Take Me to the River

This article is relevant to financial professionals who are considering offering model portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional. Not all financial professionals have access to these Model Portfolios.

I don't know why I love you like I do

All the troubles you put me through

Sixteen candles there on my wall

And here am I the biggest fool of them all…

(From “Take Me to the River,” written by Al Green and Mabon Lewis Hodges, 1974, most famously covered by the Talking Heads, 1978)

OK, so this is about the fourth time we’ve written about trying to generate risk-controlled yield in today’s market environment. But it is the story that never grows old, so let’s try again.

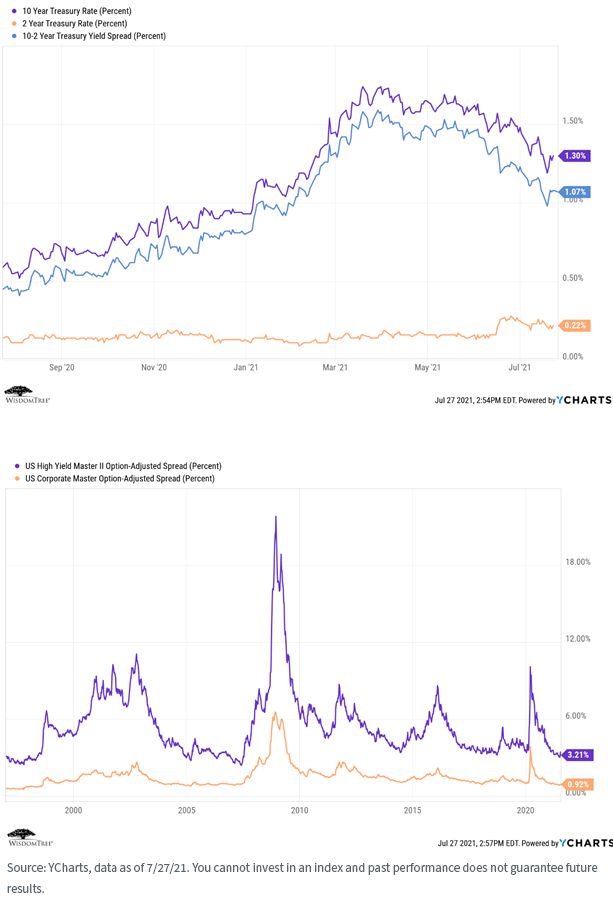

First, let’s look at rates and spreads—not much to love in either case.

For definitions of terms in the table, please visit the glossary.

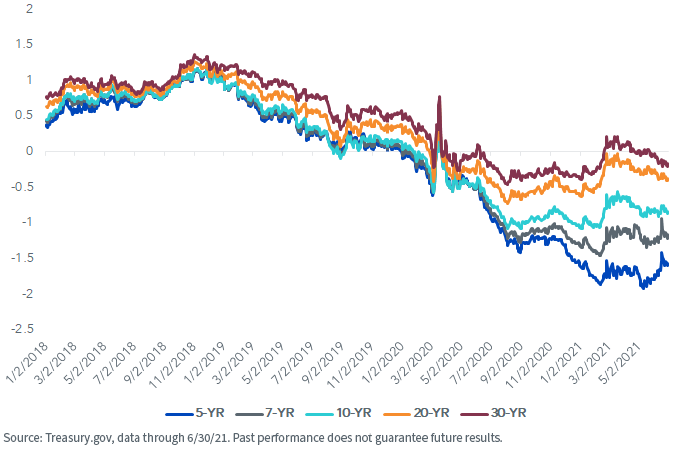

Furthermore, real yields (nominal rates minus the inflation rate) are negative across the yield curve. That is, buying Treasuries now guarantees a negative real return over the lifetime of the bond (if held to maturity). That sounds exciting, doesn’t it?

U.S. Treasury Real Yields %

Bottom line…rates are low and most likely to grind higher as the economy recovers, and spreads are historically tight. Corporate balance sheets generally are in good shape, so coupons should be safe, but there is not a lot of optimism about risk-controlled total return potential.

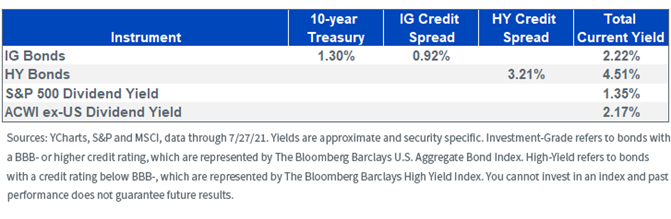

Let’s compare current fixed income yields to current equity dividend yields.

For definitions of terms in the table, please visit the glossary.

Not much to work with. Our own Model Portfolios are short duration and overweight credit, with an explicit focus on quality security selection, relative to the Bloomberg Barclays U.S. Aggregate Index (the “BarCap Agg”), but we definitely are not looking to take excessive risk in our fixed income portfolios in a “reach for yield”.

But we have some ideas.

Fixed Income Strategy Ideas

Given the challenging environment within the fixed income arena, we think it is important to emphasize a “searching for yield, not reaching for yield” approach. One area that fits this description is alternative credit, where we launched our WisdomTree Alternative Income Fund (HYIN) in May.

Until recently, alternative credit was an investment space that had been primarily limited to institutional or ultra-high net worth investors. The options tended to be more concentrated in certain sectors of publicly traded alternative credit (PACs), such as business development companies (BDCs), real estate investment trusts (REITs) or closed-end funds (CEFs). HYIN provides a way for investors to broaden and diversify their exposure within the alternative credit universe by having a vehicle that includes representation in each of the aforementioned sub-sectors.

By utilizing this diversified approach, HYIN attempts to minimize the “concentration effect,” while also avoiding over-exposure to any one individual component. With an SEC 30-day yield of 7.59% as of July 27, 2021, HYIN not only provides investors with a solution for attaining higher yields, it can also potentially smooth out performance by avoiding the heightened volatility that comes with the concentration risk that can be associated with other market cap based alternative credit vehicles.

Another potential avenue to consider is within the emerging markets corporate debt space. Oftentimes, when discussing emerging markets debt, the conversation turns to questions about local currency, or non-U.S.-dollar-based fixed income investments. The WisdomTree Emerging Markets Corporate Bond Fund (EMCB) offers investors an actively managed solution that invests in globally operating companies, which are headquartered in emerging markets, and issue debt in U.S. dollars (USD). Thus, investors are offered a different vehicle for income without the currency risk.

Another interesting attribute for EMCB is its credit quality make-up. This approach is a blend of both investment-grade and high-yield while offering an average yield to maturity of 3.93%, as of July 27, 2021, actually 2 basis points (bps) above the yield-to-worst reading of 3.91% for the benchmark Bloomberg Barclays U.S. Corporate High Yield Index, as of July 27, 2021.

The yield figure reflects the dividends and interest earned during the period, after the deduction of the Fund’s expenses. This is also referred to as the “standardized yield.” Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance data for the most recent month-end and standardized performance is available on each fund's detail page. Please click the ticker to go to the page: HYIN, EMCB.

WisdomTree shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Total returns are calculated using the daily 4:00 p.m. EST net asset value (NAV). Market price returns reflect the midpoint of the bid/ask spread as of the close of trading on the exchange where Fund shares are listed. Market price returns do not represent the returns you would receive if you traded shares at other times.

Portfolio Ideas

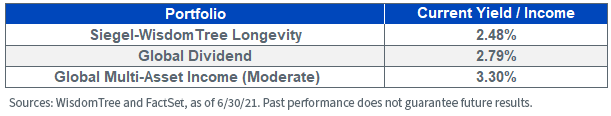

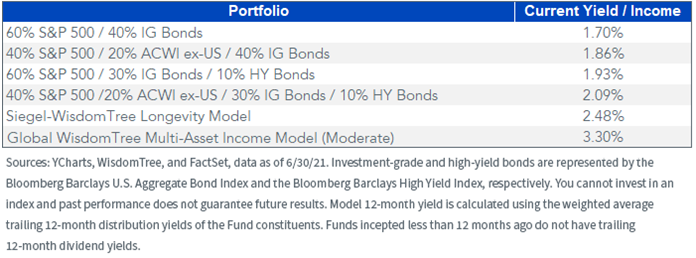

WisdomTree manages three specific Model Portfolios that are yield and income oriented—our Global Dividend, Siegel-WisdomTree Longevity and Global Multi-Asset Income Models.

Let’s take a look at the current yield of these portfolios (as of June 30, 2021)1.

For standardized performance of model portfolios in the table, please click the respective model: Siegel-WisdomTree Longevity, Global Dividend, Global Multi-Asset Income (Moderate).

And now let’s combine all this into hypothetical “typical” client portfolios.

Conclusions

Many investors are seeking current income and yield in today’s low yield environment. We think taking excessive risk in the fixed income market is the wrong place to look. We believe you can get where you want to go more safely by focusing on the global equity markets to generate yield, while still maintaining an appropriate fixed income allocation, both for income generation and as a hedge to your equity beta risk.

You can get all the details on our individual strategies and our Model Portfolios on the WisdomTree Model Adoption Center (MAC).

We hope you will take a look.

1Current Yield/Income refers to the most recently posted 12-month dividend yield, as indicated here.

Important Risks Related to this Article

Investors and their advisors should consider the investment objectives, risks, charges and expenses of the funds included in any Model Portfolio carefully before investing. This and other information can be obtained in each Fund’s prospectus by visiting www.wisdomtree.com for WisdomTree Funds. Visit the applicable third-party website for third-party funds. Please read the prospectus carefully before you invest. WisdomTree Asset Management, Inc., does not endorse and is not responsible or liable for any content or other materials made available by other ETF sponsors.

For retail Investors: WisdomTree’s Model Portfolios are not intended to constitute investment advice or investment recommendations from WisdomTree. Your investment adviser may or may not implement WisdomTree’s Model Portfolios in your account. The performance of your account may differ from the performance shown for a variety of reasons, including but not limited to: Your investment advisor, and not WisdomTree, is responsible for implementing trades in the accounts; differences in market conditions; client-imposed investment restrictions; the timing of client investments and withdrawals; fees payable; and/or other factors. WisdomTree is not responsible for determining the suitability or appropriateness of a strategy based on WisdomTree’s Model Portfolios. WisdomTree does not have investment discretion and does not place trade orders for your account. This material has been created by WisdomTree and the information included herein has not been verified by your investment adviser and may differ from information provided by your investment adviser. WisdomTree does not undertake to provide impartial investment advice or give advice in a fiduciary capacity. Further, WisdomTree receives revenue in the form of advisory fees for our exchange-traded funds and management fees for our collective investment trusts.

WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy. In providing WisdomTree Model Portfolio information, WisdomTree is not acting and has not agreed to act in an investment advisory, fiduciary or quasi-fiduciary capacity to any advisor or end client, and has no responsibility in connection therewith, and is not providing individualized investment advice to any advisor or end client, including based on or tailored to the circumstance of any advisor or end client. The Model Portfolio information is provided “as is,” without warranty of any kind, express or implied. WisdomTree is not responsible for determining the securities to be purchased, held and/or sold for any advisor or end client accounts, nor is WisdomTree responsible for determining the suitability or appropriateness of a Model Portfolio or any securities included therein for any third party, including end clients.

Advisors are solely responsible for making investment recommendations and/or decisions with respect to an end client and should consider the end client’s individual financial circumstances, investment time frame, risk tolerance level and investment goals in determining the appropriateness of a particular investment or strategy, without input from WisdomTree. WisdomTree does not have investment discretion and does not place trade orders for any end client accounts. Information and other marketing materials provided to you by WisdomTree concerning a Model Portfolio—including allocations, performance and other characteristics—may not be indicative of an end client’s actual experience from investing in one or more of the funds included in a Model Portfolio. Using an asset allocation strategy does not ensure a profit or protect against loss, and diversification does not eliminate the risk of experiencing investment losses. There is no assurance that investing in accordance with a Model Portfolio’s allocations will provide positive performance over any period. Any content or information included in or related to a WisdomTree Model Portfolio, including descriptions, allocations, data, fund details and disclosures, are subject to change and may not be altered by an advisor or other third party in any way.

WisdomTree primarily uses WisdomTree Funds in the Model Portfolios unless there is no WisdomTree Fund that is consistent with the desired asset allocation or Model Portfolio strategy. As a result, WisdomTree Model Portfolios are expected to include a substantial portion of WisdomTree Funds notwithstanding that there may be a similar fund with a higher rating, lower fees and expenses or substantially better performance. Additionally, WisdomTree and its affiliates will indirectly benefit from investments made based on the Model Portfolios through fees paid by the WisdomTree Funds to WisdomTree and its affiliates for advisory, administrative and other services.

Jeremy Siegel serves as Senior Investment Strategy Advisor to WisdomTree Investments, Inc., and its subsidiary, WisdomTree Asset Management, Inc. (“WTAM” or “WisdomTree”). He serves on the Model Portfolio Investment Committee for the Siegel-WisdomTree Model Portfolios of WisdomTree, which develops and rebalances WisdomTree's Model Portfolios. In serving as an advisor to WisdomTree in such roles, Mr. Siegel is not attempting to meet the objectives of any person, does not express opinions as to the investment merits of any particular securities and is not undertaking to provide and does not provide any individualized or personalized advice attuned or tailored to the concerns of any person.

The Siegel-WisdomTree Longevity Model Portfolio seeks to address increasing longevity by shifting the focus to potential long-term growth through a higher stock allocation versus more traditional “60/40” portfolios.

HYIN: There are risks associated with investing, including the possible loss of principal. The Fund invests in alternative credit sectors through investments in underlying closed-end investment companies (“CEFs”), including those that have elected to be regulated as business development companies (“BDCs”), and real estate investment trusts (“REITs”). The value of a CEF can decrease due to movements in the overall financial markets. BDCs generally invest in less mature private companies, which involve greater risk than well-established, publicly traded companies and are subject to high failure rates among the companies in which they invest. By investing in REITs, the Fund is exposed to the risks of owning real estate, such as decreases in real estate values, overbuilding, increased competition and other risks related to local or general economic conditions. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit, and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

EMCB: There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. Derivative investments can be volatile and these investments may be less liquid than other securities, and more sensitive to the effects of varied economic conditions.

Fixed income investments are subject to interest rate risk; their value will normally decline as interest rates rise. In addition, when interest rates fall income may decline. Fixed income investments are also subject to credit risk, the risk that the issuer of a bond will fail to pay interest and principal in a timely manner, or that negative perceptions of the issuer’s ability to make such payments will cause the price of that bond to decline. Unlike typical exchange-traded funds, there is no index that the Fund attempts to track or replicate. Thus, the ability of the Fund to achieve its objective will depend on the effectiveness of the portfolio manager. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.