July U.S. Dividend Update in Charts

S&P 500 dividends grew 1% in the first seven months of the year compared to the same period in 2020 and 6% compared to 2019.

The Federal Reserve’s (Fed) preferred inflation gauge—the Personal Consumption Expenditures Index—is up less than 5% since mid-2019, meaning dividends have proved a nice inflation hedge in a negative real interest rate environment.

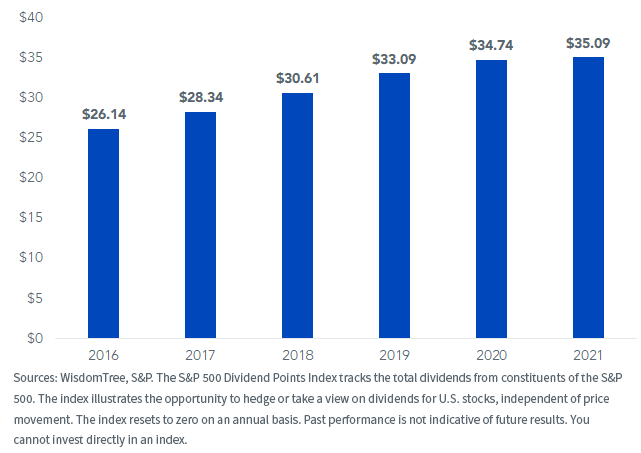

Look at the chart below—in a testament to the stability of dividend payouts, it is impossible to detect that there was one of the most severe recessions in history in the first half of 2020.

S&P 500 Dividend Points Index, as of July 31

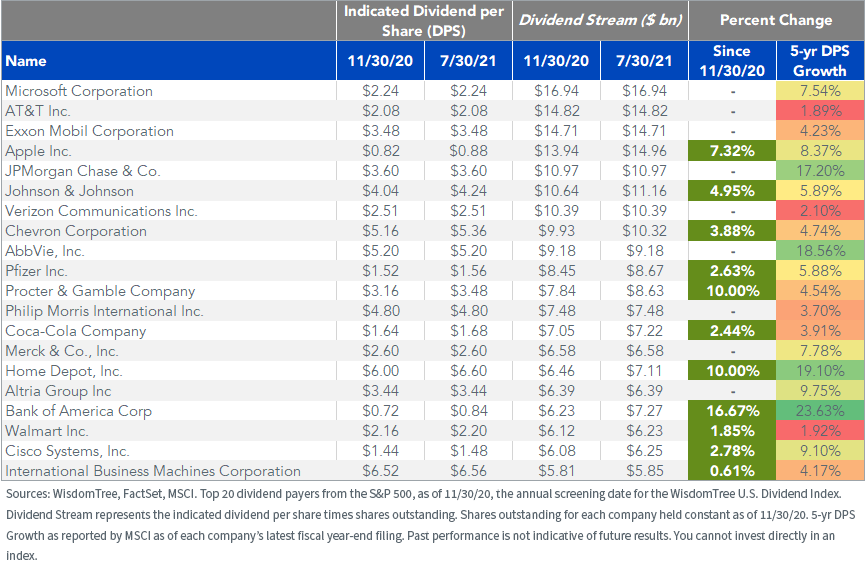

Among the 20 largest U.S. dividend payers, 11 have increased payouts, none have decreased and nine have kept their payouts unchanged.

The average change in dividends was an increase of 3.2%, with double-digit increases coming from Bank of America (16.67%), followed by Proctor & Gamble and Home Depot at 10% each.

Two notable dividend aristocrats—companies that have grown their dividends for at least 25 consecutive years—have not increased their dividends this year: AT&T and Exxon.

- AT&T has announced plans to slash its dividend by about 50% following its expected spin-off of WarnerMedia in 2022.

- Exxon has not increased its dividend since the spring of 2019. According to FactSet, analysts do not anticipate an increase until 2022 or 2023, putting its dividend aristocrat status in jeopardy.

Top 20 U.S. Dividend Payers

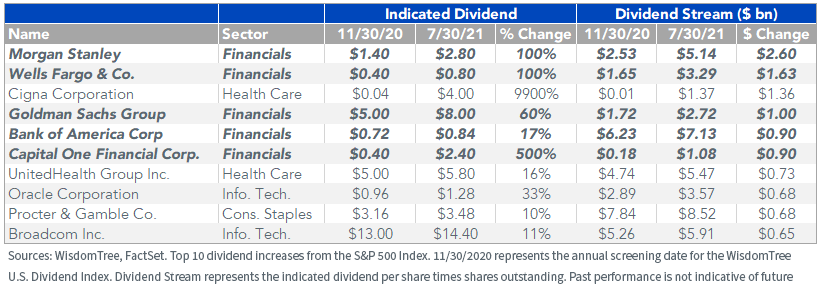

After the big banks were restricted on payouts in 2020, five of the six biggest dividend increases from a cash payout perspective have come from Financials—a total of over $7 billion in increased payouts.

Top 10 Dividend Increases

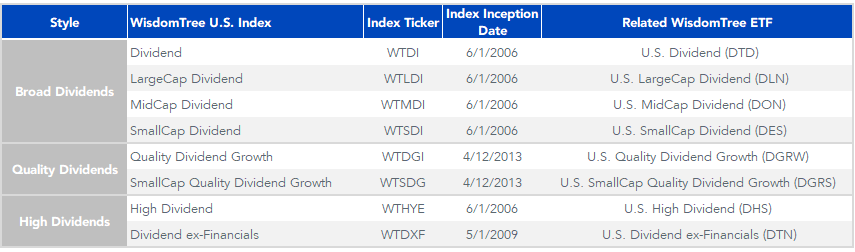

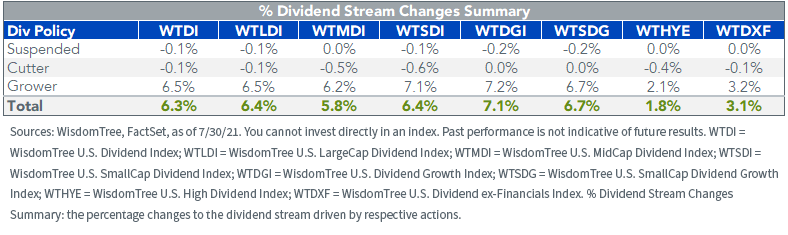

At WisdomTree, we have eight domestic dividend Indexes representing different styles of the U.S. dividend market and tracked by corresponding ETFs.

Of the 1,200 companies in the broad-market WisdomTree U.S. Dividend Index, 56% have grown their dividends this year and 44% have left them unchanged. On an aggregate basis, the annualized dollar amount paid by companies in the Index has grown by 6.3% this year.

The Index with the greatest percentage increase was the WisdomTree U.S. Quality Dividend Growth Index, which grew its dividend 7.1%, driven by growth from big Health Care/Information Technology payers.

WisdomTree Dividend Indexes

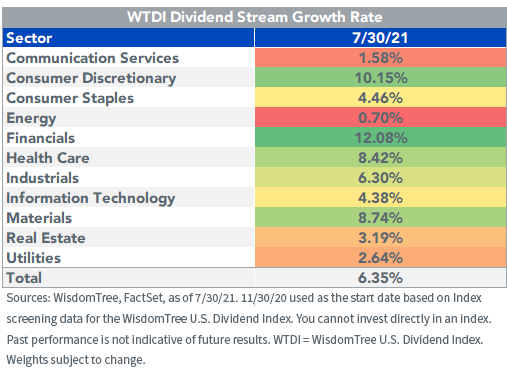

Within the WisdomTree U.S. Dividend Index, the sector with the greatest dividend growth this year is Consumer Discretionary (10.2%) and the sector with the lowest dividend growth is Energy (0.70%).

Consumer Discretionary companies have rebounded from a challenging 2020 environment in which consumers slashed discretionary spending. While rebounding oil prices have been a boon for Energy dividends, many Energy names were excluded at WisdomTree’s December rebalance due to composite risk screens and/or cancelled dividends in 2020.

WisdomTree U.S. Dividend Index (WTDI)

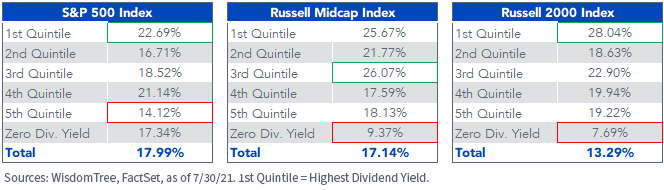

Through July of this year, the top quintile of highest-dividend payers has handily outperformed the lowest quintile and the Zero Dividend Yield category in the respective large-, mid- and small-cap indexes.

Year-to-Date Index Dividend Yield Quintiles

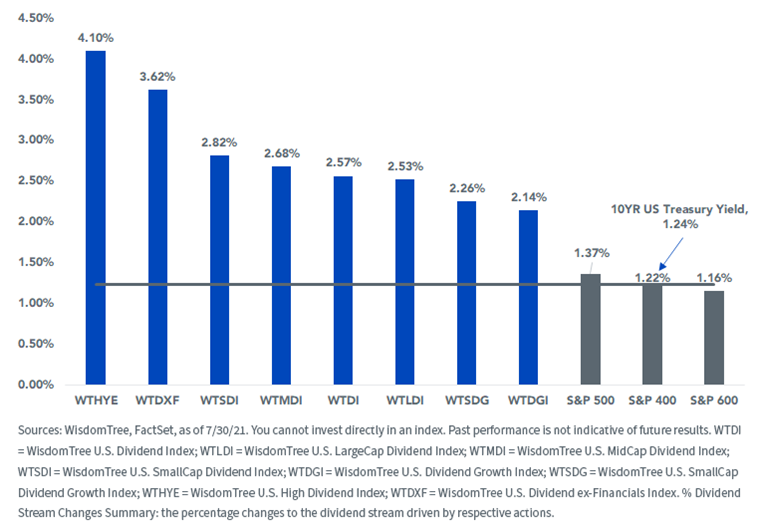

In a world of negative real yields in Treasuries, dividends can represent an increasingly attractive income replacement solution for yield-starved investors.

Indicated Dividend Yield

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Funds focusing their investments on certain sectors increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Securities that pay dividends may be out of favor with the market and underperform the overall equity market or stocks of companies that do not pay dividends. In addition, changes in the dividend policies of the companies held by the Fund or the capital resources available for such company’s dividend payments may adversely affect the Fund.

Please read each Fund’s prospectus for specific details regarding the Fund’s risk profile.