What’s Behind the Drop in the Treasury 10-Year Yield?

That’s the BIG question as we start Q3. A variety of reasons have been floated thus far to try and explain the recent decline in the U.S. Treasury (UST) 10-Year yield, and for good reason. That’s because this development was not widely anticipated, to say the least. So, let’s break it down and take a look at which explanations “hold water” and which fall into the “don’t believe the hype” category.

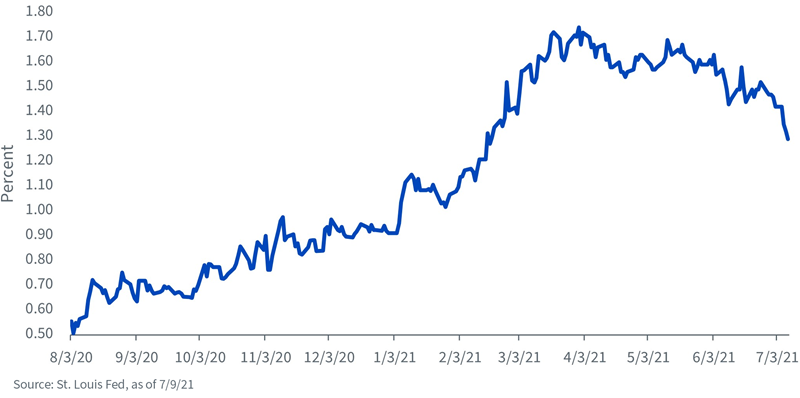

Before we get to that analysis, how about we outline just what did occur with the UST 10-Year yield? After hitting a peak reading of about 1.75% to end Q1 of this year, the 10-Year found a trading range of roughly 1.50% to 1.75% in Q2. Indeed, as recently as June 28, the UST 10-Year yield closed at 1.52%. However, in the subsequent period the yield then plummeted, hitting 1.29% on July 8. It is this decline that this blog post is all about.

U.S. 10-Year Treasury Yield

Some of the key reasons that have been floated for this decrease include: flight to quality/growth concerns arising from the Delta variant of COVID-19; a “hawkish” shift from the Fed, whereby it pursues an “exit strategy” (tapering, first rate hike) too soon; and a Treasury that has been aggressively paying down net issuance of debt.

Upon further review, I believe the decline in the UST 10-Year yield has actually been more “technical” in nature. Admittedly, the last leg to the downside may have had a “flight to quality” feel to it, but it didn’t appear to be the integral catalyst behind the downward move. To be sure, if there really were major concerns, wouldn’t risk assets have sold off as well? In the bond market, U.S. investment-grade and high-yield spreads remained at their respective “tights,” while the S&P 500 was hovering near its recent high watermark.

In my opinion, “short” positions (expectations of a further increase in yield) capitulated and had to be reversed. There is also an enormous amount of cash that continues to look for a home, and U.S. Treasuries are essentially the “best house in a bad neighborhood” with respect to yields available. In addition, key technical support/resistance levels were eclipsed, providing further momentum to the downside. As far as the Fed aspect, consider this: The UST 10-Year yield actually rose nearly 10 bps in the immediate aftermath of the June FOMC meeting.

Finally, yes, Treasury has pared down net issuance thus far in 2021. However, it has been essentially all in t-bills (more than $700 billion), as coupon sizes, like the 10-Year for example, have actually increased by $14 billion as compared to early 2020.

Conclusion

So, back to my opening remarks: “Don’t believe the hype.” The same forces (solid post-pandemic recovery, elevated inflation concerns) that pushed the UST 10-Year yield to higher ground earlier this year have not gone away. And, don’t forget the Fed…