Intro to Bitcoin: Basics of Conversations

WELCOME TO THE OFFICE HOURS RECAP BLOG ON DIGITAL ASSETS

The following conversational snippets, interactive poll questions, participant responses and other illuminating moments were mined from our session with Jason Guthrie, Matt Kress and Jeremy Schwartz. If you’re an investor, enjoy this and our other entertaining recaps and explore our website for ongoing education on cryptocurrency investing. If you’re a financial professional who didn’t participate in this edition of Office Hours, we invite you to attend our next informative and engaging session.

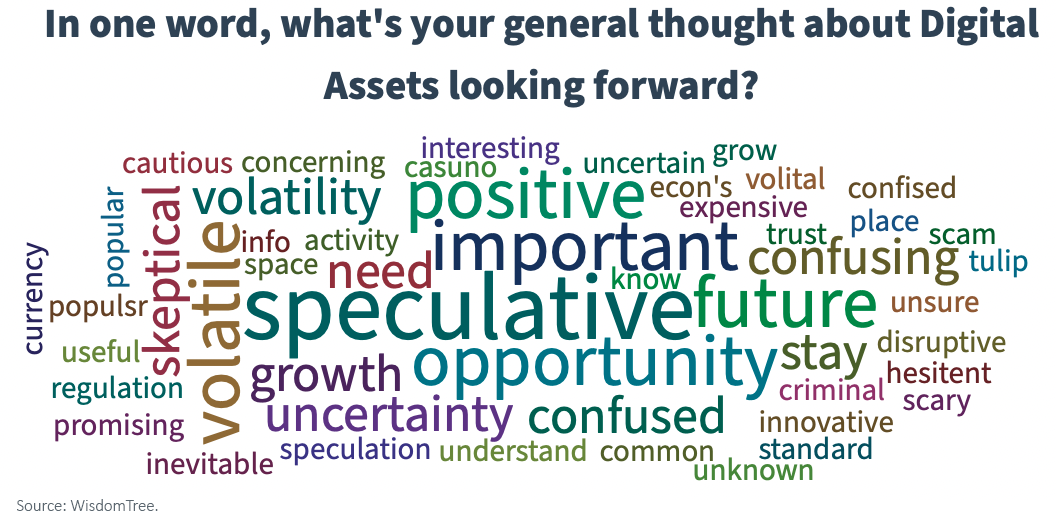

Interactive smartphone poll question:

In one word, how do you feel about digital assets moving forward?

Sample participant answers: Positive...growth...confused...opportunity...important…future...disruptive...inevitable.

72% of advisors think their clients may be investing in cryptocurrencies on their own. But how much do you know about the topic? Our goal is to educate both advisors and investors—so advisors can bring more value to their advisory relationships, and investors can move comfortably through this new investing space.

So let’s start at the beginning. In 2008, unknown developers using the pseudonym Satoshi Nakamoto created a whitepaper introducing the concept of blockchain, a revolutionary idea that decentralized how we transfer value. This ability to transfer value from peer to peer on the Internet, without centralized authorities, has grown into a rich and diverse ecosystem of clever ideas attracting significant capital investment. The pace at which this space is developing is overwhelming—like it's 1994 again and we're witnessing the birth of the Internet. Back then, we couldn’t have predicted the rise of an Amazon or a Google, but we all knew this revolutionary innovation was destined to change how we shared information and lived. Barely 25 years later, it’s second nature to “Google it” the moment we need to know something. In the next 10 or 15 years, seismic changes like that may be coming to the way we share value, thanks to the peer-to-peer transfer concept of blockchain and the cryptocurrencies it has spawned, such as Bitcoin and Ethereum.

“The investment case is a classic supply-demand story.” With only a fixed amount of supply, the question is, what is the demand? How many people are coming to the ecosystem? This is a tough question to answer. Where are you on the adoption curve to create demand for this asset class? That’s the question.

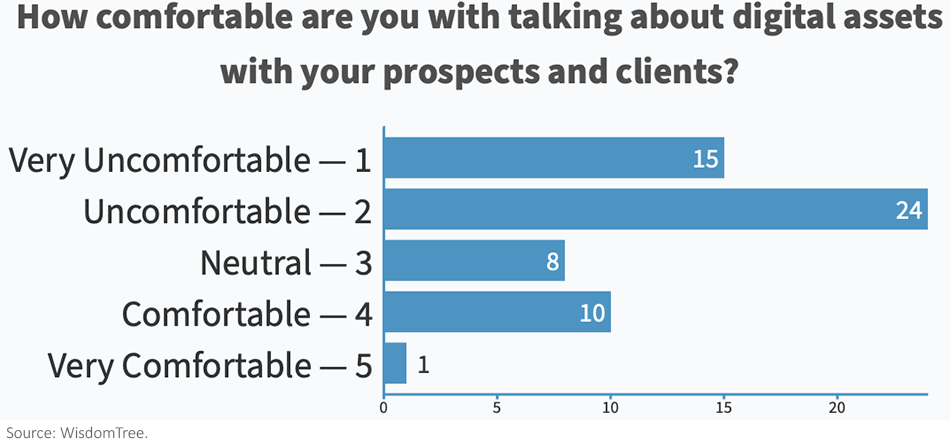

Interactive smartphone poll question:

On a scale of 1 to 5, how comfortable are you discussing digital assets with your clients? Participating Office Hours advisors leaned heavily toward the “uncomfortable” category, emphasizing the importance of crypto education now.

“What’s the difference between cryptocurrencies and blockchain technology?” Essentially, Blockchain is the underlying technology that supports a given cryptocurrency, and the type of cryptocurrency is the unit of value being spent. Without going heavily into detail, a blockchain bolts together existing technologies—such as cybersecurity, encryption and cryptography techniques—to create a user-efficient , trustless, decentralized method of transferring value.

Example #1: Think about when you send a photo or PowerPoint file over the Internet. You’re really just sending a copy, because the original stays with you. What you’re sending are the ones and zeros that make up that file. Now, a copy is perfectly fine for a PowerPoint or photo. But it’s not very good if you’re sending someone $1,000 —because a copy of that $1,000 could be spent again. That's why we've had to trust big institutions like banks to do the accounting for us.

Example #2: Now consider how you buy a cup of coffee. When you tap or insert your card at Starbucks, for example, you're not actually giving Starbucks your money, right? You're sending a message to your bank to take money from your account and put it in the account at Starbucks' bank. And as soon as that message is approved, Starbucks gives you the coffee. What the blockchain technology did was create the ability to send value digitally, without the possibility of double spending. It also gave investors the ability to constantly see where that value sits, without having to trust another party in the network.

That’s an overview of how value flows safely through a digital network without relying on big institutions to be gatekeepers.

Did you know? Each blockchain network and cryptocurrency has three elements:

The software, which is the protocol. The parties involved, which are the network. The transferable unit of value, which are the tokens.

“What is ‘mining for bitcoin’”? Again, without getting too detailed, mining for Bitcoin is the act of processing the next set of transactions to be added to the blockchain -- that is, added to the history of transactions made with that particular cryptocurrency, whether it’s Bitcoin, Etherium or one of the other large players like XRT, Stellar and Tether. A series of cryptographic formulas link those transactions into a chain using a series of random numbers that are very easy to verify, but very hard to replicate. So if someone has the correct number for their transaction, and the network agrees it’s the correct number, that block becomes locked in.

“What if a criminal wanted to go back and falsify a transaction?” They would have to retrace the cryptography used to mine each block in the chain, each number that cumulatively assembled that history. The cryptographic effort and energy that goes into mining each block secures it by making it exceptionally difficult to change. At the same time it’s easily verified by everyone else in the network, so we can all be comfortable with our transfers of value. That concept is called “proof of work” in Bitcoin, and is parallel to but different from “proof of stake” used in Ethereum. We can explore that level of detail more in another session.

“Bitcoin lost a ton of value over the FBI ransomware story. Aren’t the transactions supposed to be anonymous?” After the FBI seized Bitcoin from hackers who attacked the Colonial Pipeline, the stock fell 70%. (WT note: We did a blog post on that, and a podcast with cyberspace venture capitalists Team8, an industrial software group and our Chief Information Officer). The public questioned if Bitcoin transactions, which were believed to be anonymous, actually leave investors vulnerable to ransomware. One of the things we said on the podcast is that it’s not really an anonymous process. While it may be hard to track overnight, there is a record of your transactions over time. The FBI followed the money and were able to get the private key—the cryptographically generated result we talked about earlier—to seize and return the Bitcoin to Colonial. That chain data is actually an asset, a very powerful tool for law enforcement. But does it making it easier for criminals to get away with your funds? No, it doesn’t. The truth is, most illicit activity is still done in $100 bills, not cryptocurrency. New technologies always have to prove themselves. There was a lot of criticism leveled at the Internet early on as well. Once it proved its value to everyone, most of those concerns fell away.

Did you know? Bitcoin has a 10-year transaction history that anyone can audit.

Potentially hundreds of thousands of people have gone through the bitcoin code over the last decade. The transparency shows it functions as intended.

“Should I be worried about getting money out of exchanges?” As with anyone you deal within in financial services, you need to be cognizant of counterparty risk exposure and concentration. If you can’t find a lot of details on a company’s structure or founders, that may potentially be a red flag. There are plenty of listed, regulated entities offering services for crypto. It's important to make sure you're vetting that appropriately.

“What happens if the Internet goes down?”

The Internet doesn’t run on some single node, it’s decentralized. For the World Wide Web to go down, every section would have to go down at the same time, which has an extremely low probability. But if your particular section of the Web does goes down and your cryptocurrency validator or miner is down, they will reconnect and sync with their protocol when they come back online. Interestingly, there are companies out there, from SpaceX to JPMorgan and others, that are running Ethereum and Bitcoin blockchain nodes on satellites. Four crypto companies already have a presence on the International Space Station, and others are pushing to join them. So in the highly, highly unlikely event the entire Internet on earth goes down, there's already a redundancy up in space for that.

Want to learn more about digital assets? Whether you’re a financial professional or an investor, you can go to WisdomTree.com/crypto.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Crypto assets, such as bitcoin and ether, are complex, generally exhibit extreme price volatility and unpredictability, and should be viewed as highly speculative assets. Crypto assets are frequently referred to as crypto “currencies,” but they typically operate without central authority or banks, are not backed by any government or issuing entity (i.e., no right of recourse), have no government or insurance protections, are not legal tender and have limited or no usability as compared to fiat currencies. Federal, state or foreign governments may restrict the use, transfer, exchange and value of crypto assets, and regulation in the U.S. and worldwide is still developing.

Crypto asset exchanges and/or settlement facilities may stop operating, permanently shut down or experience issues due to security breaches, fraud, insolvency, market manipulation, market surveillance, KYC/AML (know your customer/anti-money laundering) procedures, non-compliance with applicable rules and regulations, technical glitches, hackers, malware or other reasons, which could negatively impact the price of any cryptocurrency traded on such exchanges or reliant on a settlement facility or otherwise may prevent access or use of the crypto asset. Crypto assets can experience unique events, such as forks or airdrops, which can impact the value and functionality of the crypto asset.

Crypto asset transactions are generally irreversible, which means that a crypto asset may be unrecoverable in instances where: (i) it is sent to an incorrect address, (ii) the incorrect amount is sent, or (iii) transactions are made fraudulently from an account. A crypto asset may decline in popularity, acceptance or use, thereby impairing its price, and the price of a crypto asset may also be impacted by the transactions of a small number of holders of such crypto asset. Crypto assets may be difficult to value and valuations, even for the same crypto asset, may differ significantly by pricing source or otherwise be suspect due to market fragmentation, illiquidity, volatility and the potential for manipulation. Crypto assets generally rely on blockchain technology and blockchain technology is a relatively new and untested technology which operates as a distributed ledger. Blockchain systems could be subject to Internet connectivity disruptions, consensus failures or cybersecurity attacks, and the date or time that you initiate a transaction may be different then when it is recorded on the blockchain. Access to a given blockchain requires an individualized key, which, if compromised, could result in loss due to theft, destruction or inaccessibility.

In addition, different crypto assets exhibit different characteristics, use cases and risk profiles. Information provided by WisdomTree regarding digital assets, crypto assets or blockchain networks should not be considered or relied upon as investment or other advice, as a recommendation from WisdomTree, including regarding the use or suitability of any particular digital asset, crypto asset, blockchain network or any particular strategy. WisdomTree is not acting and has not agreed to act in an investment advisory, fiduciary or quasi-fiduciary capacity to any advisor, end client or investor, and has no responsibility in connection therewith, with respect to any digital assets, crypto assets or blockchain networks.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.

Jason Guthrie is Head of Digital Assets for WisdomTree in Europe. Guthrie oversees WisdomTree’s digital assets efforts which include bringing new products to market, identifying opportunities to enhance existing products, driving distributions strategies, and leading on client education and engagement on cryptocurrencies. He is responsible for efforts beyond the traditional product set and is actively pushing the digital asset agenda by pursuing alternative and strategic projects.

Previously Guthrie was head of Capital Markets for WisdomTree in Europe for 4 years, where his team was responsible for ensuring clients had a smooth trade execution experience. Prior to joining WisdomTree, Guthrie worked at Deutsche Bank’s ETF Capital Markets group as well as Macquarie Bank as an Investment Executive based in Sydney, Australia. Jason holds a Bachelor of Commerce (Finance) from Macquarie University in Sydney.