Factor, Factor, Gimme the News

This article is relevant to financial professionals who are considering offering model portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional. Not all financial professionals have access to these Model Portfolios.

Doctor Doctor, gimme the news

I got a bad case of lovin' you

No pill's gonna cure my ill

I got a bad case of lovin' you

(From “Bad Case of Loving You (Doctor, Doctor)”, by Robert Palmer, 1979)

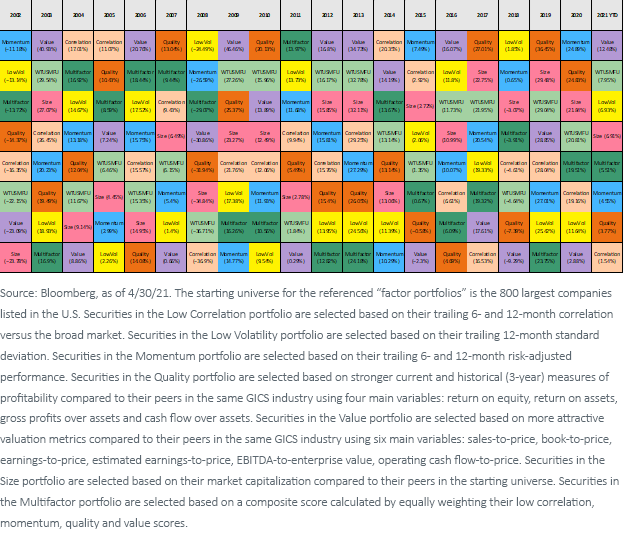

We last visited the topic of factor diversification roughly a year ago. Most investors are seemingly very familiar with the visual of an asset class “performance quilt,” which highlights the importance of asset class diversification.

But what we believe is equally as important as asset class diversification is risk factor diversification. One way to think about asset classes is that they are simply convenient and investable bundles of different risk factors. This is one explanation for why asset allocation doesn’t provide as much downside protection during market disruptions as many advisors and end clients expect.

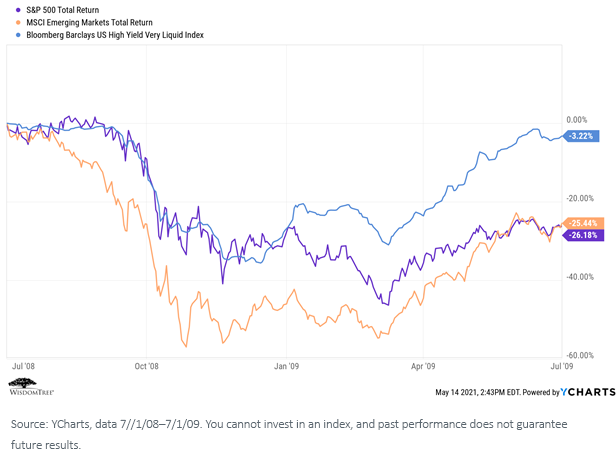

Consider the simplistic example of U.S. large-cap stocks, emerging market stocks and high-yield bonds. Three very different asset classes, to be sure. But here is how they all performed during the worst of the global financial crisis.

Looks pretty similar. How about during the early days of the COVID-19 pandemic last year?

Again, very similar. Why is that? Because all three very different asset classes are highly exposed to the equity risk factor. Three different asset classes, but with very similar factor exposures.

That’s why all WisdomTree Model Portfolios are diversified at both the asset class AND risk factor levels. We believe this helps deliver a better level of diversification and, therefore, more consistent performance over full market cycles.

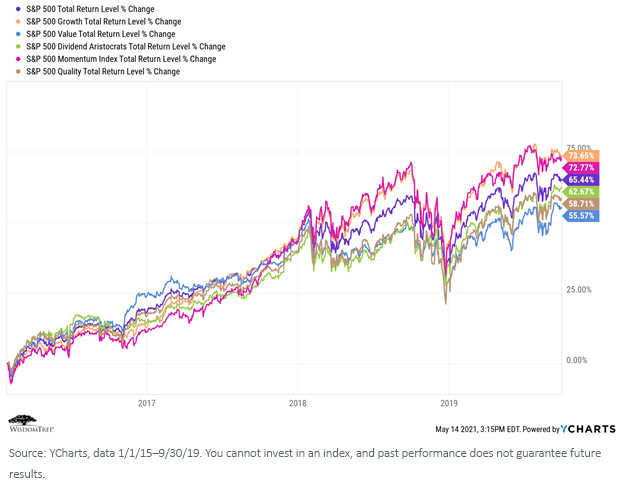

Take a look at the factor dominance under two different environments. First, let’s look at January 1, 2015, until September 30, 2019.

It seems to be all growth and momentum, all the time. Value, quality and dividends were in the caboose of the train.

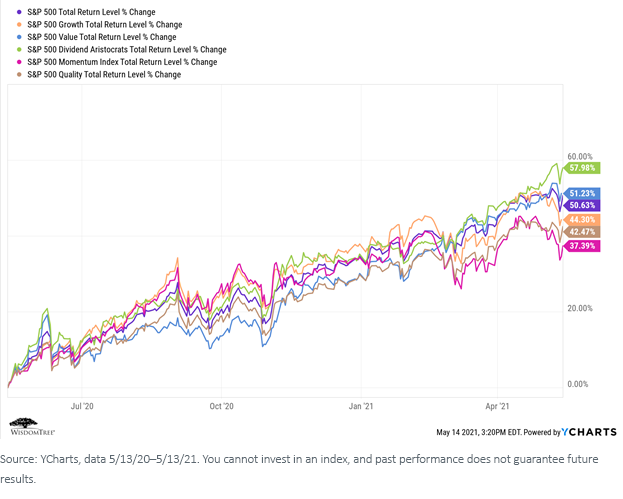

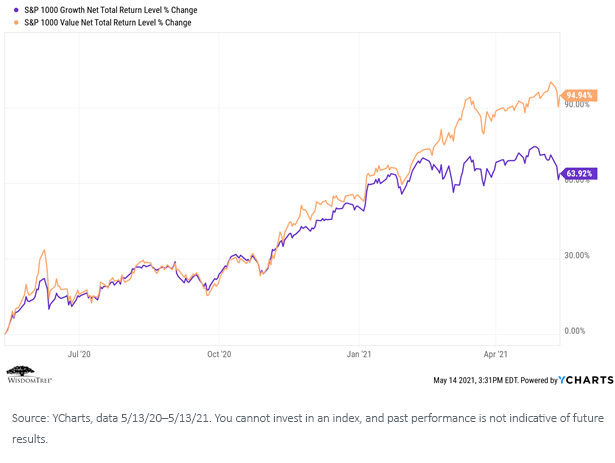

Compare that to the past 12 months. It appears dividends and value have driven performance, while growth and momentum have moved to the rear of the bus.

The point we’re trying to make is that it is just as difficult to predict factor rotation as it is asset class rotation. We’re not sure anyone predicted the massive factor rotation back toward small caps and value that occurred after the Pfizer vaccine announcement came out last November (though, given that many WisdomTree products have a value or size “tilt” to them, we certainly have enjoyed it). Value stocks in particular have roared back.

This is why we favor factor diversification as well as asset class diversification in all our Model Portfolios. We cannot guess factor rotation, which can happen quickly, so we build portfolios with diversified factor exposure.

Conclusions

All publicly available WisdomTree Model Portfolios have certain common characteristics:

- They are global in nature;

- They are diversified at both the asset class and risk factor levels;

- They are ETF-focused, to optimize fees and taxes; and

- We charge no strategist fee for them.

We are an open-architecture shop—that is, all our Models include both WisdomTree and third-party products—for many reasons: (a) it’s simply the right thing to do, (b) it’s what end clients assume, and advisors expect, and (c) it allows us to build more risk factor-diversified portfolios.

Asset class diversification is boring. We don’t mean it’s uninteresting, just that the whole point is, to use a golf expression, to keep the ball in the middle of the fairway. The power of compounding is immense—as Albert Einstein is credited with suggesting, “Compound interest is the most powerful force in the universe.”

What that means is that if you don’t lose as much in down markets, you don’t need to gain as much in up markets to still come out ahead.

We firmly believe risk factor diversification is a means to that end.

Important Risks Related to this Article

Neither diversification nor using an asset allocation strategy assures a profit or protects against loss.

WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy. In providing WisdomTree Model Portfolio information, WisdomTree is not acting and has not agreed to act in an investment advisory, fiduciary or quasi-fiduciary capacity to any advisor or end client, and has no responsibility in connection therewith, and is not providing individualized investment advice to any advisor or end client, including based on or tailored to the circumstance of any advisor or end client. The Model Portfolio information is provided “as is,” without warranty of any kind, express or implied. WisdomTree is not responsible for determining the securities to be purchased, held and/or sold for any advisor or end client accounts, nor is WisdomTree responsible for determining the suitability or appropriateness of a Model Portfolio or any securities included therein for any third party, including end clients.

Advisors are solely responsible for making investment recommendations and/or decisions with respect to an end client and should consider the end client’s individual financial circumstances, investment time frame, risk tolerance level and investment goals in determining the appropriateness of a particular investment or strategy, without input from WisdomTree. WisdomTree does not have investment discretion and does not place trade orders for any end client accounts. Information and other marketing materials provided to you by WisdomTree concerning a Model Portfolio—including allocations, performance and other characteristics—may not be indicative of an end client’s actual experience from investing in one or more of the funds included in a Model Portfolio. Using an asset allocation strategy does not ensure a profit or protect against loss, and diversification does not eliminate the risk of experiencing investment losses. There is no assurance that investing in accordance with a Model Portfolio’s allocations will provide positive performance over any period. Any content or information included in or related to a WisdomTree Model Portfolio, including descriptions, allocations, data, fund details and disclosures, are subject to change and may not be altered by an advisor or other third party in any way.

WisdomTree primarily uses WisdomTree Funds in the Model Portfolios unless there is no WisdomTree Fund that is consistent with the desired asset allocation or Model Portfolio strategy. As a result, WisdomTree Model Portfolios are expected to include a substantial portion of WisdomTree Funds notwithstanding that there may be a similar fund with a higher rating, lower fees and expenses or substantially better performance. Additionally, WisdomTree and its affiliates will indirectly benefit from investments made based on the Model Portfolios through fees paid by the WisdomTree Funds to WisdomTree and its affiliates for advisory, administrative and other services.

References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.