The Sweet Spot in High Quality, High Capital Return Stocks

S&P Dow Jones Indices (S&P) recently released data about buybacks in the S&P 500 Index. The headline reads: “Q1 2021 S&P 500 Buybacks Double Their Post-Covid Low; Companies repurchased 36.5% more shares than in Q4 2020.”

The WisdomTree U.S. Quality Shareholder Yield Fund (QSY), which targets high-quality companies with high levels of capital return, has experienced an even greater buyback rebound than the S&P 500.

- In the first quarter of 2021, QSY’s buybacks increased 161% from the second quarter of 2020 vs. 101% reported by S&P. Quarter-over-quarter buybacks increased 41% for QSY vs. 37% for the S&P 500.

- According to S&P, roughly two-thirds (335 companies) of S&P 500 companies bought back at least $5 million in shares in the first quarter. Meanwhile, 94 of the 125 companies in QSY, or three-fourths of the Fund, executed buybacks of at least $5 million during the same period. Additionally, 27, or 22% of the companies held in QSY, reduced share count by more than 4% year over year, which compares to 6% for the S&P 500.

- Buybacks are top-heavy in the S&P 500. Per S&P, the top 20 stock repurchasers account for 53.3% of all buybacks. Twelve of those names are currently held in QSY and they were 10% of the Fund’s weight as of the end of the first quarter.

QSY — A Leading Value Fund

QSY’s 1-YR performance ranks in the top decile of funds within Morningstar’s Large Value category – it ranks in the 10th percentile of the 1214 funds included in the category, based on total returns.1

Over the trailing one-year period, QSY has returned 48.9%, outperforming the S&P 500 (35.9%) and Russell 1000 Value (37.3%) Indices by at least 1,150 basis points (bps). Year-to-date, QSY has returned 22%, outperforming the S&P 500 and the Russell 1000 Value Index, which have both returned 17%, by 500bps2.

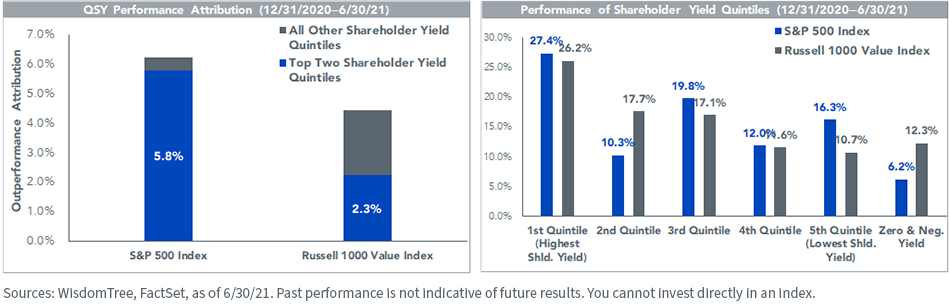

Companies in the top quintile of the S&P 500 and Russell 1000 Value index have been the top-performing subgroup year-to-date. QSY’s over-weight exposure to the high shareholder yield subgroups has driven the majority of its outperformance versus the benchmarks in the first half of 2021.

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Returns less than one year are not annualized. For current standard performance and expenses, visit www.wisdomtree.com

Lean into Quality and Shareholder Yield in the Back Half of 2021

My colleague recently wrote a great piece dissecting the quality factor and he makes a strong case, in my view, for long-term exposure to quality at the core of your portfolio. To paraphrase from Matt Wagner’s blog post, Quality 101: What it Is and Why it Works—high-quality companies have outperformed low quality stocks by 400 bps annualized, with lower down capture and downside deviation than the market3.

In theory, there should be a relatively high overlap between companies bucketed as high-quality and high capital return. Companies that are most operationally efficient (high quality) should be generating the most excess capital and therefore returning the most capital to shareholders through dividends and buybacks.

We know this does not necessarily hold true, but it is worth investigating how different reality is from theory in a follow up piece.

Part of the reason high quality is not a precondition to high capital return is because most industries do not have rules requiring that be the case, but some highly regulated industries do. U.S. banks are a good example of an industry where annual stress tests precede capital returns.

The Federal Reserve recently removed restrictions on bank dividends and buybacks, which were put in place in the wake of the COVID-19 pandemic. This development was not only a vote of confidence in the U.S. economic recovery but also a positive catalyst toward a return to pre-COVID levels of capital return across sectors.

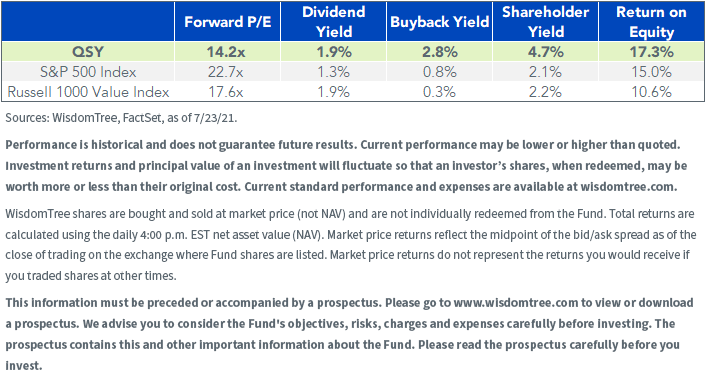

As the U.S. economy recovers, we view QSY as well positioned in a high quality, high capital return sweet spot. Today’s case for QSY three-pronged and compelling—QSY offers investors 1) higher quality and 2) higher capital return, at a 3) discounted valuation relative to benchmark indexes.

For standardized performance and 30-day SEC yield please click here.

1 Source: Morningstar. Past performance is not indicative of future results. QSY's 5-Yr performance ranks in the 6th percentile out of 1016 Large Value funds based on total returns as of 6/30/2021.

2 Performance for the period 12/31/20–7/21/21. QSY performance at NAV. Past performance is not indicative of future results.

3 Source: WisdomTree, Kenneth French Data Library, 6/30/1963-5/31/2021.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Funds focusing their investments on certain sectors increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. While the Fund is actively managed, the Fund’s investment process is expected to be heavily dependent on quantitative models and the models may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Morningstar, Inc., 2019. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance, rankings and ratings are no guarantee of future results. The % of Peer Group Beaten is the funds’ total-return percentile rank compared to all funds within the same Morningstar Category and is subject to change each month.