A Mid-Year Economic and Market Outlook in 10 Charts or Less

“I just dropped in to see what condition my condition was in”

(By Kenny Rogers & The First Edition, 1967)

When reviewing the current state of the global economy and investment markets, we recommend focusing on market signals and weeding out market noise. We believe the five primary economic and market signals that may provide perspective on where we go from here are GDP growth, earnings, interest rates, inflation and central bank policy.

GDP Growth

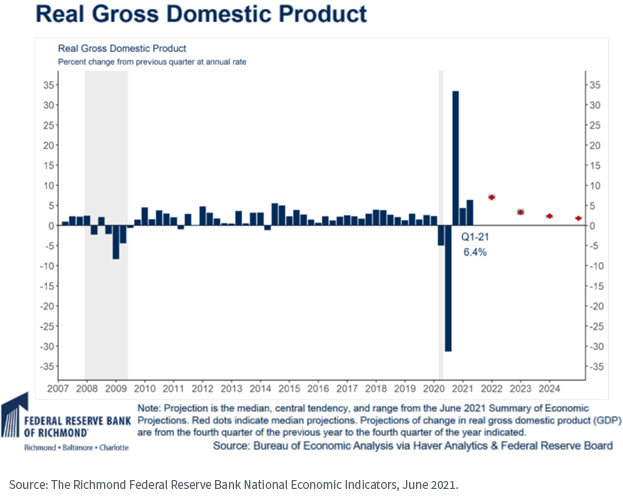

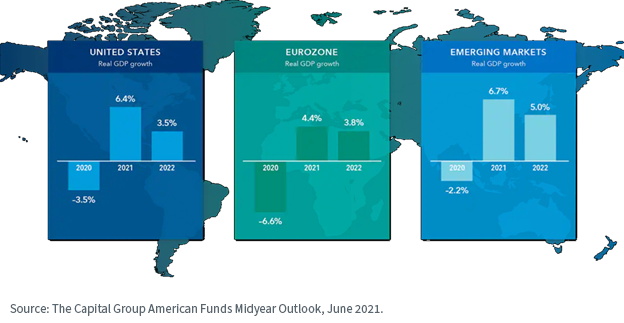

Global growth is expected to accelerate over the course of 2021. As of July 20, the Atlanta Fed’s “GDPNow” estimate for Q2 growth was 7.6%, while the Richmond Fed estimated overall GDP growth for 2021 will be between 7% and 9% (with no assumptions about additional fiscal stimulus).

Economic growth outside the U.S. is expected to be even higher, especially in emerging and developing economies. Part of the story (either positive or negative) will be the continued rollout of COVID-19 vaccines and new emerging strains of the virus. Many parts of the world, especially Asia and Latin America, currently face significant COVID-related headwinds, though perhaps the worst is behind them.

Translation: A continued positive environment for “risk on” assets, especially as vaccination rates increase.

Earnings

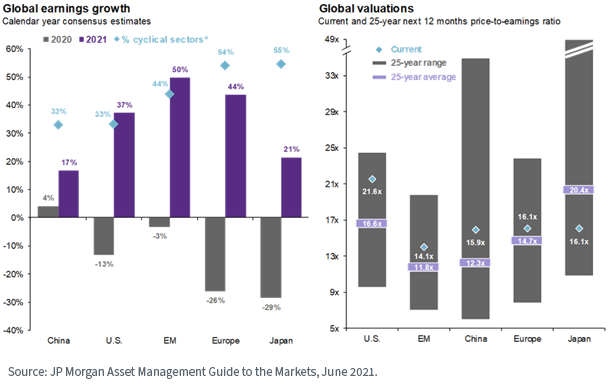

Global earnings growth is expected to be strong as we move through 2021, especially in cyclical sectors, as the global economy re-expands.

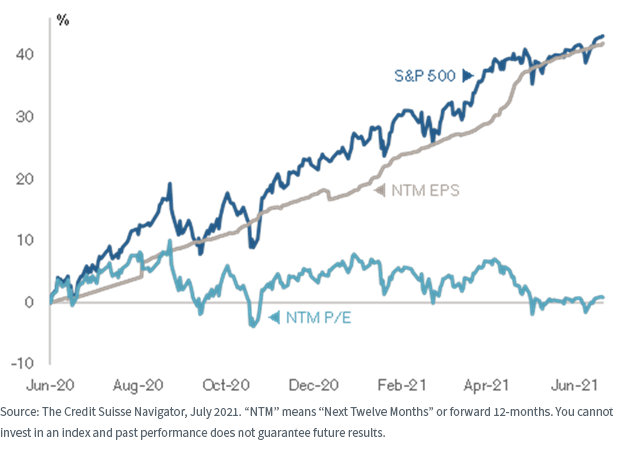

Despite steadily rising equity prices, these strong earnings numbers have acted as a counterbalance to valuations. While valuations are high, and most asset classes do not look especially cheap right now, they haven’t moved much despite the rally in prices.

Translation: A continued positive environment for global risk assets. There has been a dramatic factor rotation over the course of 2021. In Q1 (as interest rates rose), markets were led by value, size (small caps) and dividends. As rates fell over the course of Q2, we witnessed a rotation back toward large-cap and growth stocks. This is exactly why we diversify our Model Portfolios at both the asset class and risk factor levels.

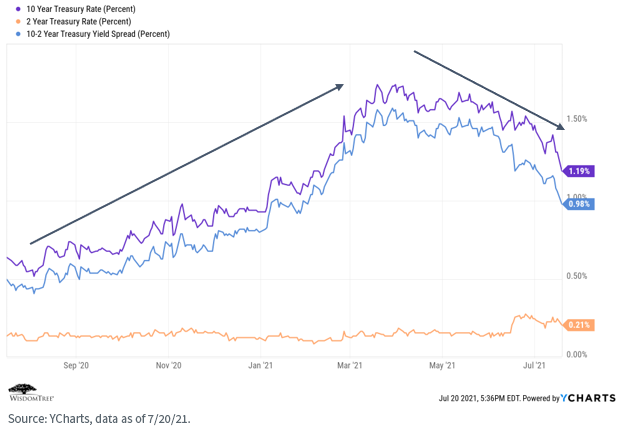

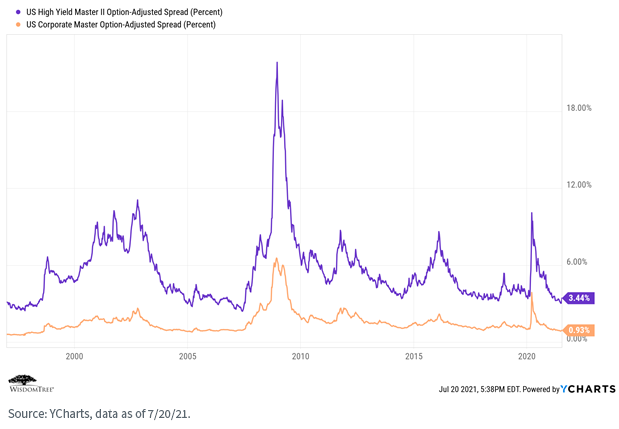

Interest Rates & Spreads

Despite the recent tumble in rates, driven by renewed concerns surrounding the COVID-19 delta variant, we maintain our outlook that rates will grind higher from here as the economy improves and inflation picks up. In addition, credit spreads are at tight levels that we have rarely seen over the past 10 years.

This will continue to make fixed income a difficult place to generate yield in a risk-controlled manner.

For definitions of indexes in the chart, please visit our glossary.

For definitions of indexes in the chart, please visit our glossary.

Translation: We maintain our positioning of being under-weight duration and over-weight credit relative to the Barclays U.S. Aggregate Bond Index, with a focus on quality security selection, especially in high yield. This also continues to play into our “Quality and Income” investment theme for 2021.

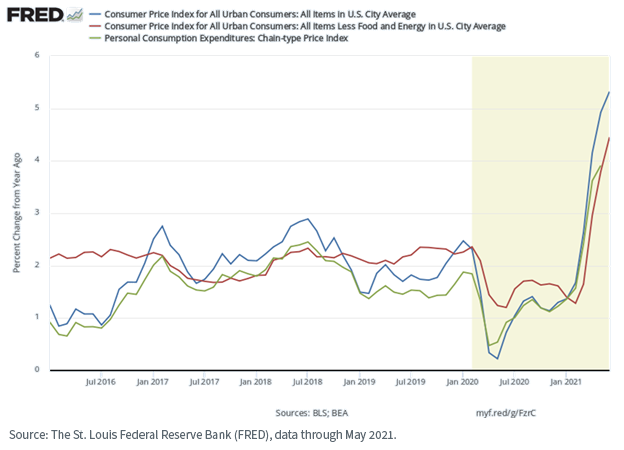

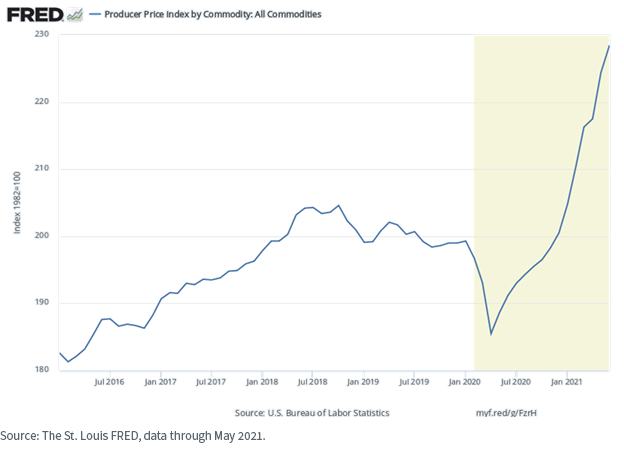

Inflation

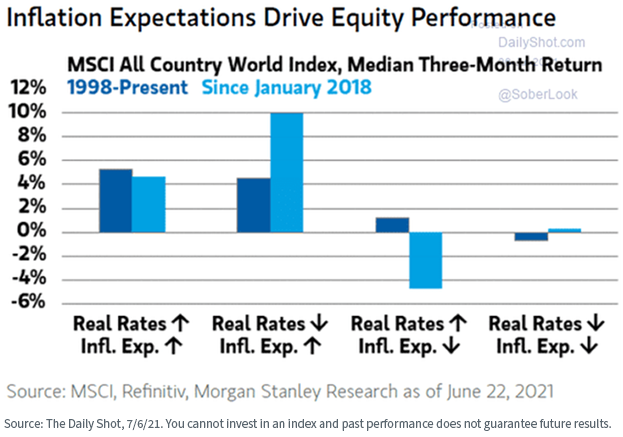

Inflation is a market buzzword right now, and the market seems to fall into one of two camps. One camp (including the Fed) believes that the current high levels of inflation are “transitory” in nature and subject to significant “base effects” (i.e., the year-over-year numbers look alarming because at this time last year inflation was, essentially, zero). The other camp believes that higher wages and higher input prices will continue as the global economy continues to recover. We generally tend to fall into the latter camp.

Translation: A generally positive environment for risk assets, and very supportive of our “Reflation” investment theme for 2021. Historically, the markets have shown they can handle moderate levels of inflation, and we believe it would only be a problem if it spikes much higher and faster than expected.

Central Bank Policy

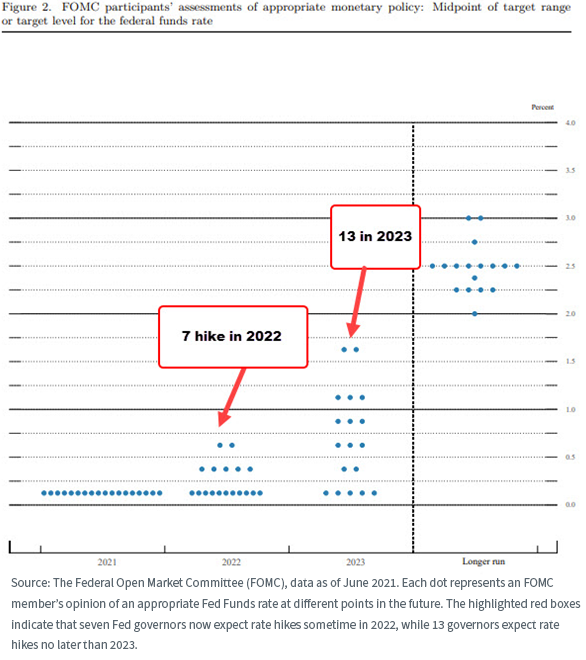

While the U.S. Fed continues to signal that it will remain accommodative into the foreseeable future, we are beginning to see increased divergence of opinion as to when it will be appropriate to begin raising rates again (with some Fed governors now voting for some time in 2022). The Fed itself describes it as “thinking about thinking about” tapering sooner than previously signaled. If the U.S. economic data continues to come in as expected, it looks increasingly likely the Fed will make some sort of tapering announcement later this year.

Translation: A generally positive environment for risk assets, though this increasing divergence of opinion regarding inflation and tapering bears watching.

The “Known Unknowns”

While the market signals we follow generally point to constructive economic and market conditions for the rest of 2021, conditions are always subject to exogenous events. The ones we can identify but whose outcomes we cannot foresee, we refer to as “known unknowns.”

As we write this in late July, the known unknowns we can identify include:

- The outcome of ongoing additional infrastructure/fiscal stimulus negotiations. At this point it appears we will see a large infrastructure package passed with at least minimal bi-partisan support, but all bets are off on additional stimulus without a straight party-line reconciliation vote.

- The impact of proposed increases to taxes and regulation in the U.S.

- The future direction of the relationships between the U.S. and China, Iran and Russia, which remain rocky. There currently are high levels of bi-partisan animosity in the U.S toward China (though perhaps each party has different reasons).

- The evolution of both COVID-19 variants and vaccination rates/effectiveness.

Summary

When focusing on what we believe are the primary market signals, the “condition our condition is in” remains relatively healthy, and we maintain our position that 2021 will enjoy a generally positive economic and market environment. But there are some significant known unknowns out there that could dramatically influence global conditions, either positively or negatively.

So, while we are optimistic in our outlook for 2021, we continue to recommend focusing on a longer-term time horizon and the construction of “all weather” portfolios, diversified at both the asset class and risk factor levels.