Solving the Portfolio Paradox: WisdomTree’s Efficient Core Funds

There’s a paradox in portfolio construction.

Traditionally, investor portfolios contained dedicated allocations to equities and fixed income, seeking capital appreciation provided by the former and risk mitigation provided by the latter.

The inherent trade-off between risk and return created the foundation for the portfolio management industry and prompted the timeless question: “How can I grow my investments during bull markets while seeking to mitigate risk during bear markets?”

Opportunity Costs

Historically, an allocation to one asset came at the expense of the other’s benefits. Investors intent on growing their portfolios may be comfortable adopting more equity exposure to participate further in market rallies. But risk-averse investors dread the thought of losing investment value during a market correction, and steer toward the perceived safety and income generation historically provided by fixed income.

Likewise, large drawdowns are difficult to overcome and waste time that is better spent continuing to grow investments instead of attempting to recover.

Consider an investor that loses 50% of portfolio value in one period due to severe market volatility. That same portfolio then needs to double in value just to restore the value it had before the initial market shock.

Thus, the portfolio paradox was born: equity upside coupled with downside risk mitigation seems fundamentally incompatible.

Buy 10, Get 60

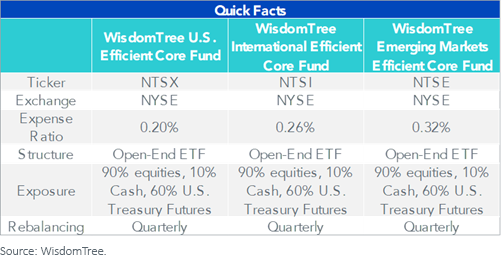

WisdomTree developed a potential solution to this mystery in 2018 with the launch of the WisdomTree U.S. Efficient Core Fund (NTSX), offering a way to participate in equity bull markets with the potential to reduce drawdowns during sharp, sudden reversals.

The WisdomTree U.S. Efficient Core Fund gains equity exposure by investing 90% of assets in the 500 largest U.S. stocks by market capitalization, with the remaining 10% cash used to collateralize 60% notional exposure to laddered U.S. Treasury futures. This means that investors can receive more fixed income exposure than the would normally receive if they invested in U.S. Treasury Bonds directly.

The result is a capital efficient strategy, where investors can achieve the potential drawdown protection offered by fixed income without dollar-for-dollar exposure or sacrificing equity allocations.

There’s a compelling investment thesis for overlaying U.S. Treasury futures over an equity-dominant strategy in pursuit of risk mitigation.

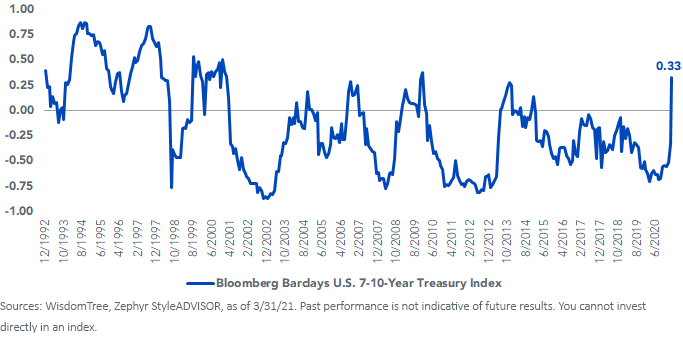

Historically, intermediate U.S. Treasuries have exhibited reduced correlations across market cycles to U.S. equities (proxied by the S&P 500 Index), validating that fixed income can potentially be an effective diversifier for equity exposures. On a rolling 12-month basis, return correlations are often consistently negative as well.

Rolling 12-Month Correlation to S&P 500 Index

But there’s more to the story. The diversification benefit does not suddenly cease as soon as you look to invest abroad. In fact, it often holds up as well as it does in the U.S.

New Markets, Similar Results

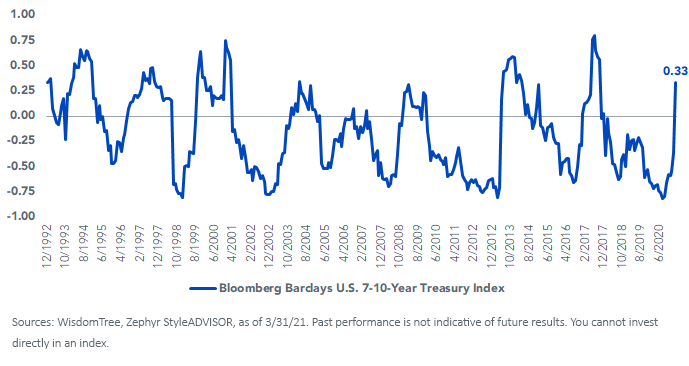

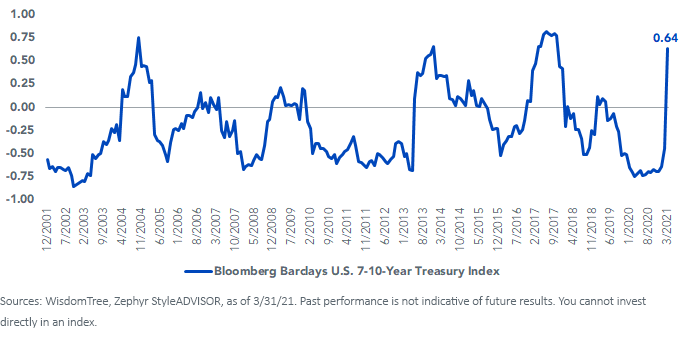

The reduced—and often negative—correlation to equity markets has been evident in developed and emerging equity markets. Once again, U.S. Treasury notes fluctuate throughout market cycles, but delivered strong diversification potential when compared to the MSCI EAFE Index and the MSCI Emerging Markets Index.

Rolling 12-Month Correlation to MSCI EAFE Index

Rolling 12-Month Correlation to MSCI Emerging Markets Index

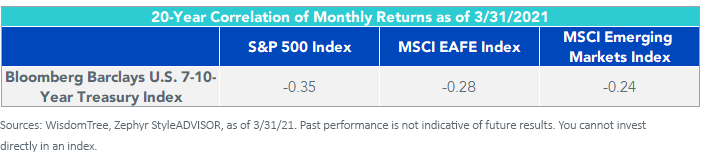

Over longer periods, such as the past 20 years, the negative relationship is even more notable when you consider that this includes three periods of significant market stress: the burst of the 2001 tech bubble, the 2008 global financial crisis and the onset of the COVID-19 pandemic.

Solutions for Developed & Emerging Markets

The unique diversification potential of intermediate U.S. Treasuries inspired us to extend our capital efficient approach to developed and emerging markets. As a result, we’re excited to introduce the WisdomTree International Efficient Core Fund (NTSI) and the WisdomTree Emerging Markets Efficient Core Fund (NTSE).

Both are constructed using the same ideas as the U.S.-focused NTSX.

They first invest 90% of assets in the 500 largest stocks by market capitalization in the developed and emerging markets regions, respectively. The remaining 10% held as cash is used to collateralize 60% notional exposure to laddered U.S. Treasury futures, once again providing capital efficiency through greater equity exposure coupled with potential drawdown risk mitigation via fixed income.

The enhanced exposure may be a benefit to investors who don’t need to sacrifice existing developed or emerging markets allocations in favor of fixed income or invest more capital to implement a more elaborate strategy.

Navigating Potential Market Uncertainty

Financial markets are ever-changing, and it’s nearly impossible for investors to adapt to these changes in real time. That’s why prudent asset allocation is necessary so that investors can try to navigate their portfolios from periods of volatility before they even appear.

We believe a large-cap equity strategy, overlaid with U.S. Treasury futures as a risk mitigator, can potentially deliver both capital appreciation and a level of downside risk management throughout market cycles when investing in the U.S. and abroad.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. No level of diversification or non-correlation can ensure profits or guarantee against losses.

Risks related to NTSX, NTSE and NTSI: While the Funds are actively managed, their investment processes are expected to be heavily dependent on quantitative models, and the models may not perform as intended. Equity securities, such as common stocks, are subject to market, economic and business risks that may cause their prices to fluctuate. The Funds invest in derivatives to gain exposure to U.S. Treasuries. The return on a derivative instrument may not correlate with the return of its underlying reference asset. The Funds’ use of derivatives will give rise to leverage, and derivatives can be volatile and may be less liquid than other securities. As a result, the value of an investment in the Funds may change quickly and without warning, and you may lose money. Interest rate risk is the risk that fixed income securities, and financial instruments related to fixed income securities, will decline in value because of an increase in interest rates and changes to other factors, such as perception of an issuer’s creditworthiness.

Additional risks specific to NTSI: Investments in non-U.S. securities involve political, regulatory and economic risks that may not be present in U.S. securities. For example, foreign securities may be subject to risk of loss due to foreign currency fluctuations, political or economic instability, or geographic events that adversely impact issuers of foreign securities.

Additional risks specific to NTSE: Investments in non-U.S. securities involve political, regulatory and economic risks that may not be present in U.S. securities. For example, foreign securities may be subject to risk of loss due to foreign currency fluctuations, political or economic instability, or geographic events that adversely impact issuers of foreign securities. Investments in securities and instruments traded in developing or emerging markets, or that provide exposure to such securities or markets, can involve additional risks relating to political, economic or regulatory conditions not associated with investments in U.S. securities and instruments or investments in more developed international markets.

Please read each Fund’s prospectus for specific details regarding the Fund’s risk profile.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.