How Many China A-shares Are in Your China Portfolio?

Unlike the U.S., where the S&P 500 Index is the main gauge for broad equity exposure, China lacks consensus on a benchmark most widely accepted index.

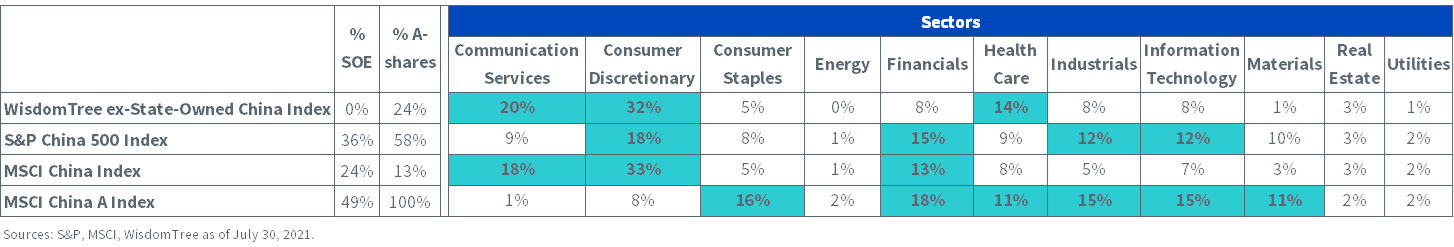

Broad China indexes differ according to how many state-owned companies and A-shares they include. As a result, the sector exposures of the indexes are widely different and their short-term performances can diverge significantly.

For example, the financial sector is dominated by state-owned banks, so the indexes that exclude state-owned enterprises are under-weight in financials but over-weight in other sectors like health care, communication services and consumer discretionary.

To illustrate further, consider the state-owned exposure (SOE), A-shares exposure and various sector exposures of four leading China equity indexes: the WisdomTree China ex-State-Owned Enterprises Index (CHXSOE), the S&P China 500 Index—which takes the largest 500 Chinese companies regardless of listing place, the MSCI China Index and the MSCI China A Index.

Table 1: SOE, A-share and Sector Exposures of Broad China Indexes

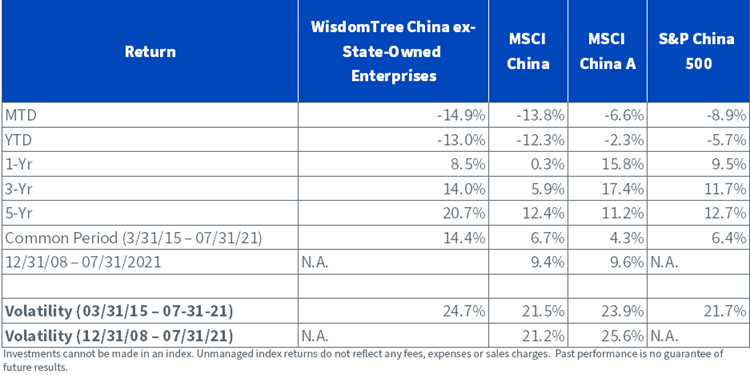

Table 2: Performance as of July 30, 2021

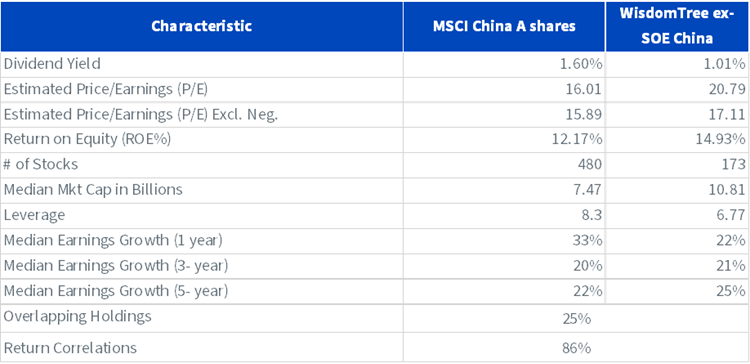

Table 3: Different Portfolio Characteristics, as of July 30, 2021: China A-shares more value, less quality, slightly less growth

Here are a few pointers for A-share exposure in a broad China equity portfolio:

1. We believe somewhere between 20% and 60% is a good reference point for A-share exposure in a broad Chinese portfolio. The MSCI China Index has finally increased its weight in A-shares, currently targeting 20%. It has been around 13% with more gradually being added.

When taking the S&P China 500 approach, A-shares are about 58% of the largest 500 Chinese companies regardless of listing location. Among SOEs, 76% are listed as A-shares. Among non-SOEs, 48% are A-shares.

With the political consequences of new U.S. delisting laws, we will likely see a trend of Chinese SOEs moving further toward A-shares, as shown by China Mobil’s recent listing approval. Non-SOEs generally prefer moving to the Hong Kong exchange from the U.S. if they can meet the stringent listing requirements, as listing offshore is still a positive signal for Chinese private businesses. Others may move to Shanghai’s NASDAQ-like STAR (Science and Technology Innovation) board or go private.

2. Mainland China A-shares and STAR board tend to offer diversification and exposure to more domestic industrial and consumer staples companies, and may have higher alpha potential for active strategies, but both come with their own nuances. That’s why we view it as an important part of broad China equity exposure for overseas investors. We recently discussed quantitative signals with Vivek Viswanathan, head of research for active alpha China strategy at Rayliant. Chinese A-shares are typical of emerging markets equities, and could provide good potential for alpha from non-traditional factors, like A-H share spread, or flow data of large clients versus small clients. Academic research found these kinds of friction-induced signals have worked better than traditional factors like value, momentum or size. Historically alpha is also higher when the strategy was run within China where one could have full access to A-share stocks. For clients based outside of China, there is a 30% hard cap on secondary market foreign ownership of any Chinese A-share stocks. The accounting standards are generally perceived to be better for offshore-listed Chinese equities than A-share stocks. However, if a company has dual A-H listings, it has less stigma for unreliable accounting data.

3. We believe A hybrid China A and H share could become the norm soon for many high-performing private Chinese companies. The case of health care company Wuxi Apptec would be an interesting case study for what’s to come. Its founder was educated both in China and the U.S. Its main operation is in China, but it also has U.S. operations. It was listed in the U.S., but the founder felt there was not enough U.S. investor interest and brand name recognition, and the company was undervalued as U.S. investors seemed to significantly favor Chinese tech companies. Wuxi Apptec then voluntarily delisted from the U.S., did a spin-off of Wuxi Biologics and listed in Hong Kong. The main Wuxi Apptec got dual-listed in Hong Kong and China A-shares. The WisdomTree China ex-State-Owned Enterprises Index owns all three listings. Through this A+H structure, the company can tap into mainland China investors through its high brand recognition in China and offshore capital.

In summary, A-shares and Shanghai STAR board stocks will likely become an even more important part of a portfolio’s China equity portfolio. We annually assess A-shares investment case and exposure in our own WisdomTree China ex-SOE Index, together with other risks such as delisting and VIE (variable interest entity) structure risks.

Liqian Ren, Ph.D., joined WisdomTree as Director of Modern Alpha in 2018. She leads WisdomTree’s quantitative investment capabilities and serves as a thought leader for WisdomTree’s Modern Alpha® approach. Liqian was previously at Vanguard, where she worked for 12 years, most recently as a portfolio manager in the Quantitative Equity Group managing Vanguard’s active funds and conducting research on factor strategies. Prior to joining Vanguard, she was an associate economist at the Federal Reserve Bank of Chicago. Liqian received her bachelor’s degree in Computer Science from Peking University in Beijing, her master’s in Economics from Indiana University—Purdue University Indianapolis, and her MBA and Ph.D. in Economics from the University of Chicago Booth School of Business. Liqian co-hosts a podcast on China and Asian markets with Jeremy Schwartz, WisdomTree’s Global Head of Research, and she is a co-host on the Wharton Business Radio program Behind the Markets on SiriusXM 132.

Aneeka Gupta is Director of Research at WisdomTree. Prior to the acquisition of ETF Securities in April 2018, Aneeka worked as an Equity & Commodities Strategist at the company. Aneeka has 17 years of experience working as a Research Analyst across a wide range of asset classes. In her current role she is responsible for conducting analysis for all in-house equity, commodity and macro publications and assisting the sales team with client queries around products and markets.

Prior to WisdomTree, Aneeka began her career as an equity analyst at Bear Stearns International Ltd in London. She also worked as an Equity Sales Trader at Sunrise Brokers across US and Pan European Exchanges. Before that she worked as an Equity Derivatives Sales Manager at Mashreq Bank in Dubai.

Aneeka holds a Masters in Mathematics from Oxford University and a BSc in Mathematics from the University of Delhi, India. She is also a CFA Charterholder.