnings have rebounded to well above their pre-pandemic highs. Since the end of 2019, forward earnings on the S&P 500 are up 18%.

Market prices have fully reflected the earnings boost—and then some. Price returns on the index have overshot that earnings growth with gains of 40% over that time frame.

S&P 500 Index

.png?h=378&w=700&hash=31C117CD1E1D824F597C4777EA48B216)

Share buybacks and dividends are on the mend this year following cuts in 2020, but there is still significant ground to be made up on payouts.

Trailing 12-month share buybacks (net of share issuance) are down by nearly a third since the end of 2019. Forward estimated dividends are roughly unchanged over the same period.

S&P 500 Index

.png?h=377&w=700&hash=6241472F57E1729FA122173AE161EF37)

S&P 500 companies (ex-Financials) are now sitting on $2 trillion in cash—an increase of over 35% relative to year-end 2019.

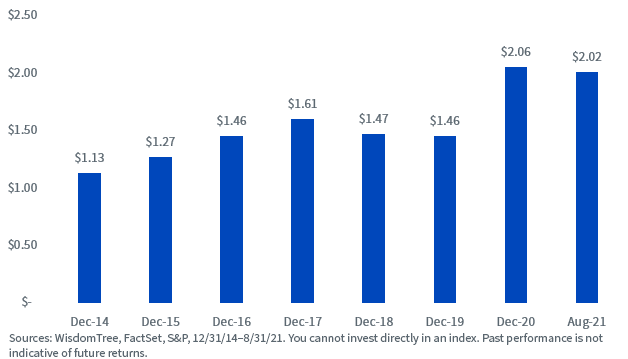

S&P 500 Cash Balance ($ trillions)

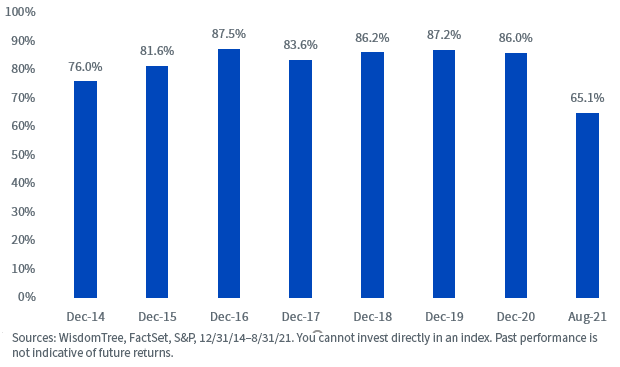

Companies have a lot of room to make up if the latest trailing 12-month payout ratio (combining earnings and buybacks) of 65% is to revert to the mean of the recent 85% historical trend.

S&P 500 Payout Ratio

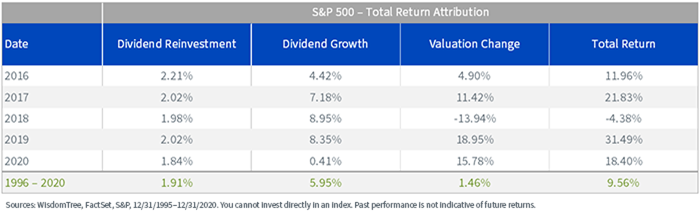

To get a better sense of how dividends relate to prices, we can separate historical S&P 500 total returns into three components:

- Dividend reinvestment: This rate is closely related to the starting dividend yield of the index—a higher starting yield will likely dictate a higher reinvestment of dividends

- Dividend growth: Growth in annual dividends per share

- Valuation change: This measures the price-to-dividend multiple (reciprocal of the dividend yield)—a positive change indicates prices are increasing faster than dividends

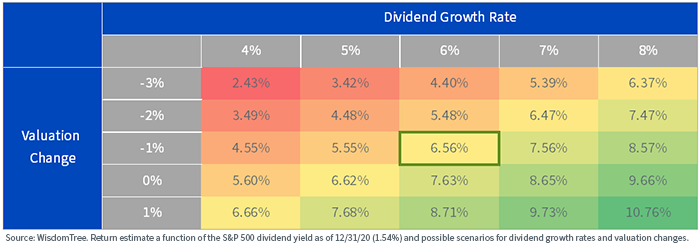

Using the same return decomposition framework, we can create a simplified total return forecast for the next five to seven years. Because the starting dividend yield is known (1.54% entering 2021), we can adjust assumptions for forward dividend growth and valuation change to arrive at a range of return estimates.

Using historical 6% dividend growth and a −1% return from valuation change—which seems appropriate, given elevated valuations—as base case assumptions we arrive at an estimate of about 6.5% annualized returns.

That return would be significantly below long-term S&P 500 returns of 10%–11% but would likely come out well ahead of fixed income alternatives.

Return Estimate = (1+Dividend Yield)*(1+Dividend Growth)*(1+Valuation Change) – 1

S&P 500 5–7 Year Estimated Return Scenarios

Conclusion

There are several catalysts with potential to drive the market higher, as well as both foreseeable and unforeseeable challenges.

If we can look through the market noise, the steady return of capital via dividends and buybacks over the next several quarters and years is likely to propel markets higher—even if valuation contraction proves a modest offset.